Ertc Rebates For Small Businesses Web For FY2020 For 2020 the ERC is a tax credit against certain payroll taxes including an employer s share of social security taxes for wages paid between March 12 2020 and

Web 26 f 233 vr 2022 nbsp 0183 32 ScottHall and ERTC Today have launched an updated eligibility quiz and application process to help small business owners and non profit organizations get pre Web Eligible Employers can claim the Employee Retention Credit equal to 50 percent of up to 10 000 in qualified wages including qualified health plan expenses on wages

Ertc Rebates For Small Businesses

Ertc Rebates For Small Businesses

https://i.pinimg.com/736x/4c/59/97/4c59978c89165eb6062bcc5a75b15b54.jpg

Calam o Best CPA ERTC Application For Tax Rebates 2022 Get Small

https://p.calameoassets.com/220330072118-87691d412cf688d1bc3c1b895bf300e4/p1.jpg

ERTC Rebate Fast Worksheet For Businesses Claim Your IRS Refund Now In

https://i.pinimg.com/originals/07/5b/5f/075b5f155706cf0e446c4d4b105dcedd.png

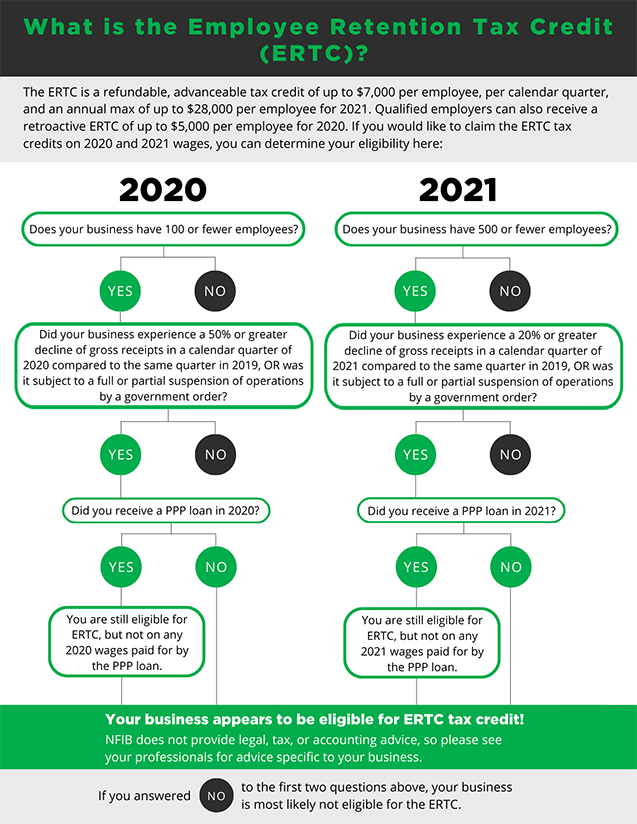

Web 26 janv 2021 nbsp 0183 32 Thus the maximum ERC amount available is 7 000 per employee per calendar quarter for a total of 14 000 in 2021 Employers can access the ERC for the Web The Employee Retention Tax Credit ERC is a credit that provides tax relief for companies that lost revenue in 2020 and 2021 due to COVID 19 The ERC was designed to

Web 17 sept 2021 nbsp 0183 32 The American Rescue Plan Act was extended in March 2021 to help small businesses and their employees get through the worst of the pandemic You could Web The ERTC program is a refundable tax credit for business owners in 2020 and 2021 In 2020 a credit is available up to 5 000 per employee from 3 12 20 12 31 20 by an

Download Ertc Rebates For Small Businesses

More picture related to Ertc Rebates For Small Businesses

Small Business ERTC Rebate 2022 Pre Qualification Eligibility Quiz

https://s.yimg.com/ny/api/res/1.2/DcyIAoYk2XVXKKa.r4D43A--/YXBwaWQ9aGlnaGxhbmRlcjt3PTY0MDtoPTQyNg--/https://media.zenfs.com/en/globenewswire.com/c2d63c37b054b468eb69212704d49296

Step By Step Guide To Getting ERTC For Small Business Owners YouTube

https://i.ytimg.com/vi/TYI79yNG03c/maxresdefault.jpg

Top ERTC CPA Specialists For Startups New Businesses Non Profits

https://i.vimeocdn.com/video/1382592730-4efff7fde0814b21f2953036021df43a587512f65fefa12ff238d66edc22c7a5-d

Web 3 juin 2022 nbsp 0183 32 New businesses founded since February 15 2020 can apply for rebates as a Recovery Startup Business and may be eligible for up to 100 000 in tax credits To Web ERTC s commitment to maximizing eligible rebate amounts allows small business owners to access much needed funds during these challenging times COVID 19 tax relief

Web 11 juin 2021 nbsp 0183 32 The ERC is a refundable and advanceable tax credit for small businesses based on the number of qualifying employees If eligible businesses can claim the ERC Web 24 sept 2022 nbsp 0183 32 The Internal Revenue Service IRS is ready to give business owners up to a 26 000 refund per employee on company payroll in 2020 and 2021 For businesses

Lloyd Cazes TFS CPA And Accounting Services

http://www.lloydcazes.com/wp-content/uploads/2023/05/ERTC-Eligibility-for-Small-Business-Rework-3.png

ERTC Tax Rebate Application Service For SMBs Startups Launched By

https://orders.newsfilecorp.com/files/8814/129887_4e3d6f49946c9938_001full.jpg

https://home.treasury.gov/.../small-business-tax-credit-programs

Web For FY2020 For 2020 the ERC is a tax credit against certain payroll taxes including an employer s share of social security taxes for wages paid between March 12 2020 and

https://finance.yahoo.com/news/small-business-ertc-rebate-2022...

Web 26 f 233 vr 2022 nbsp 0183 32 ScottHall and ERTC Today have launched an updated eligibility quiz and application process to help small business owners and non profit organizations get pre

Calam o Claim CARES Act Stimulus For Small Businesses Non Profits

Lloyd Cazes TFS CPA And Accounting Services

Top ERTC CPA Specialists For Startups New Businesses Non Profits

ERTC Application Help For Small Businesses ERC Eligibility Check

Best ERTC Specialists Pre Qualify Your Business For Rebates Get

NEWITY ERC Fast Track For Small Businesses Shorts ertc YouTube

NEWITY ERC Fast Track For Small Businesses Shorts ertc YouTube

ERTC Qualifications And Guidelines 2022 And 2023 Does Your Business

Businesses Getting Up To 7 Figure Tax Rebates From Employee Retention

Employee Retention Rebates Tax Credits Tax Free Paycheck 15

Ertc Rebates For Small Businesses - Web Guaranteed to Maximize Refundable Credits for Local and Small to Medium sized Businesses So Easy That Your Entire Commitment is 15 Minutes No Upfront Fees To