Deferred Tax Rate For Fy 22 23 In general deferred tax assets and liabilities are recognised after mutual offsetting in account group 48 account 481 Change in income tax rate from 1 January 2024 The

Finance Act 2021 makes provision for the rate of corporation tax in the UK to increase from 1 April 2023 from 19 to 25 where a company has profits in excess of Deferred Tax means the deferment of taxes due to temporary differences The tax may be required to be paid in the future DTA arises if you are required to pay

Deferred Tax Rate For Fy 22 23

:max_bytes(150000):strip_icc()/Terms-d-deferred-revenue-Final-a8fb680c51014901a4b8f88ac7fb7f77.jpg)

Deferred Tax Rate For Fy 22 23

https://www.investopedia.com/thmb/9R0Qsq4PgzyrHOAfjdMr6jMnGi8=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/Terms-d-deferred-revenue-Final-a8fb680c51014901a4b8f88ac7fb7f77.jpg

:max_bytes(150000):strip_icc()/deferredincometax-v3-b8dc55e780ab4f47a0987161ece97060.png)

Deferred Tax Assets Meaning JWord

https://www.investopedia.com/thmb/5gk30VTd3T-tJlqMprcY4lsSMJk=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/deferredincometax-v3-b8dc55e780ab4f47a0987161ece97060.png

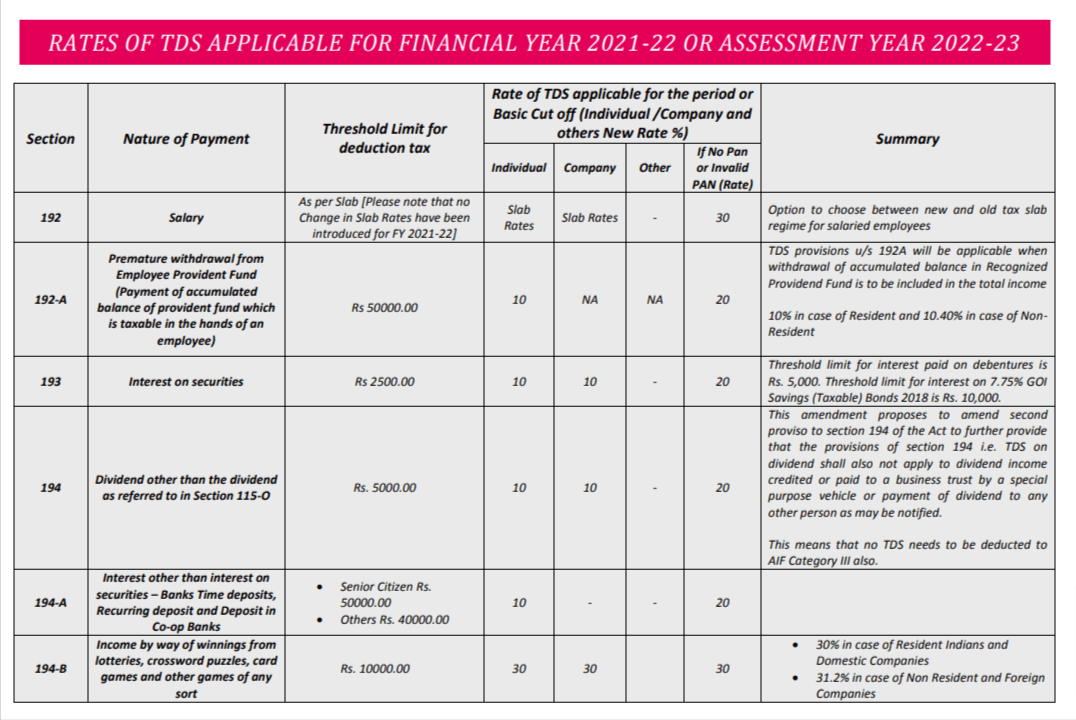

Tds Rate Chart For F Y A Y My XXX Hot Girl

https://lh3.googleusercontent.com/-qQksr75ROgw/Xsc2unmo5RI/AAAAAAAAA7o/OCKx-HPLGVcpBpHzIJHr44EJjq_ZOpeDACLcBGAsYHQ/s1600/1590113975153183-0.png

The measurement of deferred tax is based on the carrying amount of the entity s assets and liabilities IAS 12 55 and therefore cannot be based on an asset s Taxmann s AS Deferred Tax Calculator computes the deferred tax asset DTA and deferred tax liability DTL as per accounting standard 22 based on the applicable tax

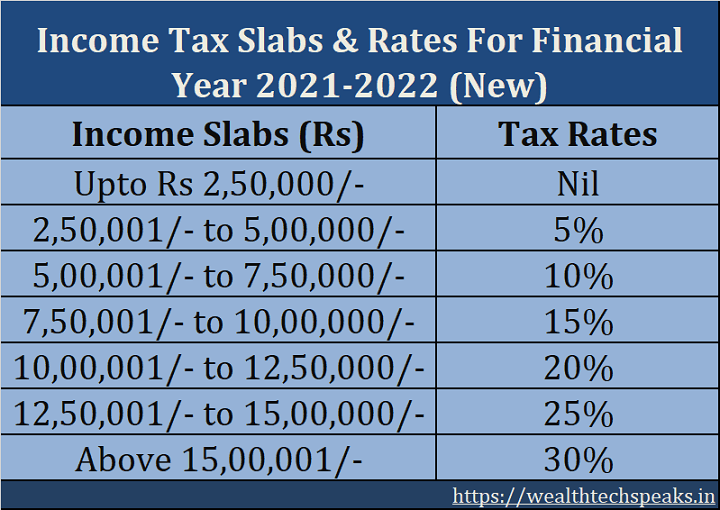

CONTENTS Show Deferred Tax Liability DTL or Deferred Tax Asset DTA forms an important part of Financial Statements This adjustment made at year Updated on Jan 7th 2024 56 min read CONTENTS Show The income tax slabs are different under the old and the new tax regimes Further the slab rates under

Download Deferred Tax Rate For Fy 22 23

More picture related to Deferred Tax Rate For Fy 22 23

Standard Deduction For Assessment Year 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-6.jpg

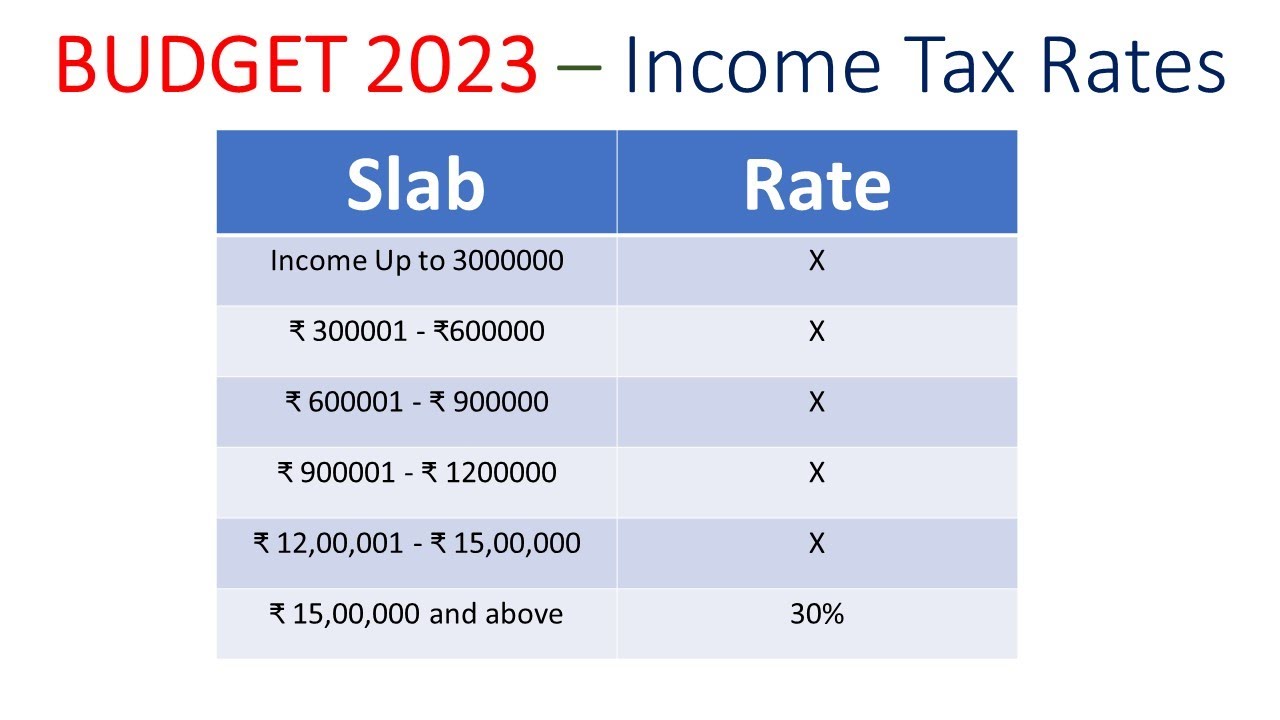

Income Tax Slab Rate FY 2023 24 AY 2024 25 In Budget 2023 FM

https://i.ytimg.com/vi/asxjIGBC24k/maxresdefault.jpg

Income Tax Rates Slab For FY 2021 22 Or AY 2022 23 Ebizfiling

https://ebizfiling.com/wp-content/uploads/2021/04/Income-Tax-Rate-Slabs.png

Depreciation Rates for FY 2023 24 Depreciation under Income Tax Act is the decline in the real value of a tangible asset because of consumption wear and tear For special tax rates applicable to special incomes like long term capital gains winnings from lottery etc refer Tax Rates under Tax Charts Tables Old Tax Regime for

Convertible foreign exchange the Minimum Alternate Tax is levied at a rate of 9 plus surcharge and cess as applicable B CO OPERATIVE SOCIETY The tax rates as III Corporate Tax Rate Applicable for AY 2023 2024 Income Tax for Companies with Turnover or gross receipts in 2020 2021 up to 400 crores Income Tax

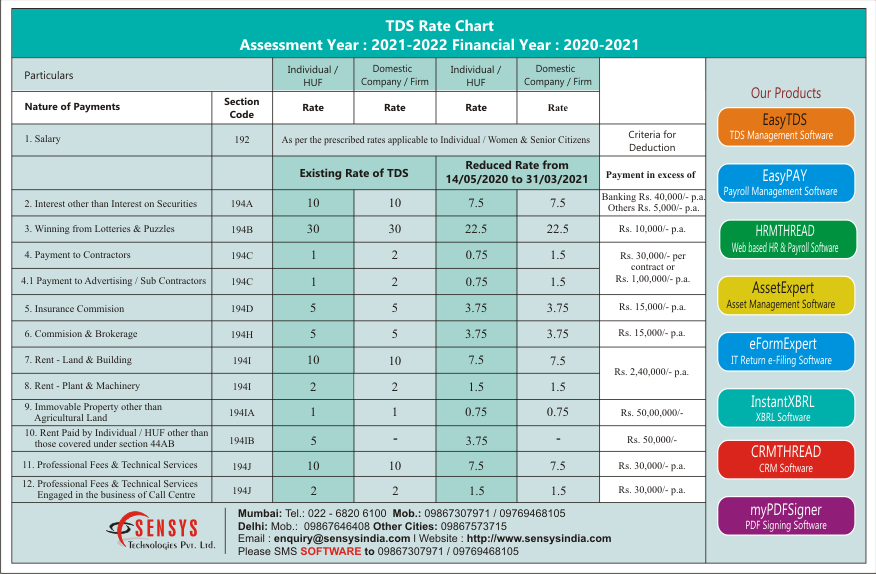

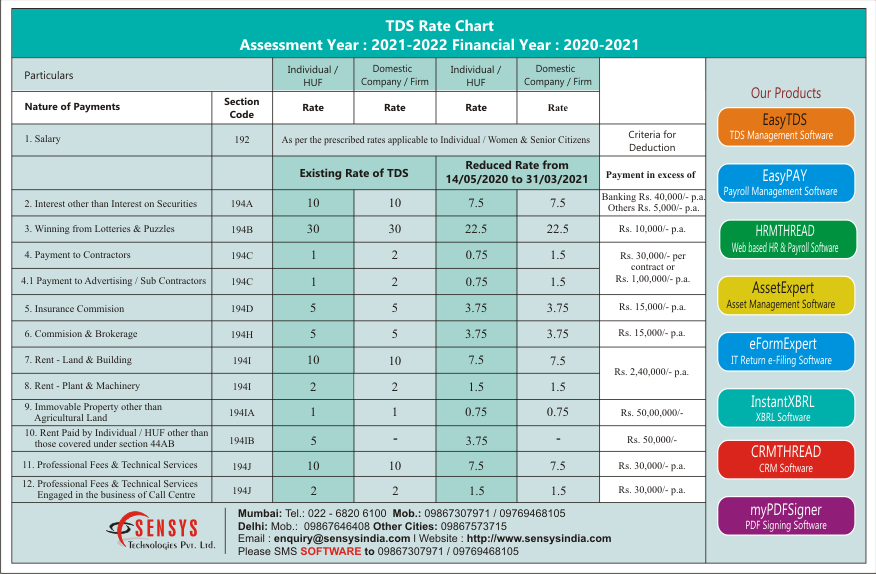

TDS Rate Chart FY 2020 2021 AY 2021 2022 Sensys Blog

http://www.sensystechnologies.com/blog/wp-content/uploads/2020/04/Rate-Chart-AY-2021-22_Sensys_New.png

:max_bytes(150000):strip_icc()/TermDefinitions_DeferredTax_V2-d5ae6ed922204f7eaa8bfb6b7b4b7f44.jpg)

Deferred Tax Assets Meaning JWord

https://www.investopedia.com/thmb/t6uPsyWkraC2sbbet4YidajtTU0=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/TermDefinitions_DeferredTax_V2-d5ae6ed922204f7eaa8bfb6b7b4b7f44.jpg

:max_bytes(150000):strip_icc()/Terms-d-deferred-revenue-Final-a8fb680c51014901a4b8f88ac7fb7f77.jpg?w=186)

https://www.dreport.cz/en/blog/what-to-remember...

In general deferred tax assets and liabilities are recognised after mutual offsetting in account group 48 account 481 Change in income tax rate from 1 January 2024 The

:max_bytes(150000):strip_icc()/deferredincometax-v3-b8dc55e780ab4f47a0987161ece97060.png?w=186)

https://www.accountingweb.co.uk/business/financial...

Finance Act 2021 makes provision for the rate of corporation tax in the UK to increase from 1 April 2023 from 19 to 25 where a company has profits in excess of

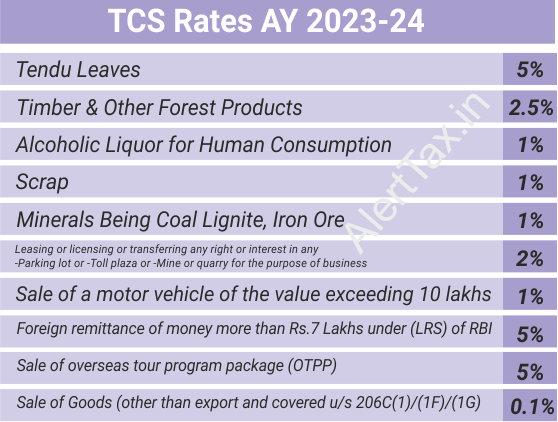

TCS Rates Chart F Y 2022 23 A Y 2023 24

TDS Rate Chart FY 2020 2021 AY 2021 2022 Sensys Blog

Deferred Revenue Debit Or Credit And Its Flow Through The Financials

Current Income Tax Rates For Fy 2021 22 Ay 2022 23 Sag Infotech

TDS Rate Chart For FY 2022 23

Tds Rate Chart For Fy 2021 22 Ay 2022 23 In India Guide Images And

Tds Rate Chart For Fy 2021 22 Ay 2022 23 In India Guide Images And

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Short Income Statement Deferred Tax Asset Journal Entry Example

Income Tax Slab Fy 2022 23 Ay 2023 24 Old New Regime Home Interior Design

TDS Rate Chart For The FY 2021 22 AY 2022 23 Ebizfiling

Deferred Tax Rate For Fy 22 23 - Rate of Income tax Assessment Year 2024 25 Assessment Year 2023 24 Up to Rs 3 00 000 Rs 3 00 000 to Rs 5 00 000 5 5 Rs 5 00 000 to Rs