Deduction Under Taxable Income A tax deduction reduces your taxable income and how much tax you owe You can itemize your deductions or take a fixed

The standard deduction in 2024 is 14 600 for individuals 29 200 for joint filers and 21 900 for heads of households The IRS Tax deductions reduce your taxable income by allowing you to write off certain expenses Learn more about this tax incentive and

Deduction Under Taxable Income

Deduction Under Taxable Income

https://www.vivabcs.com.vn/assets/uploads/2017/03/Tips-on-taxable-income-deduction-1.jpg

Standard Deduction 2020 Self Employed Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/standard-deduction-budget-announcements-budget-2018-gives.jpg

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

https://carajput.com/blog/wp-content/uploads/2023/05/Deduction-913x1024.jpg

Section 80 Deductions A complete guide on Income Tax deduction under section 80C 80CCC 80CCD 80D Find out the deduction under section 80c for FY 2023 24 AY 2024 25 A deduction is an amount you subtract from your income when you file so you don t pay tax on it By lowering your income deductions lower your tax You need documents to show expenses or losses you want to deduct

The standard deduction is a flat amount that reduces your taxable income and potentially your tax bill The amount set by the IRS could vary by tax year and filing One can claim a few selective deductions under the new tax regime for FY 2023 24 such as a standard deduction of Rs 50 000 interest on Home Loan u s 24b on let out property employer s contribution to

Download Deduction Under Taxable Income

More picture related to Deduction Under Taxable Income

Standard Deduction For Assessment Year 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-6.jpg

INCOME TAX DEDUCTION UNDER SECTION 80C TO 80U PDF

https://moneyexcel.com/images/incometaxchart.png

Tax On Fixed Deposit FD How Much Tax Is Deducted On Fixed Deposits

https://www.hdfcsales.com/blog/wp-content/uploads/2021/06/tax-deduction-on-fixed-deposit.jpg

As part of the annual budget being presented to parliament on Thursday the centre right government of Lu s Montenegro aims to reduce income tax for under As per Budget 2023 salaried taxpayers are now eligible for a standard deduction of Rs 50 000 under the new tax regime also from the financial year 2023 24 Read more on Standard Deduction

Former President Donald J Trump s economic proposals could inflame the nation s debt burden while ultimately raising costs for a vast majority of Americans For purposes of determining tested income and tested loss the gross income and allowable deductions of a controlled foreign corporation for a CFC inclusion year are

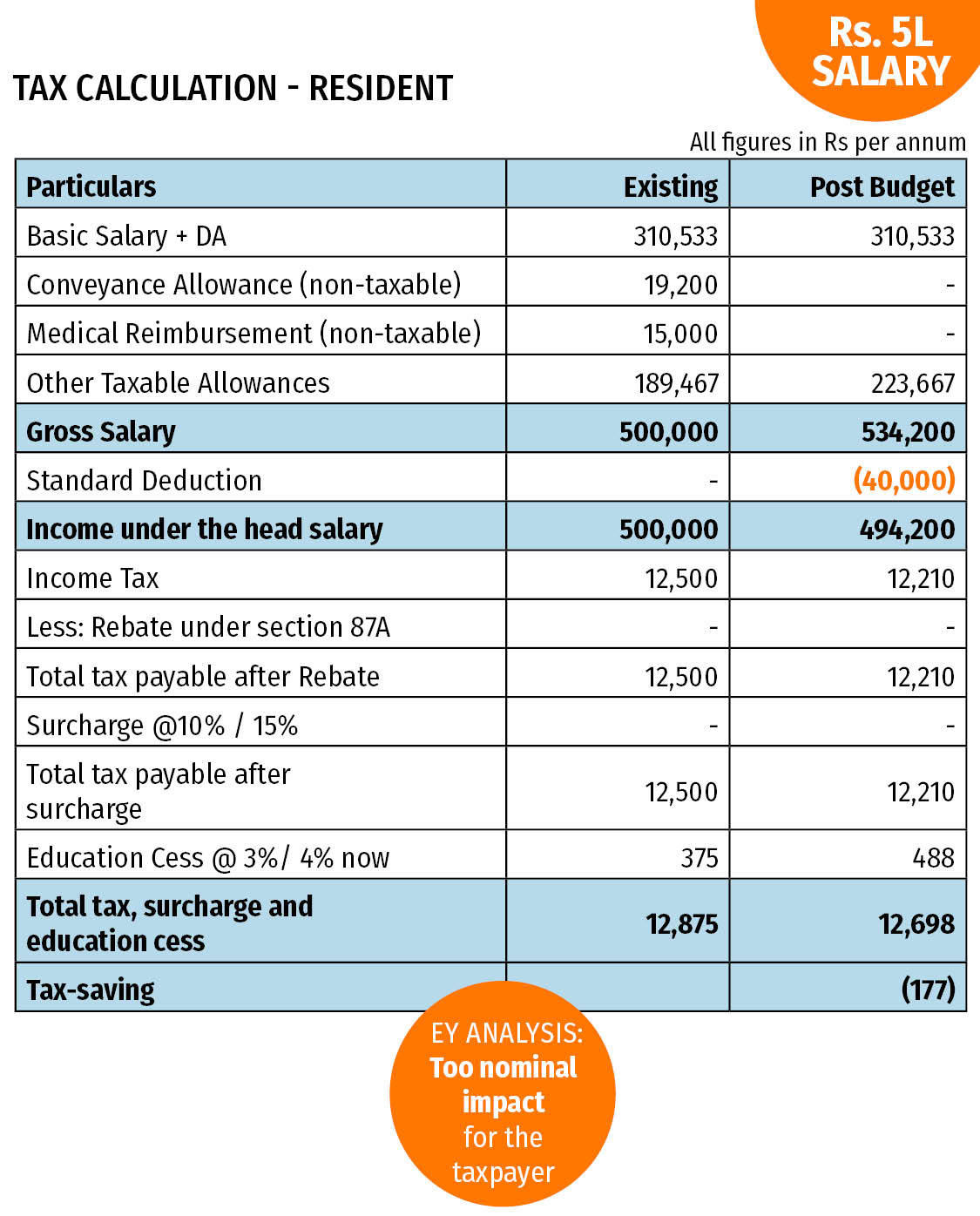

Standard Deduction Budget Announcements Budget 2018 Gives Rs 40 000

https://img.etimg.com/photo/msid-62914500/resident_gti_25l_salary-std-ded.jpg

Solved Please Note That This Is Based On Philippine Tax System Please

https://www.coursehero.com/qa/attachment/19096880/

https://www.investopedia.com › terms …

A tax deduction reduces your taxable income and how much tax you owe You can itemize your deductions or take a fixed

https://www.investopedia.com › ... › st…

The standard deduction in 2024 is 14 600 for individuals 29 200 for joint filers and 21 900 for heads of households The IRS

Solved Please Note That This Is Based On Philippine Tax System Please

Standard Deduction Budget Announcements Budget 2018 Gives Rs 40 000

Tax Savings Deductions Under Chapter VI A Learn By Quicko

What Is Standard Deduction Amount Chapter 5 Income From Salary Ded

Solved Problem 1 2 Algorithmic The Tax Formula For Chegg

Information On Section 80G Of Income Tax Act Ebizfiling

Information On Section 80G Of Income Tax Act Ebizfiling

Taxable Income Calculator India

Is Rs 40000 Standard Deduction From FY 2018 19 Really Beneficial

Income Tax Deductions For The FY 2019 20 ComparePolicy

Deduction Under Taxable Income - A deduction is an expense that can be subtracted from taxable income to reduce the amount owed Most taxpayers who take the standard deduction only need to