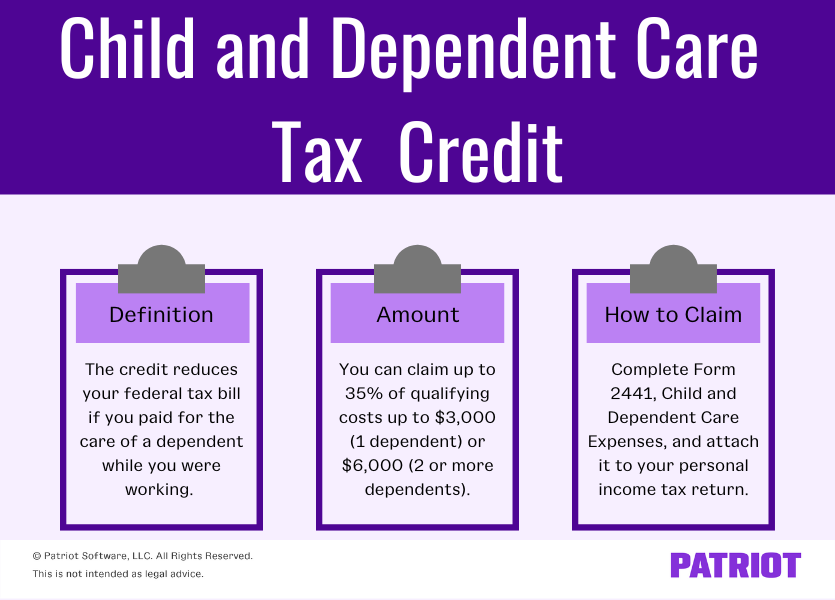

Dependent Care Tax Break The child and dependent care tax credit is a non refundable tax break designed to help parents or caregivers reclaim some of the expenses related to caring for a qualifying child

The child and dependent care tax credit is a tax break for working people with qualifying dependents It can help to offset the costs of caregiving expenses You must pay child and dependent care expenses so you or your spouse if filing jointly can work or look for work See Are These Work Related Expenses later You must make payments for child and dependent care to someone you and

Dependent Care Tax Break

Dependent Care Tax Break

https://i2.wp.com/static.twentyoverten.com/5afae91ee233a94fd2b8b963/AyQa5SwvUG/1616431432591.png

Dependent Care Tax Benefits Tax Credits Employer Plans

https://kajabi-storefronts-production.kajabi-cdn.com/kajabi-storefronts-production/blogs/16706/images/xPd6y22S4yHKBfd4NyWw_Blog_daycare_costs_3.png

How To Claim Child And Dependent Care Tax Credit In 2022 Karla Dennis

https://www.karladennis.com/wp-content/uploads/2022/10/KDA-blog-cdc-scaled.jpg

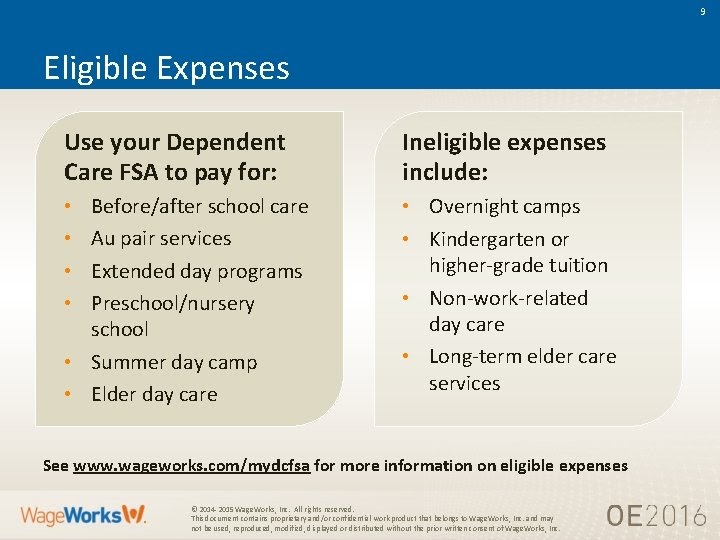

Child and Dependent Care Credit How Much Is It CDCTC The non refundable tax break can help working families afford quality care for their child or qualifying dependent Families who pay their nanny legally can qualify for two significant tax breaks the Dependent Care Account FSA and the Child or Dependent Care Tax Credit These options can make legal payment of nanny wages more

As long as the nanny is paid on the books the vast majority of families will be eligible to take the child and dependent care tax credit for their 2025 tax returns In this article we ll go in depth about this tax break to cover Benefits of the tax credit The Child and Dependent Care Credit is a tax break specifically for working people to help offset the costs associated with caring for a child or

Download Dependent Care Tax Break

More picture related to Dependent Care Tax Break

Saving On Child Care FSA Vs Child Care Tax Credit Benepass

https://assets-global.website-files.com/608f33836c9455480dd4da7d/62a227d3db4fe36f76e86c6a_FSA vs. childcare tax credit graphic2.png

Under The Radar Tax Break For Working Parents The Dependent Care FSA

https://uploads-ssl.webflow.com/60d06fe5295170bf4aac3c09/611ff9182df03b8ea38952de_Dyf2aM0vq8m-UvMRjk_z6r6YCziRUy8fQjaWkYTUI_pP5AMkYw1UGd_vbh2HwEtphyRncYbBSJwB62SE908VyPr25XpxVc2tADWpjOf6l5-ZchDlAMmkXgHct4na8jOUxg.jpeg

A Lucrative Tax Break For Manufacturers The Domestic Production

https://blog.concannonmiller.com/hubfs/mfg emblem-TAX BENEFITS copy.png#keepProtocol

The Child and Dependent Care Credit not to be confused with the similar sounding Child Tax Credit can reduce your tax bill if you paid for a dependent s care so that you could work or Here s how the FSA compares to the tax credit for dependent care when determining which one could benefit you the most come tax time

Luckily the federal government offers two tax breaks that can help defray some of these costs the child care credit and dependent care accounts If you pay for day care Contributing to a dependent care FSA generally gives you a bigger break than taking the child care credit because the money you put aside avoids not only federal income

How To Score A Tax Break For Your Charitable Giving

https://image.cnbcfm.com/api/v1/image/106268833-1574881176855gettyimages-522951298.jpeg?v=1574881259&w=1920&h=1080

Child And Dependent Care Credit LO 7 3 Calculate Chegg

https://media.cheggcdn.com/media/c7a/c7a7e54f-d046-435c-826a-3945e90aad03/php4ulBhq

https://www.kiplinger.com › taxes › child-and...

The child and dependent care tax credit is a non refundable tax break designed to help parents or caregivers reclaim some of the expenses related to caring for a qualifying child

https://www.nerdwallet.com › article › taxe…

The child and dependent care tax credit is a tax break for working people with qualifying dependents It can help to offset the costs of caregiving expenses

Tax Opportunities Expanded Individual Tax Credits In New Law Blog

How To Score A Tax Break For Your Charitable Giving

C Tax Break Special Health Chex Medical

Dependent Care Fsa Income Limit Tricheenlight

Three Tax Break Tips For Caregivers WISDOM WEALTH STRATEGIES

There s A Tax Break Waiting For Owners Who Renovated This Year

There s A Tax Break Waiting For Owners Who Renovated This Year

How To Get Your Child Care Dependent Care Tax Credit Approved YouTube

Child And Dependent Care Credit Reduce Your Tax Liability

WHICH IS BETTER TAX CREDITS OR TAX DEDUCTIONS Tax Professionals

Dependent Care Tax Break - Benefits of the tax credit The Child and Dependent Care Credit is a tax break specifically for working people to help offset the costs associated with caring for a child or