Department Of Energy Tax Credits Of the 4 billion tax credits 1 5 billion supports projects in historic energy communities These projects will create good paying jobs lower energy costs and support the climate supply chain and energy security goals

The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer Other types of renewable energy are also eligible for similar The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs and demand as we transition to cleaner

Department Of Energy Tax Credits

Department Of Energy Tax Credits

https://www.armaninollp.com/-/media/images/articles/energy-tax-credits-infographic.jpg

HVAC Tax Credits For Energy Efficiency AccuTemp

https://accutempaz.com/wp-content/uploads/2023/06/William-Potter-shutterstock_2210573383-1.jpg

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2022-10/Summary-ITC-and-PTC-Values-Table.png?itok=_72eWNBC

DOE is partnering with the Treasury Department and the IRS to implement the Qualifying Advanced Energy Project Tax Credit 48C DOE s Office of Manufacturing You can be entitled to a tax credit if electricity expenses are high in your permanent home The credit is a temporary measure in response to increased prices Only the

The following examples illustrate how DOE Home Energy Rebates and the 25C tax credits can be used to reduce the cost of energy saving home upgrades 7 Example 1 The Inflation Reduction Act of 2022 features tax credits for consumers and businesses that save money on energy bills create jobs make homes and buildings more

Download Department Of Energy Tax Credits

More picture related to Department Of Energy Tax Credits

Tax Credits Rebates Savings Department Of Energy Tax Credits

https://i.pinimg.com/originals/ac/af/fd/acaffd5c1be150ee0225502fc5fdf0ec.jpg

UK Energy Policies The Impact Of Green Taxes Bionic

https://assets-eu-01.kc-usercontent.com/77bbf83a-1306-0152-fea5-3b5eaf937634/5dc931e1-fc39-41d3-9470-e7d3675c5a5e/GettyImages-1413038230.jpg

Tax Credit Calculator My Free Taxes

https://www.myfreetaxes.org/wp-content/uploads/2022/01/iStock-Tax-Credit-word-scaled.jpg

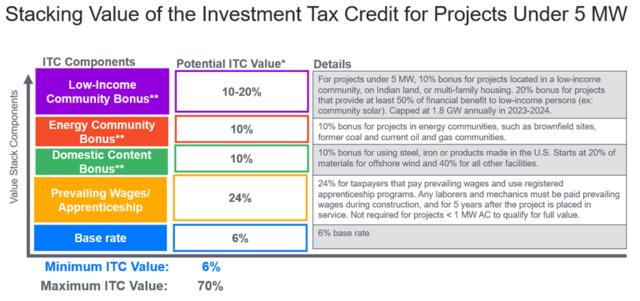

As defined in the Inflation Reduction Act IRA the Energy Community Tax Credit Bonus applies a bonus of up to 10 for production tax credits or 10 percentage points for investment tax credits for projects Did you know your energy efficient home upgrades could save you money on your taxes Check out these credits and see if you qualify

The Sustainable Growth Programme has specified the following amounts of funding to energy investments Investments in energy infrastructure EUR 155 million If you purchase EV charging equipment for a business fleet or tax exempt entity you may be eligible for a tax credit Starting on Jan 1 2023 the value of this credit is 6 of the cost of

Home Energy Improvements Lead To Real Savings Infographic Solar

https://i.pinimg.com/originals/d9/ad/96/d9ad96393cb13907229e3e2b1609bcc1.jpg

Home Energy Tax Credits John McCarthy CPA

https://johnmccarthycpa.com/wp-content/uploads/2023/07/Home-Energy-Tax-Credits-1080x675.png

https://www.energy.gov/articles/biden-h…

Of the 4 billion tax credits 1 5 billion supports projects in historic energy communities These projects will create good paying jobs lower energy costs and support the climate supply chain and energy security goals

https://www.energy.gov/eere/solar/hom…

The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer Other types of renewable energy are also eligible for similar

Save Up To 1 200 In Federal Energy Tax Credits QuantaPanel IGS

Home Energy Improvements Lead To Real Savings Infographic Solar

Residential Energy Tax Credits Changes In 2023 EveryCRSReport

Residential Energy Tax Credits Overview And Analysis

IRA Tax Provisions Prove Promising For The Renewables Sector Edison

Energy Tax Credits TC Services USA

Energy Tax Credits TC Services USA

Energy Tax Credits MTE D

How To Claim Your 2016 Energy Tax Credits For Greening Your Home

Receive Your Tax Credits

Department Of Energy Tax Credits - Manufacturers and other entities that invest in qualifying advanced energy projects may apply for a tax credit through the U S Department of Energy DOE