Costa Rica Corporate Tax Return Due Date Verkko 303 rivi 228 nbsp 0183 32 Final payment i e the balance of actual tax payable is generally due by the

Verkko 1 tammik 2022 nbsp 0183 32 1 Annual Company Tax In the month of January the annual company tax known as Impuesto a las Personas Juridicas must be paid to the Ministry of the Treasury The deadline for payment is Verkko 19 kes 228 k 2023 nbsp 0183 32 Corporate income tax CIT due dates Personal income tax PIT rates Personal income tax PIT due dates Value added tax VAT rates

Costa Rica Corporate Tax Return Due Date

Costa Rica Corporate Tax Return Due Date

https://www.nbaoffice.com/wp-content/uploads/2023/06/Green-and-White-Tax-Day-Social-Media-Graphic.png

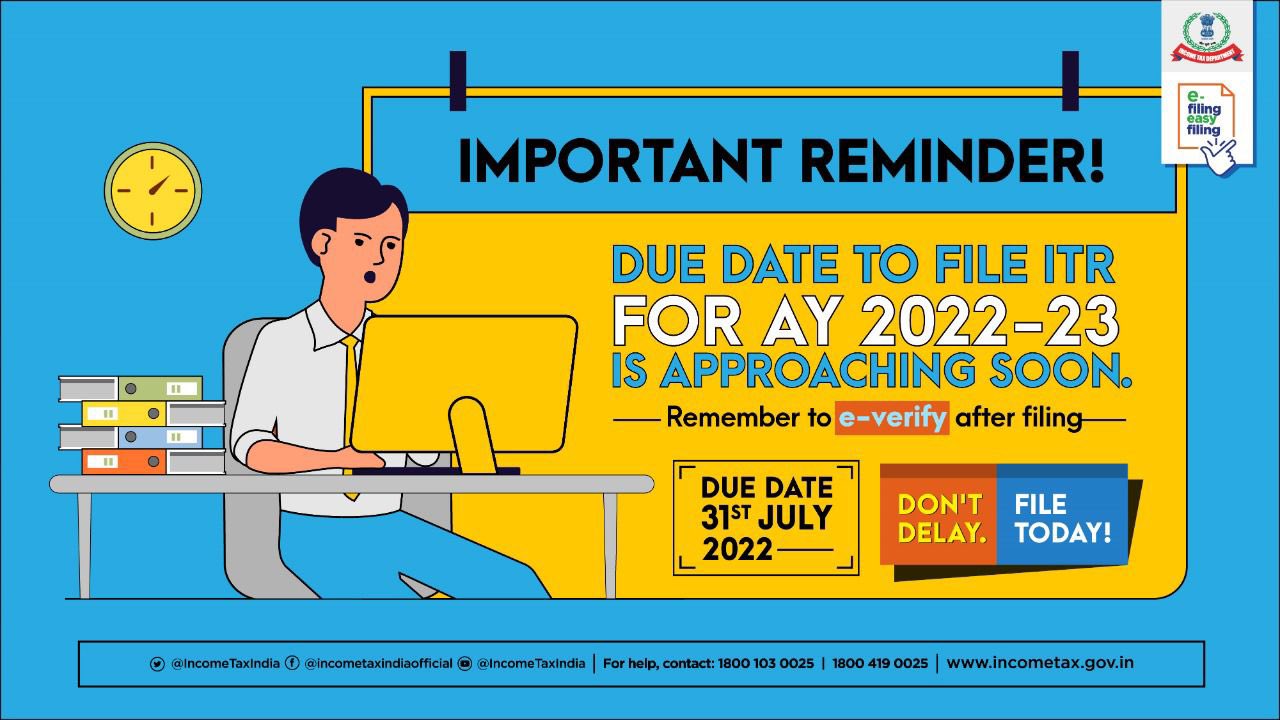

Income Tax India On Twitter Have You Filed Your ITR Yet Due Date To

https://pbs.twimg.com/media/FXhKfnhUUAAxG68.jpg:large

Taxation Updates Mayur J Sondagar On Twitter Income Tax Return And

https://pbs.twimg.com/media/Ftfrk2DagAECRKs.jpg

Verkko 19 kes 228 k 2023 nbsp 0183 32 Corporate income tax CIT due dates CIT return due date It varies according to fiscal year end but it should be on 15 March CIT final payment due Verkko 10 maalisk 2022 nbsp 0183 32 Companies that have economic activity in Costa Rica that generate income must file an Income Tax Return form D 101 The Costa Rican government

Verkko Due date for ling April 30 2022 Last day for BLP to receive information March 22 2022 Companies that do not have a director or manager with domicile in Costa Rica Verkko 15 maalisk 2022 nbsp 0183 32 Inactive entities have an additional three months to file the simplified income tax return which was due no later than 15 March 2022 Costa Rica enacts

Download Costa Rica Corporate Tax Return Due Date

More picture related to Costa Rica Corporate Tax Return Due Date

I T Return Filing Interest Penalties On The Cards If Failed To File

https://images.moneycontrol.com/static-mcnews/2022/07/Penalties-2-belate-returns-ITR-.jpg

/how-soon-can-we-begin-filing-tax-returns-3192837_final-eab4eb98b0394fb1b93c6dc6876b4062.gif)

Draht Verantwortlicher F r Das Sportspiel Vermuten States Of Jersey

https://www.thebalance.com/thmb/n0qY5_o0VzoZ5tk64K_PBHbmHrs=/1333x1000/smart/filters:no_upscale()/how-soon-can-we-begin-filing-tax-returns-3192837_final-eab4eb98b0394fb1b93c6dc6876b4062.gif

New Costa Rica Departure Tax Procedures Just Made Flying A Little Less

https://thecostaricanews.com/wp-content/uploads/2014/11/Exit-Tax-1-1000x662.jpg

Verkko 26 huhtik 2022 nbsp 0183 32 Insights Costa Rica Payment of tax obligations April 26 2022 Resolution number DGT R 012 2022 enables the payment of tax obligations due Verkko 25 kes 228 k 2020 nbsp 0183 32 The deadline to file the 2019 ordinary filing expired last March 31 2020 The deadline to file the 2020 ordinary should be achieved during September 2020 High fines apply for non

Verkko Inactive entities have an additional three months to file the simplified income tax return which was due no later than March 15 2022 On March 10 2022 Costa Rica Verkko 19 tammik 2023 nbsp 0183 32 The ordinary annual tax return must be filed by April 30 2023 at the latest Inactive companies equity declaration The mercantile companies incorporated

COSTA RICA INACTIVE COMPANY TAX FILINGS EXTENDED CostaRicaLaw

https://costaricalaw.com/wp-content/uploads/2022/03/Costa-Rica-Inactive-Company-Filings-Extended.png

VAT REQUIREMENTS FOR ARTISTS SOCIAL MEDIA INFLUENCERS SMI s

https://www.flyingcolourtax.com/wp-content/uploads/2020/09/international-taxation-2.jpg

https://taxsummaries.pwc.com/.../corporate-income-tax-cit-due-dates

Verkko 303 rivi 228 nbsp 0183 32 Final payment i e the balance of actual tax payable is generally due by the

https://costaricalaw.com/costa-rica-legal-topi…

Verkko 1 tammik 2022 nbsp 0183 32 1 Annual Company Tax In the month of January the annual company tax known as Impuesto a las Personas Juridicas must be paid to the Ministry of the Treasury The deadline for payment is

Income Tax Due Dates For FY 2021 22 AY 2022 23 CACube

COSTA RICA INACTIVE COMPANY TAX FILINGS EXTENDED CostaRicaLaw

Costa Rica Corporate Tax Rate 2022 Data 2023 Forecast 2003 2021

What Happens If Your Company Misses The Income Tax Deadline

The October Corporate Tax Deadline What You Need To Know

File Your Income Tax Return By 31st July Ebizfiling

File Your Income Tax Return By 31st July Ebizfiling

Last Date To File Income Tax Return ITR For FY 2022 23 AY 2023 24

Calendar Year Corporate Tax Return Due Date 2024 Calendar 2024

Conti Ransomware Gang Threatens To Overthrow Government Of Costa

Costa Rica Corporate Tax Return Due Date - Verkko 15 maalisk 2022 nbsp 0183 32 Inactive entities have an additional three months to file the simplified income tax return which was due no later than 15 March 2022 Costa Rica enacts