Covid Tax Credits 2020 For Self Employed Eligible self employed individuals are allowed a credit against their federal income taxes for any taxable year equal to their qualified sick leave equivalent amount or qualified family leave equivalent amount 107

Tax credits for self employed individuals and small business owners who could not work or telework due to COVID 19 are still available Qualified individuals may be able to claim up to 15 110 for the sick and family leave credits The vast majority of those eligible for Economic Impact Payments related to Coronavirus tax relief have already received them or claimed them through the Recovery Rebate Credit The deadlines to file a return and claim the 2020 and 2021 credits are May 17 2024 and April 15 2025 respectively

Covid Tax Credits 2020 For Self Employed

Covid Tax Credits 2020 For Self Employed

https://holdenassociates.co.uk/wp-content/uploads/2020/03/covid-update-1157x771.jpg

Tax Credits Available For Retaining Employees During COVID 19 Crisis

https://www.kreisenderle.com/wp-content/uploads/2020/04/COVID-19-Tax-Credits-768x512.jpg

Changes To Tax Filings Related To COVID 19 Penn Community Bank

https://penncommunitybank.imgix.net/wp-content/uploads/2020/03/Blog-Changes-to-Tax-Filings-Related-to-COVID-19-2.jpg?auto=enhance%2Ccompress&fit=crop

In order to qualify for any of the credit on your 2020 tax return you Must be a U S citizen or U S resident alien in 2020 Cannot have been a dependent of another taxpayer in 2020 Must have a Social Security number that is valid The FFCRA passed in March 2020 allows eligible self employed individuals who due to COVID 19 are unable to work or telework for reasons relating to their own health or to care for a family member to claim refundable tax credits to

The FFCRA passed in March 2020 allows eligible self employed individuals who due to COVID 19 are unable to work or telework for reasons relating to their own health or to care for a family The American Rescue Plan extends the availability of the Employee Retention Credit for small businesses through December 2021 and allows businesses to offset their current payroll tax liabilities by up to 7 000 per employee per quarter

Download Covid Tax Credits 2020 For Self Employed

More picture related to Covid Tax Credits 2020 For Self Employed

Best Investment Options For Self Employed In India Scripbox

https://cdn-scripbox-wordpress.scripbox.com/wp-content/uploads/2022/09/best-investment-options-for-self-employed-image.jpg

Guide To Help Employers Navigate COVID 19 Tax Credits Blog Casey

https://www.caseypeterson.com/application/files/cache/eeb966c193ddac86e9096665404cbcac.png

OECD Says COVID Tax Guidelines Will Not Modify TP Guidance

https://assets.euromoneydigital.com/dims4/default/5ff5ad0/2147483647/strip/true/crop/630x331+0+120/resize/1200x630!/quality/90/?url=http:%2F%2Feuromoney-brightspot.s3.amazonaws.com%2F30%2F73%2F544ff211441e22baef3de08912bb%2Fadobestock-337956025-covid-tp.jpg

These tax credits are for wages or for self employed taxpayers prorated net annual earnings with respect to days of work missed due to COVID 19 illness quarantine or family care absences Two new laws provide coronavirus relief for small businesses and the self employed including access to emergency funds loan deferment and tax benefits

Self employed people may qualify for up to 15 110 in refundable tax credits for sick and family leave related to the COVID 19 pandemic The FFCRA passed in March 2020 allows eligible self employed individuals who due to COVID 19 are unable to work or telework for reasons relating to their own health or to care for a family

The COVID 19 Delayed Tax Deadline Is Looming F A Peabody Insurance

https://www.fapeabody.com/wp-content/uploads/2020/07/Untitled-design10.png

Are Your COVID 19 Benefits Taxable Loans Canada

https://loanscanada.ca/wp-content/uploads/2020/12/COVID-19-Benefits-Taxable.png

https://www.irs.gov/newsroom/tax-credits-for-paid...

Eligible self employed individuals are allowed a credit against their federal income taxes for any taxable year equal to their qualified sick leave equivalent amount or qualified family leave equivalent amount 107

https://www.goodrx.com/insurance/taxes/coronavirus...

Tax credits for self employed individuals and small business owners who could not work or telework due to COVID 19 are still available Qualified individuals may be able to claim up to 15 110 for the sick and family leave credits

COVID 19 Tax Credits You Can Still Use This Year Lendio

The COVID 19 Delayed Tax Deadline Is Looming F A Peabody Insurance

Important COVID related Small Business Tax Changes In 2020 Myers CPA

Free Self Employment Tax Calculator 2020 2021

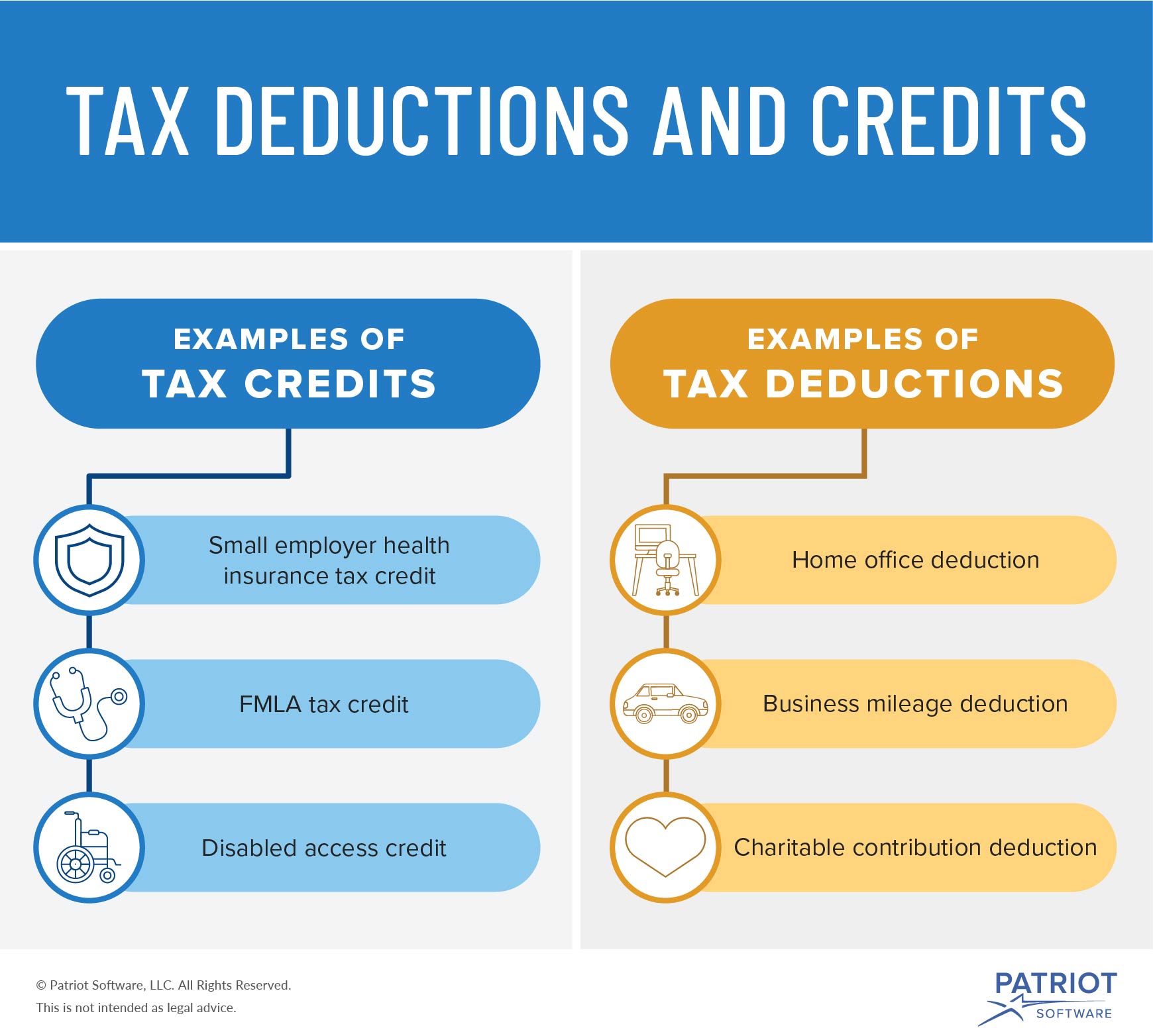

Business Tax Credit Vs Tax Deduction What s The Difference

Self Employed Home Loan Home Loans Eligibility For Self Employed

Self Employed Home Loan Home Loans Eligibility For Self Employed

Budget 2021 Financial Support Available For Self employed People

The COVID related Tax Relief Act Of 2020 Caras Shulman

Covid Bill Changes Tax Rules Midstream How To File An Amended Return

Covid Tax Credits 2020 For Self Employed - The Families First Coronavirus Response First Act which was passed March 18 provides relief in the form of refundable tax credits for sick leave and family leave for both eligible self employed and small business owners