Current Rebate In Income Tax Rebate u s 87A Resident Individuals are also eligible for a Rebate of up to 100 of income tax subject to a maximum limit depending on tax regimes as under Total Income Old

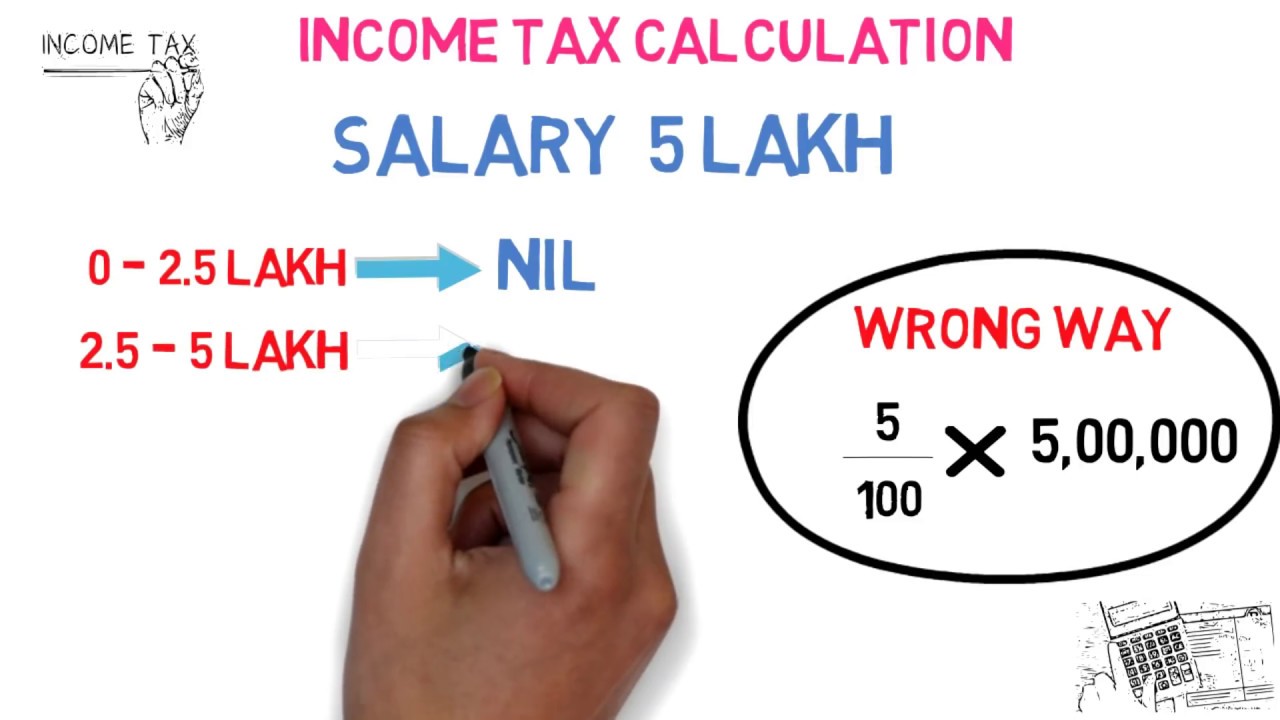

Latest update The highest surcharge rate on income above 5 crores is changed from 37 to 25 which will reduce the Maximum Marginal rate of Tax from Individuals with net taxable income less than or equal to Rs 5 lakh will be eligible for tax rebate u s 87A under the old tax regime i e tax liability will be NIL

Current Rebate In Income Tax

Current Rebate In Income Tax

https://taxguru.in/wp-content/uploads/2018/07/Tax-rebate.jpg

Individual Income Tax Rebate

https://custercountymt.gov/wp-content/uploads/2023/06/June-2023-Tax-Rebate.jpg

Income Tax Rebate U s 87A For The Financial Year 2022 23

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhjaMWWuh9Yw1oHqfkfrIaYbLGaB376RebKDTPXR4-jMTYYQRhPBXomiwY9EVzEmXIgQ2oXuDWoror_llXVa0a4CVcBPyG3JecnKbrFpU1YAcL3BqdldNxiSh81eUspfAXJiNGbHbVcluzwXjoIUmqkZimUhTYHrQKq1Zu6xuaat2LRf6h-UCOGnP3s/w640-h596/87a.jpg

The rebate amount under Section 87A allows a tax rebate of up to Rs 12 500 for individuals with taxable income up to Rs 5 00 000 FY 2023 24 under the old regime Rebate u s 87A Resident Individuals are also eligible for a Rebate of up to 100 of income tax subject to a maximum limit depending on tax regimes as under Total Income Old

Calculate tax payable Use the applicable tax slab rates to determine the amount of tax owed based on the taxable income Claim tax rebates Under the This service covers the current tax year 6 April 2024 to 5 April 2025 This page is also available in Welsh Cymraeg Use the service to check your tax code and Personal

Download Current Rebate In Income Tax

More picture related to Current Rebate In Income Tax

Madhya Pradesh Government Is Giving Rebate In Income Tax To Those

https://hindi.cdn.zeenews.com/hindi/sites/default/files/2020/12/02/703125-tax-rebate-in-madhya-prades.jpg

Rebate And Releif Of Tax Rebate 87a Of Income Tax Rebate And Relief

https://i.ytimg.com/vi/IrYTqu6Hohg/maxresdefault.jpg

Standard Deduction Income Tax Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-13.jpg

Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your Current assets Cash and cash equivalents 11 287 7 079 Short term investments 17 986 17 955 Accounts receivable net 3 131 3 402 Income tax effects

For the 2025 tax year i e the tax year commencing on 1 March 2024 and ending on 28 February 2025 the following rebates apply Primary rebate ZAR 17 235 Use this tool to find out what you need to do to get a tax refund rebate if you ve paid too much Income Tax

LHDN IRB Personal Income Tax Rebate 2022

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEi4EoUCYcQMowVkFCssu_CdI43zIKHrVC46Kba3BHcmZh3oeO18l7EDF2MRUyAcTAsJGJ4xoe-Ekdnfv4_Pv7Vwf9uH3fIfSDaX5l9O3cEd7zdy7J1TPcGn75nLB59_9Nl_SqNTLkJeFhMTJtIwlgtqjSOzqw1iz42LdAJ22TGq8dO7vpInhBCvgVt7/s1600-e60/Tax rebates 2021.jpg

How To Get Tax Rebate In Income Tax

https://lh3.googleusercontent.com/-jJ4zZZJpzu4/XkYh5zpW4bI/AAAAAAAALlw/03vDaCyfckIn2RjNTnWAHgi9ClX_V6MrACLcBGAsYHQ/s1600/Image_1.jpeg

https://www.incometax.gov.in/iec/foportal/help/...

Rebate u s 87A Resident Individuals are also eligible for a Rebate of up to 100 of income tax subject to a maximum limit depending on tax regimes as under Total Income Old

https://cleartax.in/s/marginal-relief-surcharge

Latest update The highest surcharge rate on income above 5 crores is changed from 37 to 25 which will reduce the Maximum Marginal rate of Tax from

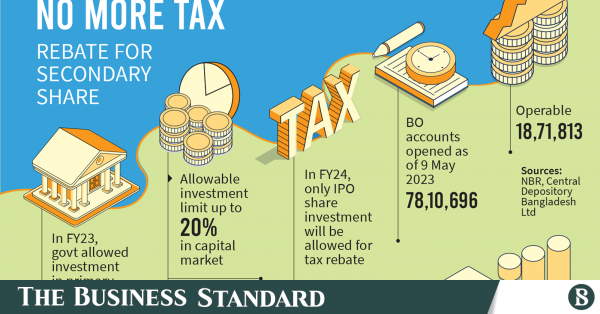

Tax Rebate On Investment In Secondary Stock May Go The Business Standard

LHDN IRB Personal Income Tax Rebate 2022

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Rebate Allowable Under Section 87A Of Income Tax Act TaxGuru

New Income Tax Calculation Rebate 2018 19 Explained YouTube

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

How To Deal With An Income Tax Notice Wealthzi

Income Tax Rebate Under Section 87A

Deferred Tax And Temporary Differences The Footnotes Analyst

Current Rebate In Income Tax - Rebate u s 87A Resident Individuals are also eligible for a Rebate of up to 100 of income tax subject to a maximum limit depending on tax regimes as under Total Income Old