Dependent Tax Deduction 2022 Key Takeaways The Child Tax Credit is up to 2 000 The Credit for Other Dependents is worth up to 500 The IRS defines a

If you can claim someone as a dependent deductions like the earned income tax credit EITC and child tax credit will lower your tax bill Learn which you can claim A dependent tax deduction can lower your overall tax liability Here are the IRS rules for dependents and how much you can qualify to get deducted

Dependent Tax Deduction 2022

Dependent Tax Deduction 2022

https://bloximages.chicago2.vip.townnews.com/walkermn.com/content/tncms/assets/v3/editorial/0/23/0239d6a0-5dd4-11ec-bd8c-8fec48e13613/61ba32c9dc80e.image.jpg?resize=1200%2C568

2022 Standard Deduction Amounts Are Now Available Bankruptcy L Lawyers

https://mediacloud.kiplinger.com/image/private/s--X-WVjvBW--/f_auto,t_content-image-full-desktop@1/v1636590821/Tax_Form_And_Calculator.jpg

Early Peek At 2021 Tax Rates Fuoco Group

https://fuoco.cpa/wp-content/uploads/2021/01/Tax-2021-A.jpg

The standard deduction amount for the 2022 tax year jumps to 12 950 for single taxpayers up 400 and 25 900 for a married couple filing jointly up 800 This part of the publication discusses the filing requirements for dependents who is responsible for a child s return how to figure a dependent s standard deduction and whether a dependent can claim

A dependent is a qualifying child or relative who relies on you for financial support To claim a dependent for tax credits or deductions the dependent must meet A tax dependent is a qualifying child or relative who can be claimed on a tax return Dependents must meet certain criteria including residency and relation in order to qualify

Download Dependent Tax Deduction 2022

More picture related to Dependent Tax Deduction 2022

Standard Deduction 2020 Age 65 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/how-the-new-tax-law-is-different-from-previous-policies-2.jpg

Ca Dependent Tax Worksheet 2022

https://www.unclefed.com/TaxHelpArchives/2002/HTML/graphics/64349y02.gif

IRS Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

https://specials-images.forbesimg.com/imageserve/5dc2fc6eca425400073c2a95/960x0.jpg?fit=scale

For taxable years beginning in 2022 the standard deduction amount for an individual who may be claimed as a dependent by another taxpayer cannot exceed 1 150 or the sum of 400 and the The deduction for an individual who can be claimed as a dependent by another taxpayer is limited to the greater of 1 150 or the sum of 400 and the

It s worth 2 000 for each qualifying child in tax year 2022 the return you ll file in 2023 Individual taxpayers with modified adjusted gross incomes MAGIs up to In this case a dependent taxpayer who is younger than 65 and not blind can take as a standard deduction the greater of 1 150 or their earned income plus 400

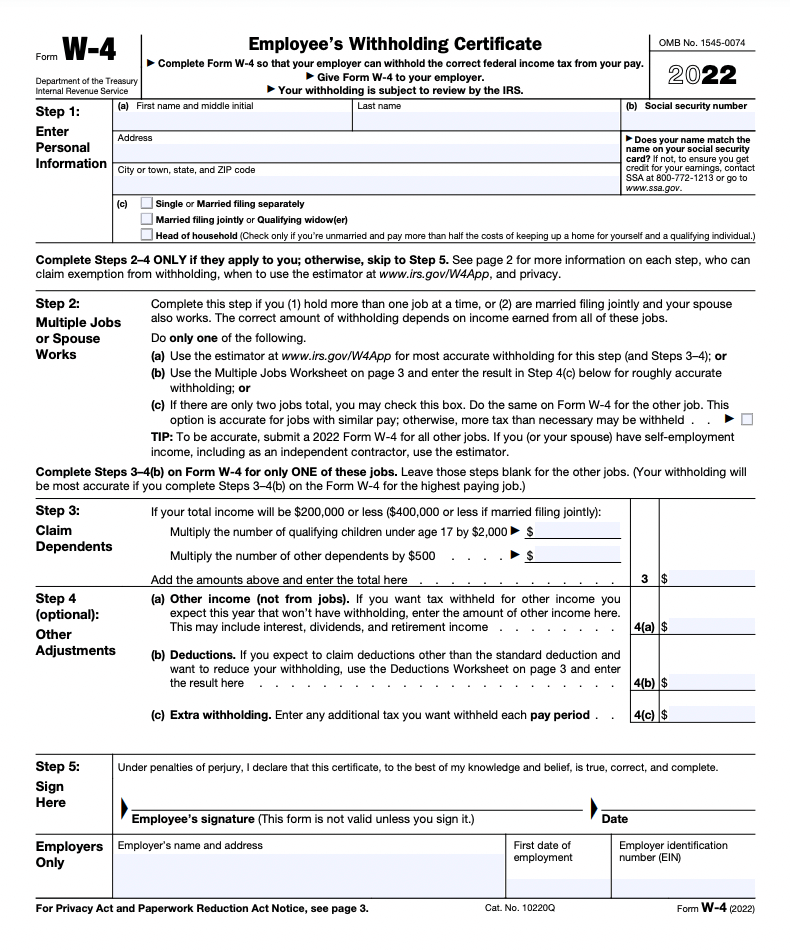

What Is Form W 4 And How To Fill It In In 2022

https://www.deel.com/hs-fs/hubfs/Imported_Blog_Media/603cee49df09b50310a13fdc_form w4.png?width=1067&name=603cee49df09b50310a13fdc_form w4.png

Tax Rates Absolute Accounting Services

https://imageio.forbes.com/specials-images/imageserve/618be1b6d57aaf84e03b72d2/Standard-Deduction-2022/960x0.jpg?format=jpg&width=960

https://turbotax.intuit.com/tax-tips/family/rule…

Key Takeaways The Child Tax Credit is up to 2 000 The Credit for Other Dependents is worth up to 500 The IRS defines a

https://www.investopedia.com/ask/answers/102015/...

If you can claim someone as a dependent deductions like the earned income tax credit EITC and child tax credit will lower your tax bill Learn which you can claim

Should You Take The Standard Deduction On Your 2021 2022 Taxes

What Is Form W 4 And How To Fill It In In 2022

Tax Time Already 2022 Tax Deductions For Homeowners A COVID Rebate

10 2023 California Tax Brackets References 2023 BGH

California Dependent Tax Worksheet

2021 Taxes For Retirees Explained Cardinal Guide

2021 Taxes For Retirees Explained Cardinal Guide

Your First Look At 2023 Tax Brackets Deductions And Credits 3

2022 Tax Brackets MeghanBrannan

Does The Child And Dependent Care Credit Phase Out Completely Latest

Dependent Tax Deduction 2022 - Even if your child was born on December 31 your child may be able to be claimed as a dependent on your taxes To qualify as a dependent the child must Be under age 19