Cpf Income Tax Relief CPF Relief is given to encourage individuals to save for their retirement Employees who are Singapore Citizens or Singapore Permanent Residents may claim CPF Relief On

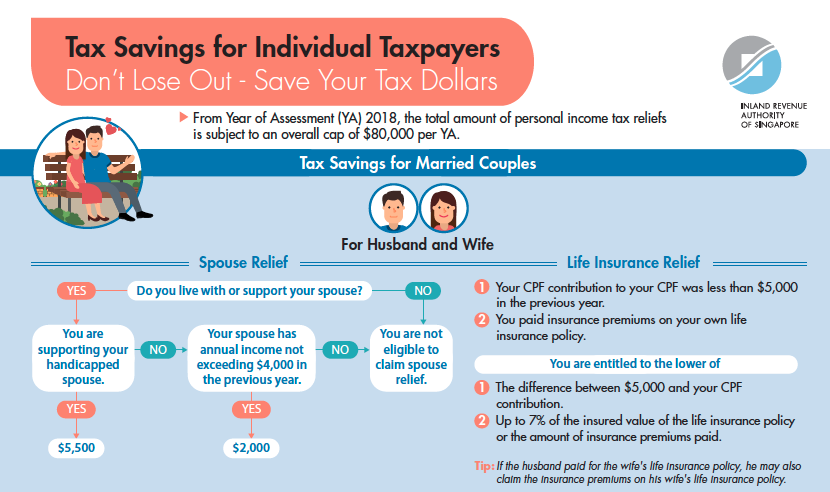

Find out the conditions to qualify for tax relief If you are an employer making cash top ups on your employees behalf you will receive an equivalent amount of tax deductions for Income tax reliefs such as the CPF Relief For Employees CPF Cash Top up Relief and Course Fees Relief can help to lower your taxable income To ensure you re taking full advantage of these tax

Cpf Income Tax Relief

Cpf Income Tax Relief

https://www.moneyline.sg/wp-content/uploads/2022/03/My-project-7-690x418.png

HUGE CPF Changes For Tax Relief DO THIS NOW YouTube

https://i.ytimg.com/vi/SRKAvF1nYXk/maxresdefault.jpg

The Ultimate Guide To CPF 5 Ways To Optimize Become A CPF

https://i0.wp.com/theinvestquest.com/wp-content/uploads/SG-Income-tax-rate.png?w=1418&ssl=1

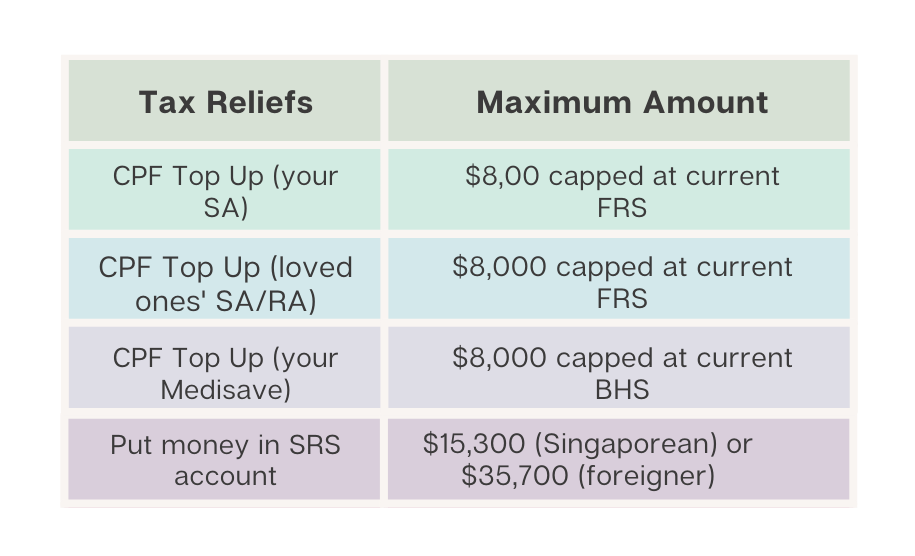

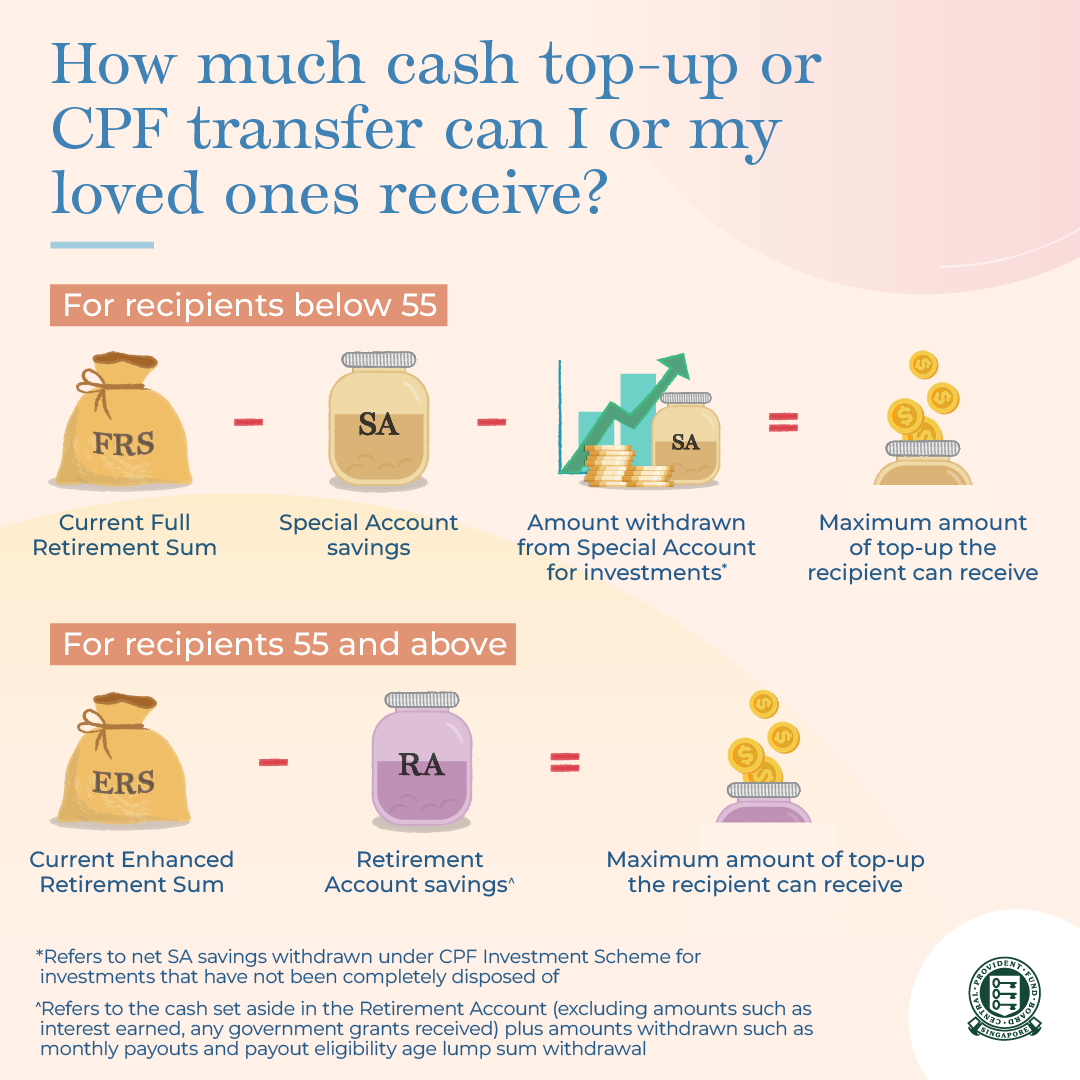

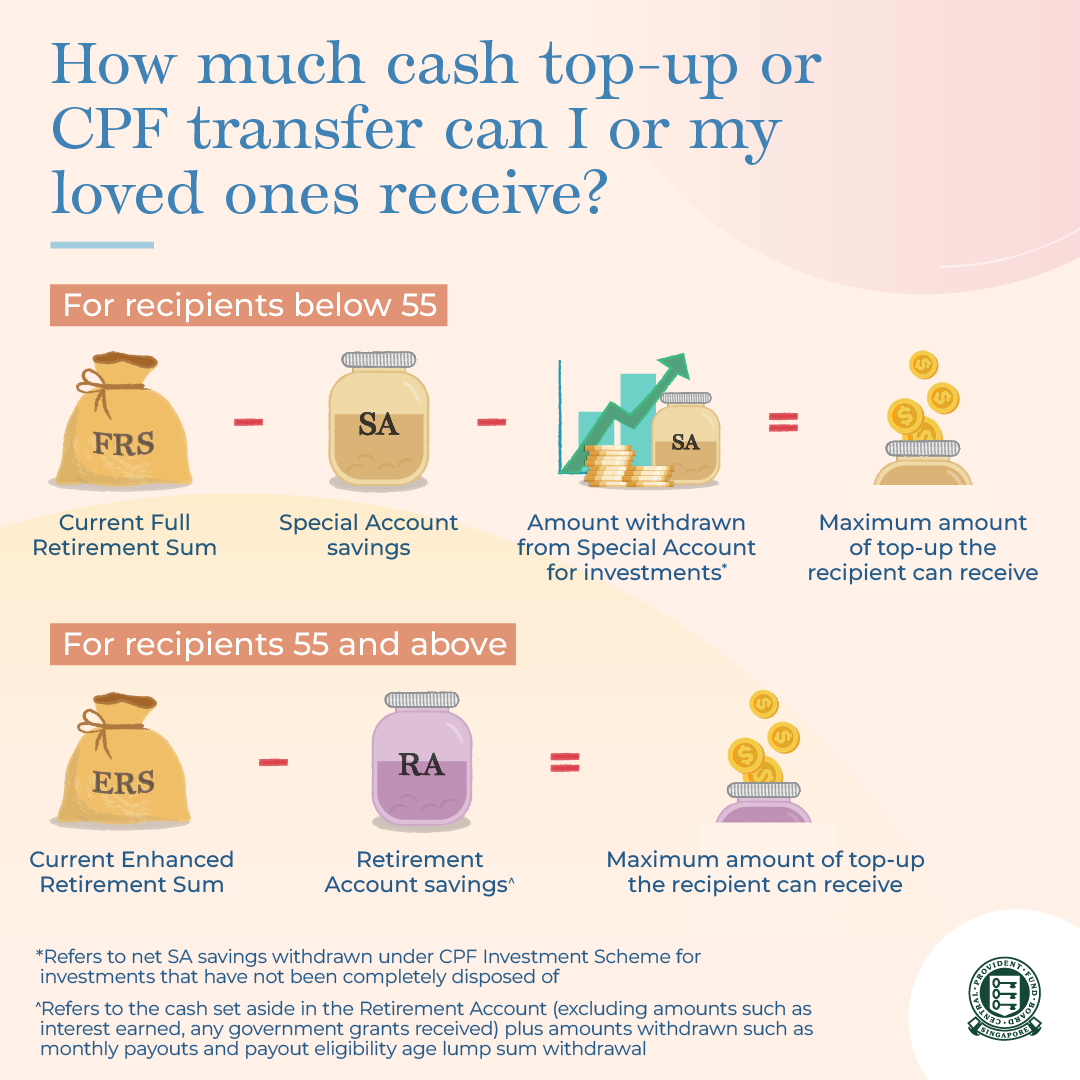

Claim tax relief for topping up your own CPF Special Retirement Account or those of your family members to meet basic retirement needs On this page Qualifying for relief Top up through transfer of funds Amount of For YA2023 meant for contributions done in 2022 the maximum tax relief for making cash top ups to our CPF accounts is 16 000 8 000 for either RSTU or MediSave top ups to self and

CPF relief is allowed based on the date of payment For example to claim for the CPF relief in the Year of Assessment 2024 you must have made the contribution by 31 Dec There is a personal income tax relief cap of 80 000 which applies to all tax reliefs including tax relief on cash top ups made to your CPF accounts The tax relief

Download Cpf Income Tax Relief

More picture related to Cpf Income Tax Relief

YA2023 Reducing Your Personal Income Tax In Six Ways SG Financial Advice

https://sg-financialadvice.com/wp-content/uploads/2022/06/1-e1654215418371.png

Use SRS And CPF To Reduce Income Tax Our Journey Towards Financial

https://www.jcprojectfreedom.com/wp-content/uploads/2019/12/JC-Project-Freedom-Income-Tax-Relief-using-SRS-and-CPF.jpg

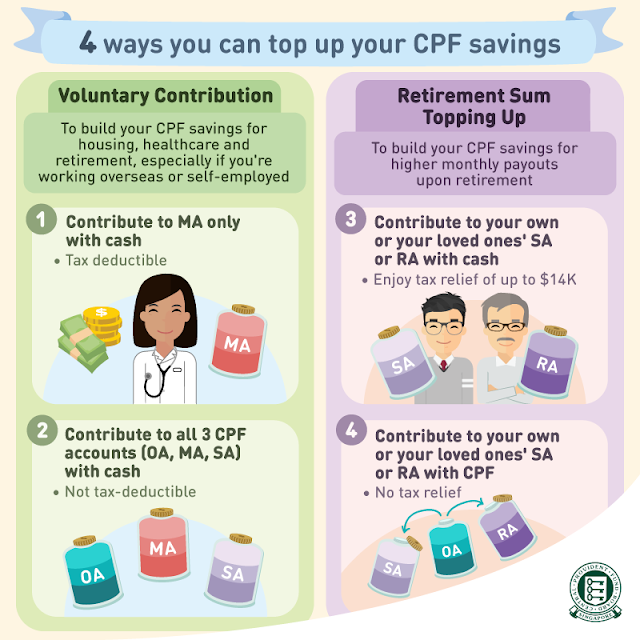

4 Types Of CPF Savings Top up The Boy Who Procrastinates TBWP

https://1.bp.blogspot.com/-0qFEtt-LJ7I/X74rcOc-dPI/AAAAAAAABwc/Pvi-T0RIrlgKoLuKK1L-G_BaoRUkqqZHwCLcBGAsYHQ/w640-h640/7Oct.png

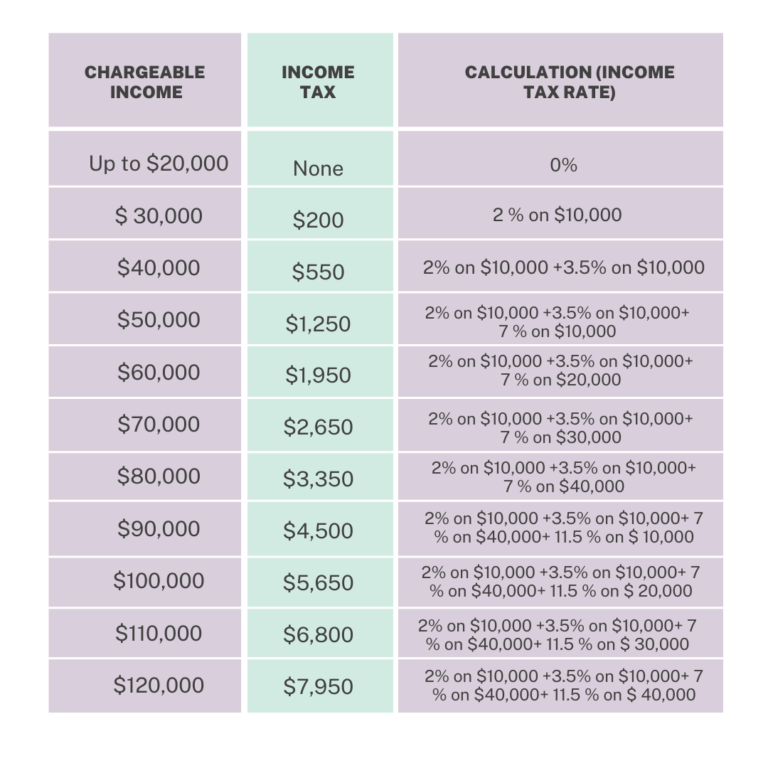

How much income tax will you pay for YA 2025 Find out with our Singapore income tax rate table plus 10 legal ways to shrink your tax bill There is no need to file or claim tax relief for your cash top up as CPF will inform the Inland Revenue Authority of Singapore IRAS if you meet all the eligibility criteria for tax

What is the personal income tax relief cap and why is there a cap on this relief for cash top ups made The personal income tax relief cap sets a limit on the total How much tax relief can you get on CPF top ups You can get tax relief on voluntary contributions to your SA RA and MediSave Account 1 CPF Cash Top up

Manage Your Family Finances

https://www.cpf.gov.sg/member/infohub/educational-resources/how-to-top-up-your-cpf-and-the-benefits-of-doing-so/_jcr_content/root/container_58825609/container_copy_copy__488319030/image_799933411_copy.coreimg.png/1681111000714/how-to-top-up-your-cpf-and-the-benefits-of-doing-so-2.png

YA2023 Reducing Your Personal Income Tax In Six Ways SG Financial Advice

https://sg-financialadvice.com/wp-content/uploads/2022/06/4-768x768.png

https://www.iras.gov.sg/taxes/individual-income...

CPF Relief is given to encourage individuals to save for their retirement Employees who are Singapore Citizens or Singapore Permanent Residents may claim CPF Relief On

https://www.cpf.gov.sg/service/article/how-much...

Find out the conditions to qualify for tax relief If you are an employer making cash top ups on your employees behalf you will receive an equivalent amount of tax deductions for

Retirement Planning What You Must Know About CPF Top Up

Manage Your Family Finances

How A Monthly Top Up To Our CPF Account Can Ensure Us A Secure Retirement

How To Reduce Your Income Tax In Singapore make Use Of These Tax

Income Tax Filing 2019 Everything You Need To Know About Tax

Singapore Personal Income Tax Guide Tax Rebate And Reliefs 2022

Singapore Personal Income Tax Guide Tax Rebate And Reliefs 2022

How To Reduce Your Income Tax In Singapore make Use Of These Tax

Reduce Your Income Tax Through CPF Top Ups A Guide For Singaporeans

Is There A Maximum Cap On Central Provident Fund CPF FAQ

Cpf Income Tax Relief - CPF relief is allowed based on the date of payment For example to claim for the CPF relief in the Year of Assessment 2024 you must have made the contribution by 31 Dec