Credit Recovery Rebate Web 17 f 233 vr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program Web 12 oct 2022 nbsp 0183 32 The recovery rebate credit is a quot refundable quot credit which means you ll get a tax refund if the credit is larger than the tax that you would otherwise have to pay quot Non refundable quot credits

Credit Recovery Rebate

Credit Recovery Rebate

https://printablerebateform.net/wp-content/uploads/2021/07/Recovery-Rebate-Credit-Form-2021.jpg

Recovery Rebate Credit Taking Forever Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/recovery-credit-printable-rebate-form-4.png?w=670&h=627&ssl=1

Ready To Use Recovery Rebate Credit 2021 Worksheet MSOfficeGeek

https://msofficegeek.com/wp-content/uploads/2022/01/Recovery-Rebate-Credit-Worksheet-1.png

Web 2020 Recovery Rebate Credit Must file a 2020 tax return to claim if eligible Get My Payment When your Third Economic Impact Payment is scheduled find when and how we sent your Payment Where s My Refund An online tool that will track your tax refund Web 1 d 233 c 2022 nbsp 0183 32 Assuming that all three meet all of the requirements for the credit their maximum 2020Recovery Rebate Credit is 4 700 This is made up of 2 900 1 200 for Alex 1 200 for Samantha 500 for

Web The 2021 RRC amount was 1 400 or 2 800 in the case of a joint return plus an additional 1 400 per each dependent of the taxpayer for all U S residents with adjusted gross income up to a phase out threshold of 75 000 150 000 in the case of a joint Web 30 d 233 c 2020 nbsp 0183 32 The Recovery Rebate Credit is a credit that was authorized by the Coronavirus Aid Relief and Economic Security CARES Act So if you were eligible for an Economic Impact P ayment EIP commonly referred to as a stimulus payment but

Download Credit Recovery Rebate

More picture related to Credit Recovery Rebate

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

http://www.taxguru.net/uploaded_images/IRSRebateRecoveryWorksheet9108Part2-764112.jpg

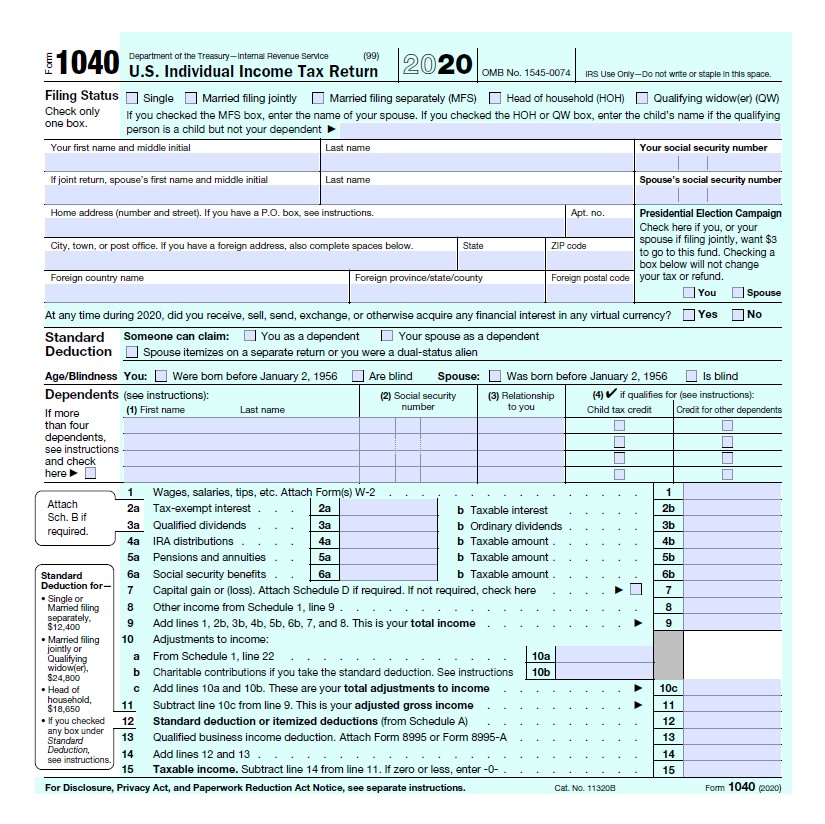

1040 Line 30 Recovery Rebate Credit Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/irs-1040-form-line-30-solved-complete-the-schedule-a-form-1040-for-1.png

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

https://i2.wp.com/lh5.googleusercontent.com/proxy/lGA90iOjY_1LO-OBBI3qmZMyKEj47RMisqIykTyVbIbO-V2GqH4xUV92z9Uq0pojRygogoMZtKIKKsqfiqET_2bvfJQoMviJq-wHNdbSR8ZyQ-ukMly2632ZZ7bKcCkHDaCeogT6Skm16tenIHu_TkBU8w=w1200-h630-p-k-no-nu

Web The 2020 Recovery Rebate Credit RRC is established under the CARES Act If you didn t receive the full amount of the recovery rebate credit as EIPs you may be able to claim the RRC on your 2020 Form 1040 U S Individual Income Tax Return or Form 1040 SR Web 15 mars 2023 nbsp 0183 32 Didn t Get the Full Third Payment Claim the 2021 Recovery Rebate Credit You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax return Individuals can view the total amount of their third Economic Impact Payments

Web 27 avr 2023 nbsp 0183 32 If you re one of the many who are owed stimulus money you may be able to claim the amount as a recovery rebate tax credit on your 2020 or 2021 federal tax return Featured Partner Offers Web 23 mai 2022 nbsp 0183 32 IRS mostly correct on recovery rebate credits TIGTA says The IRS correctly calculated taxpayers eligibility for a recovery rebate credit in the 2021 filing season 99 3 of the time the Treasury Inspector General for Tax Administration

Mastering The Recovery Rebate Credit Free Printable Worksheet Style

https://i2.wp.com/www.legacytaxresolutionservices.com/2255lega/250w/cp11r-2page001.png

Recovery Rebate Credit Worksheet Example Studying Worksheets Recovery

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/recovery-rebate-credit-worksheet-example-studying-worksheets.png?w=1125&ssl=1

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-a...

Web 17 f 233 vr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-c...

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program

Irs Form 1040 Recovery Rebate Credit IRSUKA Recovery Rebate

Mastering The Recovery Rebate Credit Free Printable Worksheet Style

Recovery Rebate Credit Calculator EireneIgnacy

The Recovery Rebate Credit Calculator ShauntelRaya Rebate2022

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

2023 Recovery Rebate Credit Calculator Recovery Rebate

2023 Recovery Rebate Credit Calculator Recovery Rebate

Recovery Rebate Credit Line 30 Instructions Recovery Rebate

The Recovery Rebate Credit Get Your Full Stimulus Check Payment With

The Recovery Rebate Credit Calculator MollieAilie

Credit Recovery Rebate - Web 3 avr 2021 nbsp 0183 32 The 1 9 trillion Covid relief bill which President Joe Biden signed in March also offers a Recovery Rebate Credit that applies to 600 1 200 and 1 400 stimulus checks The changes are