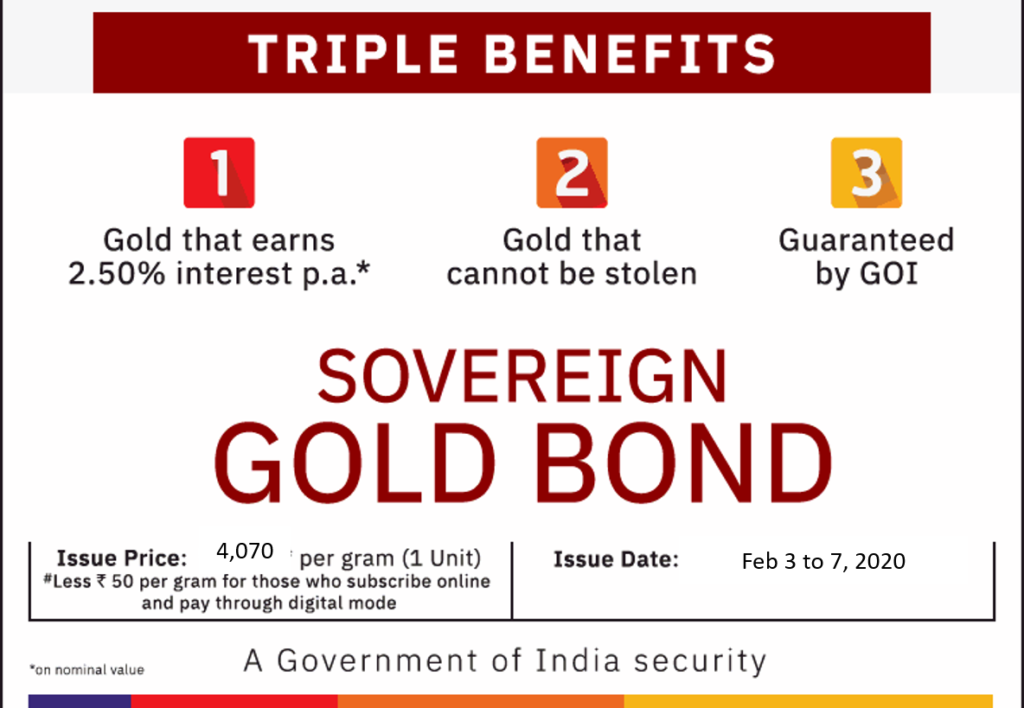

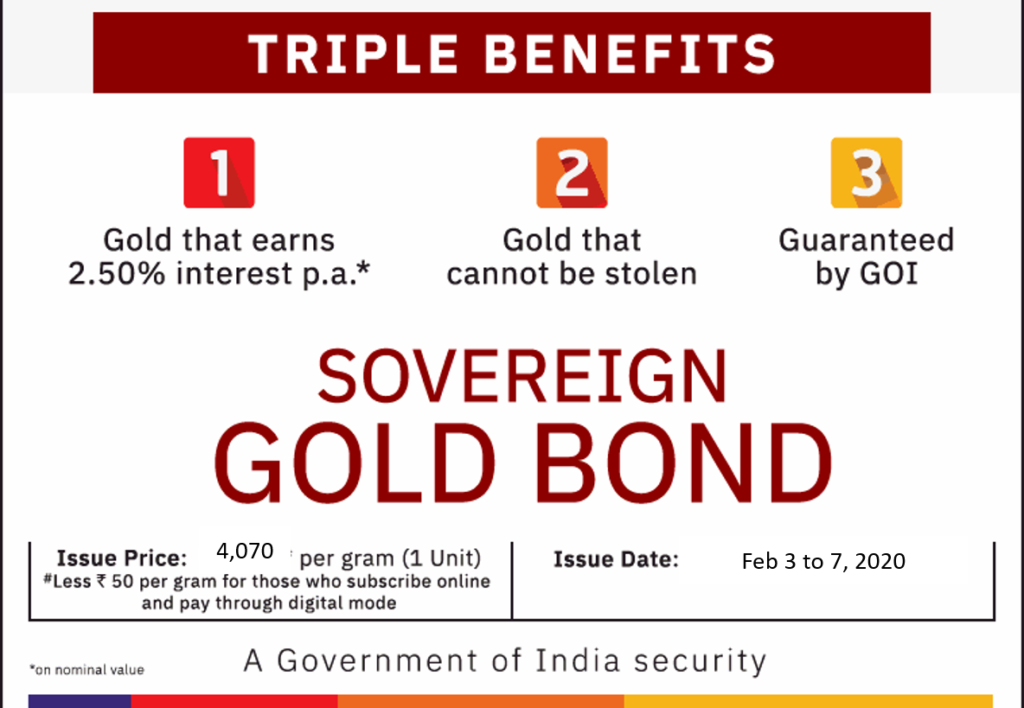

Gold Bond Income Tax Rebate Web 9 nov 2022 nbsp 0183 32 Investments in Sovereign Gold Bonds SGB not only help the investor save money to keep the gold secure but also provide 2 5 per cent annual interest payable

Web 13 janv 2022 nbsp 0183 32 TDS Tax Deducted at Source is charged at 1 on buying the physical form of gold for more than INR 1 lakh but in the case of Web 24 ao 251 t 2022 nbsp 0183 32 The nominal value of the bond is equal to Rs 5 197 per gram of gold based on the simple average closing price published by the India Bullion and Jewellers

Gold Bond Income Tax Rebate

Gold Bond Income Tax Rebate

https://www.apnaplan.com/wp-content/uploads/2020/02/Sovereign-Gold-Bond-February-2020-1024x708.png

Illinois Tax Rebate Tracker Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/05/illinois-tax-rebate-2022-cray-kaiser-1.png

Today Is The Final Day To Qualify For Illinois Income And Property Tax

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA133fb8.img?h=630&w=1200&m=6&q=60&o=t&l=f&f=jpg

Web 25 ao 251 t 2022 nbsp 0183 32 The second issue of sovereign gold bonds SGBs for 2022 23 priced at Rs 5 197 per gram is open for subscription SGBs are government securities denominated in Web 9 mars 2022 nbsp 0183 32 As per the rules the capital gains tax arising on redemption of SGB to an individual has been exempted Transfer of Sovereign Gold Bond issued by the Reserve

Web Il y a 20 heures nbsp 0183 32 In that case it shall be taxed as a short term capital gain on sale and taxed based on the income slab of the individual which may go up to 42 744 per cent highest Web 8 sept 2022 nbsp 0183 32 Although Sovereign Gold Bonds are tax free if you hold them till maturity they are taxable if you sell them before they mature This even if you sell after lock in

Download Gold Bond Income Tax Rebate

More picture related to Gold Bond Income Tax Rebate

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

https://www.practicaltaxplanning.com/ptp/wp-content/uploads/2022/06/7PY4cfZG8ZE.jpg

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

https://i.pinimg.com/originals/2d/3d/8c/2d3d8c83aee5a3115e206b0fac97c875.jpg

Section 87A Tax Rebate Under Section 87A

https://www.nitsotech.com/blog/wp-content/uploads/2020/05/taxrebate87a.jpg

Web 9 juil 2020 nbsp 0183 32 An investor who buys this gold bond online will get a Rs 50 per gm rebate too which means they can get Rs 500 per 10 gm rebate on online buying of gold bond They will have to pay just Rs 48 020 per 10 Web 20 d 233 c 2022 nbsp 0183 32 1 10 New SGB tranche Sovereign Gold Bonds 2022 23 Series III will be available for subscription from December 19 to 23 2022 with a settlement date of

Web 13 mai 2021 nbsp 0183 32 Sovereign Gold Bond Redemption The Gold Bonds shall be repayable on the expiration of eight years from the date of the issue of the Bonds The premature Web 9 janv 2022 nbsp 0183 32 Online bidders applying for the bond will get a rebate of 50 as issue price of the new series for digital applicants has been fixed at 4 736 per gram The Government

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

http://taxguru.in/wp-content/uploads/2016/05/87A-Computation.jpg

Income Tax Rebate Under Section 87A

https://image.slidesharecdn.com/incometaxrebateundersection87a2017-2018-180420103021/85/income-tax-rebate-under-section-87a-2-638.jpg?cb=1666685634

https://www.financialexpress.com/money/income-tax/sovereign-gold-bon…

Web 9 nov 2022 nbsp 0183 32 Investments in Sovereign Gold Bonds SGB not only help the investor save money to keep the gold secure but also provide 2 5 per cent annual interest payable

https://groww.in/blog/tax-implications-of-buy…

Web 13 janv 2022 nbsp 0183 32 TDS Tax Deducted at Source is charged at 1 on buying the physical form of gold for more than INR 1 lakh but in the case of

Individual Income Tax Rebate

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Income Tax Rules For Senior Citizens Senior Citizens Income Tax Slabs

Interim Budget 2019 20 The Talk Of The Town Trade Brains

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

Sovereign Gold Bonds 2020 21 Why You Should Invest

REMINDER Illinois Tax Rebate Program Filing Due Date Is October 17

What Is An Indemnity Bond Quora

Gold Bond Income Tax Rebate - Web 29 nov 2021 nbsp 0183 32 The following is the tax treatment The interest earned on the holdings of Sovereign Gold Bonds is taxable under the Income Tax Act of 1961 Interest collected