Apply For Recovery Rebate Credit Web 17 f 233 vr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Web 15 mars 2023 nbsp 0183 32 Didn t Get the Full Third Payment Claim the 2021 Recovery Rebate Credit You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax return Individuals can view the Web 10 d 233 c 2021 nbsp 0183 32 To claim the 2020 Recovery Rebate Credit you will need to Compute the 2020 Recovery Rebate Credit amount using the line 30 worksheet found in 2020 Form

Apply For Recovery Rebate Credit

Apply For Recovery Rebate Credit

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/how-to-use-the-recovery-rebate-credit-worksheet-ty2020-print-view.png

Recovery Rebate Credit Taking Forever Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/recovery-credit-printable-rebate-form-4.png?w=670&h=627&ssl=1

Mastering The Recovery Rebate Credit Free Printable Worksheet Style

https://i2.wp.com/proconnect.intuit.com/community/image/serverpage/image-id/2609i6F2345BD501809A1/image-size/large?v=1.0&px=999

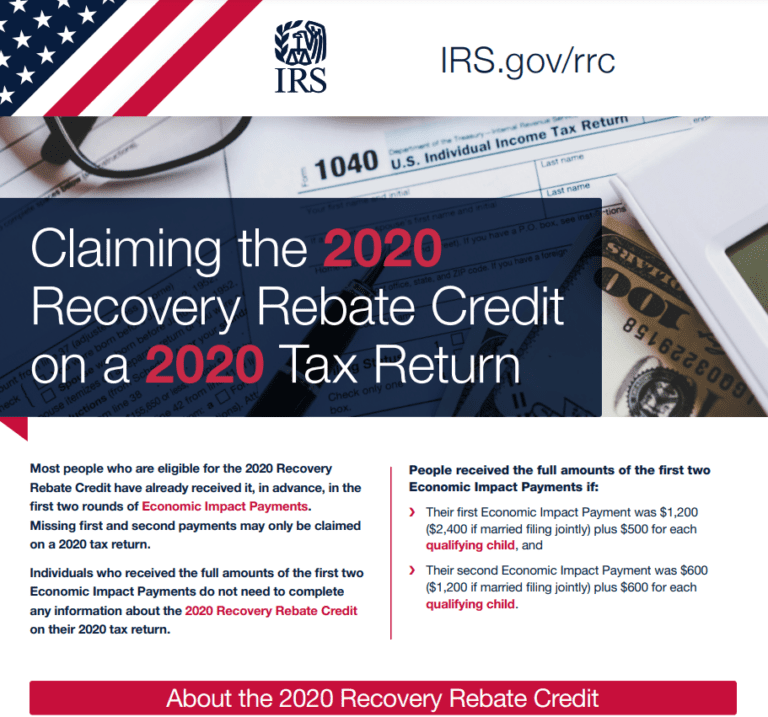

Web 10 d 233 c 2021 nbsp 0183 32 If you either didn t receive any first or second Economic Impact Payments or received less than these full amounts you may be eligible to claim the Recovery Rebate Web 15 janv 2021 nbsp 0183 32 For 2021 eligible taxpayers who did not receive the full amount can claim it as the Recovery Rebate Credit when they file their 2020 tax return Use IRS Free File

Web 13 janv 2022 nbsp 0183 32 If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program The fastest way to get your Web 10 d 233 c 2021 nbsp 0183 32 DO NOT file an amended tax return if you entered an incorrect amount for the 2020 Recovery Rebate Credit on your tax return If you entered an amount on line

Download Apply For Recovery Rebate Credit

More picture related to Apply For Recovery Rebate Credit

What Section Is The Recovery Rebate Credit On Turbotax Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/recovery-rebate-credit-worksheet-turbotax-studying-worksheets-30.png?fit=924%2C568&ssl=1

Recovery Rebate Credit Tax Hound College

https://www.iorad.com/api/tutorial/stepScreenshot?tutorial_id=1896467&step_number=1&width=800&height=600&mobile_width=450&mobile_height=400&apply_resize=true&min_zoom=0.5

What Is The Recovery Rebate Credit And Should You Apply For It

https://media.licdn.com/dms/image/C4E12AQFXBi1ASUIUqw/article-cover_image-shrink_720_1280/0/1616192357688?e=2147483647&v=beta&t=skOV4kJWSh4I5xDQSyDVAl_ksrOV0PAasAlCX5247gI

Web 1 d 233 c 2022 nbsp 0183 32 The 2020 Recovery Rebate Credit is part of the Coronavirus Aid Relief and Economic Security CARES Act that was signed into law in March of 2020 The initial stimulus payment provided up to 1 200 per Web 27 avr 2023 nbsp 0183 32 How To Claim the Recovery Rebate Credit on a Tax Return You will need to file your recovery rebate worksheet along with your 2020 or 2021 federal tax return whichever is applicable

Web 29 mars 2021 nbsp 0183 32 A recovery rebate credit worksheet can help determine whether you are eligible for more money and for how much Those instructions are available with Forms Web 17 ao 251 t 2022 nbsp 0183 32 Qualifying for a Recovery Rebate Credit Before claiming a Recovery Rebate Credit you would have had to first determine whether you were due one

Child Tax Credit Worksheet Claiming The Recovery Rebate Credit

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/child-tax-credit-worksheet-claiming-the-recovery-rebate-credit.jpg?resize=791%2C1024&ssl=1

Recovery Rebate Credit Worksheet 2022 Recovery Rebate

https://www.recoveryrebate.net/wp-content/uploads/2023/01/recovery-rebate-credit-worksheet-youtube.jpg

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-a...

Web 17 f 233 vr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

https://www.irs.gov/coronavirus/economic-im…

Web 15 mars 2023 nbsp 0183 32 Didn t Get the Full Third Payment Claim the 2021 Recovery Rebate Credit You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax return Individuals can view the

2022 Irs Recovery Rebate Credit Worksheet Recovery Rebate

Child Tax Credit Worksheet Claiming The Recovery Rebate Credit

Recovery Rebate Credit Third Stimulus StimulusInfoClub Recovery Rebate

Recovery Rebate Credit Line 30 Instructions Recovery Rebate

1040 Line 30 Recovery Rebate Credit Recovery Rebate

How Do I Apply For The Recovery Rebate Credit Limit Printable Rebate Form

How Do I Apply For The Recovery Rebate Credit Limit Printable Rebate Form

How To Figure The Recovery Rebate Credit Recovery Rebate

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

Irs Recovery Rebate Credit Worksheet Pdf IRSYAQU Recovery Rebate

Apply For Recovery Rebate Credit - Web 10 d 233 c 2021 nbsp 0183 32 If you either didn t receive any first or second Economic Impact Payments or received less than these full amounts you may be eligible to claim the Recovery Rebate