Deduction Under Section 16 Iii Of Income Tax Act Deductions from Salary Section 16 Income tax Act allows three deductions from the salary income i e Standard Deduction Deduction for Entertainment Allowance and Deduction for

Deduction for professional tax paid on salary income under Section 16 iii Your salary income attracts professional tax which forms a part of your tax liability However Section 16 iii of the Income Tax Act 1961 Professional tax deduction under Section 16 iii is limited to 2 500 per year if paid by the employer included in salary Pensioners can also claim 50 000 or their pension amount whichever is less as the standard deduction

Deduction Under Section 16 Iii Of Income Tax Act

Deduction Under Section 16 Iii Of Income Tax Act

https://enskyar.com/img/Blogs/Deduction-from-Salary-under-section-16-of-Income-Tax-Act.jpg

Section 16 Of The Income Tax Act

https://www.canarahsbclife.com/content/dam/choice/blog-inner/images/tax-deduction-under-section-16.jpg

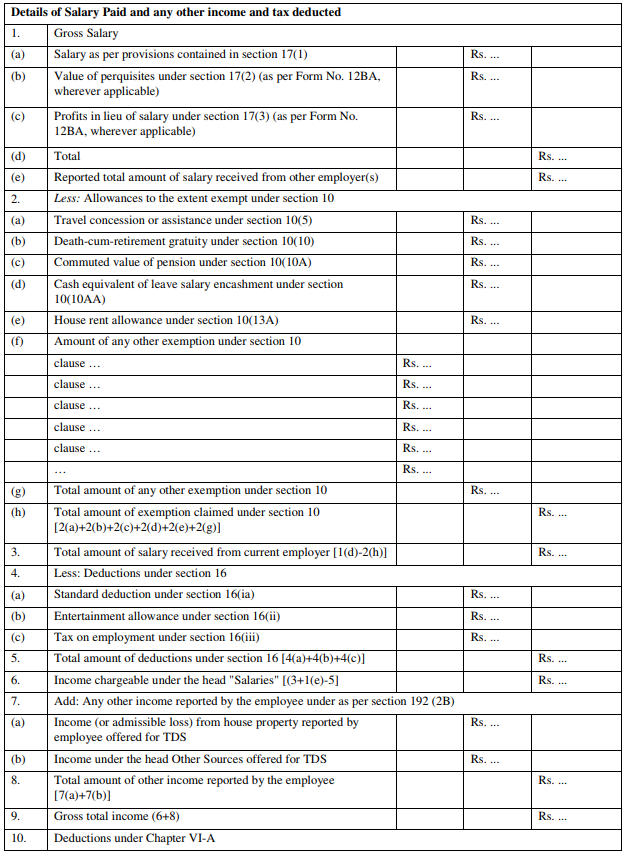

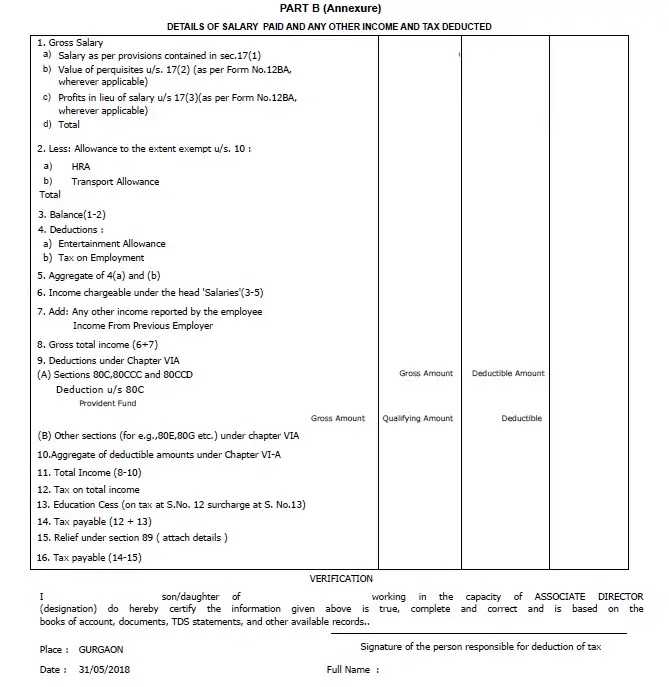

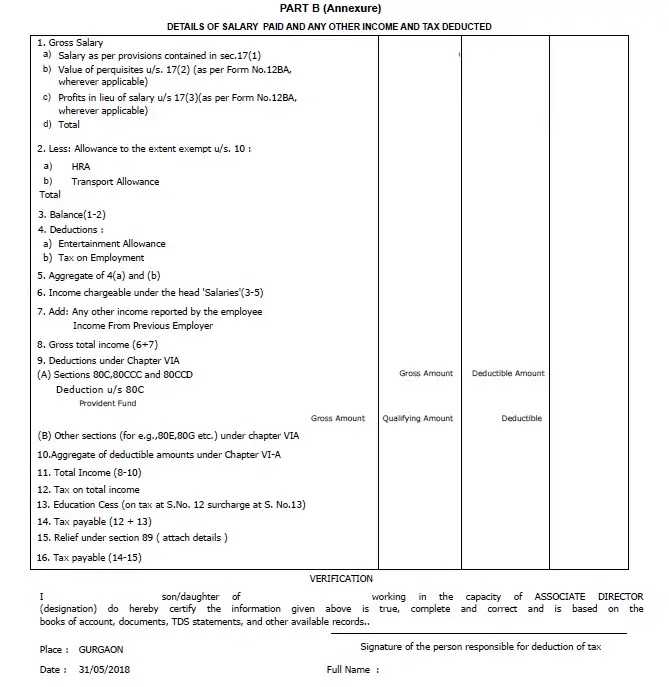

Revised Form 16 Under Income Tax Act Notification

https://7thpaycommissionnews.in/wp-content/uploads/2019/04/New-format-of-form-16-1.png

Explore the benefits and eligibility criteria for the Section 16 deduction under the Income Tax Act Understand how salaried employees can claim relief and reduce taxable income Section 16 iii of Income Tax Act 1961 provides for deduction of any sum paid by the assessee on account of Employment Tax Profession Tax levied within the meaning of

Section 16 of the Income Tax Act contains important provisions regarding deductions allowed from gross salary income to arrive at net taxable salary Salaried individuals and pensioners should accurately claim these Explore Standard Deduction under Section 16 ia and in the new tax regime Know standard deduction in new old tax regimes its applicability benefits for senior citizens Learn how it would impact your income tax

Download Deduction Under Section 16 Iii Of Income Tax Act

More picture related to Deduction Under Section 16 Iii Of Income Tax Act

Section 16 Of The Income Tax Act A Detailed Guide

https://www.tataaia.com/content/dam/tataaialifeinsurancecompanylimited/blogs/investment-planning/section-16-of-the-income-tax-act-a-detailed-guide/Section-16-of-the-Income-Tax-Act-Desktop.jpg

Standard Deduction From Salary Income Under Section 16 IndianTaxStudy

https://i0.wp.com/indiantaxstudy.com/assets/uploads/2021/02/STANDARD-DEDUCTION-FROM-SALARY.png?fit=1180%2C659&ssl=1

Income Tax Section 16 Standard Deduction Rs 50 000

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEipYTNNBfVeEsg9xC9nvAOGswnXRG8vvHp86XGaR1rC0RSMMS4SN5zm0IwveAvmzvDOy-brTVoZfHps_scHfbn1hckxnXSlV5PQpnyKhsF-AIy6FU4vkT5xjXmzH9vFn33vrT3-yLHYCg6PmwQbBbPdbnqHHx9B9ipd7vL9DizameF7ilwLkhIJwU6x/w640-h412/Form 16 Part B.jpg

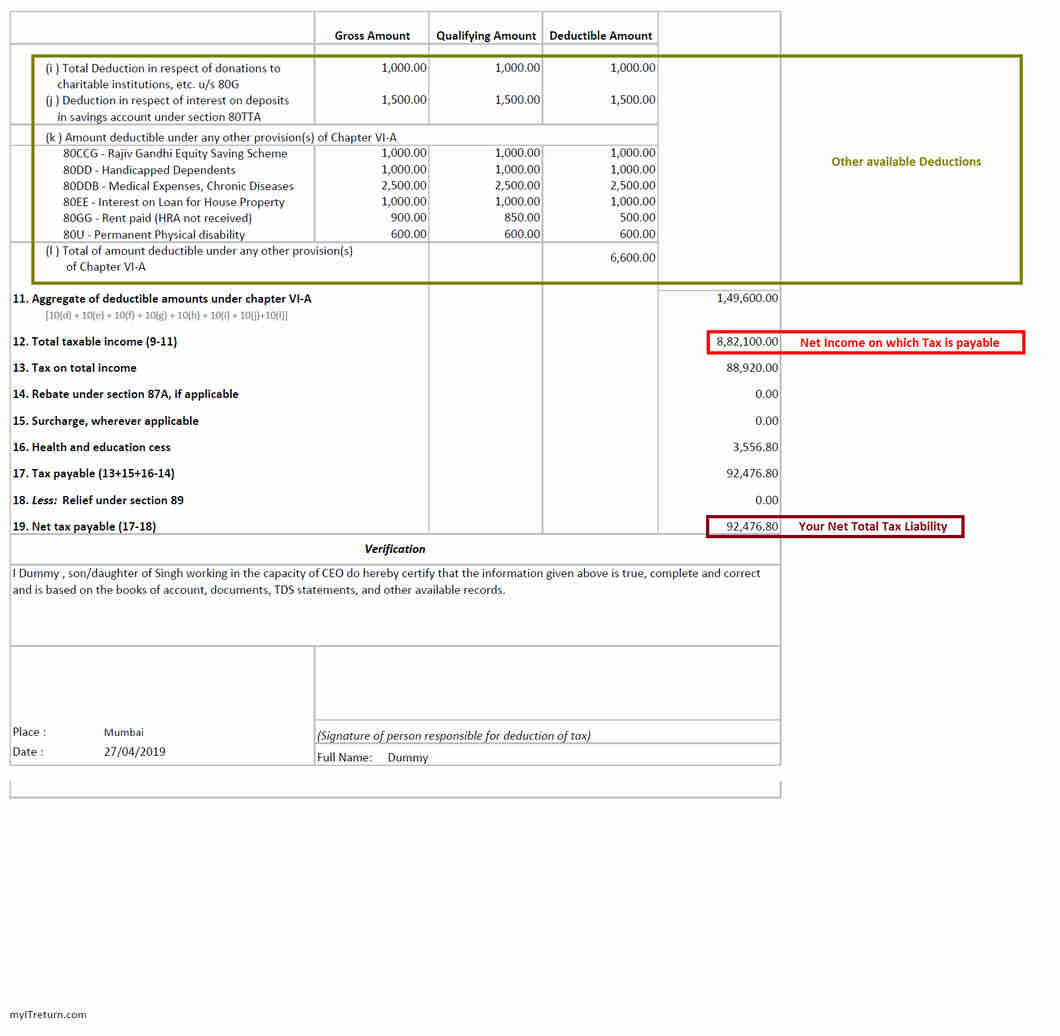

According to Section 16 iii of the income tax act the professional tax paid by employees is eligible for deduction from their income This deduction is available to all salaried individuals and is limited to the actual amount of Section 16iii of the Income Tax Act allows for a deduction for employment taxes Section 16 allows a taxpayer to deduct the amount paid on account of a tax on employment or professional tax The employment tax is allowed for in Article

Deduction on the professional tax under Section 16 iii Professional tax is applicable on your salary income and becomes a part of your tax liability However Section Section 16 iii in The Income Tax Act 1961 iii a deduction of any sum paid by the assessee on account of a tax on employment within the meaning of clause 2 of article 276 of the

Section 16 Of Income Tax Act Benefits And Eligibility Criteria

https://margcompusoft.com/m/wp-content/uploads/2023/03/6-50-1024x576.jpg

Income Tax Form 16 What Is Form 16 Eligibility Benefits And Exemptions

https://www.godigit.com/content/dam/godigit/directportal/en/contenthm/tax-form-16-2.jpg

https://incometaxindia.gov.in/Tutorials/80...

Deductions from Salary Section 16 Income tax Act allows three deductions from the salary income i e Standard Deduction Deduction for Entertainment Allowance and Deduction for

https://www.turtlemint.com/tax/section-…

Deduction for professional tax paid on salary income under Section 16 iii Your salary income attracts professional tax which forms a part of your tax liability However Section 16 iii of the Income Tax Act 1961

Section 16 Standard Deduction Professional Tax LegalRaasta

Section 16 Of Income Tax Act Benefits And Eligibility Criteria

Deduction Under Section 16 Income From Salary YouTube

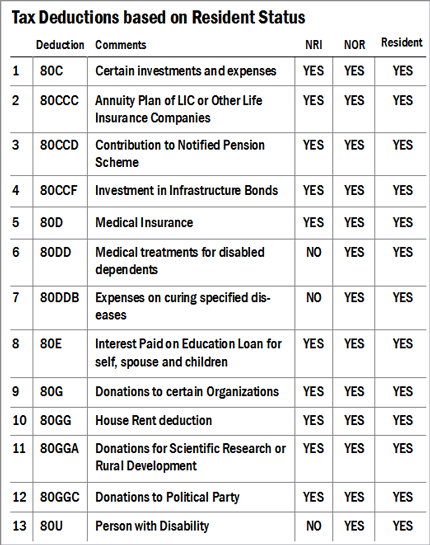

All About Tax Deductions To Save Taxes Value Research

File Your Salary Income Tax For FY 2019 20

Standard Deduction U s 16 ia With Automated Income Tax Form 16

Standard Deduction U s 16 ia With Automated Income Tax Form 16

Salaries Deduction Under Section 16 YouTube

How To Claim Standard Deduction Under Section 16 ia YouTube

How To Claim Deduction Under Section 80GG Of Income Tax Act For Rent

Deduction Under Section 16 Iii Of Income Tax Act - ITR Filing Section 16 is a provision under the Income Tax Act under the section a deduction is provided to taxpayers from the income chargeable to tax under the head salaries