Welcome to Our blog, a space where inquisitiveness satisfies details, and where everyday subjects come to be appealing discussions. Whether you're looking for understandings on way of living, innovation, or a little everything in between, you've landed in the best location. Join us on this expedition as we study the worlds of the common and extraordinary, understanding the globe one blog post each time. Your journey right into the interesting and varied landscape of our Deduction On Housing Loan Interest Section 80eea begins here. Explore the exciting web content that awaits in our Deduction On Housing Loan Interest Section 80eea, where we decipher the complexities of various subjects.

Deduction On Housing Loan Interest Section 80eea

Deduction On Housing Loan Interest Section 80eea

Interest On Home Loan For Affordable Housing Income Tax Benefits

Interest On Home Loan For Affordable Housing Income Tax Benefits

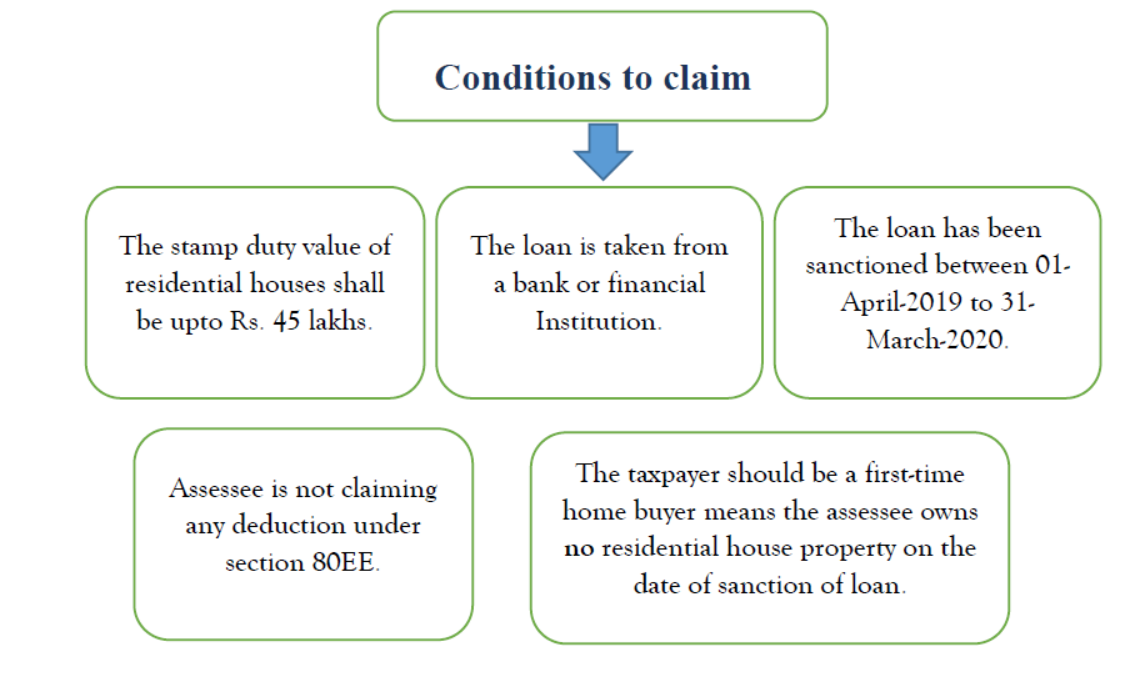

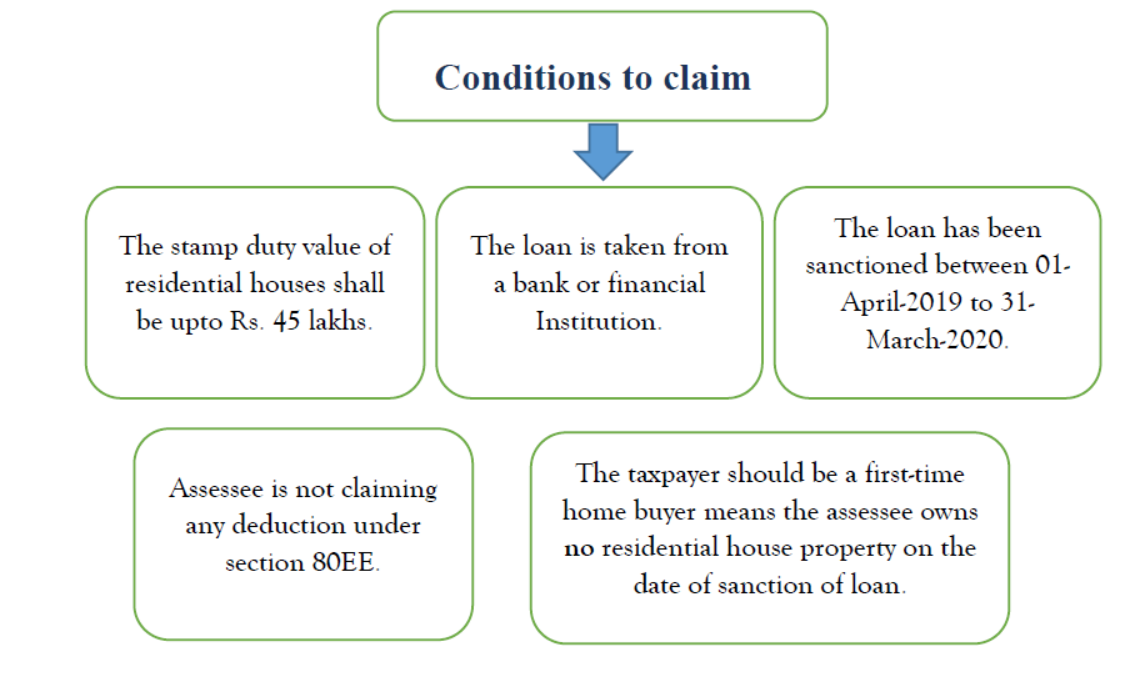

Section 80EEA Deduction For Interest Paid On Home Loan For Affordable

Section 80EEA Deduction For Interest Paid On Home Loan For Affordable

Gallery Image for Deduction On Housing Loan Interest Section 80eea

All About Section 80EEA For Deduction On Home Loan Interest

Section 80EEA Tax Deduction On Home Loan Interest Payment

Section 80EEA Deduction For Interest Paid On Home Loan By Sobha

Section 80EE Income Tax Deduction For Interest On Home Loan

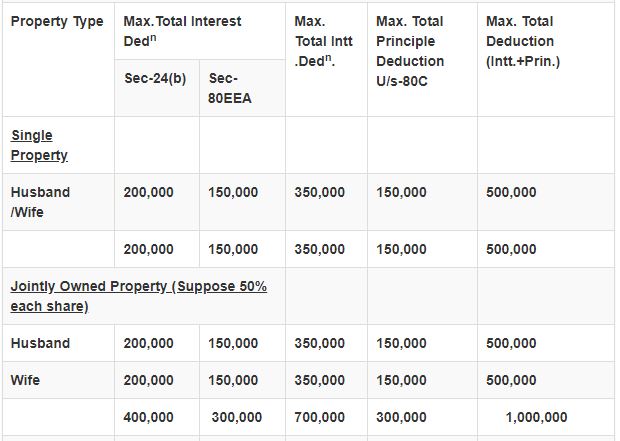

Tax Benefits On Home Loan Know More At Taxhelpdesk

Section 80EEA Of IT Act Additional Deduction Of Interest Payment In

Section 80EEA Of IT Act Additional Deduction Of Interest Payment In

All About Deduction Of Housing Loan Interest U s 24 b Of The Income

Thank you for choosing to discover our website. We best regards hope your experience surpasses your expectations, and that you discover all the details and sources about Deduction On Housing Loan Interest Section 80eea that you are looking for. Our dedication is to supply a straightforward and helpful system, so do not hesitate to navigate via our pages with ease.