Mt Gov Tax Rebate Web 28 juin 2023 nbsp 0183 32 The Montana Department of Revenue will begin issuing rebates of 2021 individual income taxes to over 530 000 qualifying Montana taxpayers beginning July 3 The department anticipates distributing most

Web Based on 2021 filing status Single HoH or MFS max is 1 250 MFJ max is 2 500 Limited by amount reported on 2021 Montana Form 2 line 20 If line 20 is 4 000 for MFJ they Web Governor Greg Gianforte in 2022 proposed a property tax rebate for Montanans for their primary residence and signed it into law in March 2023 The rebate provides Montanans

Mt Gov Tax Rebate

Mt Gov Tax Rebate

https://custercountymt.gov/wp-content/uploads/2023/06/June-2023-Tax-Rebate-1024x683.jpg

Update On Montana Tax rebates Bill

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1b1vWJ.img?w=1280&h=720&m=4&q=50

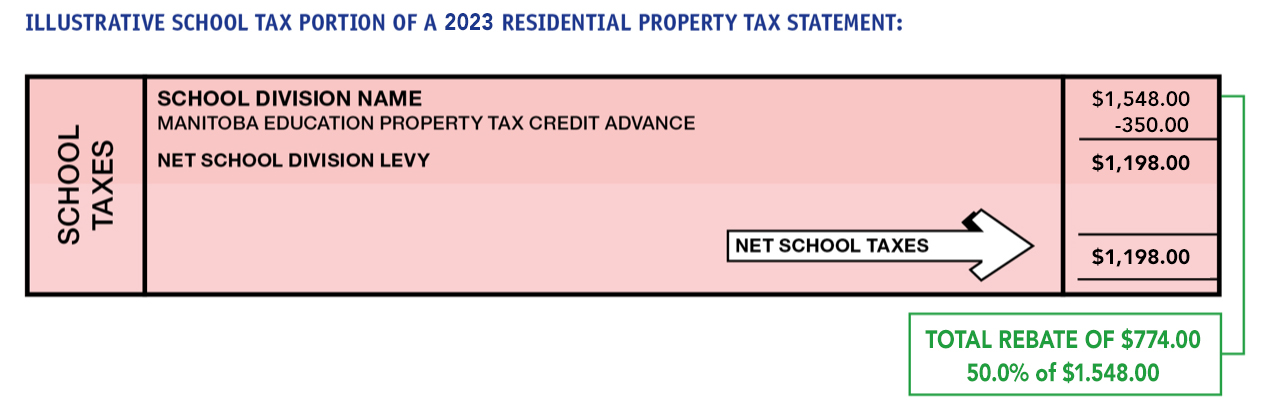

Province Of Manitoba School Tax Rebate

https://www.gov.mb.ca/asset_library/en/schooltaxrebate/white-slip-school-taxes-2023.jpg

Web DORHelp mt gov INDIVIDUAL INCOME TAX REBATE How much is the rebate The rebate amount depends on an individual s 2021 tax filing status and the amount reported Web 6 sept 2023 nbsp 0183 32 Montana Individual Income Tax Rebate amp Property Tax Rebate Tax News You Can Use March 22 2023 On March 13 2023 House Bills 192 and 222 were

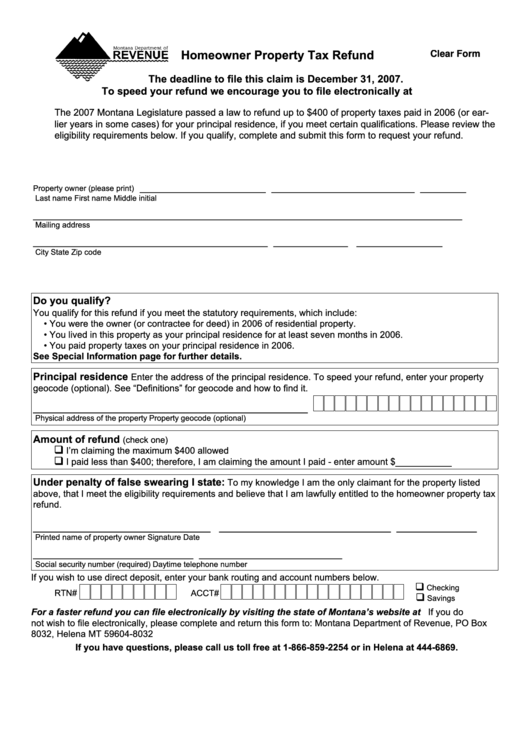

Web These new laws provide property tax rebates to eligible taxpayers for tax years 2022 and 2023 Each rebate is equal to the lesser of the amount of Montana property taxes billed Web Property tax rebate 1 A taxpayer that is entitled to a rebate of 28 Montana property taxes paid pursuant to sections 1 through 3 of House Bill No 222 may increase the dollar

Download Mt Gov Tax Rebate

More picture related to Mt Gov Tax Rebate

Fillable Homeowner Property Tax Refund Form Montana Department Of

https://data.formsbank.com/pdf_docs_html/177/1774/177484/page_1_thumb_big.png

![]()

Montana Tax Rebates Montana Department Of Revenue

https://mtrevenue.gov/wp-content/uploads/2023/06/IIT-Rebate-Icon.png

Minnesota Tax Rebate 2023 Your Comprehensive Guide Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/04/Minnesota-Tax-Rebate-2023-768x679.png

Web 29 juin 2023 nbsp 0183 32 For additional information about the Individual Income Tax Rebate or to check on the status of a rebate visit GetMyRebate mt gov Recent Headlines Share This Web tap dor mt gov

Web 8 sept 2023 nbsp 0183 32 Montana homeowners who qualify can claim up to 675 in property tax rebates through getmyrebate mt gov The deadline for filing claims is October 1 2023 Web 14 ao 251 t 2023 nbsp 0183 32 The amount of the rebate is the property taxes paid on this principal Montana residence for 2022 up to 675 To claim the rebate taxpayers may apply at either

Mt Dor Mw 3 Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/422/65/422065537/large.png

Province Of Manitoba School Tax Rebate

https://www.gov.mb.ca/asset_library/en/schooltaxrebate/school-taxes.png

https://mtrevenue.gov/montana-department-o…

Web 28 juin 2023 nbsp 0183 32 The Montana Department of Revenue will begin issuing rebates of 2021 individual income taxes to over 530 000 qualifying Montana taxpayers beginning July 3 The department anticipates distributing most

https://leg.mt.gov/.../Revenue/Meetings/July-2023/dor-2023 …

Web Based on 2021 filing status Single HoH or MFS max is 1 250 MFJ max is 2 500 Limited by amount reported on 2021 Montana Form 2 line 20 If line 20 is 4 000 for MFJ they

4 150

Mt Dor Mw 3 Fill Out Sign Online DocHub

Tax Rebate For Individual It Is The Refund Which An Individual Can

.png)

Diamond Clear Dental

How To Claim and Increase Your P800 Refund Tax Rebates

Maine Tax Relief 2023 Printable Rebate Form

Maine Tax Relief 2023 Printable Rebate Form

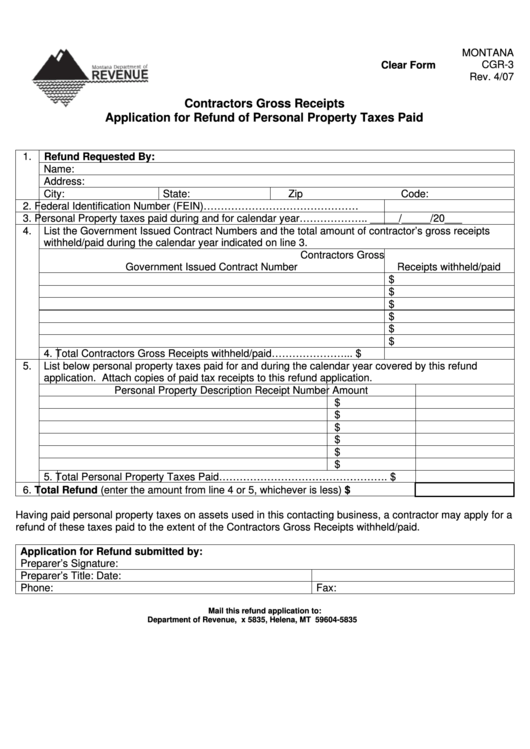

Fillable Application Form For Refund Of Personal Property Taxes Paid

500 New Mexico Tax Rebate Checks Why Some May Not Get It

When Will We Get The Extra Tax Rebate Checks In Montana Details

Mt Gov Tax Rebate - Web DORHelp mt gov INDIVIDUAL INCOME TAX REBATE How much is the rebate The rebate amount depends on an individual s 2021 tax filing status and the amount reported