How Are Rebates Treated In Accounting Rebates come in many flavors and understanding the different types is key to managing them effectively in your business s books Each type of rebate has rules for how and when it s applied which can affect both the timing and the accounting treatment

What is Vendor Rebates Accounting Treatment Vendor rebates exist so that companies can better manage their supplier rebate programs The rebate will specify the terms in which the company qualifies for a rebate if they reach the target sales of a A rebate is a portion of the purchase price of a product or service that a seller gives back to the buyer It s typically valid for a specified period Unlike a discount which is deducted from the purchase price at the time of sale a rebate is a refund a purchaser applies for after paying for a product or service

How Are Rebates Treated In Accounting

How Are Rebates Treated In Accounting

https://cljgives.org/wp-content/uploads/2017/08/20170809-MM0000809-rebates.png

Managing Rebates In Dynamics 365 For Operations AXSource

https://www.axsource.com/wp-content/uploads/2017/03/1.png

Accounting For E Commerce Rebates

https://www.selleraccountant.com/wp-content/uploads/2022/02/Accounting-for-E-Commerce-Rebates-1-640x360.png

How Do You Record Customer Rebates in Accounting Customer rebates are recorded by estimating the expected amount to be redeemed and setting this aside as a liability on the balance sheet As customers redeem their rebates actual expenses against these liabilities are recognized reducing both the liability account and affecting net 1 Understanding the rebate agreements Core business systems are often inadequate for capturing and representing agreed rebate deals When you add the subjectivity that rebate agreements can be viewed with into the mix the result can be a misaligned understanding and incorrect calculation of amounts due

Example trade discounts settlement discounts volume based rebates and other rebates Accounting for these reductions will vary depending on the type of arrangement This IFRS Viewpoint provides our views on the purchaser s accounting treatment for the different types of rebate and discount along with some application examples The Concept of Rebates in Finance Rebates in finance refer to the return of a portion of a purchase price by a seller to a buyer often used as a promotion or incentive They differ from discounts which are applied at the point of sale rebates are typically received after the purchase

Download How Are Rebates Treated In Accounting

More picture related to How Are Rebates Treated In Accounting

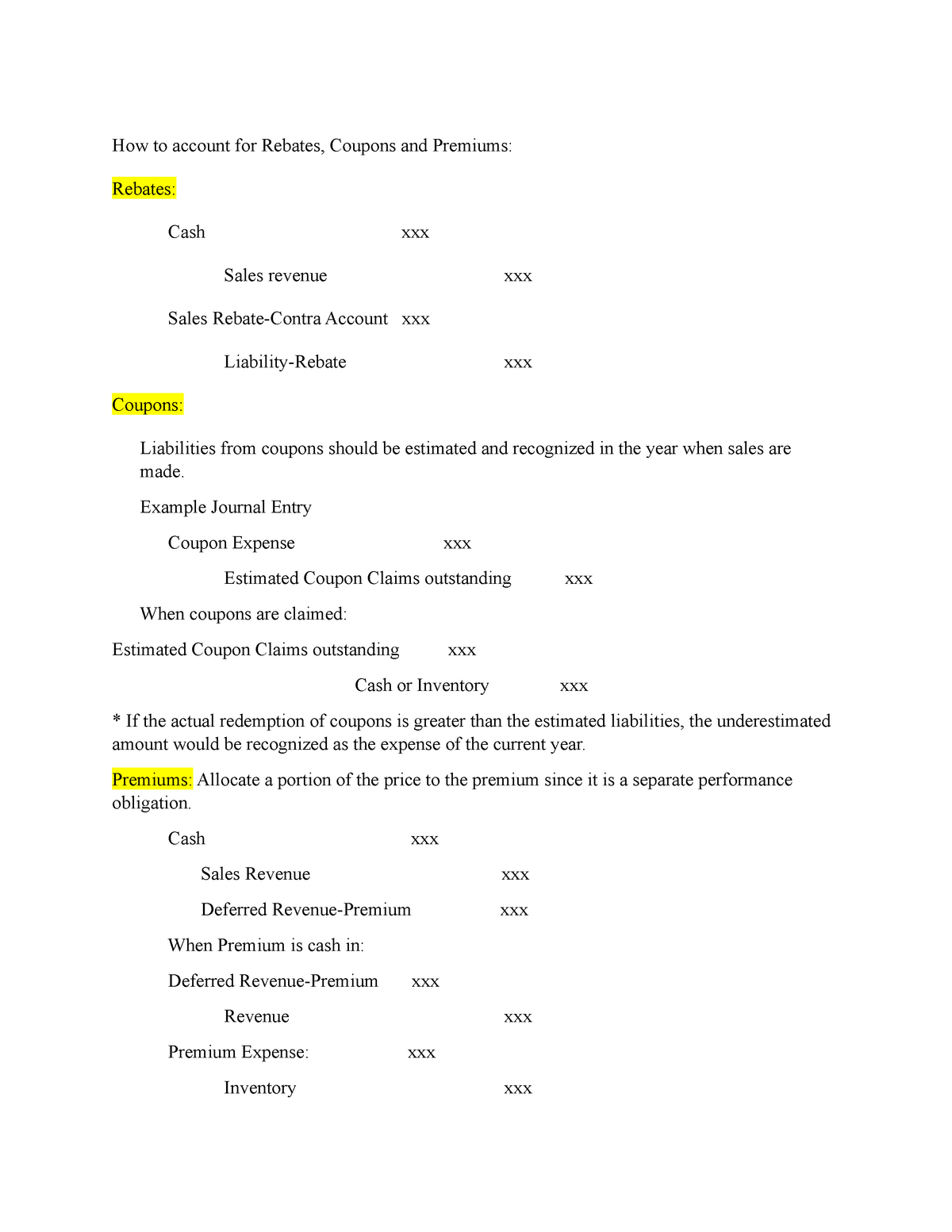

How To Account For Rebates Coupons And Premiums How To Account For

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/1bd30c80ad32dc5602c670339f766657/thumb_1200_1553.png

Calculate A Rebate YouTube

https://i.ytimg.com/vi/Gm-LyXhsTao/maxresdefault.jpg

What Are Forex Rebates

https://www.rebatekingfx.com/Content/dist/articles/images/45d3j3pvy3h.png

Five key steps to getting rebate accounting right The key to getting your rebate accounting right is to ensure you understand both the contractual form and commercial substance of your rebates and the appropriate accounting treatment 1 Spreadsheet replacement Manual rebate accounting processes such as calculating rebates in financial spreadsheets can t successfully do the job alone in large companies or in fact even in small companies if they re managing complex trade agreements with various combinations of rebate arrangements

Table of Contents What Are Rebates Rebate Example Rebate Types Rebate for volume incentive Rebate for value incentive Rebate on Product Mix Incentive Payments The Challenges in Calculating Rebates Communication problems Managing accruals Errors on the balance sheet How to Use Rebates for Your Retail Customers From an accounting perspective rebates are typically treated as a revenue when they are earned rather than at the time of purchase What is Supplier Rebate Accounting Supplier rebate accounting involves the recognition and recording of rebates or incentives provided by suppliers to their customers as a part of their sales agreements

Managing Rebates At A Manufacturer YouTube

https://i.ytimg.com/vi/3lMPlzCn4mI/maxresdefault.jpg

Are Rebates Important YouTube

https://i.ytimg.com/vi/fdKDvaa9AKw/maxresdefault.jpg

https:// incentx.com /blog/rebate-accounting-explained

Rebates come in many flavors and understanding the different types is key to managing them effectively in your business s books Each type of rebate has rules for how and when it s applied which can affect both the timing and the accounting treatment

https://www. solvexia.com /blog/accounting-for-vendor-rebates

What is Vendor Rebates Accounting Treatment Vendor rebates exist so that companies can better manage their supplier rebate programs The rebate will specify the terms in which the company qualifies for a rebate if they reach the target sales of a

7 Common Problems With Accounting For Rebates Enable

Managing Rebates At A Manufacturer YouTube

What Is A Rebate Enable

Accounting Procedures For Product Rebates Your Business

How Rebates Work The Daily Drive Consumer Guide The Daily Drive

Calculating And Measuring The Potential ROI Of Supplier Rebates Enable

Calculating And Measuring The Potential ROI Of Supplier Rebates Enable

Tax Credits Save You More Than Deductions Here Are The Best Ones

The Tetra Pak Case Are Loyalty Rebates Treated Differently By The

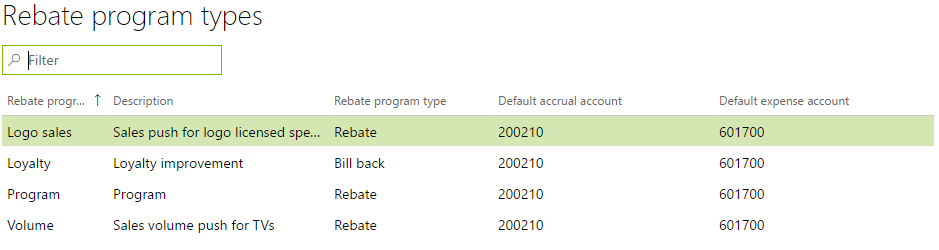

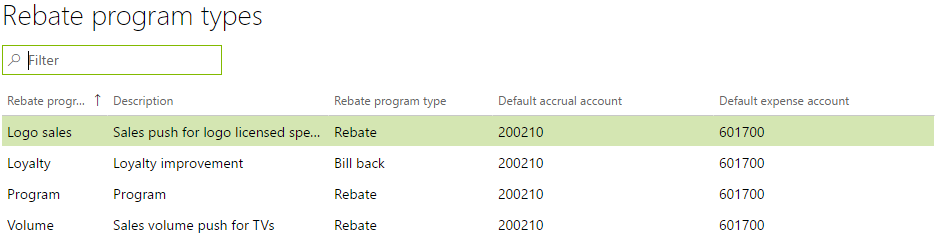

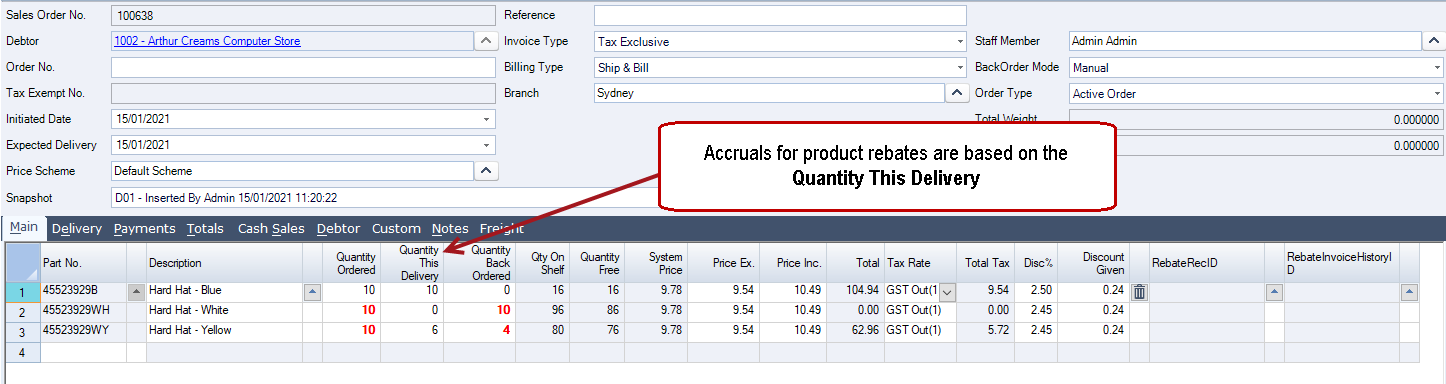

Rebates Rebate Accruals JIWA Training

How Are Rebates Treated In Accounting - 1 Understanding the rebate agreements Core business systems are often inadequate for capturing and representing agreed rebate deals When you add the subjectivity that rebate agreements can be viewed with into the mix the result can be a misaligned understanding and incorrect calculation of amounts due