Difference Between Income Tax Deduction And Rebate And Relief Web Difference between Income Tax Deduction Rebate and Relief Tweet Key Difference Tax Relief is any program or incentive that helps reduce the tax in some way or another This tax relief can be in the form of a

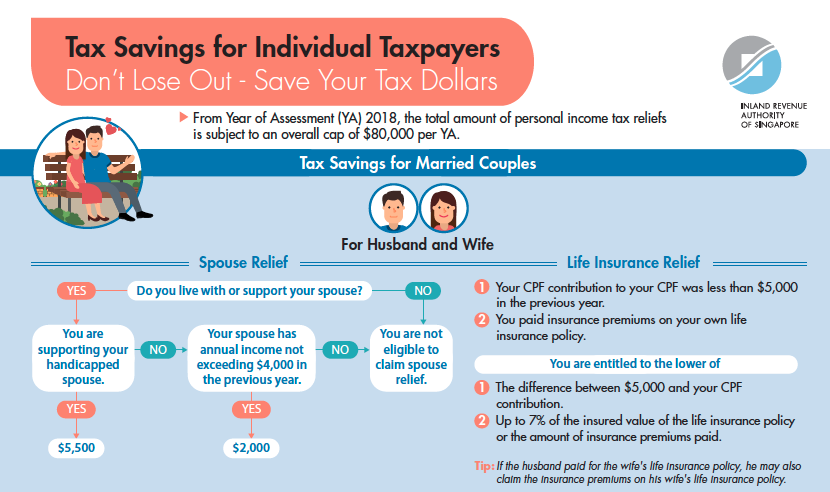

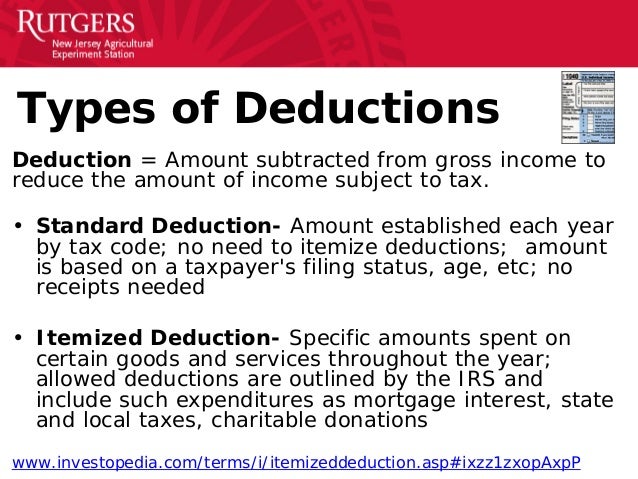

Web 2 mars 2023 nbsp 0183 32 Key Takeaways Various types of tax relief can help you lower your tax bill or settle tax related debts Tax deductions let you deduct certain expenses such as home mortgage interest Web 6 avr 2021 nbsp 0183 32 Tax reliefs and tax exemptions are deducted from your total annual income After deduction this amount is known as chargeable income Meanwhile

Difference Between Income Tax Deduction And Rebate And Relief

Difference Between Income Tax Deduction And Rebate And Relief

https://image.slidesharecdn.com/basicprinciplesofincome-tax-131128002331-phpapp02/95/basic-principles-of-income-tax-47-638.jpg?cb=1385598541

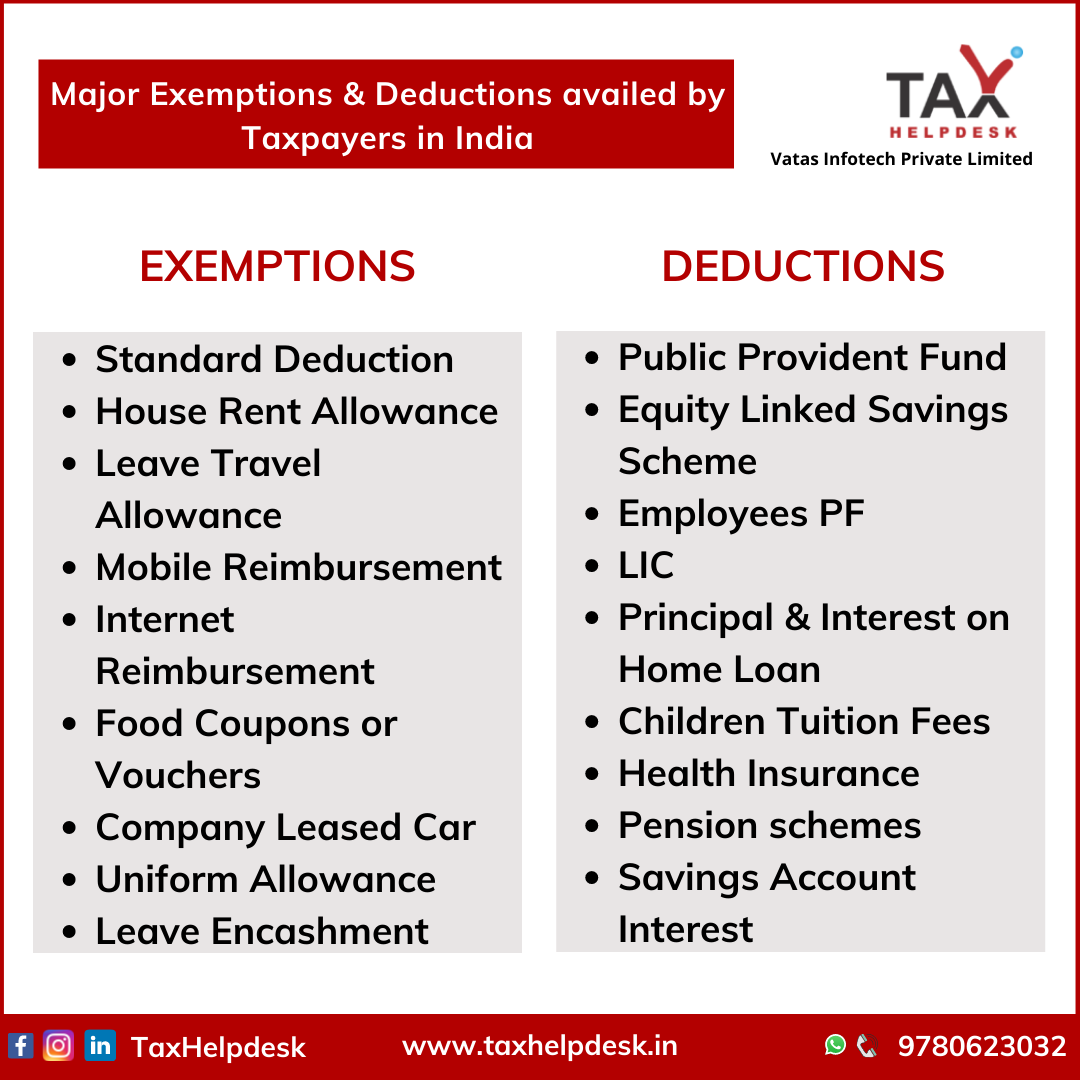

Major Exemptions Deductions Availed By Taxpayers In India

https://www.taxhelpdesk.in/wp-content/uploads/2020/12/Weekly-Updates-1.png

How To Reduce Your Income Tax In Singapore make Use Of These Tax

https://2.bp.blogspot.com/-K9_dSfxkDAY/WsuZ0sW9kfI/AAAAAAAAYr8/jyEM9Omr9VAUSM3NzZmZpkq-zw_UIlymwCLcBGAs/s1600/Screen%2BShot%2B2018-04-10%2Bat%2B12.49.49%2Bam.png

Web 1 f 233 vr 2023 nbsp 0183 32 Date 01 02 2023 Read 4 mins Learn the difference between an income tax rebate and tax exemption and compare it with a tax deduction Check how pensions and gratuity help in taxation Tax Web Un all 233 gement fiscal est un programme ou un incitatif qui aide 224 r 233 duire l imp 244 t d une mani 232 re ou d une autre Cet all 233 gement fiscal peut prendre la forme d une d 233 duction

Web 14 f 233 vr 2023 nbsp 0183 32 Relief Tax Tax rebate is a refund of tax that has already been paid The relief of tax is a reduction in the amount of tax that is payable Tax rebate is available Web Individual Income Tax Individual Income Tax Basics of Individual Income Tax Go to next level Basics of Individual Income Tax Basics of Individual Income Tax Managing

Download Difference Between Income Tax Deduction And Rebate And Relief

More picture related to Difference Between Income Tax Deduction And Rebate And Relief

Difference Between Income Tax Slabs 2019 20 And 2020 21 Gservants

https://www.planyourfinances.in/wp-content/uploads/2019/11/Difference-Between-Income-Tax-Deductions-Exemptions-and-Rebate.jpg

Business Tax Credit Vs Tax Deduction What s The Difference

https://www.patriotsoftware.com/wp-content/uploads/2019/12/business-tax-credit-vs-tax-deduction-visual.jpg

What Is The Difference Between A Tax Credit And Tax Deduction

https://static.twentyoverten.com/5d5413591d304774fba39eb3/WZASn6oAJLl/Tax-Credits-vs-Deductions.jpg

Web 12 mars 2019 nbsp 0183 32 The difference between the two is a tax relief is deduction from the total income to derive your chargeable income whereas tax rebate is deducted from the actual taxed amount While Web 24 janv 2019 nbsp 0183 32 You can claim a deduction by making investments in specified products or by incurring certain expenses under different income tax sections

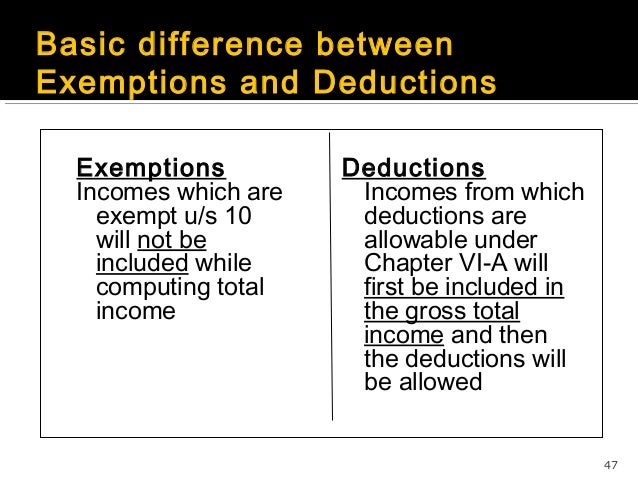

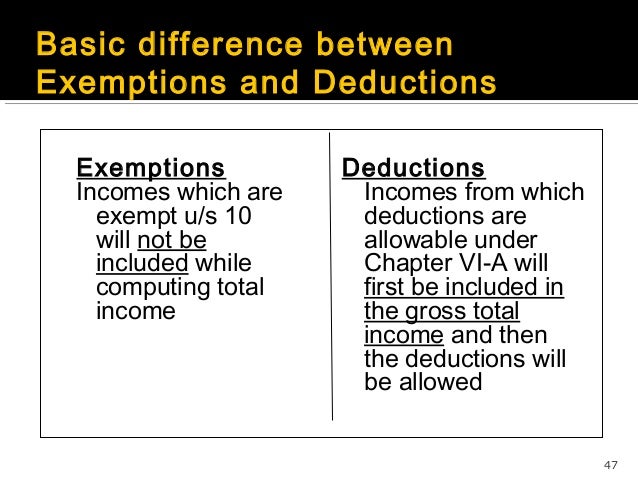

Web Exemption Deduction and Rebate are three terms that are commonly come across when filing for taxes These are three ways that a taxpayer can avail for tax concessions Exemptions and deductions both reduce the Web 28 mars 2023 nbsp 0183 32 Jacie Tan 28th March 2023 5 min read When it comes to filing your income tax you re probably familiar with claiming for tax reliefs After all tax reliefs are

Difference Between Tax Credit And Tax Deduction Main Differences

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhajwB1803G-1d-yB9dU2ek-n9DCCyLaWclpukczZqvCMMobD79Ucf5PUinCKOGXzMKa-EaX9GttLk47cffZCb2IK_VT3SiPU4fg8snQAQfNsZAxDeH0H1j2-Yjd25K0Co0J2nWpdbyuAlma2V3A6mXSaAnmrka4IZT0hmRuMRbE9fkTtg0hzpA8izG3A/s679/tax credit vs tax deduction.jpg

DEDUCTION UNDER SECTION 80C TO 80U PDF

https://www.relakhs.com/wp-content/uploads/2018/03/Income-Tax-Deductions-List-FY-2018-19-Income-tax-exemptions-tax-benefits-Fy-2018-19-AY-2019-20-Section-80c-limit-80D-80E-NPS-Home-loan-interest-loss-standard-deduction.jpg

http://www.differencebetween.info/differenc…

Web Difference between Income Tax Deduction Rebate and Relief Tweet Key Difference Tax Relief is any program or incentive that helps reduce the tax in some way or another This tax relief can be in the form of a

https://www.investopedia.com/terms/t/tax-reli…

Web 2 mars 2023 nbsp 0183 32 Key Takeaways Various types of tax relief can help you lower your tax bill or settle tax related debts Tax deductions let you deduct certain expenses such as home mortgage interest

REBATE AND RELIEFS UNDER INCOME TAX

Difference Between Tax Credit And Tax Deduction Main Differences

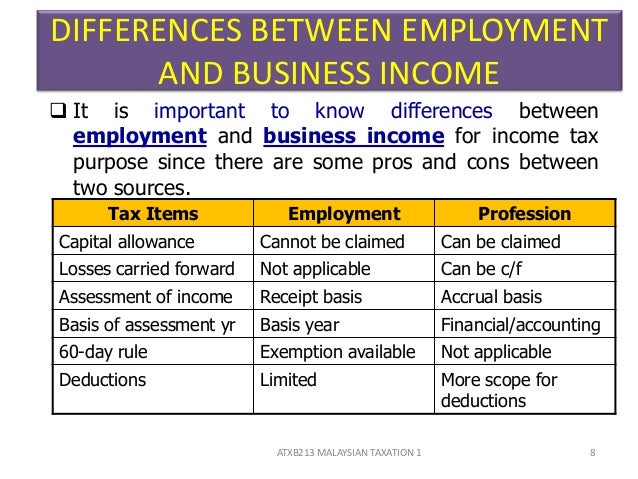

Chapter 4 a employment Income Stds 1

Income Tax Deduction Malaysia Joseph Randall

Old Personal Tax Regime Vs New Tax Regime Choosing Made Easy Here Mint

Income Tax Exemption No 2 Order 2017 Corporate Income Tax Rebate

Income Tax Exemption No 2 Order 2017 Corporate Income Tax Rebate

Budget 2023 Old Vs New Tax Regimes Who Should Make The Switch

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

State Taxes State Taxes Standard Deduction

Difference Between Income Tax Deduction And Rebate And Relief - Web 1 f 233 vr 2023 nbsp 0183 32 Date 01 02 2023 Read 4 mins Learn the difference between an income tax rebate and tax exemption and compare it with a tax deduction Check how pensions and gratuity help in taxation Tax