Tax Rebate Business Mileage Web 21 mars 2023 nbsp 0183 32 How to Claim a Mileage Tax Deduction You need to know the rules for claiming mileage on your taxes and more importantly you need to keep careful records

Web 28 mars 2014 nbsp 0183 32 Where an employee s business journey qualifies for tax relief the amount of tax relief to which they are entitled is the full cost of that business journey In working Web The current mileage allowance rate is 45p per mile for the first 10 000 miles and 25p per mile for any additional miles Note that if you count mileage from two different

Tax Rebate Business Mileage

Tax Rebate Business Mileage

https://goselfemployed.co/wp-content/uploads/2019/02/tax-rebate-work-mileage-1-1068x889.png

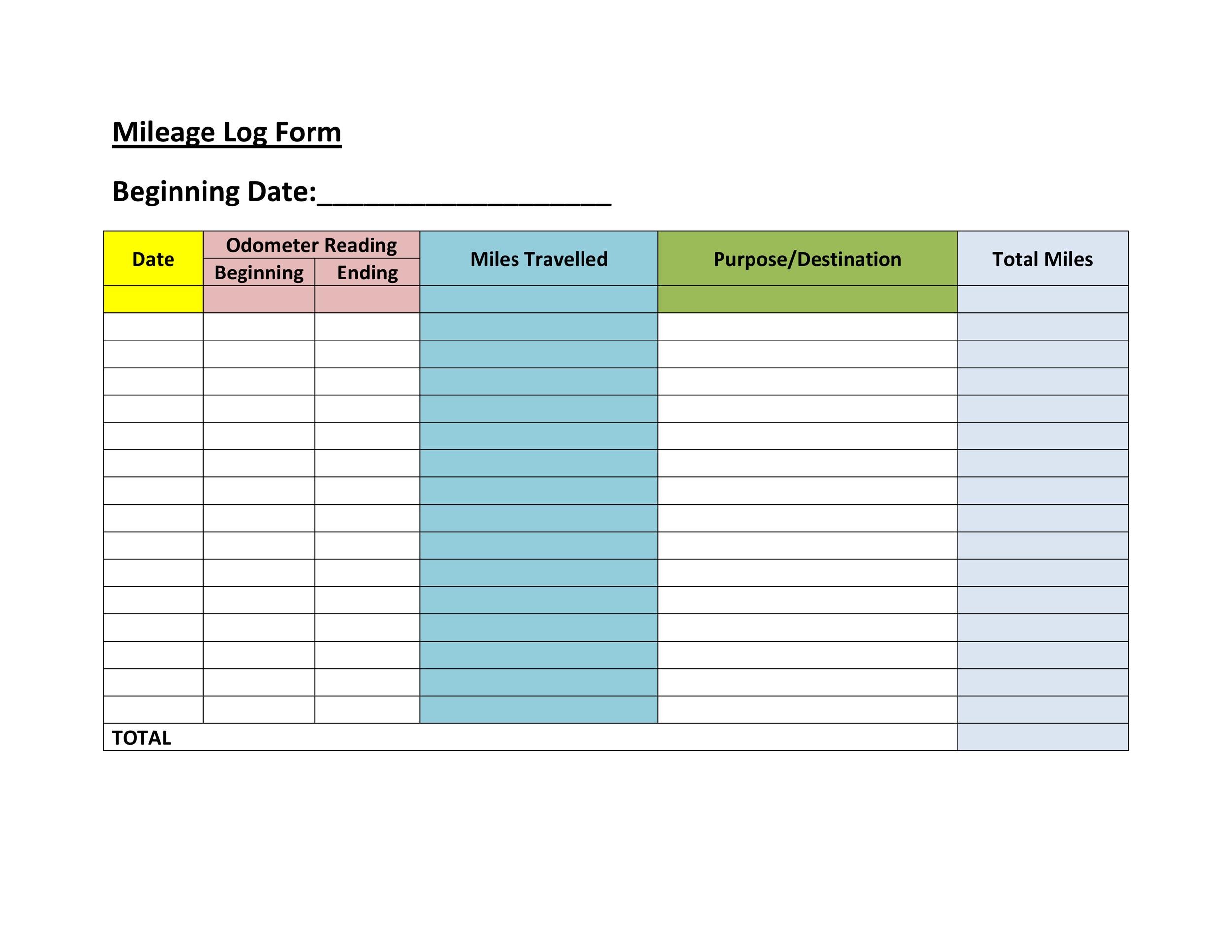

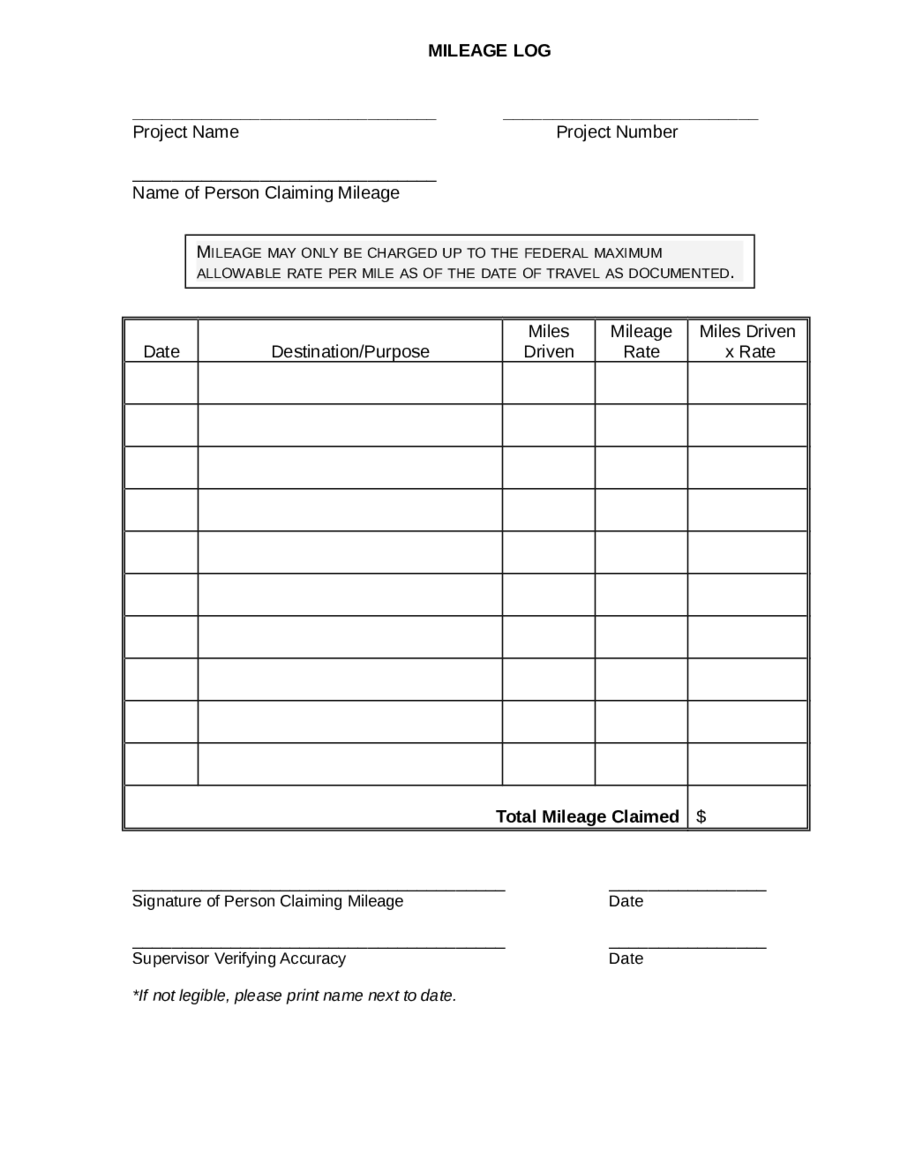

Mileage Log Template For Taxes Awesome Free Mileage Spreadsheet For

https://i.pinimg.com/originals/83/e0/1f/83e01f67e4be5e30783b672af4d0b280.jpg

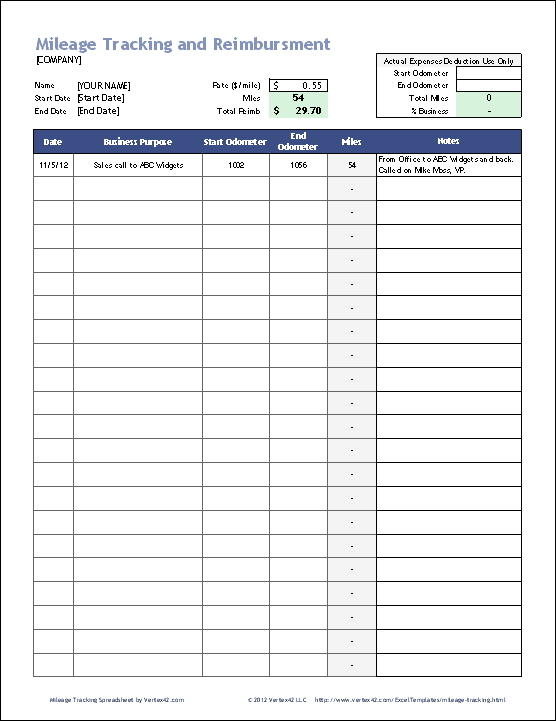

Mileage Log With Reimbursement Form MS Excel Excel Templates Excel

https://i.pinimg.com/originals/89/1b/0a/891b0ad37c9259795ebb74fa88dbb1e0.png

Web If you carry a passenger in your car 163 0 05 per passenger per business mile Motorcycle 163 0 24 per mile Bicycle 163 0 20 per mile How much is a mileage tax rebate worth The Web 21 d 233 c 2022 nbsp 0183 32 Business miles can be deducted at a rate of 0 585 per mile for tax year 2022 You can deduct business miles in many more situations if you are self employed Changes to Mileage Deductions In previous

Web 27 janv 2023 nbsp 0183 32 For the 2022 tax year you re looking at two mileage rates for business use A rate of 58 5 cents a mile applies to travel from January through June last year and it s 62 5 cents per mile Web Using an IRS tax deduction rate as a business mileage reimbursement in 2022 This inequity of rate could easily cause low mileage employees like Driver 1 to attempt to

Download Tax Rebate Business Mileage

More picture related to Tax Rebate Business Mileage

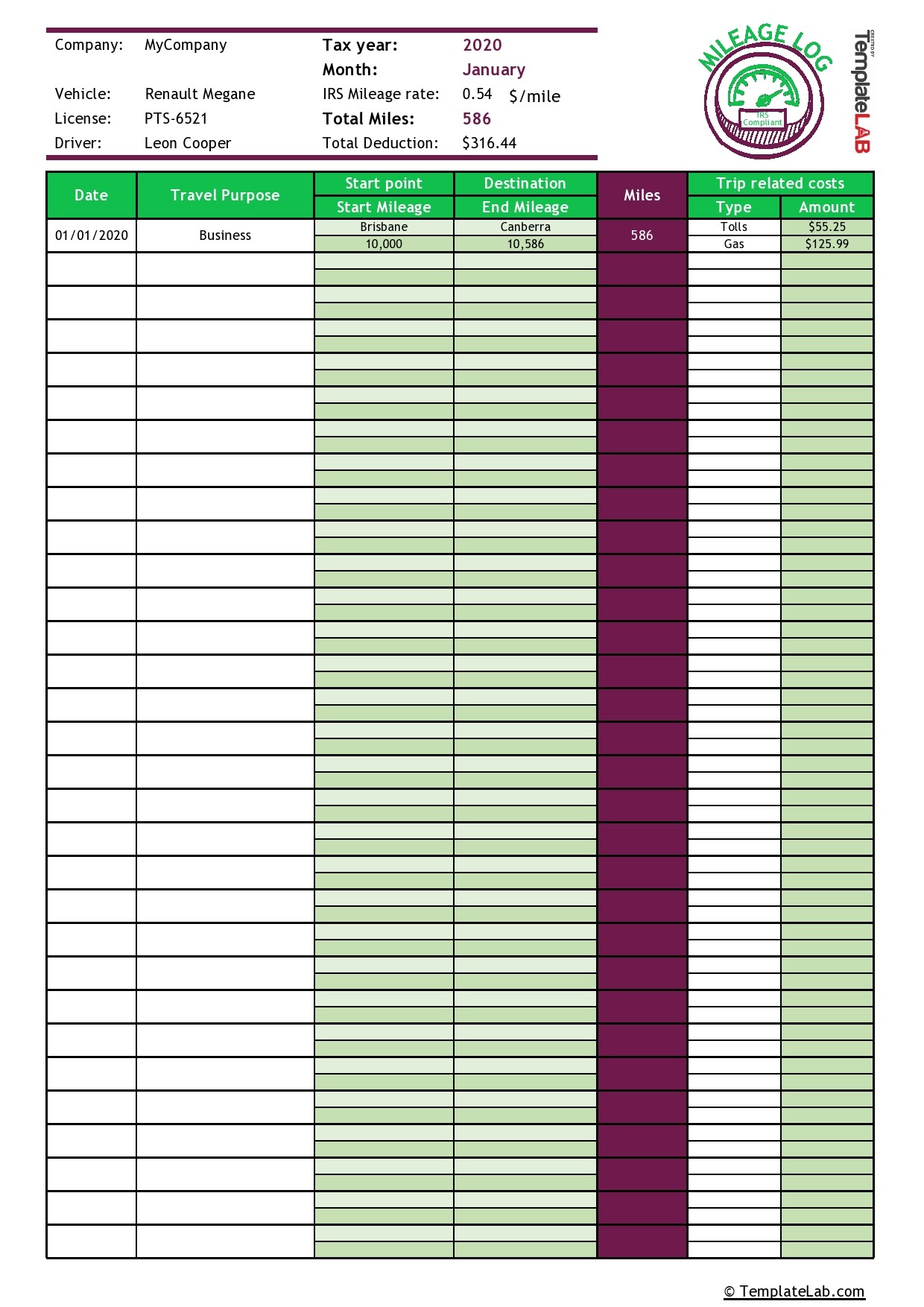

31 Printable Mileage Log Templates Free TemplateLab

http://templatelab.com/wp-content/uploads/2020/02/IRS-Compliant-Mileage-Log-01-TemplateLab.com_.jpg

31 Printable Mileage Log Templates Free TemplateLab

http://templatelab.com/wp-content/uploads/2015/11/Mileage-Log-10.jpg?w=320

31 Printable Mileage Log Templates Free TemplateLab

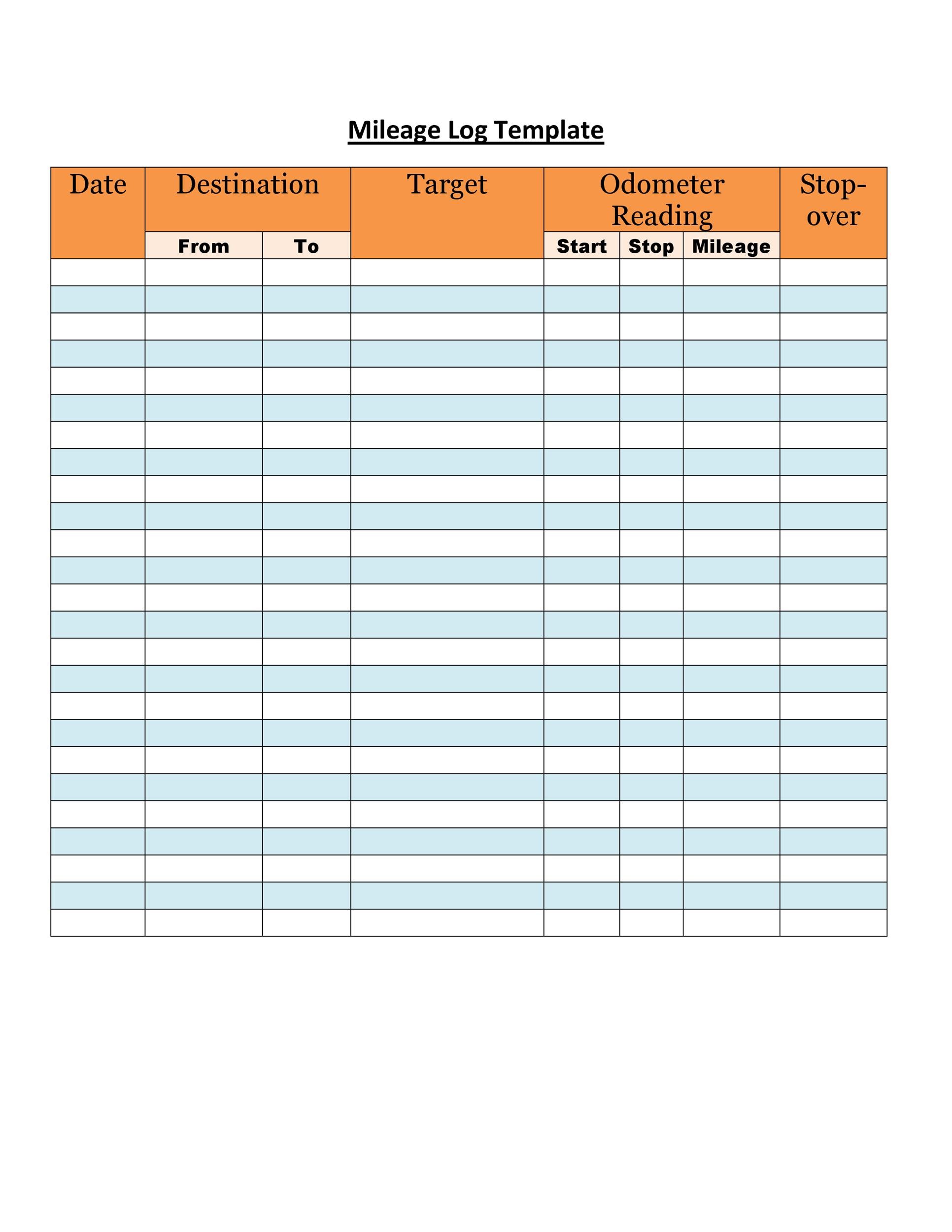

http://templatelab.com/wp-content/uploads/2015/11/Mileage-Log-06.jpg?w=320

Web Mileage allowance rebate works by reducing your taxable pay based the total number of business miles travelled in the year multiplied by specific Approved Mileage Rates Web Mileage Allowance Relief can be calculated by multiplying your business mileage by the Approved Rates set out below This will give you the amount on which you can claim tax

Web 2 janv 2023 nbsp 0183 32 Multiply business miles driven by the IRS rate To find out your business tax deduction amount multiply your business miles driven by the IRS mileage deduction Web From tax year 2011 to 2012 onwards First 10 000 business miles in the tax year Each business mile over 10 000 in the tax year Cars and vans 45p 25p Motor cycles 24p

Mileage Log Mileage Tracker For Tax Purposes Printable Etsy Mileage

https://i.pinimg.com/originals/f8/d9/9a/f8d99ab7e9c144e310820bd1d9ef80b4.jpg

22 Business Mileage Template Excel Templates

http://www.exceltemplates.org/wp-content/uploads/2016/05/Mileage-Log.jpeg

https://money.usnews.com/money/personal-finance/taxes/articles/...

Web 21 mars 2023 nbsp 0183 32 How to Claim a Mileage Tax Deduction You need to know the rules for claiming mileage on your taxes and more importantly you need to keep careful records

https://www.gov.uk/guidance/business-journeys-tax-relief-490-chapter-5

Web 28 mars 2014 nbsp 0183 32 Where an employee s business journey qualifies for tax relief the amount of tax relief to which they are entitled is the full cost of that business journey In working

Mileage Report Template 7 TEMPLATES EXAMPLE TEMPLATES EXAMPLE

Mileage Log Mileage Tracker For Tax Purposes Printable Etsy Mileage

Printable Free Mileage Log Template For Taxes Track Business Miles

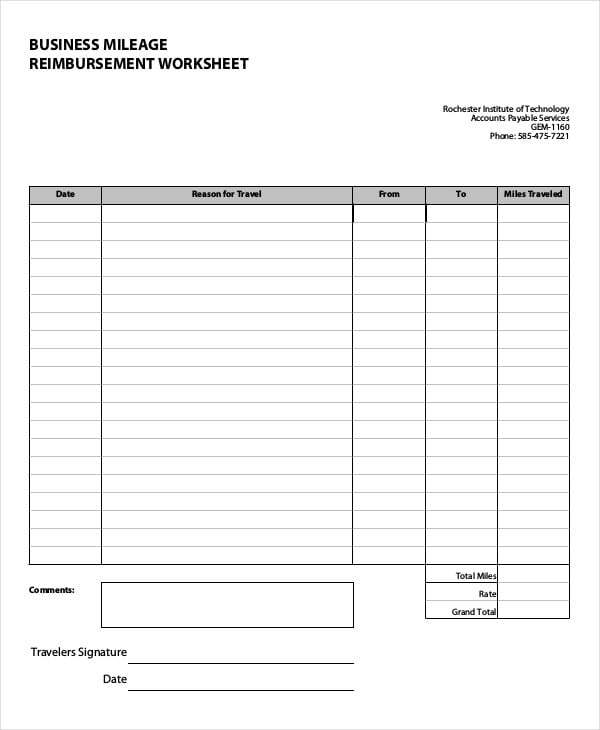

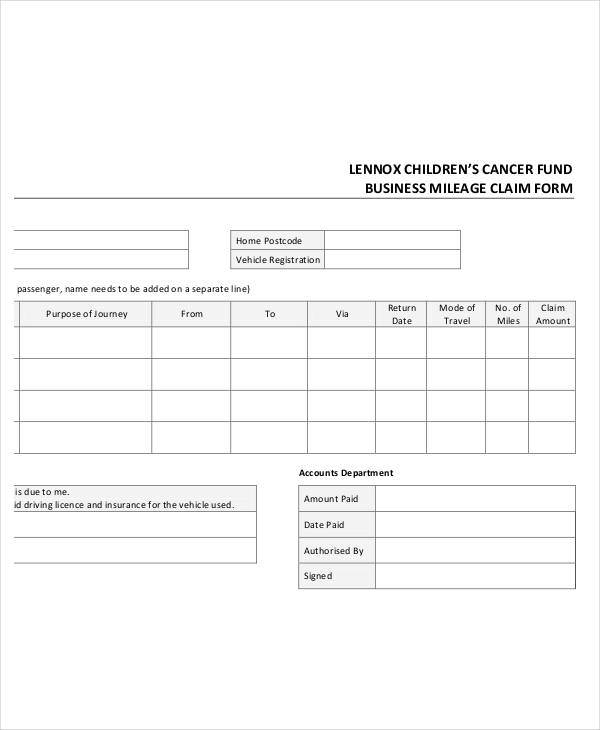

Mileage Reimbursement Form Word MS Excel Templates

Mileage Log Template For Taxes Inspirational 2019 Mileage Log Fillable

Mileage Spreadsheet For Taxes Mileage Spreadsheet Mileage Tracker

Mileage Spreadsheet For Taxes Mileage Spreadsheet Mileage Tracker

Mileage Reimbursement Spreadsheet MS Excel Templates

10 Excel Mileage Log Templates Excel Templates

FREE 32 Claim Form Templates In PDF Excel MS Word

Tax Rebate Business Mileage - Web 1 ao 251 t 2023 nbsp 0183 32 When you use your personal vehicle for business purposes many employers will reimburse you per mile with Mileage Allowance Payments MAP HMRC provides