Definition Of Input Services Under Service Tax Service Tax Cenvat Credit Input Services Mandap Keeper Services During the course of advertising and publicizing the product the assessee enlisted the services of a

The definition of input service has been given in sec 2 53 as any service used or intended to be used by a supplier in the course or furtherance of business CESTAT Can input services used by the provider of taxable service for providing output service be covered by the exclusion clause Tribunal answers

Definition Of Input Services Under Service Tax

Definition Of Input Services Under Service Tax

https://incometaxmanagement.com/Pages/Tax-Ready-Reckoner/GST-India/Images/Apportionment of Input Tax Credit in case of Goods and Services Used-Section 17-1.gif

Input Tax Credit Under GST YouTube

https://i.ytimg.com/vi/QGYbKa3uYIU/maxresdefault.jpg

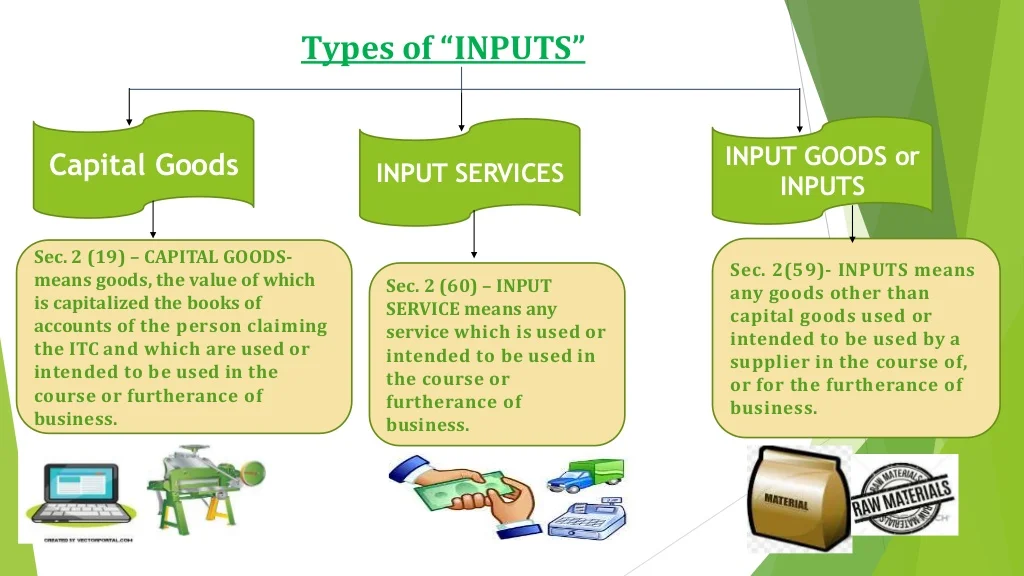

Input Under GST Act

https://image.slidesharecdn.com/pptoninputgst-210715062122/95/input-under-gst-act-4-1024.jpg?cb=1628083253

Definition of Input Service Last updated at May 29 2023 by Teachoo Rule 2 l Input service w e f 1 4 2011 Input service means any service i used by Under the GST regime input service means any service used or intended to be used by a supplier in the course or furtherance of business Analysis Definition is much wider

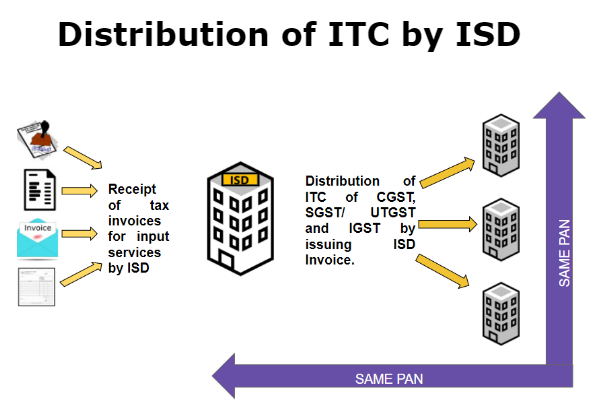

input service distributor means an office of the manufacturer or producer of final products or provider of output service which receives invoices issued under Rule 4A of the Service Tax Rules As per the means clause of the definition of input service as it stands w e f 1 4 2011 input service means any service i used by a provider of taxable service for providing

Download Definition Of Input Services Under Service Tax

More picture related to Definition Of Input Services Under Service Tax

Section 19 Of GST Act ITC For Inputs And Capital Goods Sent For Job

https://www.aubsp.com/wp-content/uploads/input-tax-credit.jpg

Input Service Distributor Input Service Distributor Mandatory Registered

https://carajput.com/art_imgs/input-service-distributor-mandatory-registered-under-gst-act.jpg

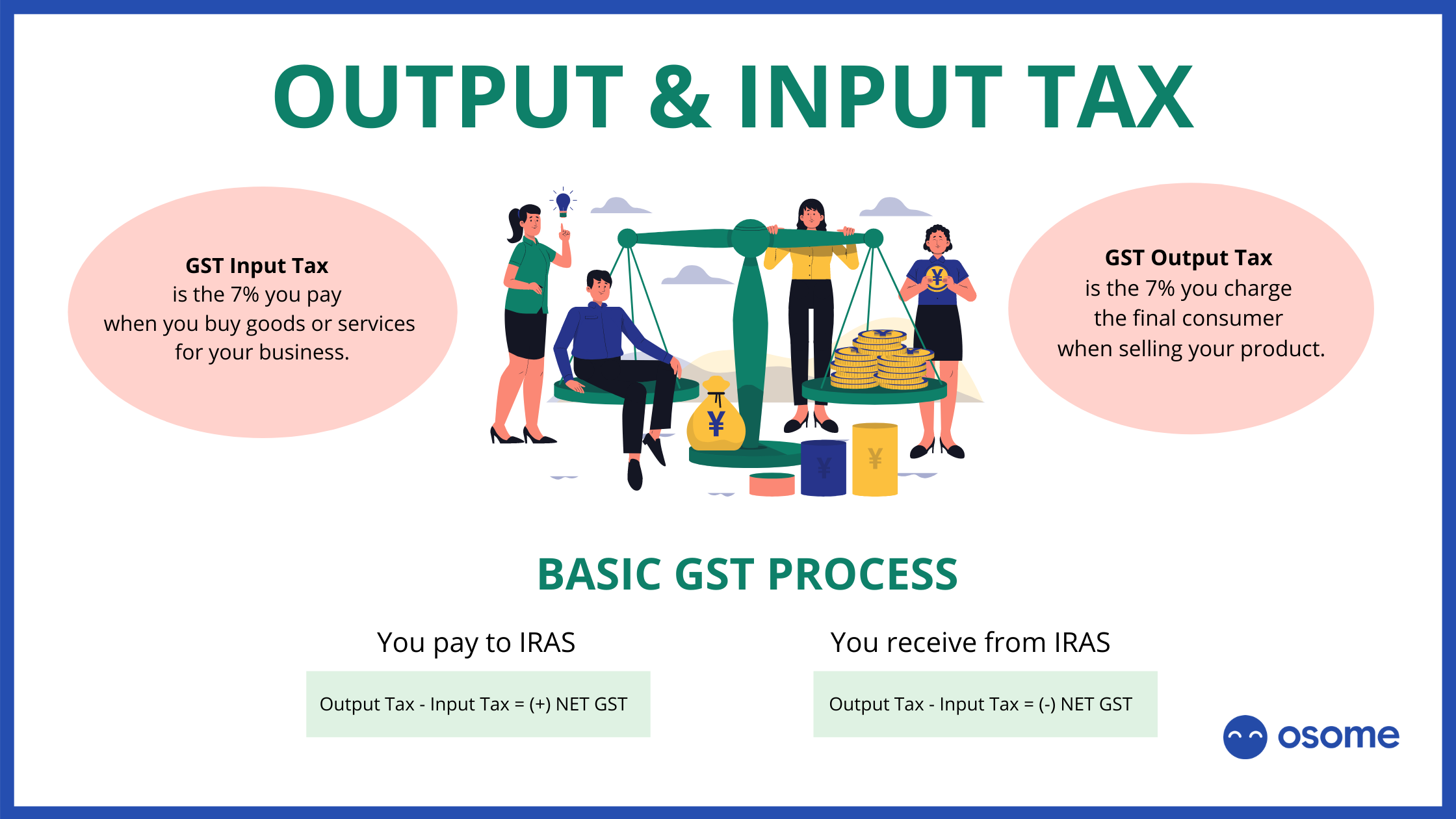

Goods And Services Tax GST In Singapore What Is It

https://osome.com/content/images/2021/03/Differences-between-input-and-output-tax.png

Input service means any service i used by a provider of taxable service for providing an output service or ii used by the manufacturer whether directly or Person liable to pay service tax The tax is normally payable by the service provider However law empowers the Government to notify a person other than the service

Meaning scope of Input service Presently ninety seven services are subject to levy of service tax and new services are added in the tax net every year In the Finance Negative list denotes the list of services on which no service tax is payable under Section 66B of the Finance Act 1994 As per Section 66D e trading of goods is

The Input Tax Credit Conundrum Under GST

https://www.taxscan.in/wp-content/uploads/2022/02/Input-Tax-Credit-Conundrum-GST-Taxscan.jpg

Service Tax Paid On Input Services Used For Export Of Services To Be

https://www.taxscan.in/wp-content/uploads/2021/07/Service-Tax-Input-Services-export-of-services-CESTAT-Taxscan.jpeg

https://www.servicetaxonline.com/content.php?id=1470

Service Tax Cenvat Credit Input Services Mandap Keeper Services During the course of advertising and publicizing the product the assessee enlisted the services of a

https://taxguru.in/goods-and-service-tax/...

The definition of input service has been given in sec 2 53 as any service used or intended to be used by a supplier in the course or furtherance of business

INPUT TAX CREDIT UNDER GST GOODS AND SERVICE TAX SIMPLE TAX INDIA

The Input Tax Credit Conundrum Under GST

Input Tax Vs Output Tax Nigelctzx

A Complete Guide On Input Tax Credit ITC Under GST

Input Tax Credit Reversal On Sale Of Shares Mutual Funds Chandan

Bombay HC Issues Notice Against Contradictory Provisions

Bombay HC Issues Notice Against Contradictory Provisions

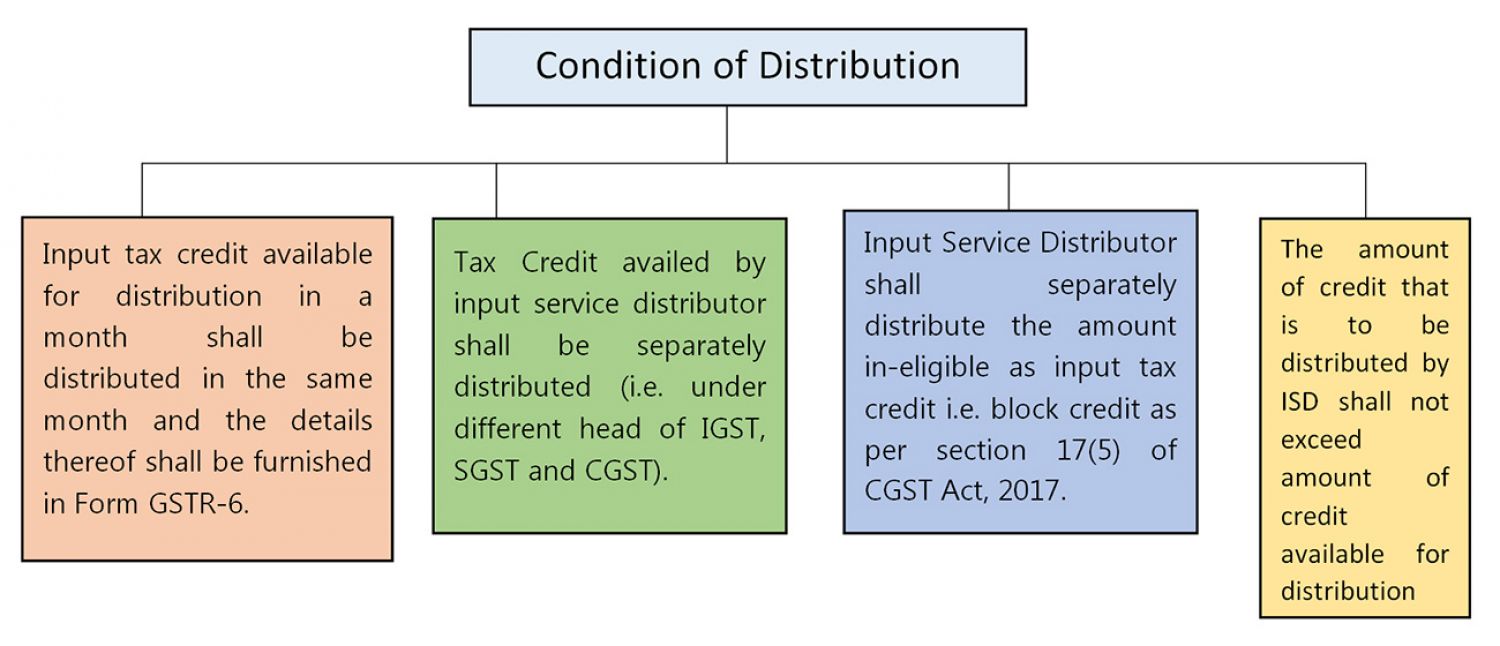

ITC Rules For Input Service Distributor CA Rajput Jain

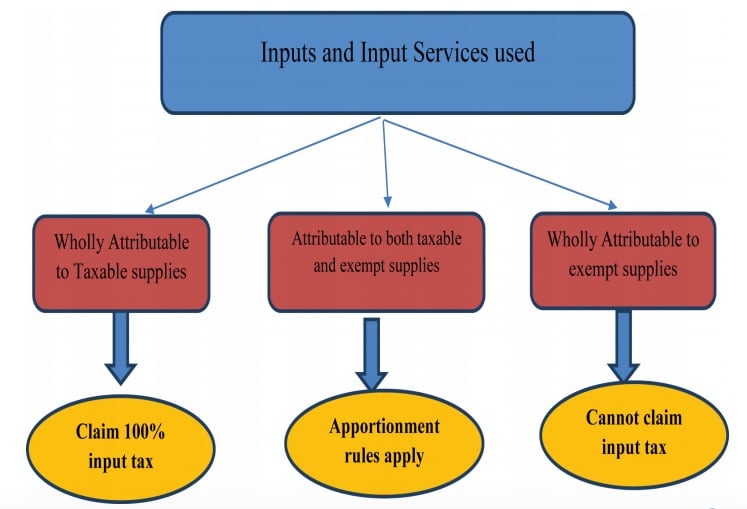

Apportionment Of Credit On Inputs And Input Services Under GST

No Verification Of Reversal Of Credit Of Input Service Attributed On

Definition Of Input Services Under Service Tax - Under the GST regime input service means any service used or intended to be used by a supplier in the course or furtherance of business Analysis Definition is much wider