Deduction In Income Tax For Senior Citizens Find out how to file and pay taxes get free tax services and access special tax rules for older adults Learn about retirement plans Social Security benefits and taxable

Learn how to get a higher standard deduction if you are 65 or older and how to calculate the taxable amount of your Social Security benefits Find out if you qualify for the The Extra Standard Deduction for People 65 or Older New Income Tax Brackets for 2025 Are Set Big State Tax Changes to Watch on the 2024 Ballot As the senior tax editor at Kiplinger

Deduction In Income Tax For Senior Citizens

Deduction In Income Tax For Senior Citizens

https://carajput.com/blog/wp-content/uploads/2017/03/Income-Tax-Deductions-Financial-Year-2020-21..jpg

Deduction Under Income Tax For Individuals PDF Tax Deduction Loans

https://imgv2-2-f.scribdassets.com/img/document/121585036/original/2d55fbfa7f/1708933060?v=1

How To Calculate Standard Deduction In Income Tax Act Scripbox

https://cdn-scripbox-wordpress.scripbox.com/wp-content/uploads/2021/05/standard-deduction-income-tax.jpg

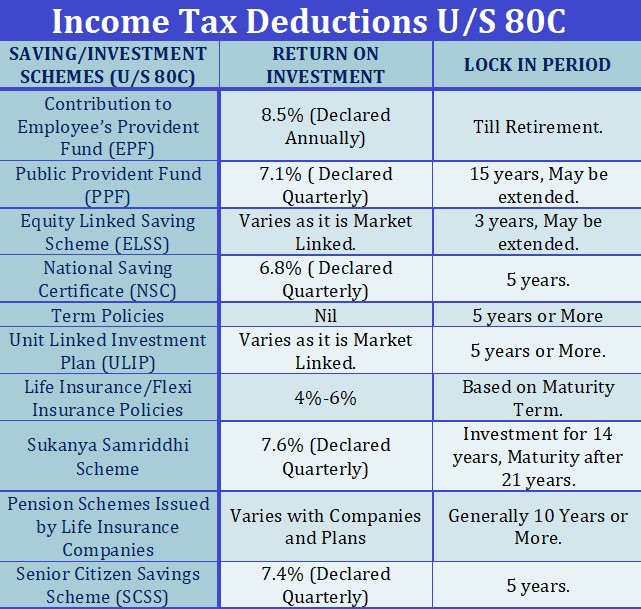

Senior citizens over 60 years of age can invest in the Senior Citizens Savings Scheme and save tax by claiming a deduction up to Rs 1 50 000 under Section 80C under the old tax regime Learn how to reduce your tax bill as a senior with various credits and deductions such as IRA and 401 k catch up contributions higher standard deductions and property tax exemptions Find out if you qualify for the tax

For other taxpayer assessees i e senior citizens and super senior citizens the Income tax limit for availing the exemption would be Rs 3 00 000 Rs 5 00 000 respectively Individuals with net taxable income less than or Learn how to claim the extra standard deduction for taxpayers who are 65 or older by the end of the tax year and how it varies depending on filing status and blindness Find out

Download Deduction In Income Tax For Senior Citizens

More picture related to Deduction In Income Tax For Senior Citizens

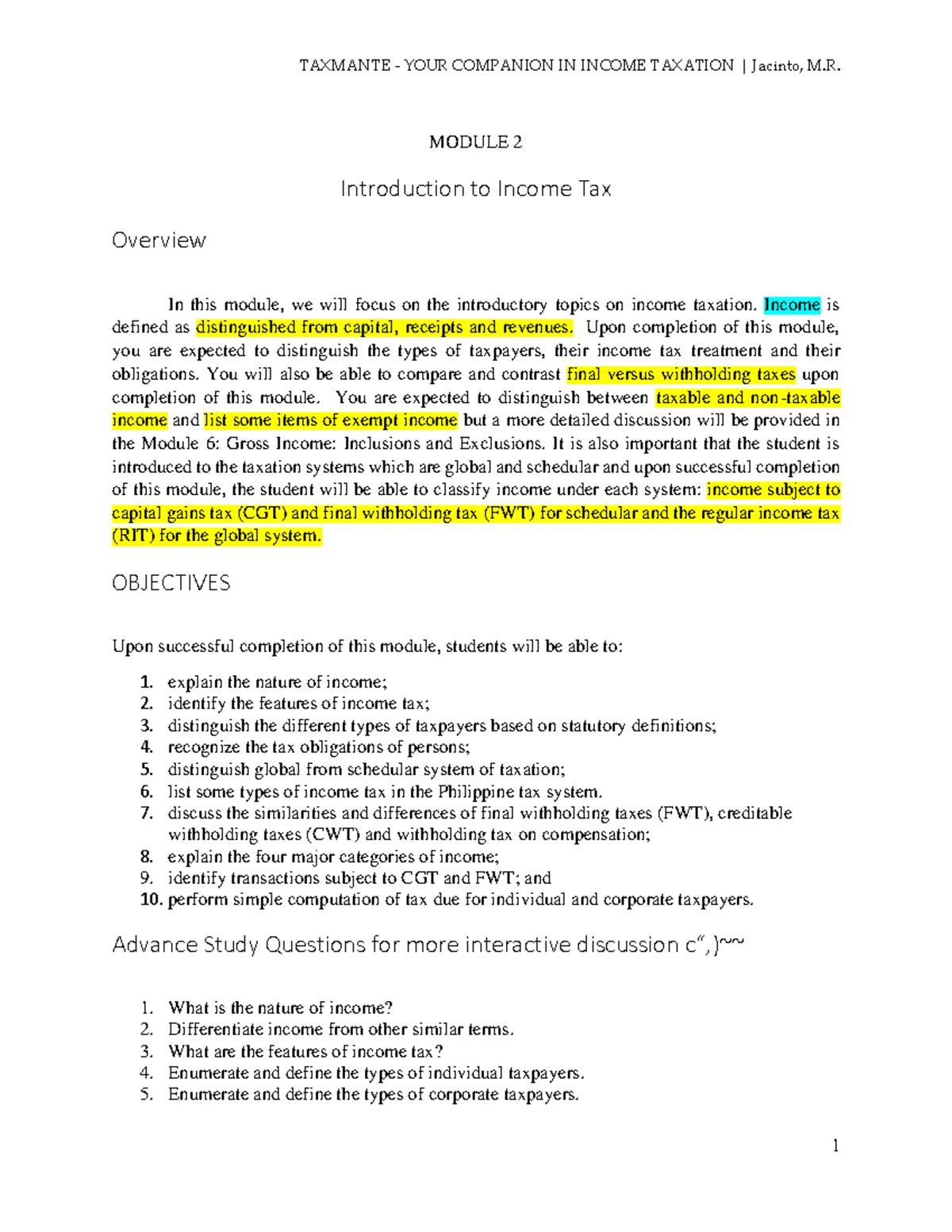

Module 2 Introduction TO Income TAX MODULE 2 Introduction To Income

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/2ebc8de11ae6b27dadd9a043e635b63a/thumb_1200_1553.png

Senior Citizen Income Tax Calculation 2021 22 Excel Calculator

https://i.ytimg.com/vi/Ww-ESeJgiP8/maxresdefault.jpg

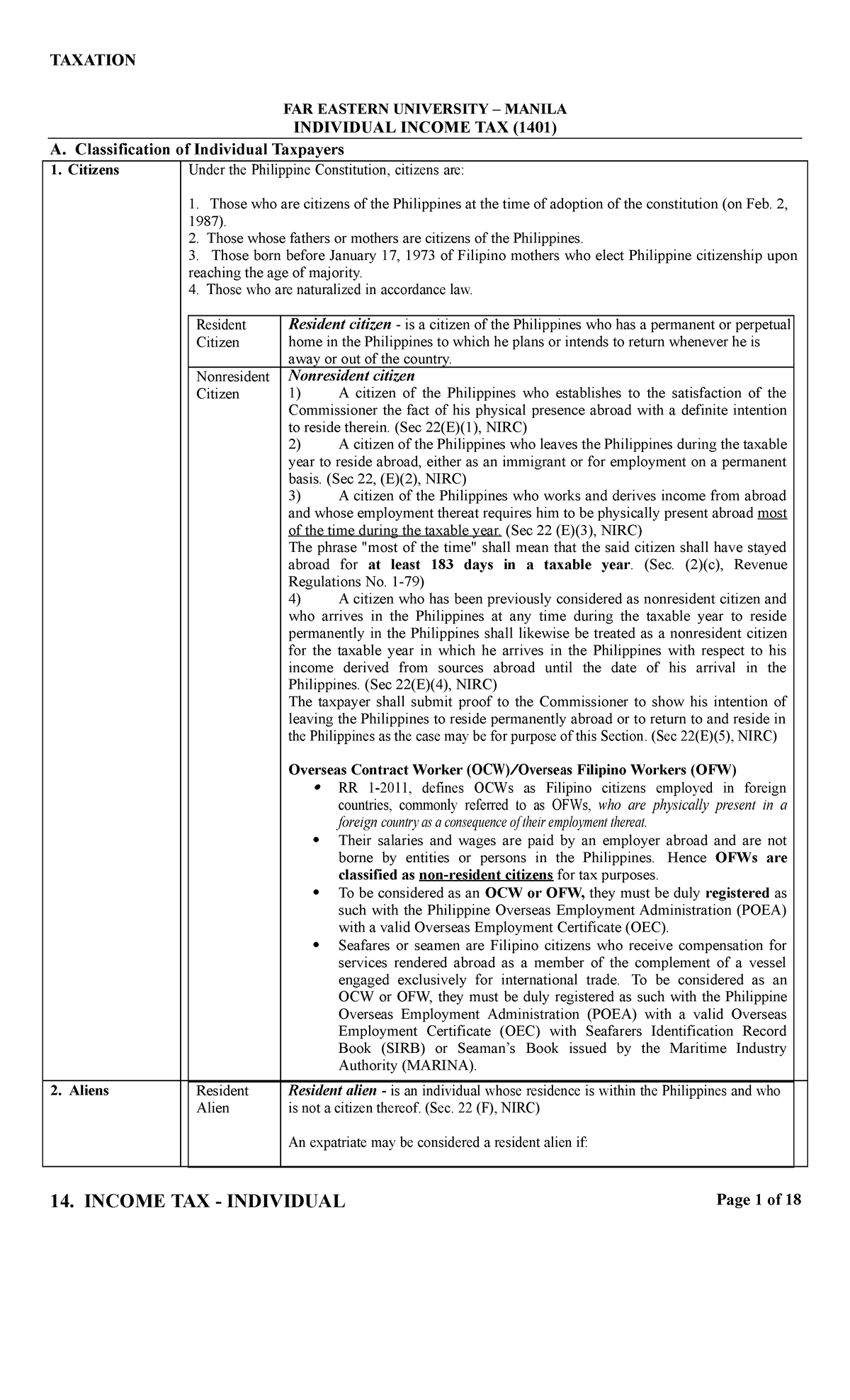

14 Individual Income Tax 14 INCOME TAX INDIVIDUAL Page 1 Of 18

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/4d966e49d5a44496b768338cc972ac91/thumb_1200_1976.png

Eliminating the income tax could be a future aspirational goal Trump campaign senior adviser Jason Miller told reporters Saturday noting that the former president s top Section 199A Qualified Business Income Deduction As part of the 2017 tax reform law sole proprietors and owners of pass through businesses like LLCs S corporations

Along with tax credits and other useful strategies income tax deductions for seniors can save hundreds or thousands of dollars on your annual tax bill In this guide we ll explain Learn about the extra standard deduction IRA contribution Medicare premiums deduction and tax credit for low income older adults that you may qualify for as a retiree over

Budget 2022 Different Types Of Taxable Incomes Income Tax Slab Rates

https://i.postimg.cc/bN09RcMs/Latest-Income-Tax-Slab-Rates-for-FY-2022-23-AY-2023-24.jpg

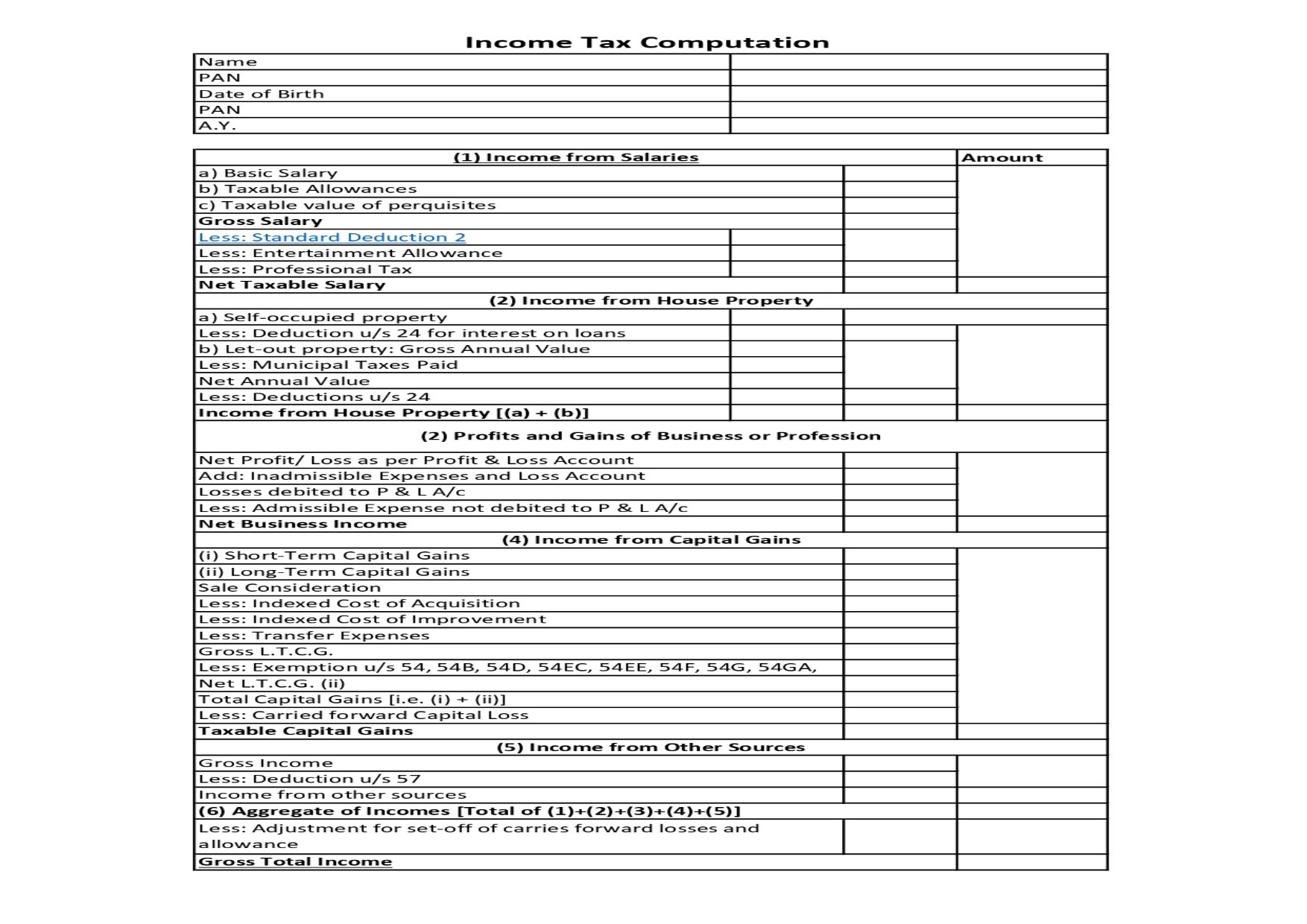

Income Tax Computation Format PDF A Comprehensive Guide

https://www.thetaxheaven.com/public/uploads/news-39.jpeg

https://www.irs.gov/individuals/seniors-retirees

Find out how to file and pay taxes get free tax services and access special tax rules for older adults Learn about retirement plans Social Security benefits and taxable

https://www.irs.gov/individuals/seniors-retirees/...

Learn how to get a higher standard deduction if you are 65 or older and how to calculate the taxable amount of your Social Security benefits Find out if you qualify for the

Qualified Business Income Deduction And The Self Employed The CPA Journal

Budget 2022 Different Types Of Taxable Incomes Income Tax Slab Rates

Income Tax Slabs Rates And Exemptions For Senior Citizens Know How

INCOME TAX CALCULATOR Income Tax For Senior Citizens TAXCONCEPT

Senior Citizen Income Tax Calculation 2022 23 Excel FinCalC Blog

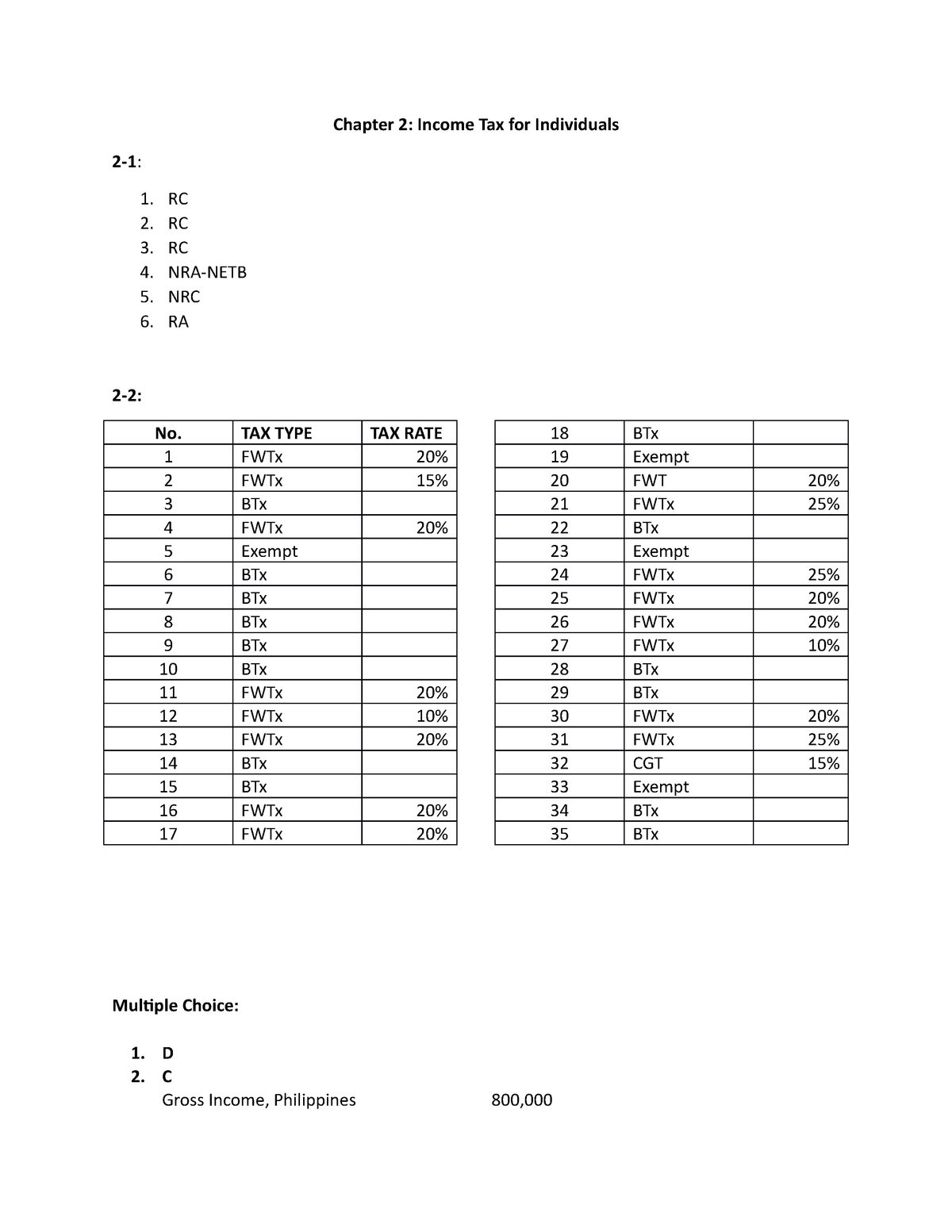

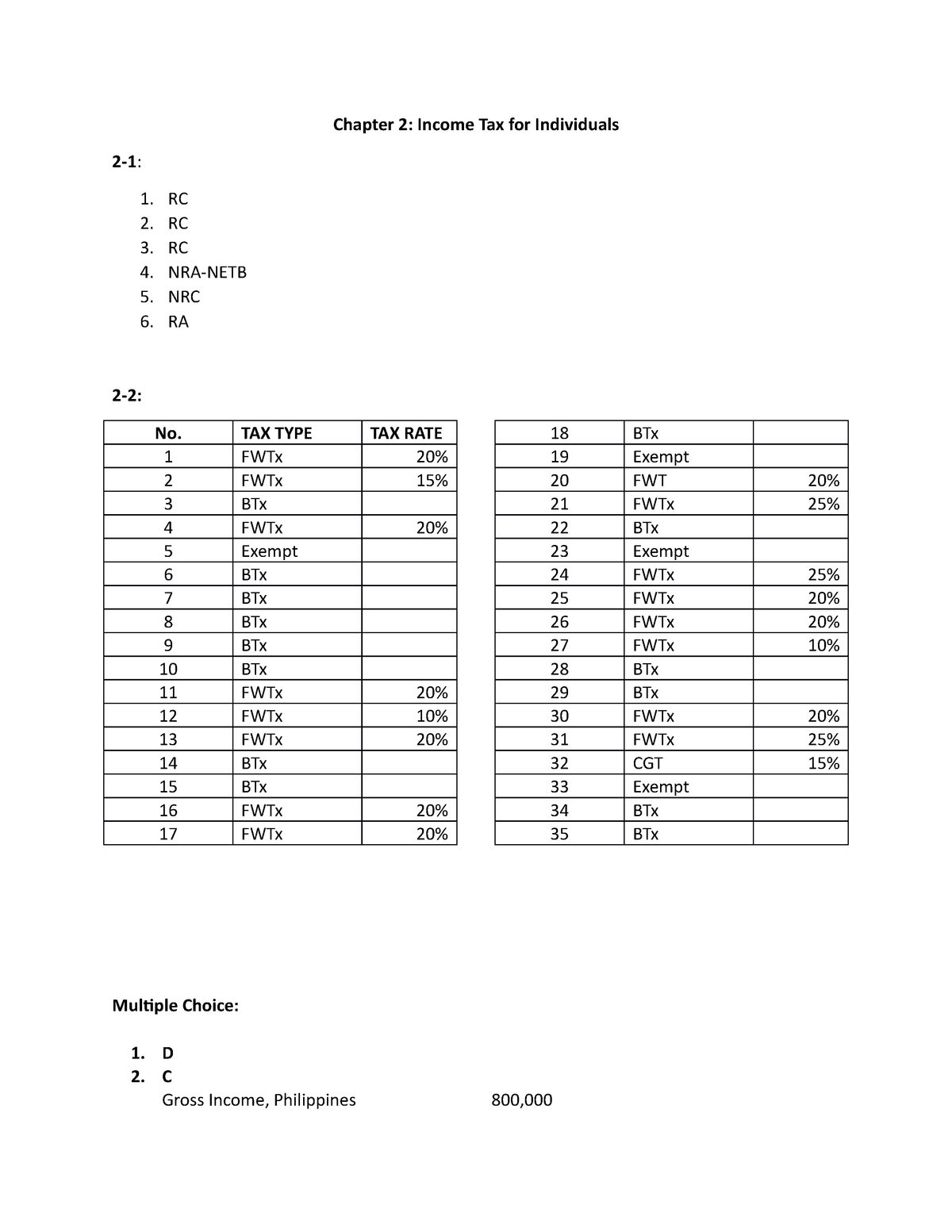

Income Taxation 2 Chapter 2 Income Tax For Individuals 2 1 RC RC

Income Taxation 2 Chapter 2 Income Tax For Individuals 2 1 RC RC

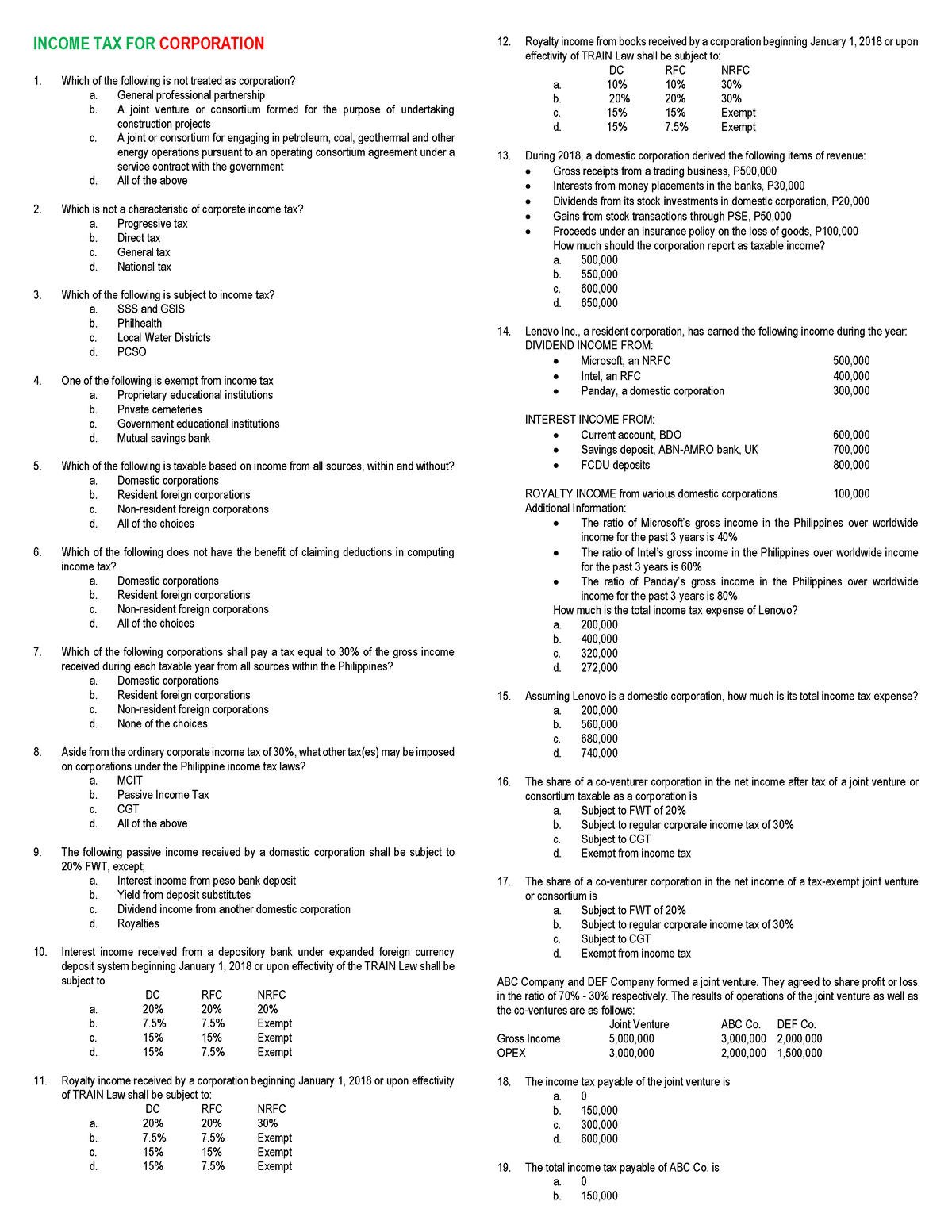

Pdfcoffee INCOME TAXATION INCOME TAX FOR CORPORATION Which Of The

Standard Deduction For Fy 2023 24 In New Tax Regime Printable Forms

Reported Plan For 2p Pre election Cut In Income Tax indefensible

Deduction In Income Tax For Senior Citizens - Learn how to lower your tax bill as a retiree with higher standard deduction filing threshold itemizing long term care expenses spousal IRA and more AARP provides tips and