Deductions For Salaried Employees Ay 2024 25 Nature of deduction Who can claim 1 2 3 Against salaries 16 ia Standard Deduction Rs 50 000 or the amount of salary whichever is lower Individual

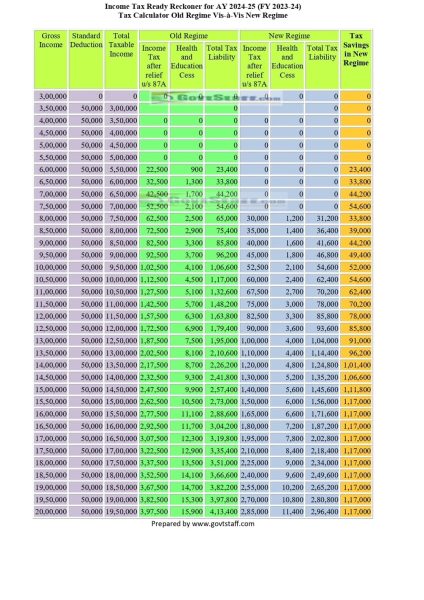

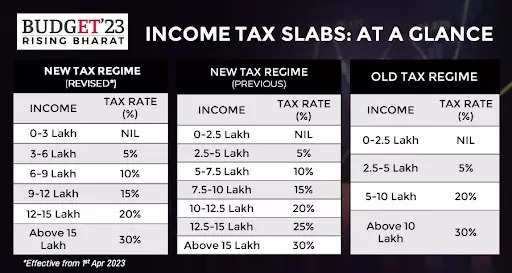

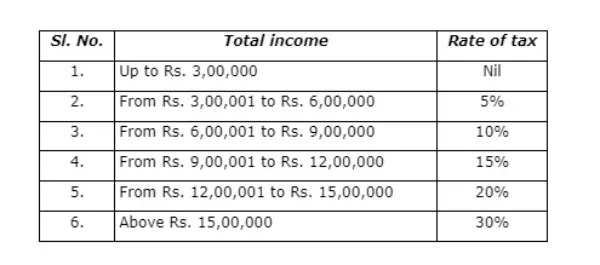

FY 2023 24 AY 2024 25 Up to Rs 3 00 000 Nil Rs 3 00 000 to Rs 6 00 000 5 on income which exceeds Rs 3 00 000 Rs 6 00 000 to Rs 900 000 Rs The IT calculator given on this page is aligned with the updates announced in the Union Budget for FY 2023 24 and AY 2024 25 How to Use the Online Income Tax Calculator

Deductions For Salaried Employees Ay 2024 25

Deductions For Salaried Employees Ay 2024 25

https://taxconcept.net/wp-content/uploads/2022/07/folders-with-the-label-employees-and-salaries_3e0575f6-3d79-11e8-80b2-0257d29a997a_1656410417035.jpg

Income Tax Slabs For Salaried Individuals For FY 2023 24 AY 2024 25

https://www.taxgyata.com/admin/article/income-tax-slabs-for-fy-2023-24-ay-2024-25.jpg

List Of Allowances Exemptions Relevant To Salaried Employees TAXCONCEPT

https://i0.wp.com/taxconcept.net/wp-content/uploads/2021/12/WhatsApp-Image-2021-12-10-at-12.22.57-PM.jpeg?fit=700%2C410&ssl=1

Budget 2023 proposes to extend the benefit of standard deduction to the new tax regime for the salaried class and the pensioners including family pensioners Standard deduction of 50 000 to salaried individual and What is Income Tax Calculator How to Use the Income Tax Calculator for FY 2023 24 How to Calculate Income Tax With Example Income Tax Slab Under the Old Tax Regime Income Tax Slab Under the New Tax

As per Budget 2023 salaried taxpayers are now eligible for a standard deduction of Rs 50 000 under the new tax regime also from the financial year 2023 24 Read more on The taxpayer opting for concessional rates in the New Tax Regime will not be allowed certain Exemptions and Deductions like 80C 80D 80TTB HRA available in the Old

Download Deductions For Salaried Employees Ay 2024 25

More picture related to Deductions For Salaried Employees Ay 2024 25

How To File ITR 1 For Salaried Employees AY 2023 24 ITR Filing Online

https://i.ytimg.com/vi/SYaY_nL0FeI/maxresdefault.jpg

Income Tax Slabs For FY 2022 23 AY 2023 24 FinCalC Blog

https://fincalc-blog.in/wp-content/uploads/2022/09/income-tax-slabs-india-2022-23-1024x576.webp

Govt Announced Seven Slabs For Salaried Class In Budget 2022 23

https://fsconline.info/wp-content/uploads/2022/06/Govt-Announced-Seven-Slabs-for-Salaried-Class-in-Budget-2022-23.jpeg

Income Tax Slab FY 2024 25 Check the latest Income Tax Slab Rates in India for FY 2023 24 AY 2024 25 on ET Wealth by The Economic Times Discover the latest tax slabs New Regime Income Tax Calculator FY 2023 2024 AY 2024 2025 Calculate your tax liability with New Regime Tax Calculator know how much tax you will have to

Income Tax Deductions Exemptions List for AY 2024 25 Under Old New Tax Regimes Below are the important income tax deductions and exemptions that When will Standard Deduction under New Tax Regime apply The standard deduction benefit under the New Tax Regime will apply from AY 2024 25 i e for

Discover Your Favorite Brand Free Shipping Stainless Steel Flat Collar

https://wealthtechspeaks.in/wp-content/uploads/2022/02/Income-Tax-Deductions.png

Explained Exemptions And Deductions For Salaried Employees Top News Wood

https://topnewswood.com/wp-content/uploads/2022/11/Explained-Exemptions-And-Deductions-For-Salaried-Employees.jpg

https://taxguru.in/income-tax/section-wise-income-tax-deductions.html

Nature of deduction Who can claim 1 2 3 Against salaries 16 ia Standard Deduction Rs 50 000 or the amount of salary whichever is lower Individual

https://cleartax.in/s/income-tax-slabs

FY 2023 24 AY 2024 25 Up to Rs 3 00 000 Nil Rs 3 00 000 to Rs 6 00 000 5 on income which exceeds Rs 3 00 000 Rs 6 00 000 to Rs 900 000 Rs

Income Tax Ready Reckoner For AY 2024 25 FY 2023 24 Tax Calculator

Discover Your Favorite Brand Free Shipping Stainless Steel Flat Collar

New Income Tax Slab Rates For FY 2023 24 AY 2024 25 In India Budget

Income Tax 2022 23 Slab Bed Frames Ideas

Revise Income Tax Due Date Chart For FY 2021 22 After 20th May

List Of Allowances Perquisites Deductions Available To Salaried Persons

List Of Allowances Perquisites Deductions Available To Salaried Persons

Standard Deduction 2020 Self Employed Standard Deduction 2021

New Income Tax Slabs 2023 Is The Simplified Tax Regime Really

Income Tax Calculator Ay 2023 24 Excel For Government Salaried

Deductions For Salaried Employees Ay 2024 25 - What is Income Tax Calculator How to Use the Income Tax Calculator for FY 2023 24 How to Calculate Income Tax With Example Income Tax Slab Under the Old Tax Regime Income Tax Slab Under the New Tax