School Tax Rebate For Seniors Web be residents of Manitoba The maximum Rebate for 2021 is 293 75 for eligible seniors The Rebate calculation is based on the total of residential school taxes assessed net of

Web To be eligible for the Seniors School Tax Rebate you or your spouse common law partner must be 65 years of age or older by the end of the year December 31 own Web The Rebate calculation is based on the total of residential school taxes assessed net of the Basic and Seniors Education Property Tax Credit received or receivable In addition for

School Tax Rebate For Seniors

School Tax Rebate For Seniors

https://www.gov.mb.ca/asset_library/en/schooltaxrebate/white-slip-school-taxes-2023.jpg

Tax Credits Could Replace Senior Freeze Rebates New Jersey Monitor

https://newjerseymonitor.com/wp-content/uploads/2022/09/seniorfreeze-scaled.jpeg

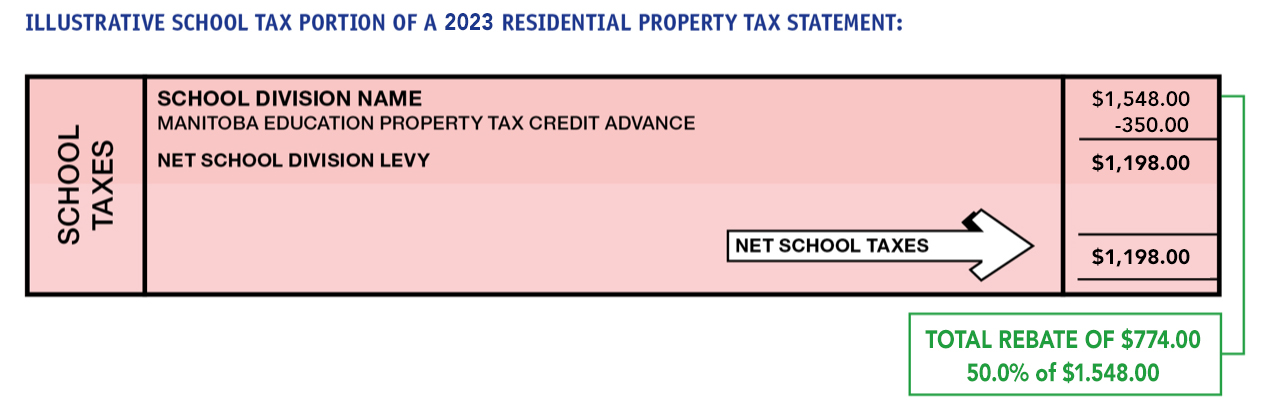

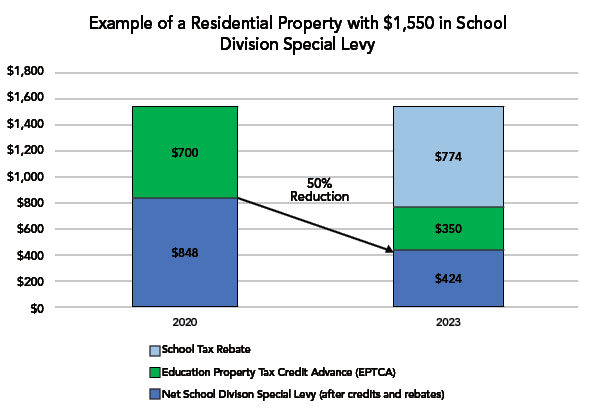

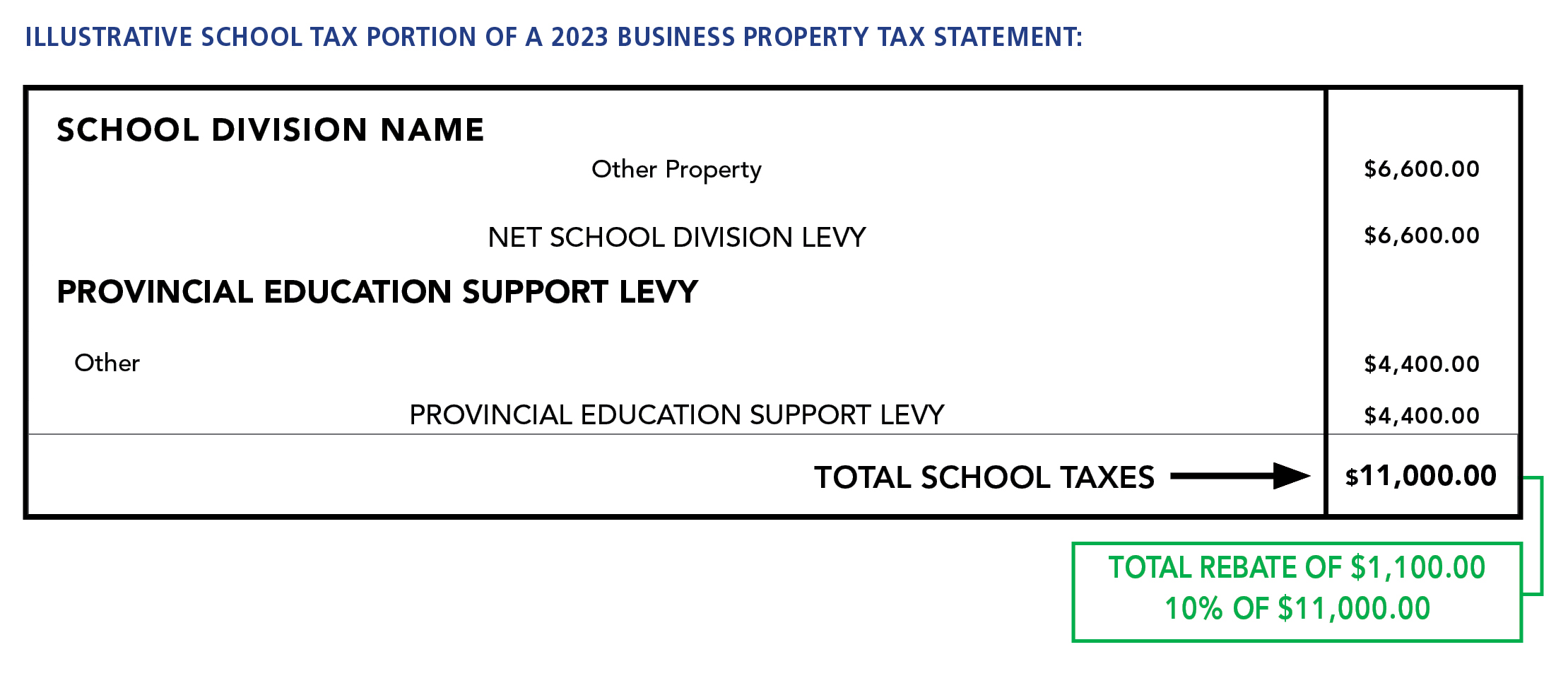

Province Of Manitoba School Tax Rebate

https://www.gov.mb.ca/asset_library/en/schooltaxrebate/schooltaxrebate-header.jpg

Web Seniors School Tax Rebate Seniors Education Property Tax Credit fore senior homeowners to an income tested maximum of 294 in 2022 235 in 2023 Further Web 3 avr 2023 nbsp 0183 32 Seniors School Tax Rebate Seniors could be eligible for up to 294 through this rebate To be eligible you or your spouse common law partner must be 65 years of

Web Seniors School Tax Rebate will be up to 235 minus 1 0 on family net income over 40 000 Seniors Education Property Tax Credit will be up to 200 minus 0 5 of family Web If you own and live in your home you can claim up to an extra 470 with the Senior s school tax rebate The amount you can claim depends on your net family income the

Download School Tax Rebate For Seniors

More picture related to School Tax Rebate For Seniors

Province Of Manitoba School Tax Rebate

https://www.gov.mb.ca/asset_library/en/schooltaxrebate/school-taxes.png

Province Of Manitoba School Tax Rebate

https://www.gov.mb.ca/asset_library/en/schooltaxrebate/residential-example.jpg

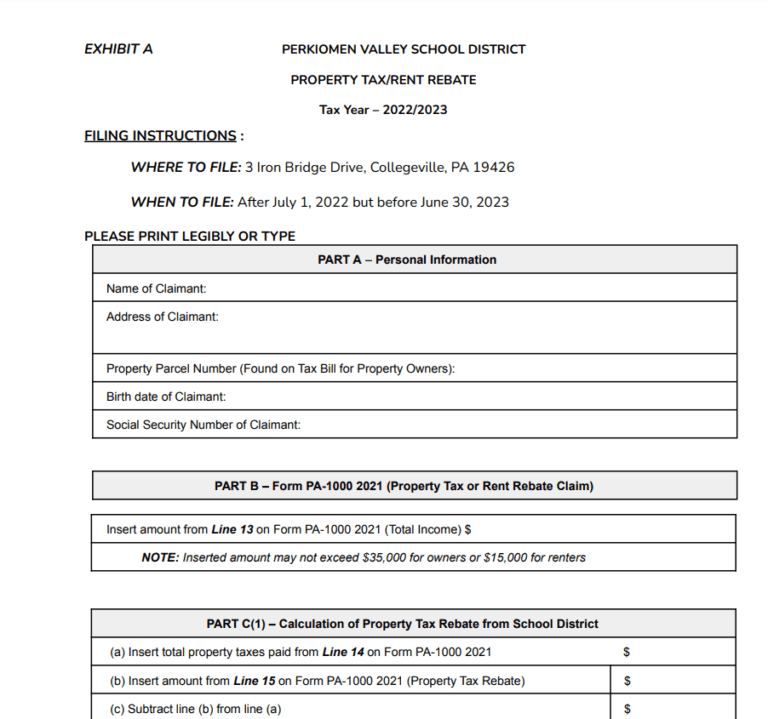

Property Tax Rebate Form For Seniors In Pa Printable Rebate Form

https://www.propertyrebate.net/wp-content/uploads/2023/05/property-tax-rebate-form-for-seniors-in-pa-printable-rebate-form-5.png

Web a school tax credit of up to 175 for persons aged 55 and up whose family income is less than 23 750 a seniors school tax rebate of up to 470 for a senior whose family Web Seniors School Tax Rebate Up to 353 Minus 1 5 on family net income over 40 000

Web Seniors School Tax Rebate Manitoba seniors who live in their own homes may be eligible for the Seniors School Tax Rebate Learn more Seniors with income under 40 000 Web 5 juil 2023 nbsp 0183 32 Dans le formulaire de d 233 claration de revenus 224 remplir en ligne les frais de scolarit 233 sont 224 indiquer dans la partie R 233 ductions d imp 244 t Cr 233 dits d imp 244 t au sein

Senior Citizen Income Tax Calculation 2023 24 Examples New Tax Slabs

https://i.ytimg.com/vi/rfW84weCMCs/maxresdefault.jpg

Happy Chinese New Year

https://content.govdelivery.com/attachments/fancy_images/NVLASVEGAS/2022/01/5470504/util-tax-rebate-2022_original.png

https://www.gov.mb.ca/finance/tao/sstrebate.html

Web be residents of Manitoba The maximum Rebate for 2021 is 293 75 for eligible seniors The Rebate calculation is based on the total of residential school taxes assessed net of

https://www.gov.mb.ca/finance/tao/sstr_faq.html

Web To be eligible for the Seniors School Tax Rebate you or your spouse common law partner must be 65 years of age or older by the end of the year December 31 own

School Tax Rebates Are In The Mail Winnipeg For Free

Senior Citizen Income Tax Calculation 2023 24 Examples New Tax Slabs

Abington School Board Approves Senior Citizen Real Estate Tax Rebate

School tax Rebate Clawback Rankles Winnipeg Senior Winnipeg Free Press

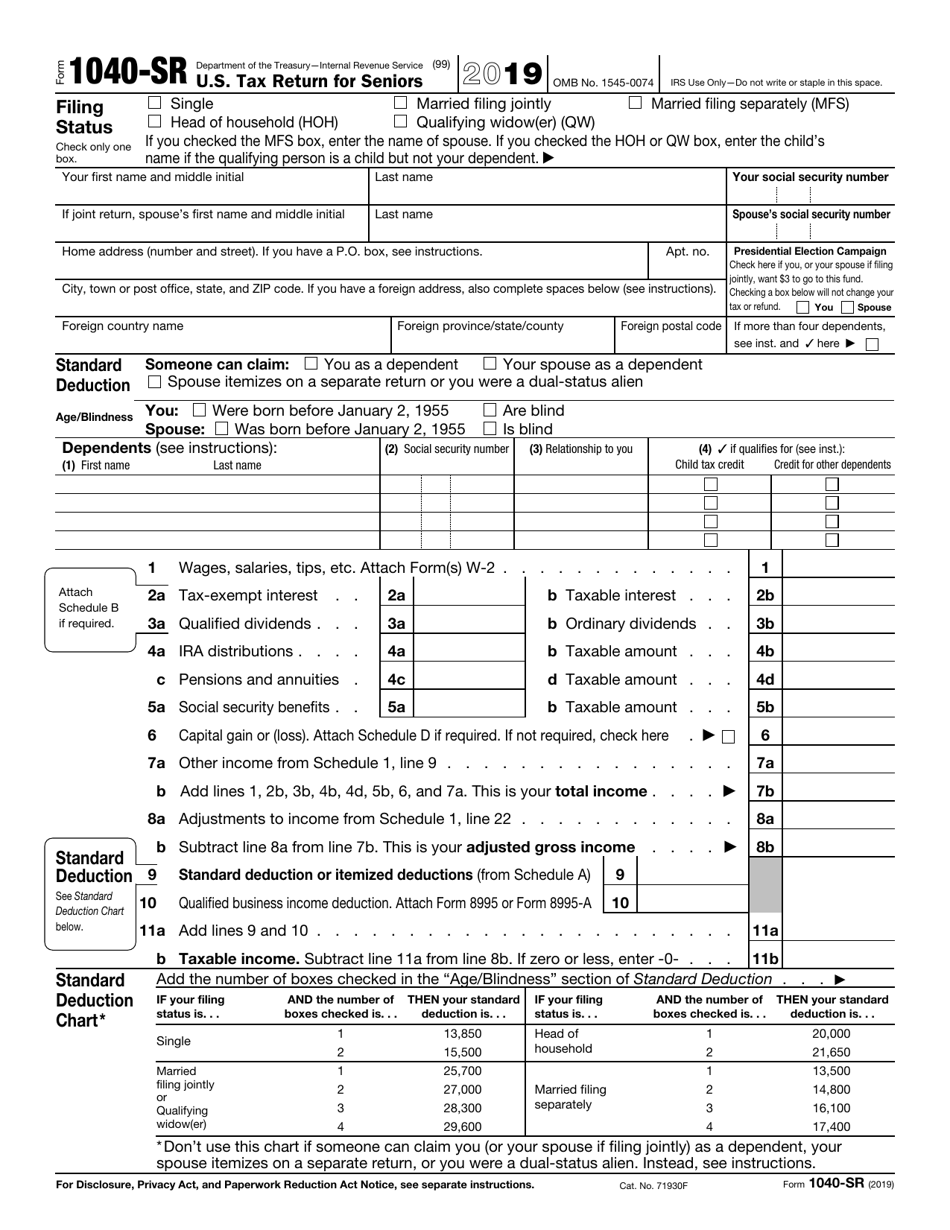

IRS Form 1040 SR 2019 Fill Out Sign Online And Download Fillable

New Jersey Property Tax Relief For Seniors Property Walls

New Jersey Property Tax Relief For Seniors Property Walls

2022 Property Tax Rebate For Seniors Funding For Eskasoni First

Pa Senior Citizen Property Tax Rebate Property Walls

2020 Property Tax Rebate For Seniors Program Rafah Di Costanzo

School Tax Rebate For Seniors - Web Tax Credit and Rebate Amounts 2020 2021 2022 2023 Education Property Tax Credit and Advance Up to 700 Up to 525 Up to 438 Up to 350 Seniors School Tax