Single Parent Tax Rebate Web 17 f 233 vr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is adults with disabilities parents and

Web 16 d 233 c 2022 nbsp 0183 32 A single parent who files taxes as head of household for the 2022 tax year the return you ll file in 2023 will pay 10 income taxes Web 28 juin 2021 nbsp 0183 32 The amount of the sole parent rebate notional tax offset for an income year is 1 607 This amount is not indexed and not subject to an income test The offset is

Single Parent Tax Rebate

Single Parent Tax Rebate

https://media.cheggcdn.com/media/5f4/5f446443-3876-4bdf-af30-bd53ed6ed3da/phpQaHDkw

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

https://i0.wp.com/www.theastuteparent.com/wp-content/uploads/2019/02/53287756_1898285556949795_4177201277018570752_n-1.jpg?resize=654%2C960&ssl=1

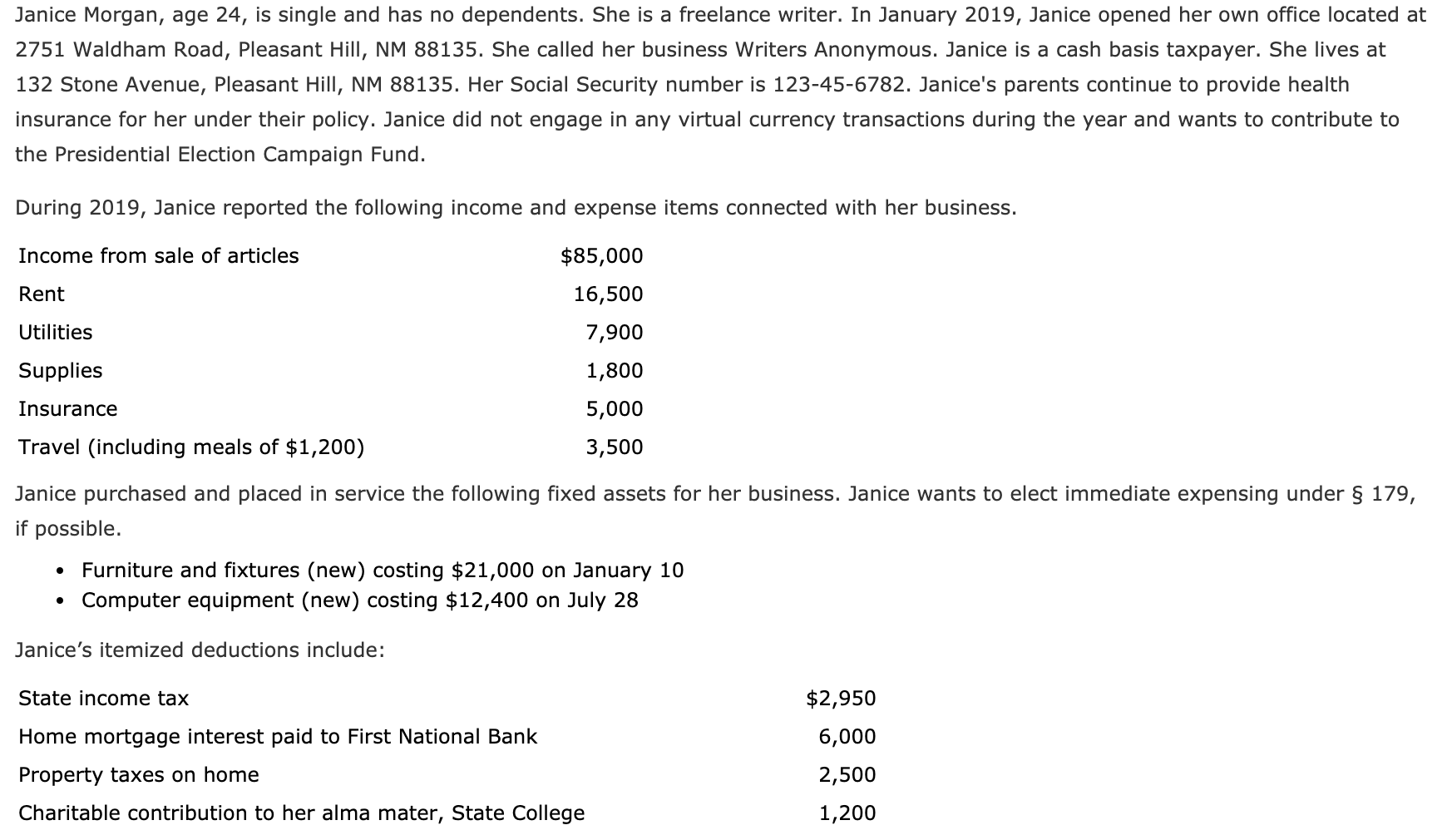

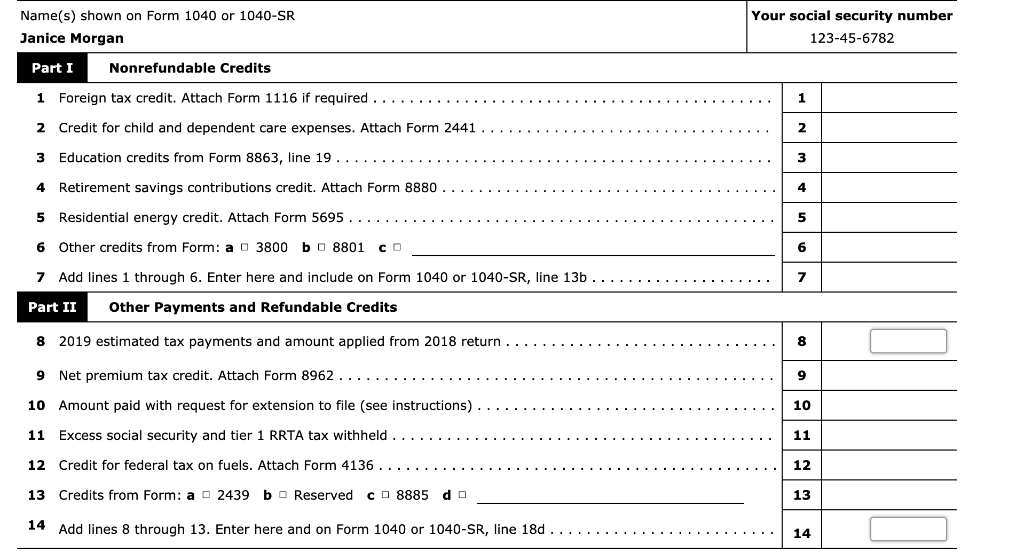

Solved Janice Morgan Age 24 Is Single And Has No Chegg

https://media.cheggcdn.com/media/352/352a3722-57e2-4b91-9847-2c96a9aaa22b/phpdoDoVK

Web 1 janv 2023 nbsp 0183 32 The sole earner and single parent credits increase by 232 Euro until 2022 220 Euro in each case for each additional child Web Parenthood Tax Rebate PTR Married divorced or widowed parents may claim tax rebates of up to 20 000 per child As PTR is a one off rebate you may only claim PTR

Web For single parents it can be a struggle to handle the never ending stream of expenses and that s where the federal Child Tax Credit comes into play The Child Tax Credit can shave as much as 1 000 per child off Web 27 f 233 vr 2020 nbsp 0183 32 The earned income tax credit is among the tax changes for 2022 For the 2022 tax year the earned income credit ranges from 560 to 6 935 depending on your filing status and how many children you have

Download Single Parent Tax Rebate

More picture related to Single Parent Tax Rebate

Tips For Single Parents Taxes Single Parent Tax Credit Tricks

https://i.pinimg.com/originals/0b/ca/91/0bca91d8b30ed701d4576e8130ab0f2a.jpg

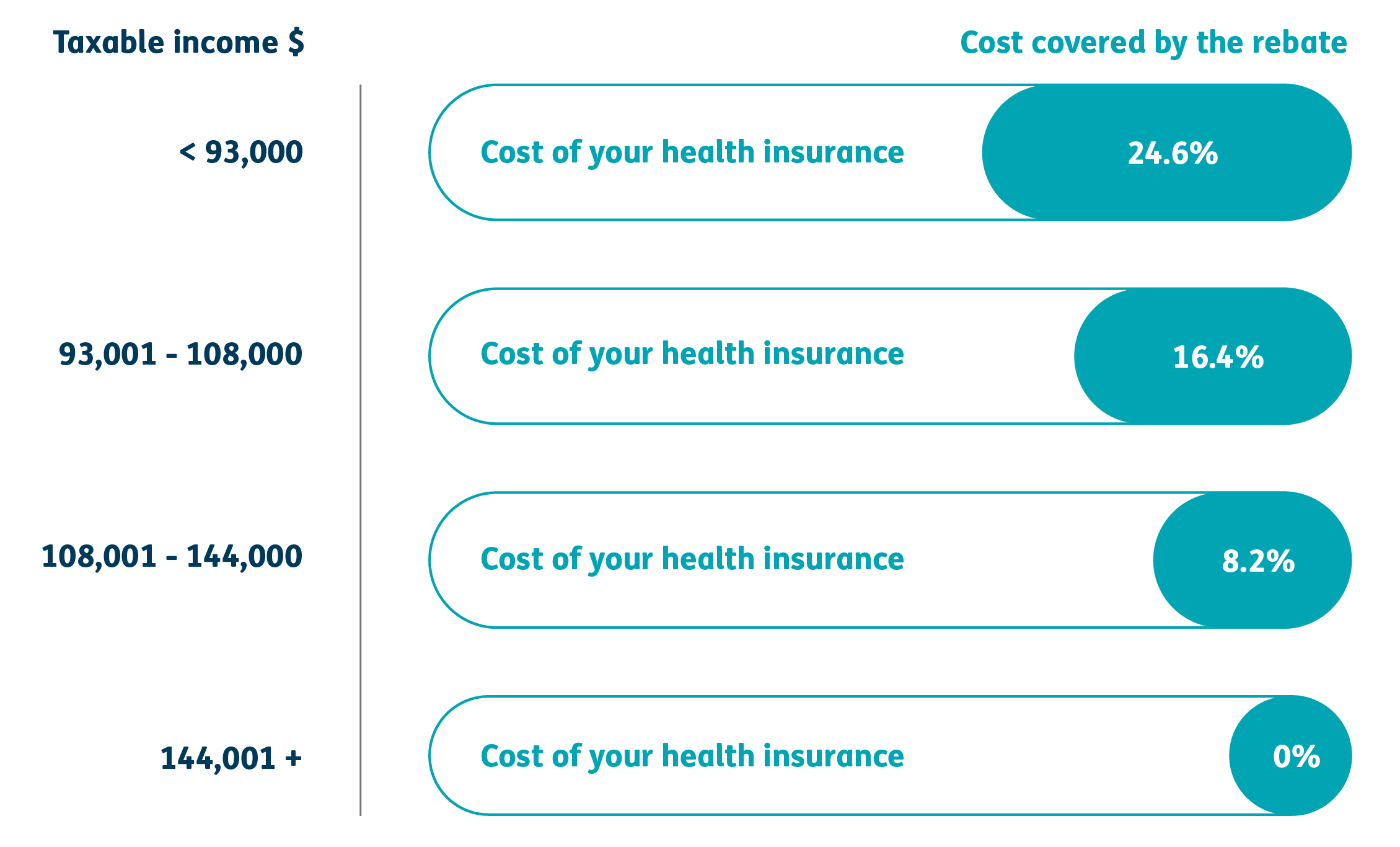

Tax And Rebates HBF Health Insurance

https://www.hbf.com.au/-/media/images/hbf/health-insurance/extras/singles-under-65.png?la=en&hash=46D4FB6E7BDC69C8763810EDA3F938B622C37A8C

Disability Support Pension With Single Parent Fortnightly Payment 944

https://i.pinimg.com/originals/e1/7e/6d/e17e6d37a3d665b894554542ada9f144.jpg

Web You were age pension age and eligible for an Australian Government age pension during the income year but you didn t receive it because you didn t make a claim or because of Web If you separated from your spouse during the financial year and remain single with no dependants as at 30 June your rebate entitlement is calculated only on your own

Web 28 f 233 vr 2020 nbsp 0183 32 Parenthood tax rebates start at 5 000 of tax rebate for the first child and go up to 20 000 for the 4th child and subsequent children They are available for parents Web If you were single in 2022 23 these examples can help you work out what to do so we can balance your payments Examples to help you balance your family assistance payments

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

https://i1.wp.com/www.theastuteparent.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-25-at-11.16.02-PM.png?resize=645%2C267&ssl=1

Solved Janice Morgan Age 24 Is Single And Has No Chegg

https://media.cheggcdn.com/media/3b6/3b6e0b0f-5f0b-4b1a-993f-e6359e2d4ede/phpXXJUd2

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-a...

Web 17 f 233 vr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is adults with disabilities parents and

https://www.thebalancemoney.com/tax-break…

Web 16 d 233 c 2022 nbsp 0183 32 A single parent who files taxes as head of household for the 2022 tax year the return you ll file in 2023 will pay 10 income taxes

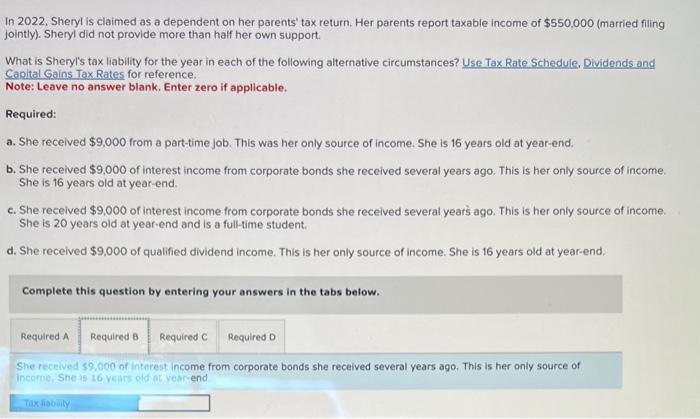

Solved I Need Help In 2022 Sheryl Is Claimed As A Depend

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

An Overview Of Single Parents Tax Credit Marcfair

Tax Benefits Your Savings Checklist

Pat Rabbitte Questioned By DSN About The Removal Of Single Parent Tax

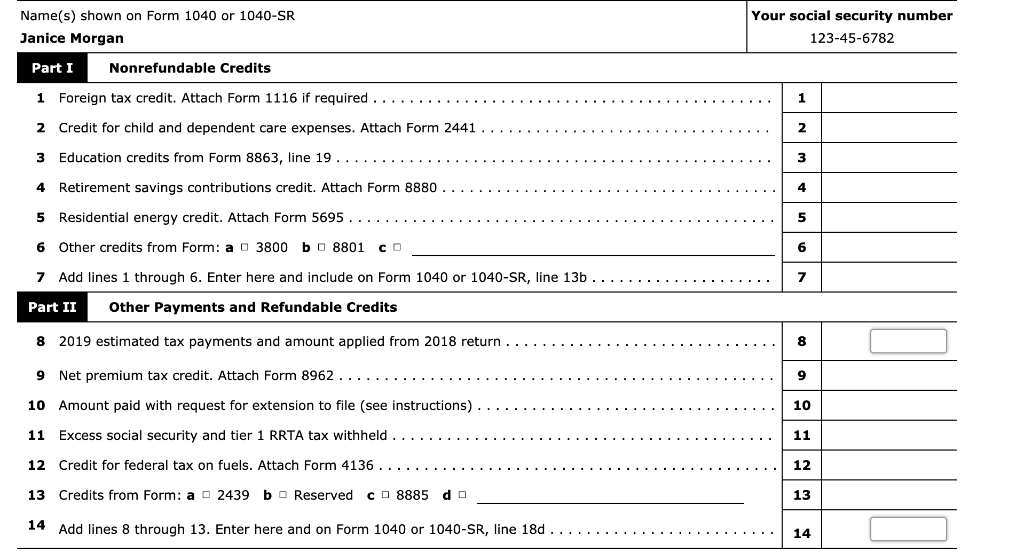

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Services CADC

Judge Rules Single Parents Are Entitled To Bedroom Tax Rebates For

Index Of wp content uploads 2022 03

Single Parent Tax Rebate - Web Single 949 30 includes Parenting Payment and a pension supplement of 27 20 Partnered 631 20 Partnered separated due to illness respite care or prison 745 20