Dfas Severance Pay Tax Refund Timeline Simply write Disability Severance Pay on Form 1040X line 15 and enter the standard refund amount listed below on line 15 column B and on line 22 leaving

Put the total amount of wages that you reported on your tax return 1040 on the 1040X Next subtract the DSP from that amount to get your new taxable wages A refund is awarded in the same calendar year in which a military member received disability severance pay To obtain a refund from us you must submit the following

Dfas Severance Pay Tax Refund Timeline

Dfas Severance Pay Tax Refund Timeline

https://s3-prod.crainscleveland.com/s3fs-public/396987953_i.jpg

Severance Agreement Template 1

https://source.cocosign.com/images/employment/severance/severance_1.jpg

CA Inflation Relief Check Payments State Releases New Timeline

https://patch.com/img/cdn20/shutterstock/24438295/20221110/115335/styles/patch_image/public/shutterstock-17681746___10115314874.jpg

Moving forward Defense Finance and Accounting Service DFAS HQ has established a policy to provide financial relief for affected members who have not yet received their Calculation and Payment Disability severance pay is a one time lump sum payment The amount equals 2 months of basic pay for each year of service which includes active

Our site allows customers the ability to request support or provide feedback Every individual is unique but they often face similar issues Browse our frequently asked The Disability Severance payment may be from as far back as 1991 Veterans have one 1 year from the date of the letter they received from the Department of Defense DoD to

Download Dfas Severance Pay Tax Refund Timeline

More picture related to Dfas Severance Pay Tax Refund Timeline

Is Severance Pay Taxable

https://cdn-kpjff.nitrocdn.com/AxTXxYeslnrhNCZKGDGrrJHROeToIVnA/assets/images/optimized/wp-content/uploads/2020/02/b1b08f603712a78d61789fed1125e3c6.severance-pay-tax.jpg

Military Compensation Separation Pay 2020

https://armyreup.s3.amazonaws.com/site/wp-content/uploads/2020/07/30125946/SeparationPay2020.png

Taxes 2023 How Does Severance Pay Get Taxed

https://s.yimg.com/ny/api/res/1.2/byuEQuM7sTTXj21KZIGlhg--/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD02NzU-/https://media.zenfs.com/en/gobankingrates_644/997ffa4286a03fecd2536f9128659b96

With our askDFAS self serve tools you can conveniently update your mailing address request a duplicate 1099 R tax statement or request verification of pay using an online form Simply and securely submit Members separated from military service due to medical conditions who had taxes withheld from an entitlement to Disability Severance Pay may be entitled to have their taxes

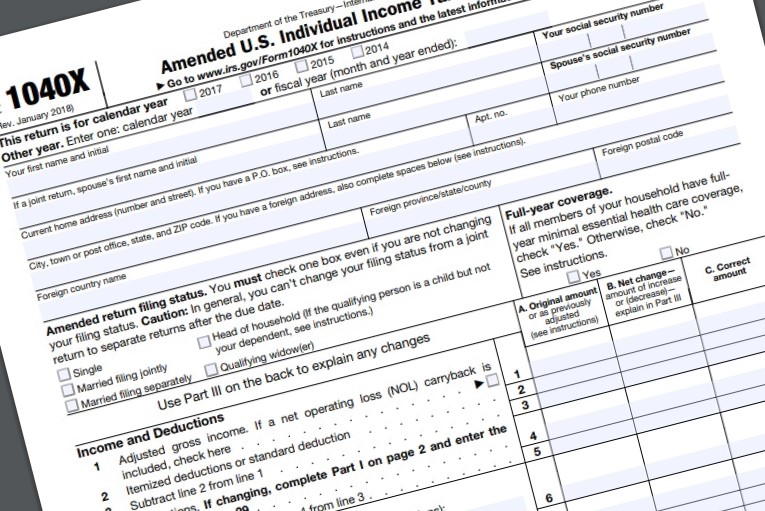

Veterans who are eligible for a refund for taxes paid on their disability severance payment can submit a 1040X Amended U S Individual Tax Return for their A service member may request refund of taxes withheld from the gross taxable amount of their disability severance pay payment from DFAS if notification of disability

Eligible Veterans Can Seek Refund For Taxes On Disability Severance

https://media.defense.gov/2018/Jul/18/2001944030/-1/-1/0/180716-D-BN624-0001.JPG

What You Need To Know About Severance Packages Taxes Optima Tax Relief

https://optimataxrelief.com/wp-content/uploads/2023/03/2023-optima-severance-packages-taxes.jpg

https://www.dfas.mil/dsp_irs

Simply write Disability Severance Pay on Form 1040X line 15 and enter the standard refund amount listed below on line 15 column B and on line 22 leaving

https://corpweb1.dfas.mil/askDFAS/faqView?faq.faqId=13958

Put the total amount of wages that you reported on your tax return 1040 on the 1040X Next subtract the DSP from that amount to get your new taxable wages

Army Continuation Pay 2021 Army Military

Eligible Veterans Can Seek Refund For Taxes On Disability Severance

Peterjun s Life

2024 Mil Pay Chart

How Do I Minimize Taxes On Severance Payments YouTube

Retiree Newsletter Accounting Services Military Pay Chart Finance

Retiree Newsletter Accounting Services Military Pay Chart Finance

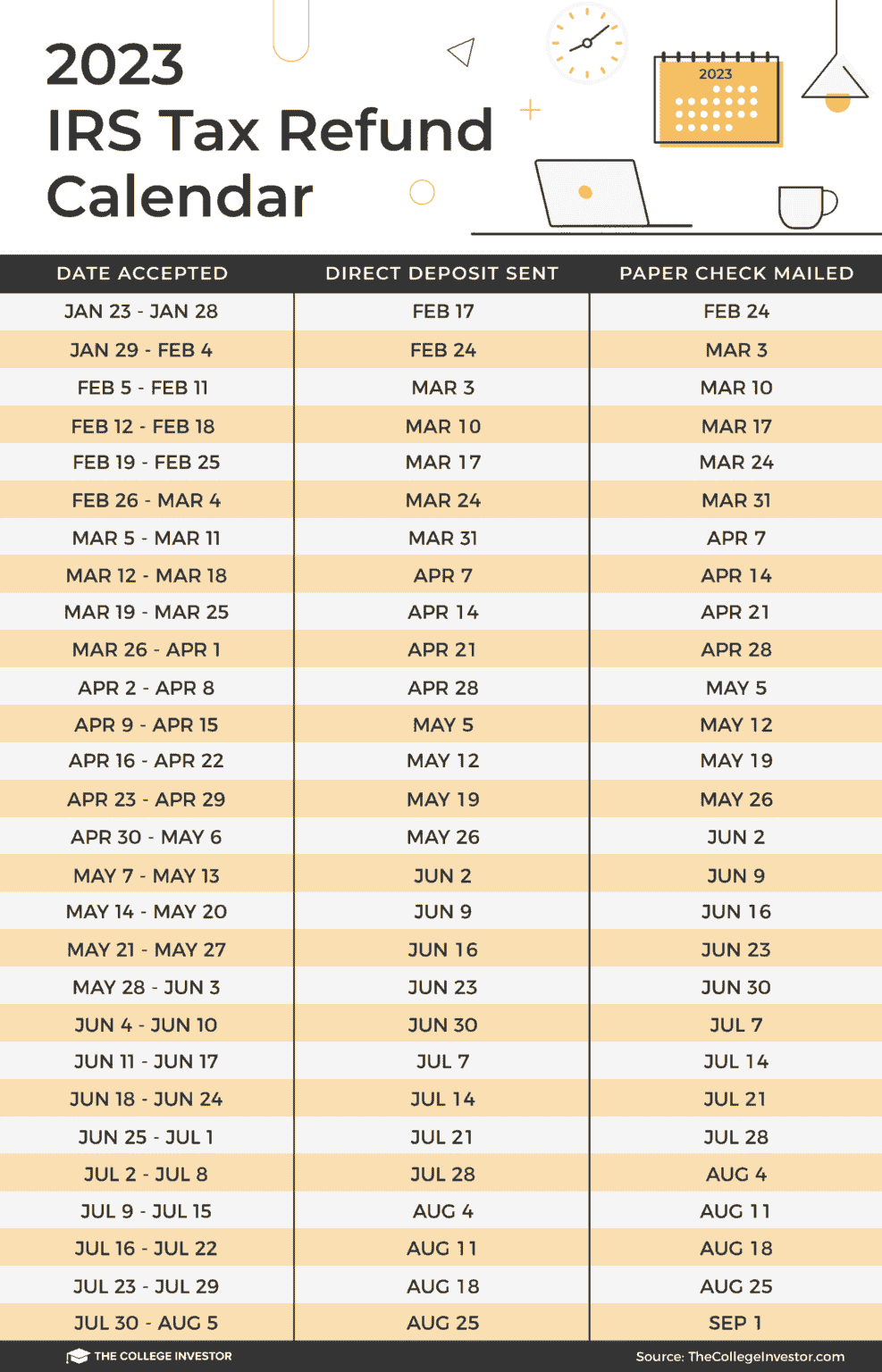

2023 Tax Return Timeline When To Expect Your Refund Texas Breaking News

Severance Pay Calculator Ontario Calculating Severance Pay Ertl Law

Tax Implications Of Severance Pay Namibian Sun

Dfas Severance Pay Tax Refund Timeline - DFAS just emailed me stating I may be entitled to a refund of the federal income tax withheld from my disability severance pay Disability Severance Pay is not taxable or