Dependent Care Tax Benefits You may be able to claim the child and dependent care credit if you paid expenses for the care of a qualifying individual to enable you and your spouse if filing a joint return to work or actively look for work

Dependent care benefits include tax credits and employee benefits such as daycare allowances for the care of their dependents The IRS provides a child and dependent care tax credit The child and dependent care credit CDCC is a tax credit for parents or caregivers to help cover the cost of qualified care expenses for a child under 13 a spouse or parent unable to

Dependent Care Tax Benefits

/GettyImages-909214952-b76b53d77293486dbad086ac1cc87364.jpg)

Dependent Care Tax Benefits

https://www.investopedia.com/thmb/YMrJyIWimeD7X7IT7LOgtpPMJZM=/2120x1414/filters:fill(auto,1)/GettyImages-909214952-b76b53d77293486dbad086ac1cc87364.jpg

Learn About The Child And Dependent Care Tax Credit Credit Karma

https://creditkarma-cms.imgix.net/wp-content/uploads/2018/02/gettyimages-684060418-kidscredit-e1519138847780.jpg

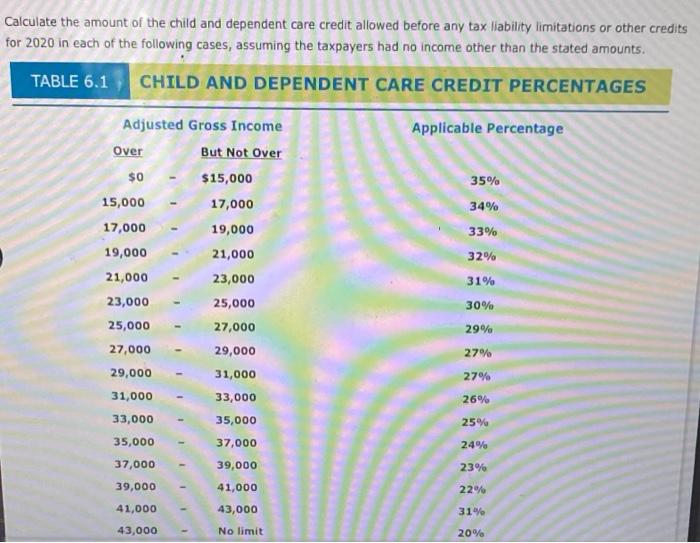

Solved Calculate The Amount Of The Child And Dependent Care Chegg

https://media.cheggcdn.com/study/c1e/c1e6c6b2-2420-432b-bc09-0a6b45cd2a4c/image

WASHINGTON The Internal Revenue Service today issued guidance on the taxability of dependent care assistance programs for 2021 and 2022 clarifying that amounts attributable to carryovers or an extended Benefits of Dependent Care FSA Contributing to a dependent care FSA has significant benefits including Federal and state tax advantages Since you deposit pre tax dollars into the account you reduce your taxable income and can even drop a tax bracket depending on your financial circumstances

If you paid for your child s or a dependent s care while you worked or looked for a job you may be eligible for a credit on your tax return Your eligibility to claim the child and dependent care credit will depend on the amount you paid to care for a qualifying child spouse or other dependent Benefits of the tax credit The Child and Dependent Care Credit is a tax break specifically for working people to help offset the costs associated with caring for a child or dependent with disabilities There are two major benefits of

Download Dependent Care Tax Benefits

More picture related to Dependent Care Tax Benefits

Tax Opportunities Expanded Individual Tax Credits In New Law Blog

https://mfiworks.com/wp-content/uploads/2021/05/the-child-tax-credit-and-the-dependent-care-credit.jpg

Dependent Care Fsa Or Child Tax Credit 2022 Kitchen Cabinet

https://i2.wp.com/static.twentyoverten.com/5afae91ee233a94fd2b8b963/AyQa5SwvUG/1616431432591.png

Saving On Child Care FSA Vs Child Care Tax Credit Benepass

https://assets.website-files.com/608f33836c9455480dd4da7d/62a227d3db4fe36f76e86c6a_FSA vs. childcare tax credit graphic2.png

A dependent care FSA allows you to save pretax dollars and can lower your taxable income to support a dependent child or adult Learn about more benefits to FSAs Form 2441 Child and Dependent Care Expenses is an Internal Revenue Service IRS form used to report child and dependent care expenses on your tax return in order to claim a tax credit for

A dependent care FSA is a tax advantaged account offered by many companies as part of their benefits package If your company is among the 40 of employers that offer this benefit you can put If you re a parent or caretaker of young children disabled dependents or a disabled spouse listen up you may qualify for a special tax credit used for claiming child care expenses and dependent care expenses

How To Claim Child And Dependent Care Tax Credit In 2022 Karla Dennis

https://www.karladennis.com/wp-content/uploads/2022/10/KDA-blog-cdc-scaled.jpg

Child And Dependent Care Credit LO 7 3 Calculate Chegg

https://media.cheggcdn.com/media/c7a/c7a7e54f-d046-435c-826a-3945e90aad03/php4ulBhq

/GettyImages-909214952-b76b53d77293486dbad086ac1cc87364.jpg?w=186)

https://www.irs.gov/taxtopics/tc602

You may be able to claim the child and dependent care credit if you paid expenses for the care of a qualifying individual to enable you and your spouse if filing a joint return to work or actively look for work

https://www.investopedia.com/terms/d/dependent-care-benefits.asp

Dependent care benefits include tax credits and employee benefits such as daycare allowances for the care of their dependents The IRS provides a child and dependent care tax credit

Under The Radar Tax Break For Working Parents The Dependent Care FSA

How To Claim Child And Dependent Care Tax Credit In 2022 Karla Dennis

A Lucrative Tax Break For Manufacturers The Domestic Production

10 Tax Benefits Of Real Estate Real Estate Business Plan Real Estate

How To Get Your Child Care Dependent Care Tax Credit Approved YouTube

Dependent Care Tax Credits Distribution Of Benefits Attorney Aaron Hall

Dependent Care Tax Credits Distribution Of Benefits Attorney Aaron Hall

Big Changes To The Child And Dependent Care Tax Credits FSAs In 2021

Tax Benefits Of Buying Stewart Brown Jr Mortgage Loan Originator

Child Dependent Care Taxes For Families 1040 Tax Guide YouTube

Dependent Care Tax Benefits - WASHINGTON The Internal Revenue Service today issued guidance on the taxability of dependent care assistance programs for 2021 and 2022 clarifying that amounts attributable to carryovers or an extended