Definition Of Input Tax Credit Under Gst Input credit means at the time of paying tax on output you can reduce the tax you have already paid on inputs Input tax credit in realtion to GST to a registered person means the CGST SGST UTGST

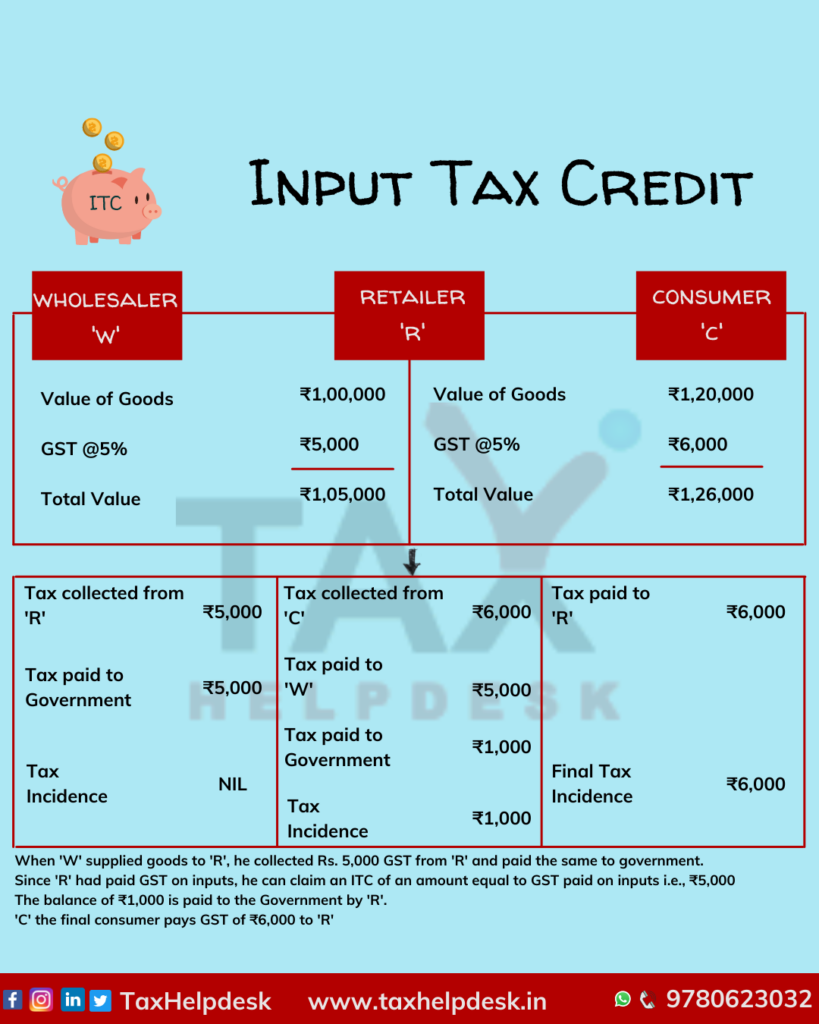

Input Tax Credit means claiming the credit of the GST paid on purchase of Goods and Services which are used for the furtherance of business The Mechanism of Input Input tax credit refers to the mechanism of claiming a reduction of tax paid on the inputs of a business or profession In India under the Goods and Service Tax

Definition Of Input Tax Credit Under Gst

Definition Of Input Tax Credit Under Gst

https://lh6.googleusercontent.com/6_vrCS2ruYo2EBXgd4vnYcPLU10fZ-5SKARwk3ODr1An1c6dcrg3rLqX6uZesnjjIkH_Ruz0a_pDCTzy1hZeocI6e-sbJ6SAB588YG8EpdyNFX81n8j1yt7RXo89wxYVY5fUcRpSzK_xS7kmEDW6JFU

What Is Input Tax Credit And How To Claim It YouTube

https://i.ytimg.com/vi/pDMQR1e2g4w/maxresdefault.jpg

What Is Input Tax Credit ITC INSIGHTSIAS Simplifying UPSC IAS

https://www.insightsonindia.com/wp-content/uploads/2020/12/ITC.png

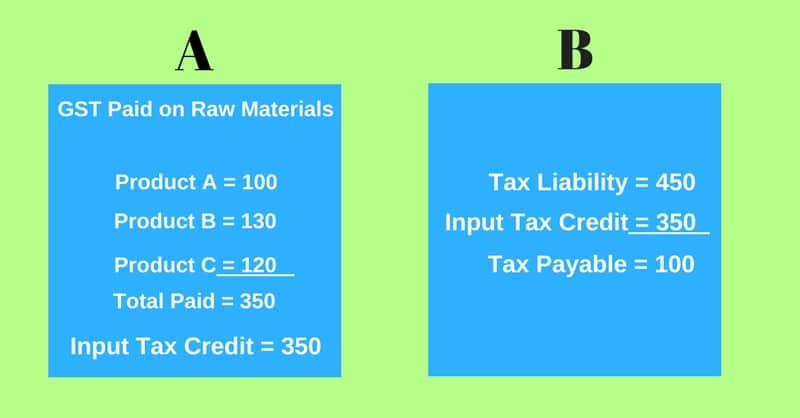

Input credit means that when you pay tax on output you can deduct the tax you ve already paid on inputs and pay the difference When you buy a Input tax credit ITC is the tax paid by the buyer on purchase of goods or services Such tax which is paid at the purchase when reduced from liability

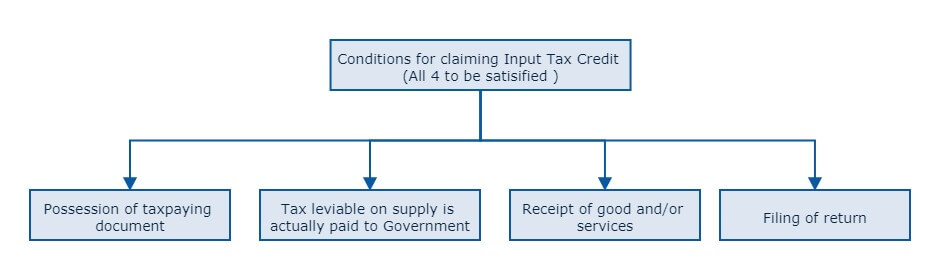

Input tax credit means that when a manufacturer pays the tax on his output he can deduct the tax he previously paid on the input he purchased Here What is input tax credit Conditions to claim input tax credit under GST When does one become eligible to avail input tax credit under GST When does one

Download Definition Of Input Tax Credit Under Gst

More picture related to Definition Of Input Tax Credit Under Gst

Input Tax Credit Guide Under GST Calculation With Examples

https://blog.saginfotech.com/wp-content/uploads/2017/06/input-tax.jpg

The Grey Aspects Of Input Tax Credit Under GST Regime

http://legalserviceindia.com/legal/uploads/thegreyaspectsofinputtaxcreditundergstregime_8958931360.jpg

Input Tax Credit Under GST Section 16 ITC Explained GST Classes In

https://i.ytimg.com/vi/4QU4YnFWuwM/maxresdefault.jpg

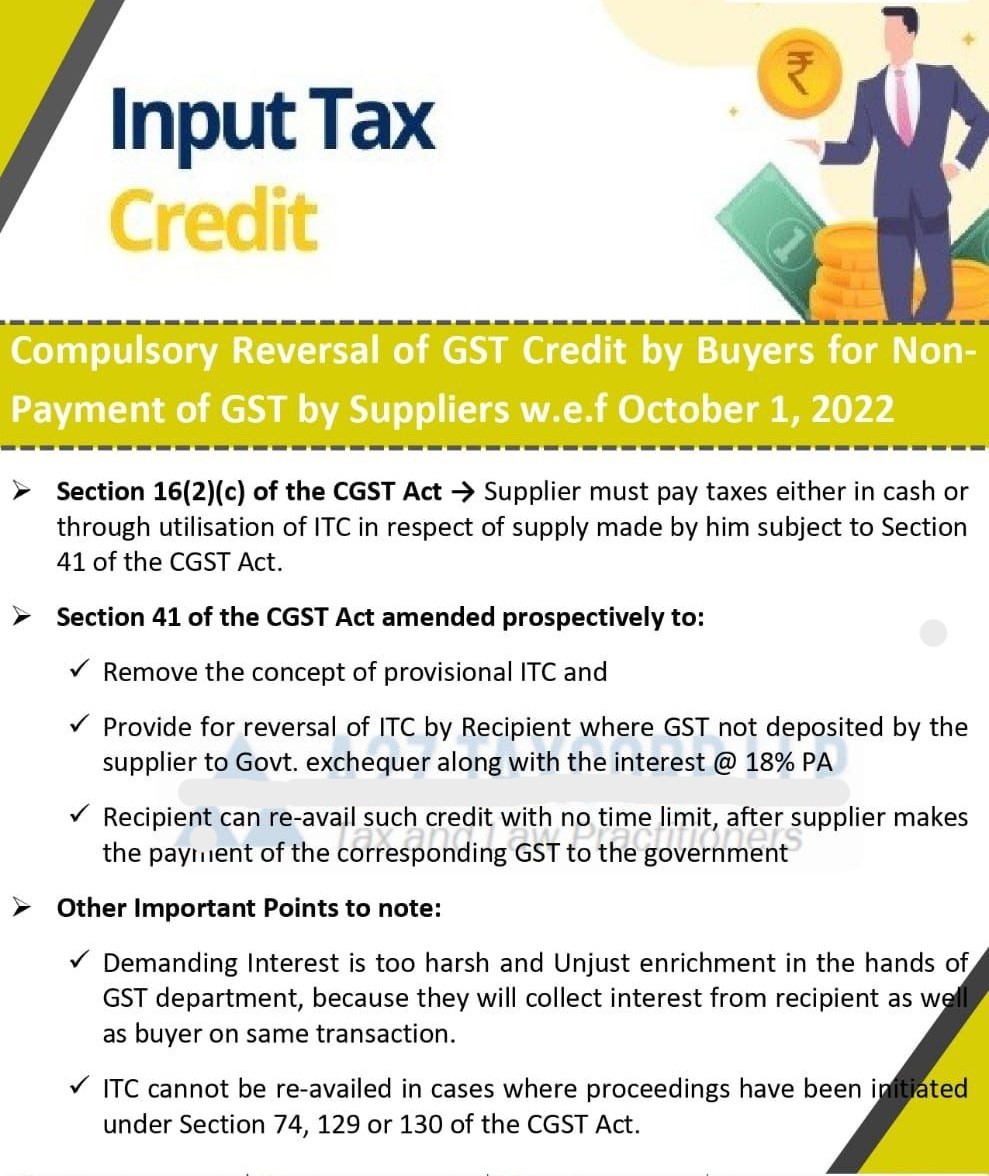

Back to Guides With the rollout of GST in July one of the most important concepts that every tax payer needs to understand is input tax credit ITC Before diving into details INPUT TAX CREDIT UNDER GST 1 DEFINITION SECTIONS Section 2 59 Input Means any good other than capital goods used or intended to be

Input Tax Credit ITC under GST is only available for business purposes Common credit is crucial to separate expenses used for personal exempted and Date modified 2023 12 21 GST HST Find out about input tax credits if you are eligible to claim ITCs how to calculate ITCs how to claim ITCs determine the

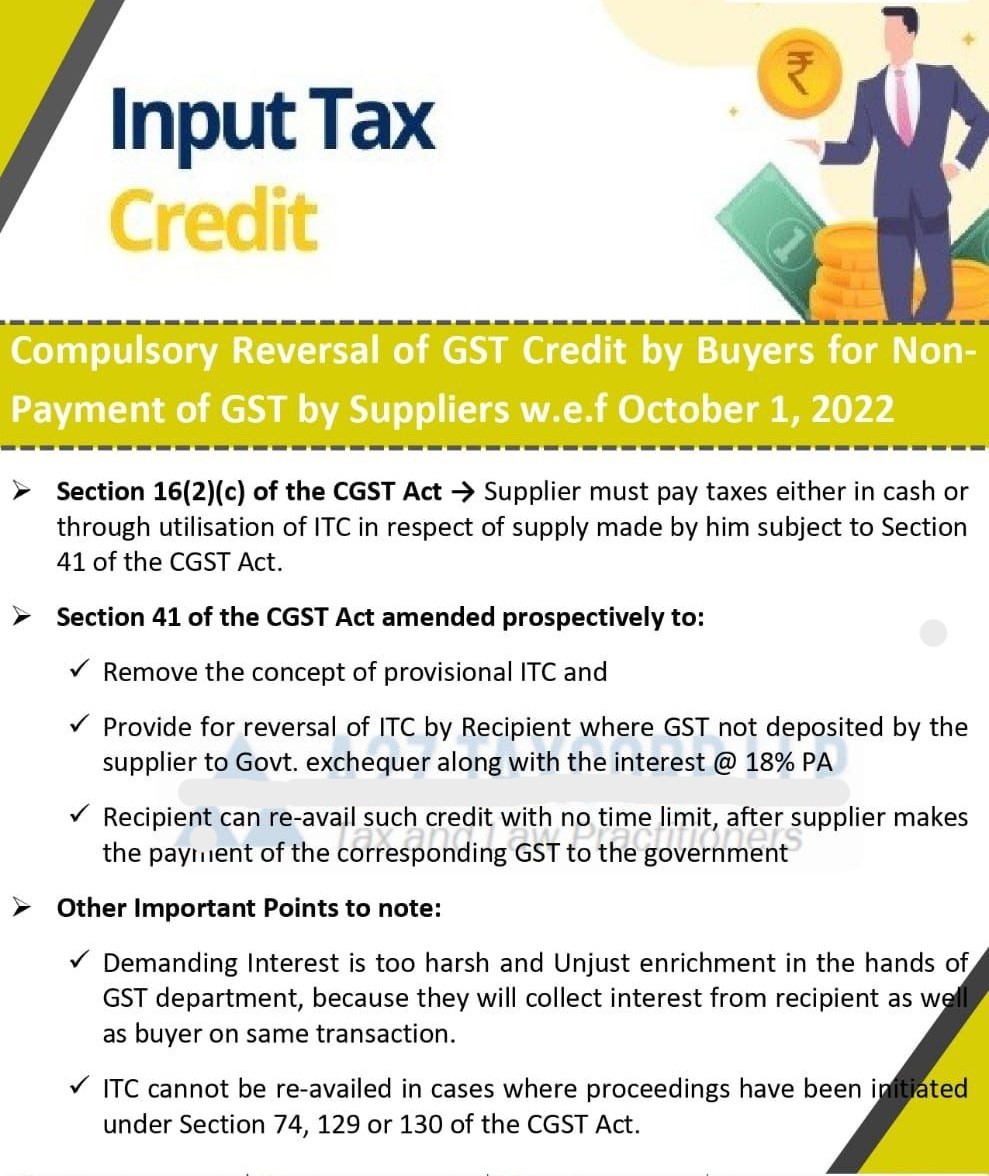

Input Tax Credit Under Goods And Services Tax Act RJA

https://carajput.com/blog/wp-content/uploads/2021/09/Compulsory-Reversal-of-GST-Credit-by-Buyers-for-Non-Payment-.jpg

Input Tax Credit Or ITC Guide On Meaning Eligibility And How To

https://www.saralgst.com/wp-content/uploads/2018/06/Input-Tax-credit.jpg

https://taxguru.in/goods-and-service-tax…

Input credit means at the time of paying tax on output you can reduce the tax you have already paid on inputs Input tax credit in realtion to GST to a registered person means the CGST SGST UTGST

https://www.charteredclub.com/gst-input-tax-credit

Input Tax Credit means claiming the credit of the GST paid on purchase of Goods and Services which are used for the furtherance of business The Mechanism of Input

Apportionment Of Input Tax Credit ITC Under GST Section 17 1 2

Input Tax Credit Under Goods And Services Tax Act RJA

What Is Input Tax Credit Or ITC Under GST ExcelDataPro

Input Tax Credit Utilisation Changes Through GST Amendment 2019

An In depth Look At Input Tax Credit Under GST Razorpay Business

All About Input Tax Credit Under GST Ebizfiling India Pvt Ltd

All About Input Tax Credit Under GST Ebizfiling India Pvt Ltd

Input Tax Credit Under GST ITC Meaning Rules And Guide With Example

Input Tax Credit Know How Does It Work

Input Tax Credit On Capital Goods Under GST YouTube

Definition Of Input Tax Credit Under Gst - There is a very simple definition of Input Tax Credit under the Act Section 2 63 of the CGST Act says Input Tax Credit credit of input tax Now question arise