Recovery Rebate Credi Web 13 janv 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the 2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit Your

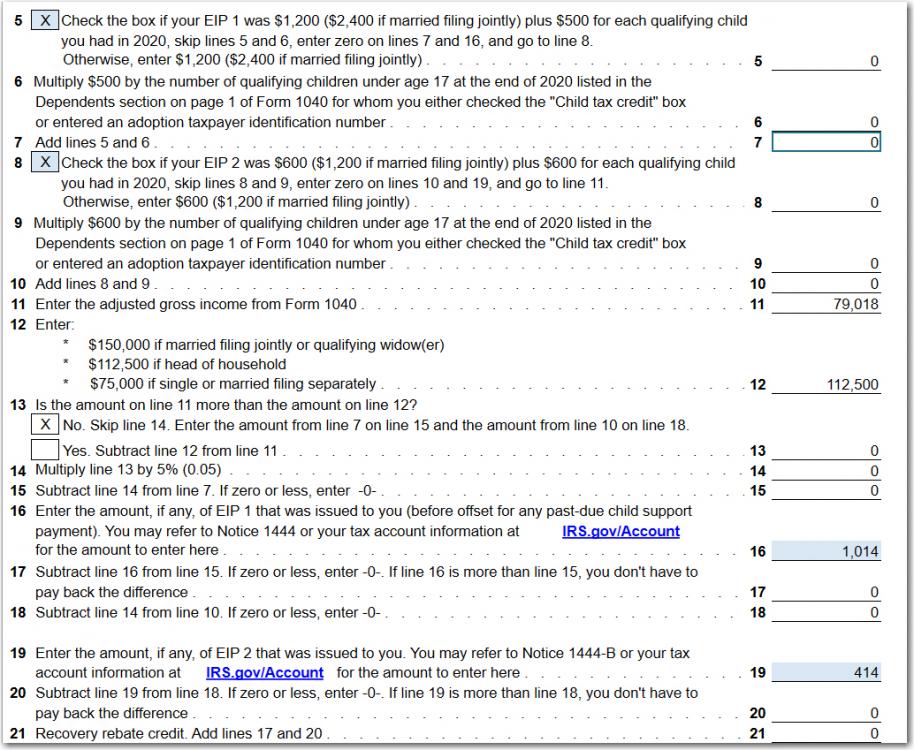

Web 10 d 233 c 2021 nbsp 0183 32 To claim the 2020 Recovery Rebate Credit you will need to Compute the 2020 Recovery Rebate Credit amount using the line 30 worksheet found in 2020 Form Web 30 d 233 c 2020 nbsp 0183 32 The Recovery Rebate Credit is a credit that was authorized by the Coronavirus Aid Relief and Economic Security CARES Act So if you were eligible

Recovery Rebate Credi

Recovery Rebate Credi

https://www.atxcommunity.com/uploads/monthly_2021_02/199195342_Line30JF.thumb.jpg.e31662de98fd0de6ecee8a30cd267c75.jpg

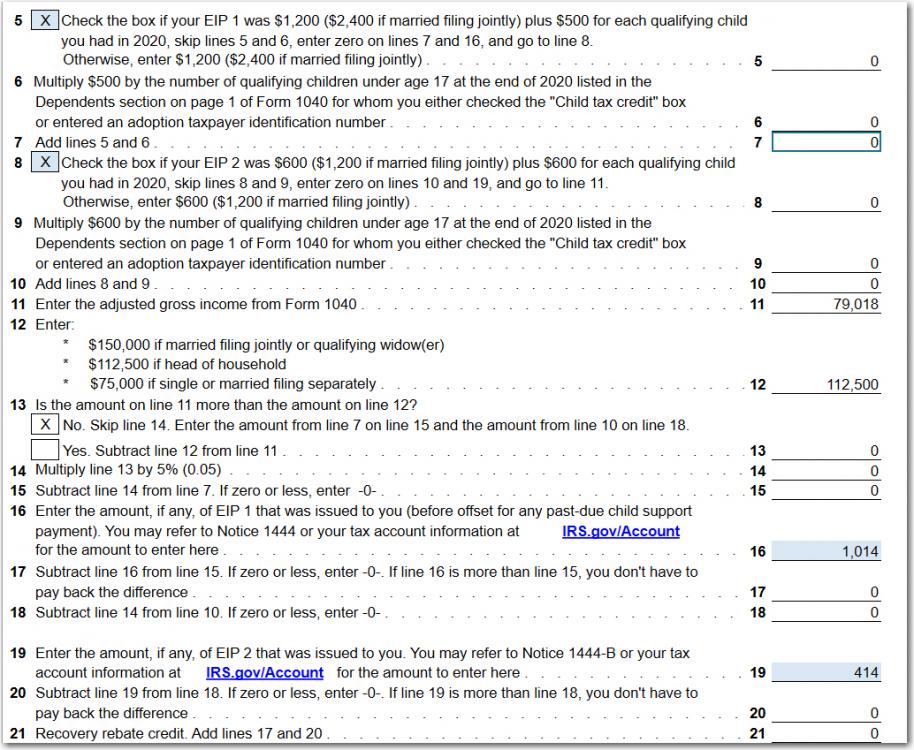

Ready To Use Recovery Rebate Credit 2021 Worksheet MSOfficeGeek

https://msofficegeek.com/wp-content/uploads/2022/01/Recovery-Rebate-Credit-Worksheet-1.png

Mastering The Recovery Rebate Credit Free Printable Worksheet Style

https://i2.wp.com/www.legacytaxresolutionservices.com/2255lega/250w/cp11r-2page001.png

Web 1 d 233 c 2022 nbsp 0183 32 What is the 2020 Recovery Rebate Credit The 2020 Recovery Rebate Credit is part of the Coronavirus Aid Relief and Economic Security CARES Act that was signed into law in March of Web 12 oct 2022 nbsp 0183 32 What s the Recovery Rebate Credit If you didn t get a third stimulus check or you didn t get the full amount you may be able to claim the recovery rebate credit on

Web 13 avr 2022 nbsp 0183 32 Please do not call the IRS Topic A Claiming the Recovery Rebate Credit if you aren t required to file a 2020 tax return Topic B Eligibility for claiming a Web What is the Recovery Rebate Credit The Recovery Rebate Credit makes it possible for any eligible individual who did not receive an Economic Impact Payment also known as

Download Recovery Rebate Credi

More picture related to Recovery Rebate Credi

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

http://www.taxguru.net/uploaded_images/IRSRebateRecoveryWorksheet9108-780101.jpg

How To Claim Missing Stimulus Money On Your 2020 Tax Return In 2021

https://i.pinimg.com/originals/c5/01/7b/c5017b88440e5203d6056b3107d8882f.png

Recovery Rebate Credit Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Recovery-Rebate-Credit-Form-2021.jpg

Web 21 avr 2023 nbsp 0183 32 The Recovery Rebate is available for federal income tax returns up to 2021 Tax dependents who qualify can receive up 1 400 married couples with two Web What is the Recovery Rebate Credit The Recovery Rebate Credit was added to 2020 individual tax returns in order to reconcile the Economic Impact stimulus Payments

Web 1 mars 2022 nbsp 0183 32 The recovery rebate credit is for those who did not receive a third stimulus check In some cases even a person who did receive the third 1 4000 stimulus check Web 10 d 233 c 2021 nbsp 0183 32 If you must file an amended return to claim the Recovery Rebate Credit use the worksheet on page 59 of the 2020 instructions for Form 1040 and Form 1040 SR

What Is The Recovery Rebate Credit CD Tax Financial

https://cdtax.com/wp-content/uploads/2021/02/Recovery-Rebate-Worksheet-1-1187x1536.png

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

https://i2.wp.com/lh5.googleusercontent.com/proxy/lGA90iOjY_1LO-OBBI3qmZMyKEj47RMisqIykTyVbIbO-V2GqH4xUV92z9Uq0pojRygogoMZtKIKKsqfiqET_2bvfJQoMviJq-wHNdbSR8ZyQ-ukMly2632ZZ7bKcCkHDaCeogT6Skm16tenIHu_TkBU8w=w1200-h630-p-k-no-nu

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e...

Web 13 janv 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the 2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit Your

https://www.irs.gov/newsroom/2020-recovery-rebate-credit-topic-a...

Web 10 d 233 c 2021 nbsp 0183 32 To claim the 2020 Recovery Rebate Credit you will need to Compute the 2020 Recovery Rebate Credit amount using the line 30 worksheet found in 2020 Form

Recovery Rebate Credit Calculator EireneIgnacy

What Is The Recovery Rebate Credit CD Tax Financial

The Recovery Rebate Credit Calculator MollieAilie

How To Use The Recovery Rebate Credit Worksheet TY2020 Print View

Filing Your 2008 Taxes With The Economic Stimulus Recovery Rebate Credit

Recovery Rebate Credit 2020 Calculator KwameDawson

Recovery Rebate Credit 2020 Calculator KwameDawson

1040 EF Message 0006 Recovery Rebate Credit Drake20

Recovery Credit Printable Rebate Form

How To Claim Recovery Rebate Credit Turbotax Romainedesign Recovery

Recovery Rebate Credi - Web 1 d 233 c 2022 nbsp 0183 32 What is the 2020 Recovery Rebate Credit The 2020 Recovery Rebate Credit is part of the Coronavirus Aid Relief and Economic Security CARES Act that was signed into law in March of