Deduction On Car Loan Interest Typically deducting car loan interest is not allowed But there is one exception to this rule If you use your car for business purposes you may be allowed to partially deduct car

Some interest can be claimed as a deduction or as a credit To deduct interest you paid on a debt review each interest expense to determine how it qualifies Deducting auto loan interest on your federal income tax return is not allowed for typical borrowers But if you re self employed and use your car for business

Deduction On Car Loan Interest

Deduction On Car Loan Interest

https://www.axisbank.com/images/default-source/progress-with-us/4-easy-steps-to-get-a-car-loan-at-best-interest-rate-link-6.jpg

Best Auto Loan Rates Top Lenders Finder

https://www.finder.com/finder-us/wp-uploads/2021/12/AverageAutoLoanRatesUpdated1221_finder_1640x924.png

Car Loan Payoff Calculator Auto Loan Payoff Calculator

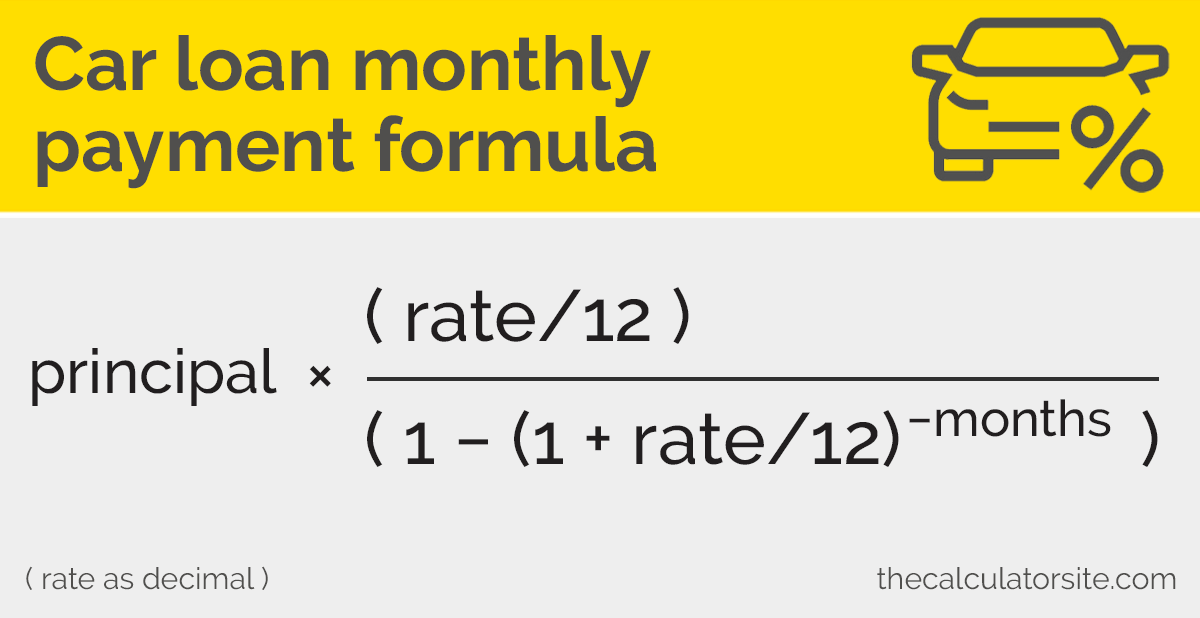

https://www.thecalculatorsite.com/images/car-loan-monthly-formula.png

Follow Stellantis NV Follow WASHINGTON Oct 10 Reuters Republican presidential candidate Donald Trump on Thursday will propose making all interest on Tax deductible interest is a borrowing expense that a taxpayer can claim on a federal or state tax return to reduce their taxable income Several types of interest are tax deductible

If you pay 1 000 in interest on your car loan annually this means you can only claim a 500 deduction On the other hand if the car is used entirely for business You can deduct the interest paid on an auto loan as a business expense using one of two methods the expense method or the standard mileage deduction when you file your

Download Deduction On Car Loan Interest

More picture related to Deduction On Car Loan Interest

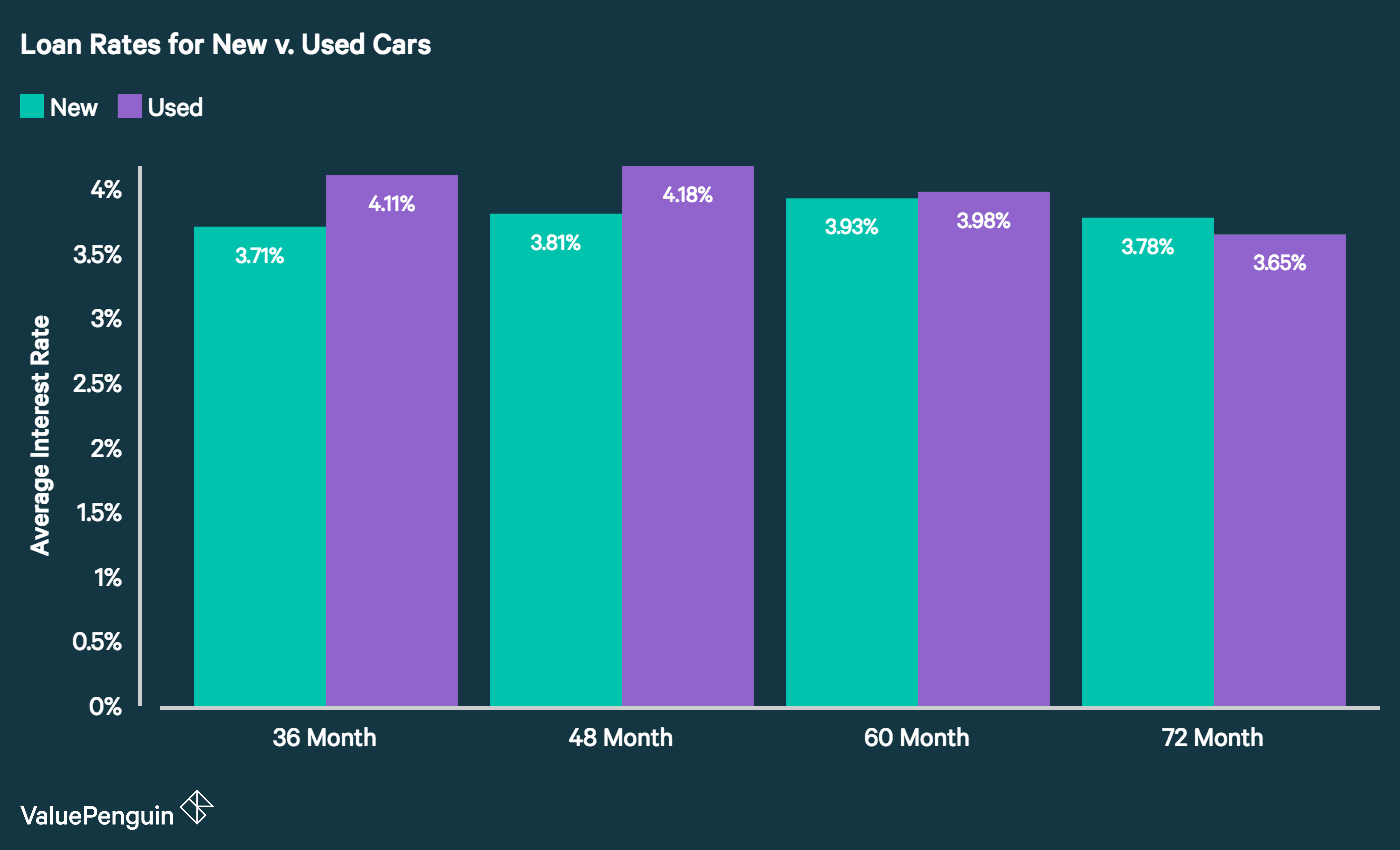

Average Auto Loan Interest Rates Facts And Figures Aromanist

https://res.cloudinary.com/value-penguin/image/upload/c_limit,dpr_1.0,f_auto,h_1600,q_auto,w_1600/v1/Loan_Rates_New_v._Used_SNL_fxgcwg

Check Out Average Auto Loan Rates According To Credit Score RoadLoans

https://i.pinimg.com/736x/4a/c4/35/4ac435606f0dd11911da664af27ac82c.jpg

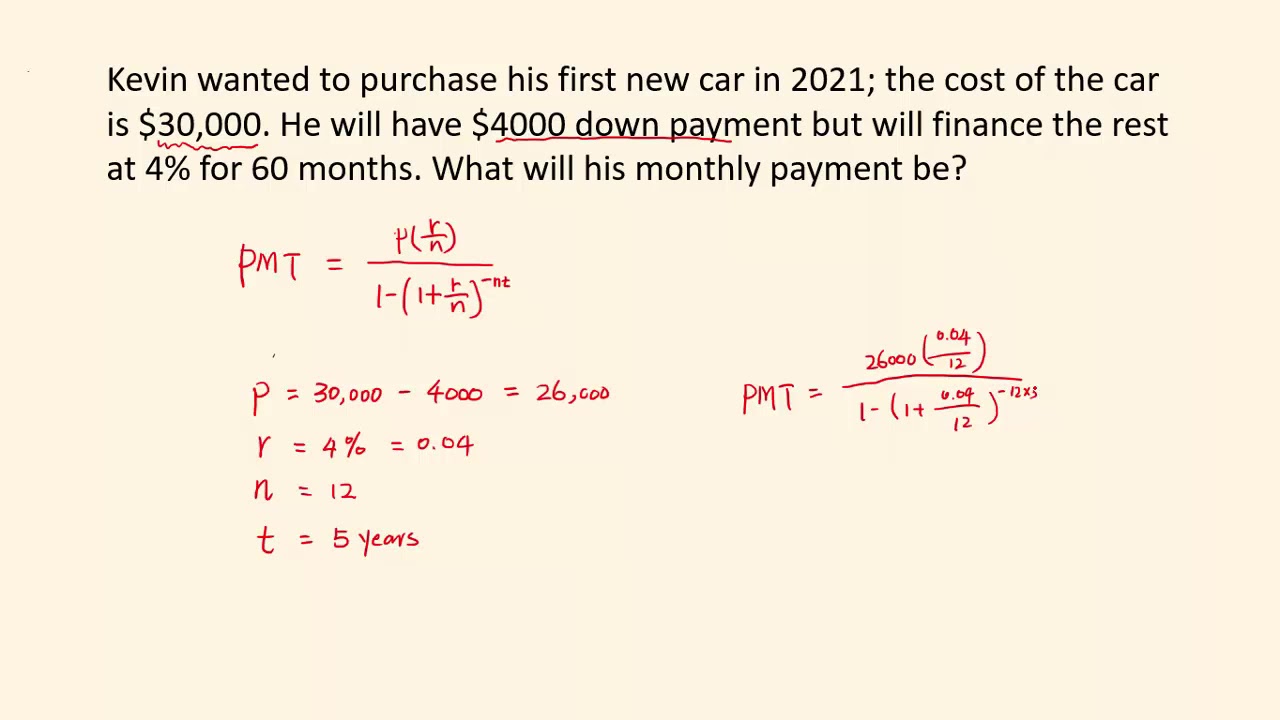

Calculate Monthly Payment And Total Interest For A Car Loan YouTube

https://i.ytimg.com/vi/lVIbAEipwik/maxresdefault.jpg

Short answer You will be able to deduct car loan interest from your tax returns only if you own a car for business purposes If you re self employed you will be able to write off a portion of your interest payment Generally auto loan interest is not tax deductible for personal use vehicles However there are exceptions If you use your car for business a portion of the interest may be deductible The key is determining the percentage of

Published Oct 10 2024 5 05 p m ET Former President Donald Trump promised Thursday he would make interest incurred on car loans fully tax deductible How can I deduct car loan interest There are two options for deducting vehicle expenses like car loan interest the standard mileage rate or the actual expense method It is up

How To Find The Best Car Loan Rate YourMechanic Advice

https://res.cloudinary.com/yourmechanic/image/upload/dpr_auto,f_auto,q_auto/v1/article_images/3_How_to_Compare_Car_Loan_Rates_calculator

How Do Loans Work Earnest

https://s3.amazonaws.com/earnest-static-assets/blog/How-a-loan-works-4-how-later-payments-include-less-interest.jpg

https://www.hrblock.com/tax-center/filing/...

Typically deducting car loan interest is not allowed But there is one exception to this rule If you use your car for business purposes you may be allowed to partially deduct car

https://www.irs.gov/taxtopics/tc505

Some interest can be claimed as a deduction or as a credit To deduct interest you paid on a debt review each interest expense to determine how it qualifies

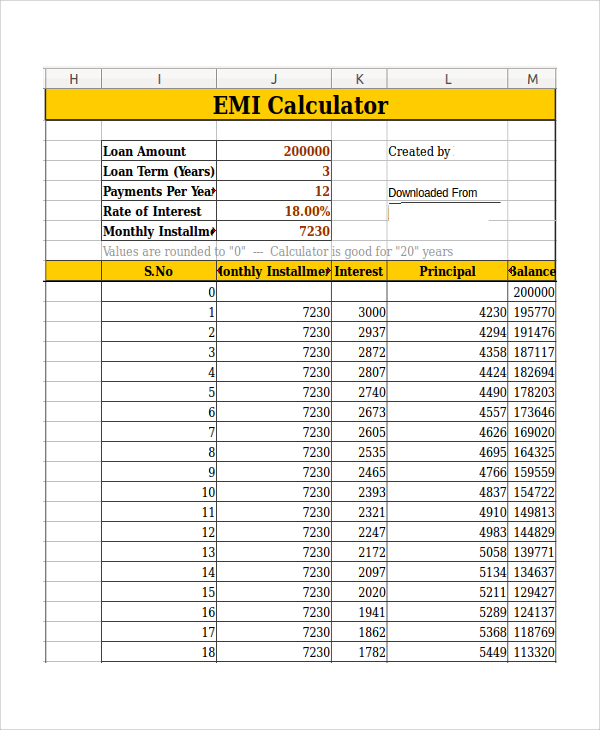

Car Loan Interest And Principal Calculator BriakruwHurst

How To Find The Best Car Loan Rate YourMechanic Advice

Average Interest Rate On 84 Month Car Loan Loan Walls

FREE 8 Sample Car Loan Calculator Templates In PDF MS Word EXEL

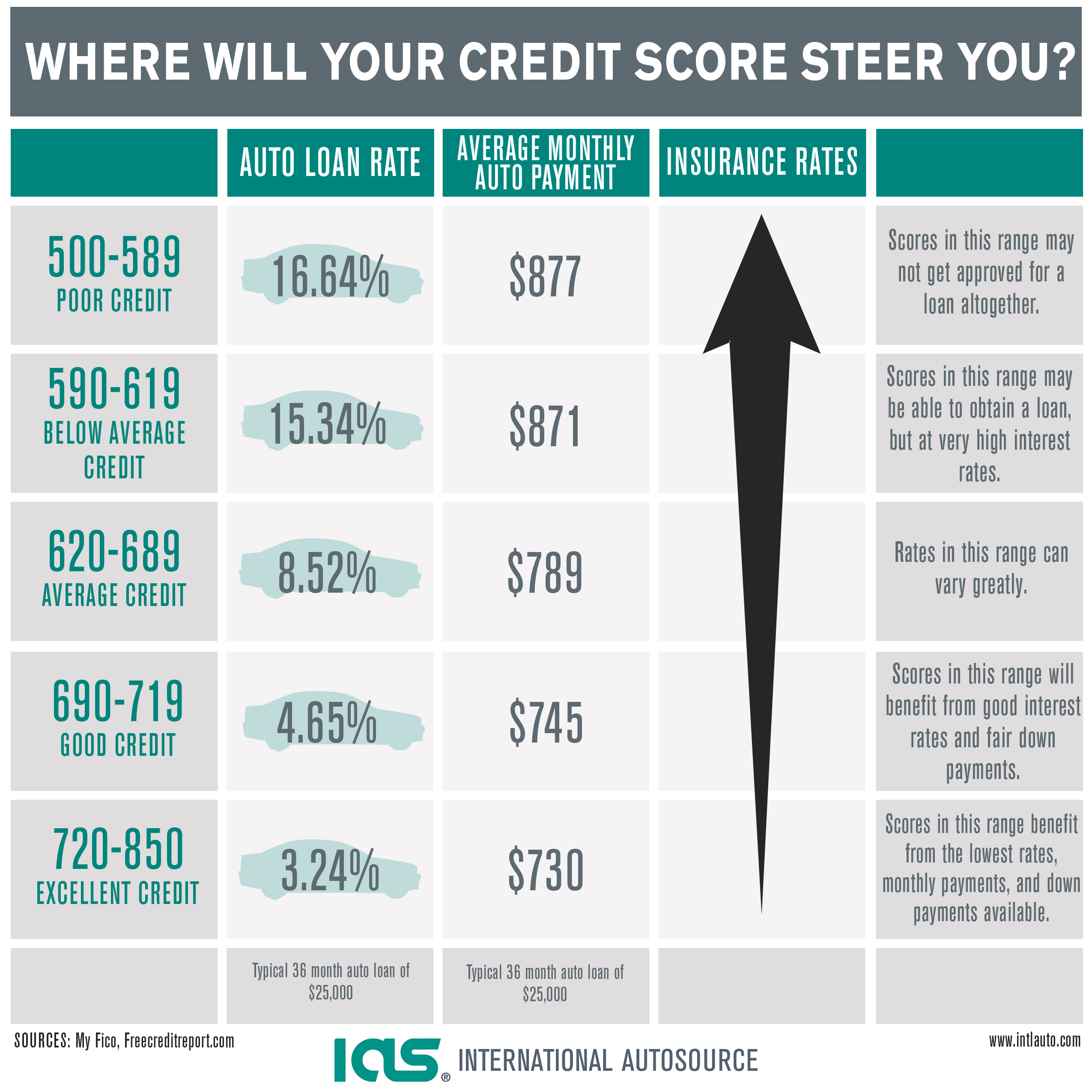

How A Bad Credit Score Affects Your Auto Loan Rate International

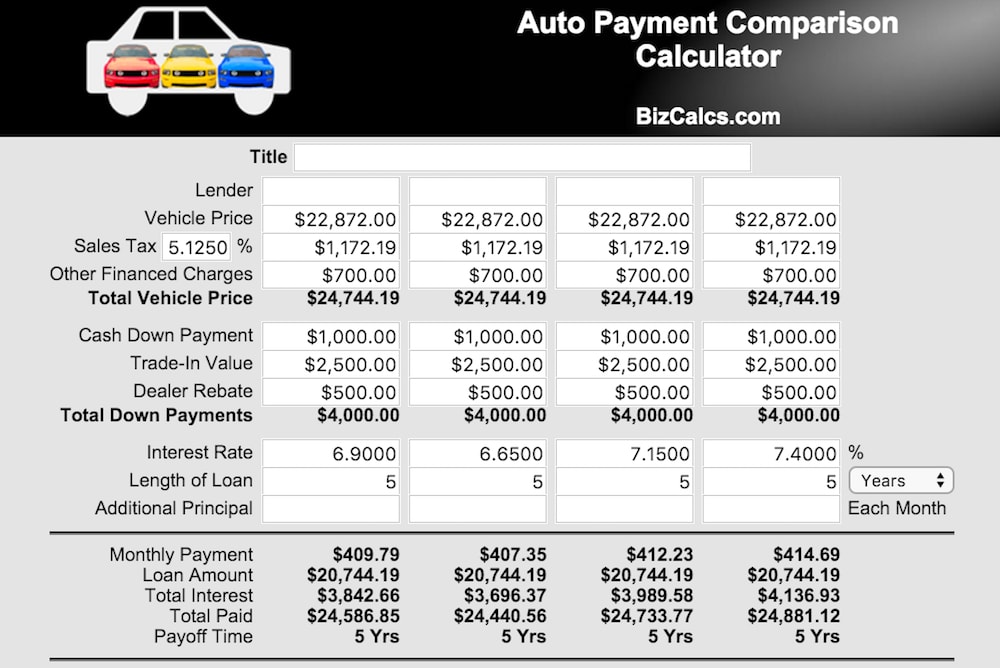

Car Payment Calculator Calculate Monthly Auto Loan Payment Interest

Car Payment Calculator Calculate Monthly Auto Loan Payment Interest

Student Loan Interest Deduction Los Angeles ORT College

How To Get The Interest Deduction On Your Student Loan

Car Loan Interest Based On Credit Score Loan Walls

Deduction On Car Loan Interest - Interest on car loans If you are an employee you can t deduct any interest paid on a car loan This interest is treated as personal interest and isn t deductible If you are self