Dependent Tax Return Filing Requirements 2022 Irs Web 8 Aug 2023 nbsp 0183 32 Tax Year 2022 Filing Thresholds by Filing Status Self employment status Self employed individuals are required to file an annual return and pay estimated tax quarterly if they had net earnings from self employment of 400 or more Status as a dependent A person who is claimed as a dependent may still have to file a return

Web 15 Juni 2023 nbsp 0183 32 Top Frequently Asked Questions for Filing Requirements Status and Dependents Web Dependents who are required to file a tax return must have a TIN A TIN may be a social security number SSN an individual taxpayer identification number ITIN or an adoption taxpayer identification number ATIN Social security number SSN

Dependent Tax Return Filing Requirements 2022 Irs

Dependent Tax Return Filing Requirements 2022 Irs

https://carajput.com/blog/wp-content/uploads/2018/08/Filing-Income-Tax-Return-FY19.jpg

2022 Income Tax Brackets Chart Printable Forms Free Online

https://ocdn.eu/pulscms-transforms/1/qTck9ktTURBXy8xMDA3MTBjYS1jNzY0LTQ0OTQtOTJhNy0xNjRkNDc0NzU0YzMucG5nkIGhMAA

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TTFQ5PWB2VCDTLFATMLHV6MLDQ.png)

Your 2022 Tax Fact Sheet And Calendar Morningstar

https://morningstar-morningstar-prod.web.arc-cdn.net/resizer/AcZRoZYme0OfsPOmM0CHwb6drSs=/1200x0/filters:no_upscale():quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TTFQ5PWB2VCDTLFATMLHV6MLDQ.png

Web 22 Nov 2022 nbsp 0183 32 Those who receive a 1099 K reflecting income they didn t earn should call the issuer The IRS cannot correct it Credit amounts also change each year like the Child Tax Credit CTC Earned Income Tax Credit EITC and Dependent Care Credit Taxpayers can use the Interactive Tax Assistant on IRS gov to determine their eligibility Web 15 Juni 2023 nbsp 0183 32 How much income can an unmarried dependent student make before he or she must file an income tax return Back to Frequently Asked Questions Page Last Reviewed or Updated 15 Jun 2023 Share Print

Web 29 Nov 2023 nbsp 0183 32 Who is a qualifying child To claim a child as a dependent on your tax return the child must meet all of the following conditions 1 The child has to be part of your family This is the Web Overview of the Rules for Claiming a Dependent This table is only an overview of the rules For details see Publication 17 Your Federal Income Tax For Individuals You can t claim any dependents if you or your spouse if filing jointly could be claimed as a dependent by another taxpayer

Download Dependent Tax Return Filing Requirements 2022 Irs

More picture related to Dependent Tax Return Filing Requirements 2022 Irs

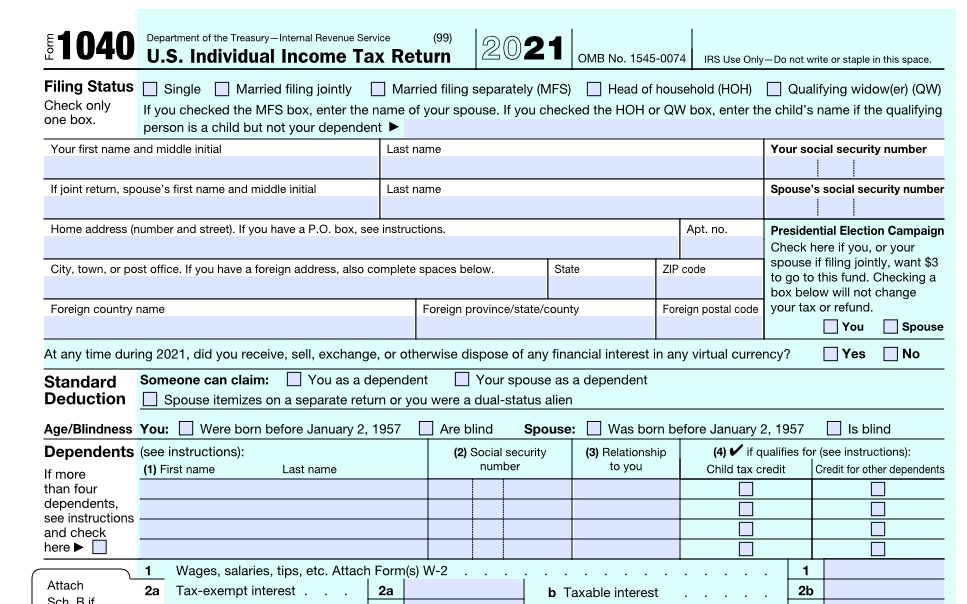

Taxpayers Should Take These Steps Before Filing Income Taxes CPA

https://www.cpapracticeadvisor.com/wp-content/uploads/sites/2/2022/02/Form_1040_2021.62006f6875b45.png

Michigan Llc Tax Return Filing Requirements LLC Bible

https://llcbible.com/posts/michigan-llc-tax-return-filing-requirements.png

Federal Income Tax Brackets 2021 Vs 2022 Klopwatch

https://i0.wp.com/www.whitecoatinvestor.com/wp-content/uploads/2020/12/tax-brackets-2022-img-1024x597.jpg

Web Individuals who qualify to be claimed as a dependent may be required to file a tax return if they meet the filing requirements How do I apply the dependency tests Web 15 Feb 2023 nbsp 0183 32 2022 income requirements for dependents If you re a dependent however your income requirements may be slightly different If you are able to be claimed as a dependent by another taxpayer you

Web OVERVIEW The IRS requires that all taxpayers file a tax return regardless of age TABLE OF CONTENTS Filing requirements for children Dependent children Your child s earned income Click to expand Key Takeaways Tax requirements for dependent children are different from those of other taxpayers Web 17 Dez 2022 nbsp 0183 32 It s worth 2 000 for each qualifying child in tax year 2022 the return you ll file in 2023 Individual taxpayers with modified adjusted gross incomes MAGIs up to 200 000 and married taxpayers filing jointly with MAGIs up

California Individual Tax Rate Table 2021 20 Brokeasshome

https://imageio.forbes.com/specials-images/imageserve/618be39f8dd74be3a7c319d4/Married-Separately-tax-rates-2022/960x0.jpg?height=440&width=711&fit=bounds

ITR Filing Checklist Documents Required To File Income Tax Returns For

https://d6xcmfyh68wv8.cloudfront.net/blog-content/uploads/2022/07/Document-Checklist-1.png

https://www.irs.gov/newsroom/who-needs-to-file-a-tax-return

Web 8 Aug 2023 nbsp 0183 32 Tax Year 2022 Filing Thresholds by Filing Status Self employment status Self employed individuals are required to file an annual return and pay estimated tax quarterly if they had net earnings from self employment of 400 or more Status as a dependent A person who is claimed as a dependent may still have to file a return

https://www.irs.gov/faqs/filing-requirements-status-dependents

Web 15 Juni 2023 nbsp 0183 32 Top Frequently Asked Questions for Filing Requirements Status and Dependents

FBR Further Extended Income Tax Returns Filing Date For Tax Year 2022

California Individual Tax Rate Table 2021 20 Brokeasshome

Tax Return Filing Lawplustax

Documents Required For Income Tax Return ITR Filing In India FY 2022

Income Tax Return Filing Service Local Area B Tax Advisors ID

Income Tax Return Filing Service At Best Price In Gurugram ID

Income Tax Return Filing Service At Best Price In Gurugram ID

Latest ITR Forms Archives Certicom

2019 Minimum Tax Filing Requirement

Tax Return Filing Services At Best Price In Ahmedabad ID 2848942165430

Dependent Tax Return Filing Requirements 2022 Irs - Web The short answer is no Like many other tax topics there s a fair share of rules around claiming dependents on taxes which we ll unpack below We ll also share the qualifying child and qualifying relative definitions too so you can better gauge the nuances of each What is a dependent