School Tax Exemption For Seniors There are several obstacles to creating a school tax exemption for Senior Citizens loss of revenue shifting the tax burden an economic development impact but

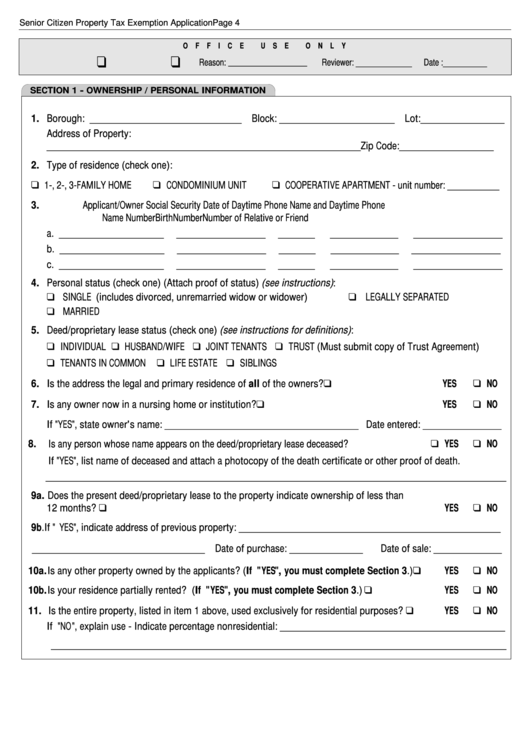

Provides an increased benefit for the primary residences of senior citizens age 65 and older with qualifying incomes 88 050 or less for the 2020 2021 school For a unit to be exempt from the School Facilities Special Tax the unit must be the primary residence of an occupant either an owner or a tenant who will be 65 years

School Tax Exemption For Seniors

School Tax Exemption For Seniors

https://www.gannett-cdn.com/-mm-/3ba01b2ad2daa0eba1afadc28fcdcdb80a5c3cfb/c=0-40-400-266/local/-/media/2016/04/01/Westchester/Westchester/635951236244655460-uscpcent02-6l5w66jzf39jxlfl8wg-layout.jpg?width=3200&height=1680&fit=crop

Shoreline Area News Property Tax Exemption For Seniors

https://2.bp.blogspot.com/-3e6xG-dglpg/XCUQA-cyb7I/AAAAAAAB6Iw/tcc3qNCu91ga_eDv6DWSzt03YbKQHsYMwCLcBGAs/s1600/Senior%2Bproperty%2Btax.jpg

Petition Add A School Tax Exemption For Senior Citizens 62 Y o And

https://assets.change.org/photos/6/wr/gk/LxwrgkLUXAEhebm-1600x900-noPad.jpg?1509226419

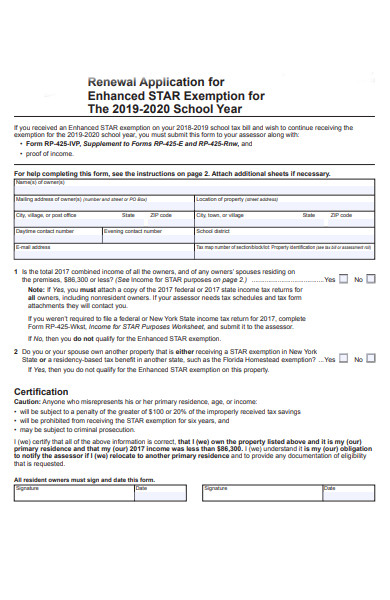

The STAR program provides eligible homeowners with relief on their school property taxes There are two types of STAR exemptions The Basic STAR exemption is The senior citizens property tax exemption can reduce property taxes for lower income homeowners who are at least 65 years old by up to 50 percent Cities towns villages

Homeowners aged 80 and up who qualify for the Enhanced Star Program would not need to pay school property taxes if this bill were to pass Income min for tax exemptions increases for senior citizens In a move aimed at providing relief to the elderly during this time of high inflation and costs the Oswego City School

Download School Tax Exemption For Seniors

More picture related to School Tax Exemption For Seniors

FREE 52 School Forms In PDF MS Word Excel

https://images.sampleforms.com/wp-content/uploads/2019/12/School-Exemption-Form.jpg?width=320

Ncua Letter Exemption Form Fill Out And Sign Printable PDF Template

https://www.signnow.com/preview/100/589/100589137/large.png

Senior Citizen Property Tax Exemption Application Form Printable Pdf

https://data.formsbank.com/pdf_docs_html/219/2191/219188/page_1_thumb_big.png

STAR exemption a reduction on your school tax bill If you ve been receiving the STAR exemption since 2015 you can continue to receive it for the same primary residence As long as you remain The enhanced STAR exemption will provide an average school property tax reduction of at least 45 percent annually for seniors living in median priced homes Senior citizens

Updated on May 27 2023 Written by Geoff Williams As a senior citizen you probably will end up paying property taxes for as long as you are a homeowner However depending To win voter approval for school parcel taxes many K 12 districts offer exemptions to people 65 and older But they don t often publicize the exemptions or

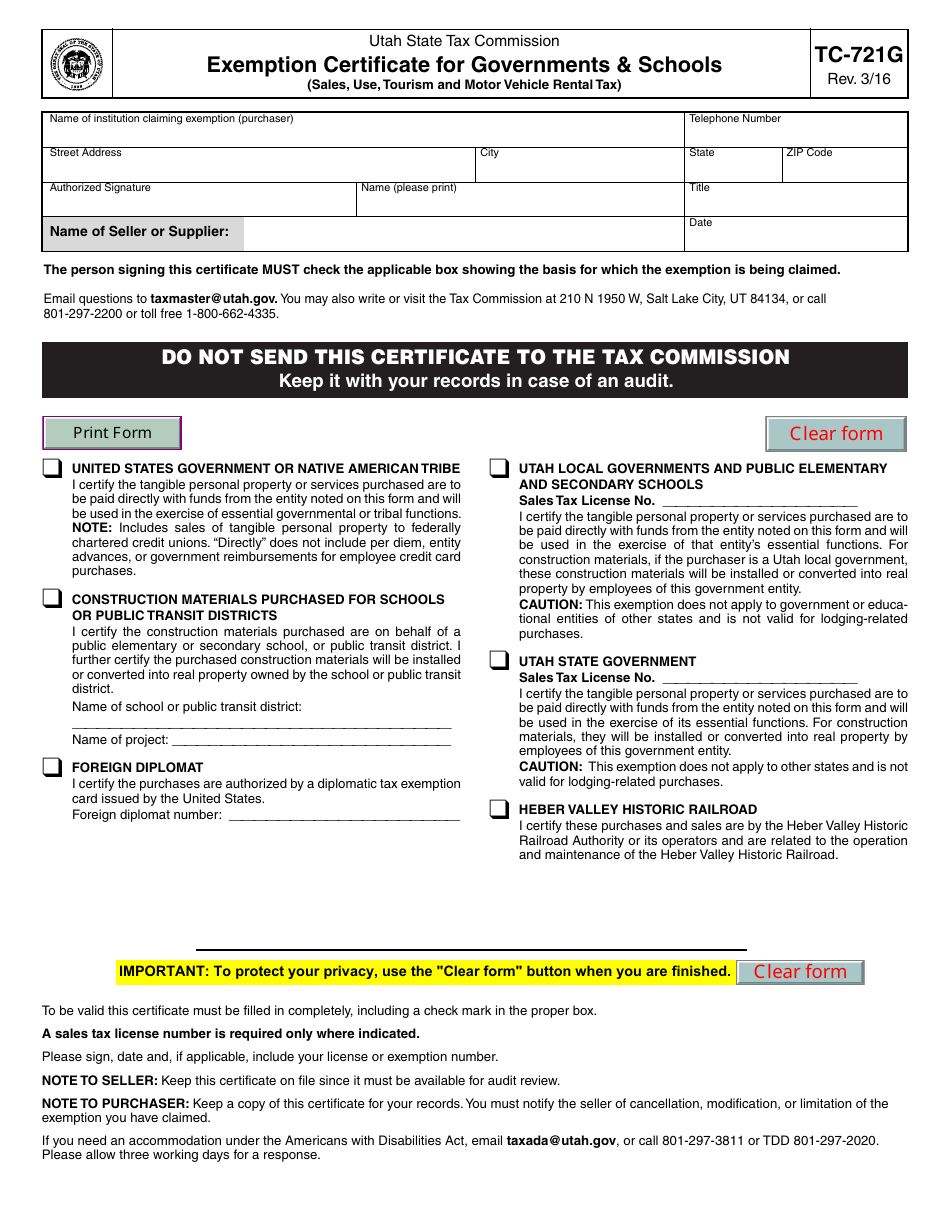

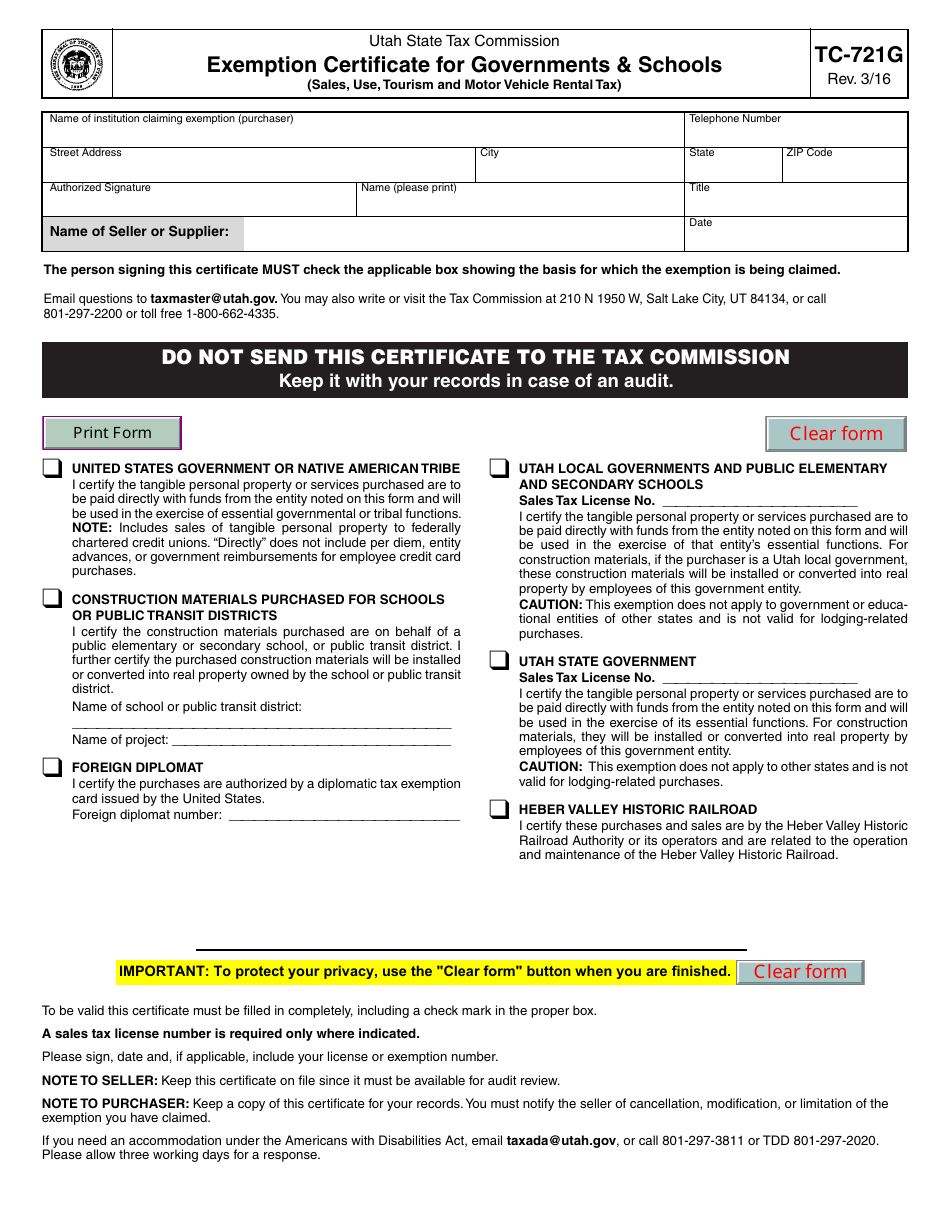

Form TC 721g Fill Out Sign Online And Download Fillable PDF Utah

https://data.templateroller.com/pdf_docs_html/418/4188/418847/form-tc-721g-exemption-certificate-form-government-and-schools-utah_print_big.png

Certificate Of Exemption Form Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/50/825/50825271/large.png

https://www.treybailey.us/blog/senior-school-tax-exemptions

There are several obstacles to creating a school tax exemption for Senior Citizens loss of revenue shifting the tax burden an economic development impact but

https://www.nysenate.gov/newsroom/articles/2021/...

Provides an increased benefit for the primary residences of senior citizens age 65 and older with qualifying incomes 88 050 or less for the 2020 2021 school

Tax File Number Declaration Form Pdf Withholding Tax Payments Vrogue

Form TC 721g Fill Out Sign Online And Download Fillable PDF Utah

Nysc Exemption Letter How To Apply And Collect Nysc Exemption Letter

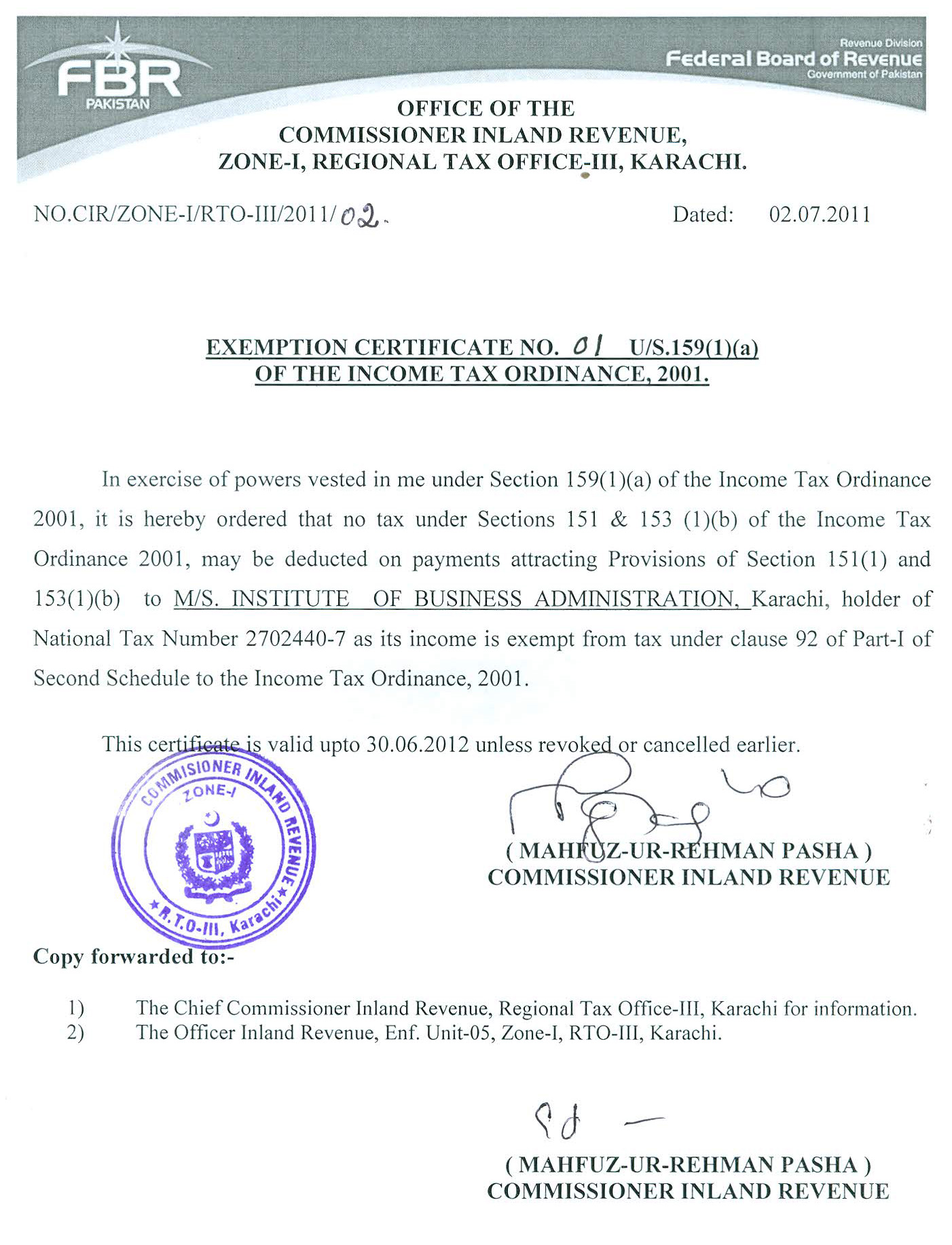

Tax Exemption Certificate SACHET Pakistan

Low income Seniors May Apply For Special Property Tax Exemption

Government Tax Exempt Form Pdf Fill Online Printable Fillable

Government Tax Exempt Form Pdf Fill Online Printable Fillable

Form Rev 1220 Pennsylvania Exemption Certificate Printable Pdf Download

2023 Tax Exemption Form Pennsylvania ExemptForm

Logos School Tax Exemption

School Tax Exemption For Seniors - Income min for tax exemptions increases for senior citizens In a move aimed at providing relief to the elderly during this time of high inflation and costs the Oswego City School