Dependent Spouse Tax Credit Canada Verkko If the eligible dependant is under 18 years of age at the end of the year you may claim one of the following amounts 2 350 on line 30500 of your return for each eligible

Verkko An individual may claim under certain circumstances the quot amount for an eligible dependant quot equivalent to spouse tax credit for a dependent child or other Verkko As of September 23 2022 you must now apply online for this program If you can t apply online and require accommodations including for a disability you can ask for

Dependent Spouse Tax Credit Canada

Dependent Spouse Tax Credit Canada

https://www.taxtips.ca/filing/eligible-dependant-tax-credit.jpg

With The Participation Of Canada The Canadian Film Of Video Production

https://i.pinimg.com/originals/aa/60/32/aa60329d06ee2c2b47c1f795c44d3048.png

Canadian Film Tax Credit Logo Compilation YouTube

https://i.ytimg.com/vi/Q6INrvAKWiw/maxresdefault.jpg

Verkko 10 helmik 2022 nbsp 0183 32 Claim the eligible dependant credit to reduce your taxable income and save money on taxes Learn who can claim this credit what types of dependants are Verkko If you did not claim an amount on line 30300 of your return you may be able to claim this amount for one dependant if at any time in the year you met all the following

Verkko 1 helmik 2022 nbsp 0183 32 You can claim the dependent tax credit for one of these people Spousal tax credit If your spouse s net income is less than 13 808 the basic personal exemption for 2021 you can claim Verkko 1 lokak 2020 nbsp 0183 32 If at any time in the taxation year in question you and or your spouse maintained a home for a disabled or elderly relative over the age of 18 you may be

Download Dependent Spouse Tax Credit Canada

More picture related to Dependent Spouse Tax Credit Canada

Tax Credit To Spur Carbon Capture Utilization And Storage Tech

https://www.vmcdn.ca/f/files/stalberttoday/images/news/1304-tax-credit-sup-cc.jpg;w=960

Qu bec Film And Television Tax Credit Gestion SODEC The Canadian Film

https://i.pinimg.com/originals/ef/d4/f8/efd4f874f09f9cc18a19f921859d7e55.png

Ontario Film And Television Tax Credits Credits Variants Logo

https://static.wikia.nocookie.net/logo-timeline/images/5/54/54855333-A50C-4D11-883E-3EDEF12E920A.jpg/revision/latest/scale-to-width-down/1200?cb=20220710180329

Verkko 3 elok 2023 nbsp 0183 32 The Canada Revenue Agency CRA allows you to take a spousal tax credit if you provide primary support for your spouse This applies to you if you re Verkko Depending on your family situation and any changes to your marital status during the year you might have to choose between claiming the spouse or common law partner

Verkko The spouse or common law partner amount is a non refundable tax credit is reduced by income earned by the spouse or common law partner can be claimed by only one Verkko You should choose whichever option is more advantageous for your situation In addition to the spousal type tax benefit for dependants the Canadian tax system provides a

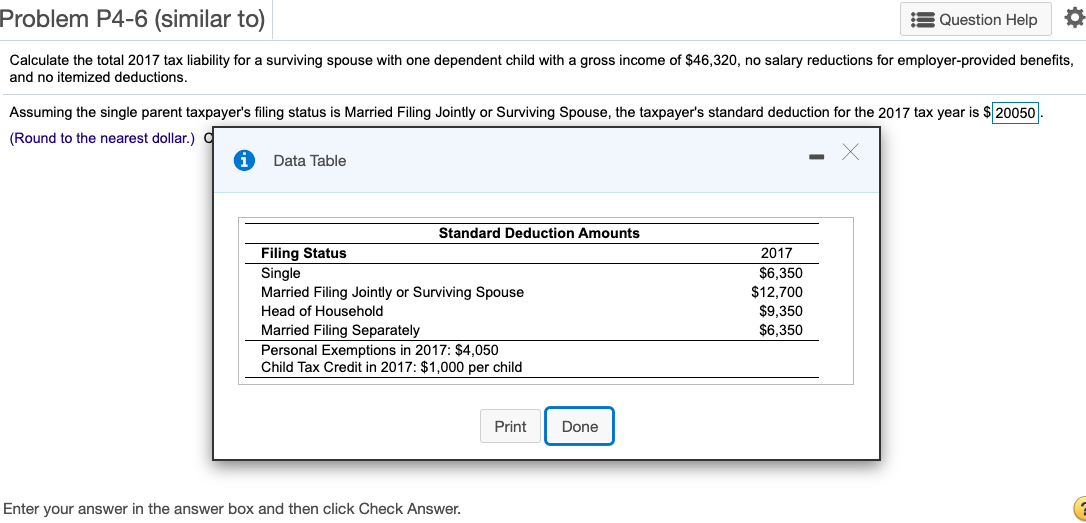

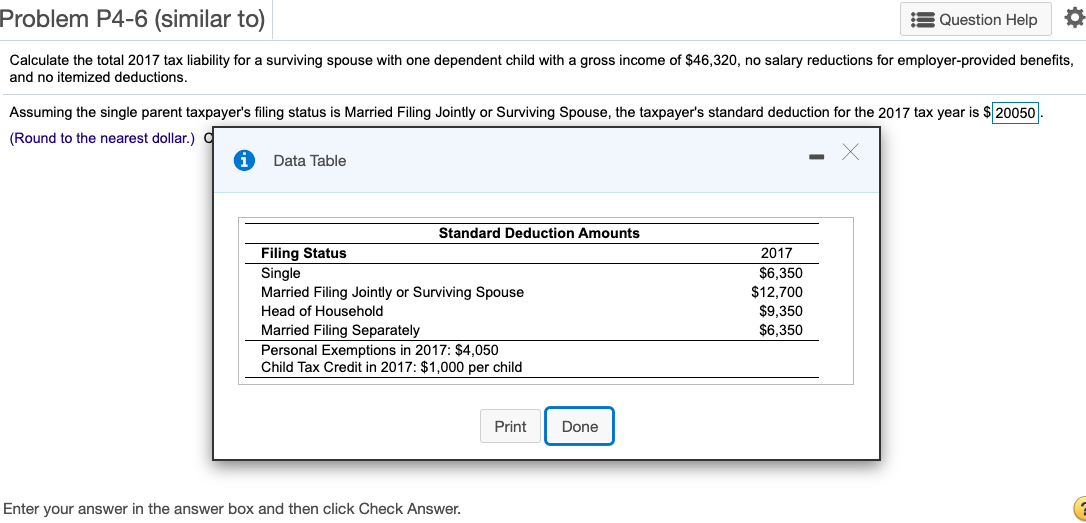

Solved Problem P4 6 similar To Question Help Calculate The Chegg

https://media.cheggcdn.com/media/b01/b011a9f1-150d-4348-b67e-8a016a5eb75d/phpBOUCCQ.png

Basis Adjustment Proposal

https://ntcic.com/wp-content/themes/ntcic/assets/images/no-image.jpg

https://www.canada.ca/en/revenue-agency/services/tax/individuals/...

Verkko If the eligible dependant is under 18 years of age at the end of the year you may claim one of the following amounts 2 350 on line 30500 of your return for each eligible

https://www.taxtips.ca/filing/eligible-dependant-equivalent-to-spou…

Verkko An individual may claim under certain circumstances the quot amount for an eligible dependant quot equivalent to spouse tax credit for a dependent child or other

Monthly Child Tax Credit Payments Understand The Options Articles

Solved Problem P4 6 similar To Question Help Calculate The Chegg

How People Are Using The Monthly Child Tax Credit Payments SaverLife

What Is Innocent Spouse Tax Relief A Lot Of Married As Well As

Adoption Tax Credit

Federal Tax Credits Carrier Residential

Federal Tax Credits Carrier Residential

House Lawmakers Scrutinize Pandemic era Employee Retention Tax Credit

The Canadian Film Or Production Tax Credit And Quebecor Fund Company

Canadian Film Or Video Production Tax Credit Logo

Dependent Spouse Tax Credit Canada - Verkko If you did not claim an amount on line 30300 of your return you may be able to claim this amount for one dependant if at any time in the year you met all the following