Disability Tax Credit Diabetes Examples Disability Tax Credit Guide for Diabetes Specific Disability Tax Credit information for diabetics eligibility criteria for both Type 1 and Type 2 how to apply what to do if you re denied and more

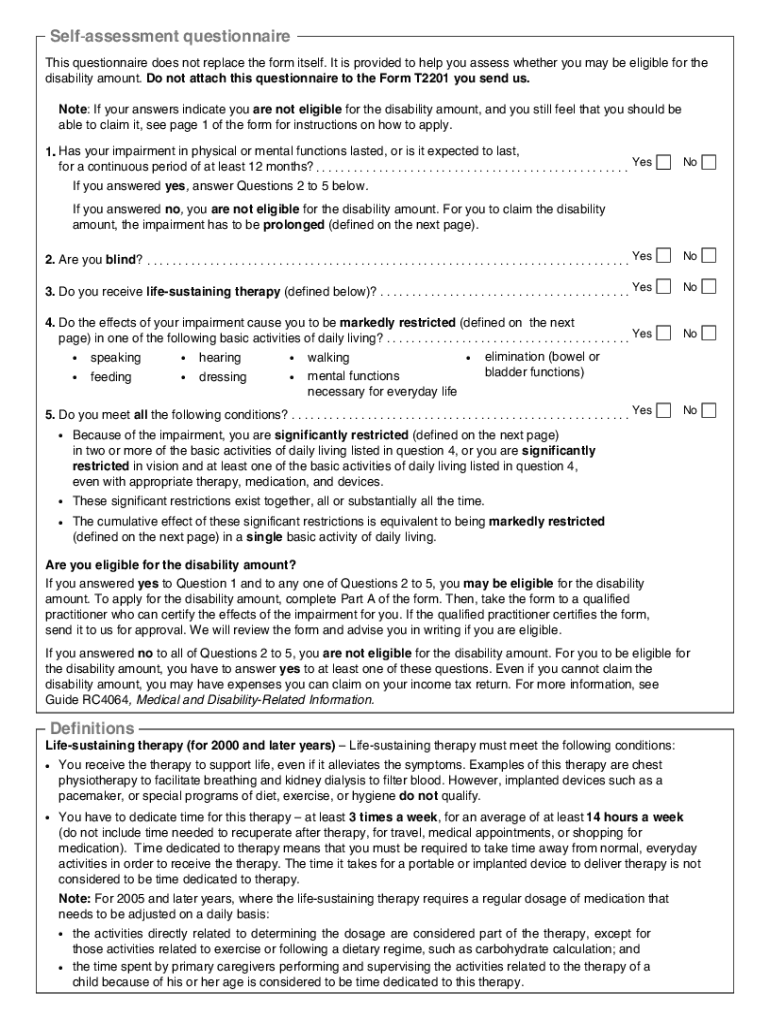

In the 2019 tax year the DTC provided a non refundable tax credit of 8 416 An additional 4 909 was available for eligible children younger than 18 years of age According to the Agency s website The disability tax credit is a non refundable tax credit used to reduce income tax payable A person with a severe and prolonged impairment in

Disability Tax Credit Diabetes Examples

Disability Tax Credit Diabetes Examples

https://www.laservices.ca/sites/default/files/styles/max_1300x1300/public/2021-12/dreamstime_m_111953008-1536x1536.jpg?itok=VIHDEIwQ

How To Use The Disability Tax Credit For Type 1 Diabetes Connected In

https://www.connectedinmotion.ca/wp-content/uploads/2022/09/CIM-Blog-DisabilityTaxCredit-00670-1536x1024.jpg

How Do You Apply For The Disability Tax Credit T2201 CCCA

https://www.consolidatedcreditcanada.ca/wp-content/uploads/2021/12/disability-tax-credit.jpg

Discover how an individual with diabetes accessed the Disability Tax Credit through a compelling case study Gain insights into the application Note on the video The eligibility criteria about type 1 diabetes in the video and transcript are outdated and only apply to 2020 and prior years Consult the eligibility criteria below for the

June 23 2022 Toronto ON JDRF is thrilled to announce that the approximately 300 000 Canadians living with type 1 diabetes T1D can now automatically Background On June 23 2022 Bill C 19 received royal assent in Parliament and enacted a change to the Income Tax Act in relation to the Disability Tax Credit

Download Disability Tax Credit Diabetes Examples

More picture related to Disability Tax Credit Diabetes Examples

Disability Tax Credit Guide For Diabetes Life Sustaining Therapy

https://ekbasipym5m.exactdn.com/wp-content/uploads/diabetes4-featured-Image.jpg

How To Use The Disability Tax Credit For Type 1 Diabetes Connected In

https://www.connectedinmotion.ca/wp-content/uploads/2022/09/CIM-Blog-DisabilityTaxCredit-6740-675x900.jpg

Ontario Disability Tax Credit Diabetes DiabetesWalls

http://beyondtype1.org/wp-content/uploads/2017/10/Jen-Costs.png

Our detailed Disability Tax Credit workbook will help you log the time spent on diabetes related tasks that qualify you for the DTC Available in a PDF or a fillable Word document buy now What OVERVIEW The IRS allows you to claim a tax deduction for many of the expenses you incur to diagnose monitor and treat diabetes TABLE OF

Home Guide to diabetes Life with diabetes Benefits Save for later Diabetes and benefits If you can t manage your diabetes without insulin another medication or Here are tips on how you can be approved for the Disability Tax Credit if you are living with insulin dependent diabetes Who can apply for the

Diabetes Disability Tax Credit

https://disabilitycreditconsultants.ca/wp-content/uploads/2017/02/Diabetes-Disability-Tax-Credit.jpg

Disability Tax Credit In 2021 Type 1 Diabetes Tax Credits Diabetes

https://i.pinimg.com/originals/26/02/b0/2602b0c70eb06646ca152400181eddb0.jpg

https://disabilitycreditcanada.com/disability …

Disability Tax Credit Guide for Diabetes Specific Disability Tax Credit information for diabetics eligibility criteria for both Type 1 and Type 2 how to apply what to do if you re denied and more

https://www.rdsp.com/wp-content/uploads/2020/10/...

In the 2019 tax year the DTC provided a non refundable tax credit of 8 416 An additional 4 909 was available for eligible children younger than 18 years of age

The Disability Tax Credit Your Online Guide For 2023

Diabetes Disability Tax Credit

Disability Tax Credit For People With Diabetes Diabetes Advocacy

Diabetes Archives Disability Tax Credits Benefits Service Child

The Disability Tax Credit DTC Is Now Available To Anyone Living With

73 Best Disability Tax Credit Images In 2020 Tax Credits Diabetes

73 Best Disability Tax Credit Images In 2020 Tax Credits Diabetes

Unlock Government Benefits And Save Money With The Disability Tax Credit

How Is COVID 19 Affecting T1D Research

2008 Form Canada T2201 E Fill Online Printable Fillable Blank

Disability Tax Credit Diabetes Examples - Discover how an individual with diabetes accessed the Disability Tax Credit through a compelling case study Gain insights into the application