Ct Child Tax Credit 2023 The child tax rebate which was recently authorized by the Connecticut General Assembly and signed into law by Governor Ned Lamont is intended to help Connecticut families with children You may be eligible for a child tax rebate of up to a maximum of 750 250 per child up to three children

Connecticut income tax liability This credit is effective for taxable years commencing on or after January 1 2022 Column LineC Enter the amount earned during 2023 Column D Enter the amount applied to your 2023 income tax liability If you are claiming the Birth of a Stillborn Child Tax Credit A CT child tax credit has a better chance of becoming real now that CT s highest ranking state senator offered an alternate route this week

Ct Child Tax Credit 2023

Ct Child Tax Credit 2023

https://s.hdnux.com/photos/01/35/74/61/24628288/5/rawImage.jpg

T22 0188 Repeal Child Tax Credit CTC Earned Income Threshold By

https://www.taxpolicycenter.org/sites/default/files/styles/full-page-1500x700/public/model-estimates/images/t22-0188.gif?itok=6FfQuMuW

Child Tax Credit CTC and The Value Of Credits In Excess Of

https://images.squarespace-cdn.com/content/v1/57f3f70b6b8f5b5432eb355e/1583186637955-WX801J3QCXMXA1DAWBDI/image-asset.jpeg

The bill would raise the refundable portion of the credit from 1 600 to 1 800 increasing by 100 a year until the 2025 tax year as well as adjust it based on the rate of inflation It would Dozens of legislators have co sponsored bills to help establish a 600 per child CT tax credit and about 100 people have testified on them

Updated 6 39 PM EDT April 14 2023 HARTFORD Conn State officials lawmakers and advocates are once again pushing to make the child tax credit permanent in Connecticut The state had a child The bill includes 33 billion to expand the widely used child tax credit for three years including the tax season currently underway provided the bill quickly passes the Senate

Download Ct Child Tax Credit 2023

More picture related to Ct Child Tax Credit 2023

Child Tax Credit 2024 Child Tax Credit 2024 By Clear Start Tax

https://miro.medium.com/v2/resize:fit:1200/1*KsfOocLtQfEdOBFic2MiOw.png

Written By Diane Kennedy CPA On March 12 2022

https://www.ustaxaid.com/wp-content/uploads/2022/03/1928846-1536x1024.jpg

The Proposed 2022 Child Tax Credit How Will The Changes Affect You

https://lirp.cdn-website.com/md/pexels/dms3rep/multi/opt/pexels-photo-6863513-1920w.jpeg

Creating a Child Tax Credit CTC of 600 per child is an important high impact step to support the parents and children who call Connecticut home Those who have a qualifying child and an annual income of less than 200 000 individually or 400 000 if filing jointly will be eligible for the full credit amount for each eligible child Those

CT s 250 child tax rebate program has brought 84 5 million to families with 353 000 kids this past year The child tax credit CTC allows eligible parents and caregivers to reduce their tax liability and might even result in a tax refund However not everyone can claim the credit and credit

Child Tax Credit 2021 American Parents Could Owe Money After Monthly

https://cdn.abcotvs.com/dip/images/11421664_010322-ktrk-ewn-4pm-NNA-child-tax-credit-MON-matt-vid.jpg?w=1600

Child Tax Credit PR 2021 Carolina

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=172232188655184

https://portal.ct.gov/drs/credit-programs/child-tax-rebate/overview

The child tax rebate which was recently authorized by the Connecticut General Assembly and signed into law by Governor Ned Lamont is intended to help Connecticut families with children You may be eligible for a child tax rebate of up to a maximum of 750 250 per child up to three children

https://portal.ct.gov/-/media/drs/forms/2023/...

Connecticut income tax liability This credit is effective for taxable years commencing on or after January 1 2022 Column LineC Enter the amount earned during 2023 Column D Enter the amount applied to your 2023 income tax liability If you are claiming the Birth of a Stillborn Child Tax Credit

Minnesota Tax Credits For Workers And Families

Child Tax Credit 2021 American Parents Could Owe Money After Monthly

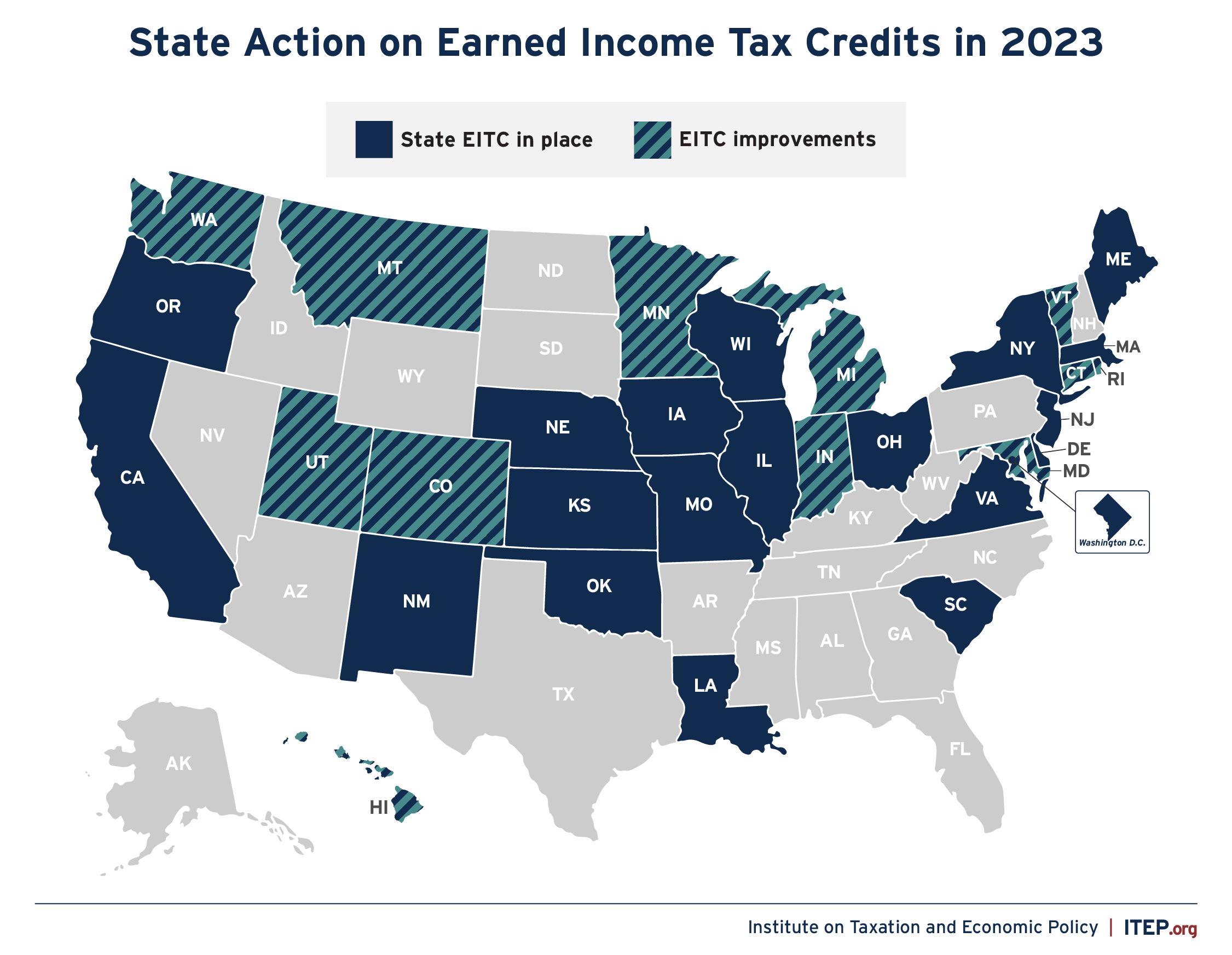

Refundable Credits A Winning Policy Choice Again In 2023 ITEP

House Passes Child Tax Credit Expansion NPR Tmg News

IRS Releases Website To Manage Child Tax Credit Deposits Payne

One Republican Eyes More Direct Payments Amid Rising Childcare Costs

One Republican Eyes More Direct Payments Amid Rising Childcare Costs

.jpg)

Child Tax Credit Stimulus Payments Here s What To Expect The

Parents Of 2021 Babies Can Claim Child Tax Credit Payments Here s How

Monthly Child Tax Credit Payments Understand The Options Articles

Ct Child Tax Credit 2023 - The Connecticut Child Tax Credit provides tangible benefits for middle and lower income families including households earning up to 100 00 single filers or 200 000 joint filers to help offset the high costs of raising kids in our state