Discount Received Journal Entry In Tally Guide to what is Discount Allowed and what Discount is Received Here we discuss its journal entries including examples advantages differences

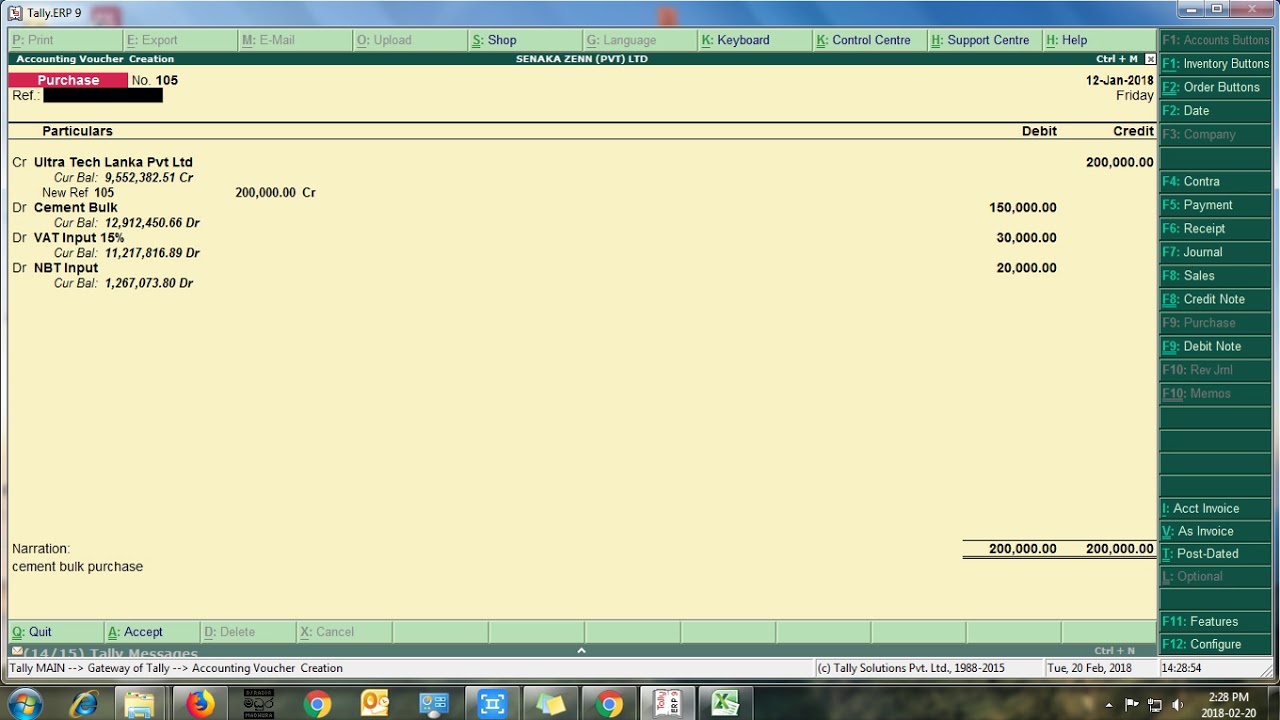

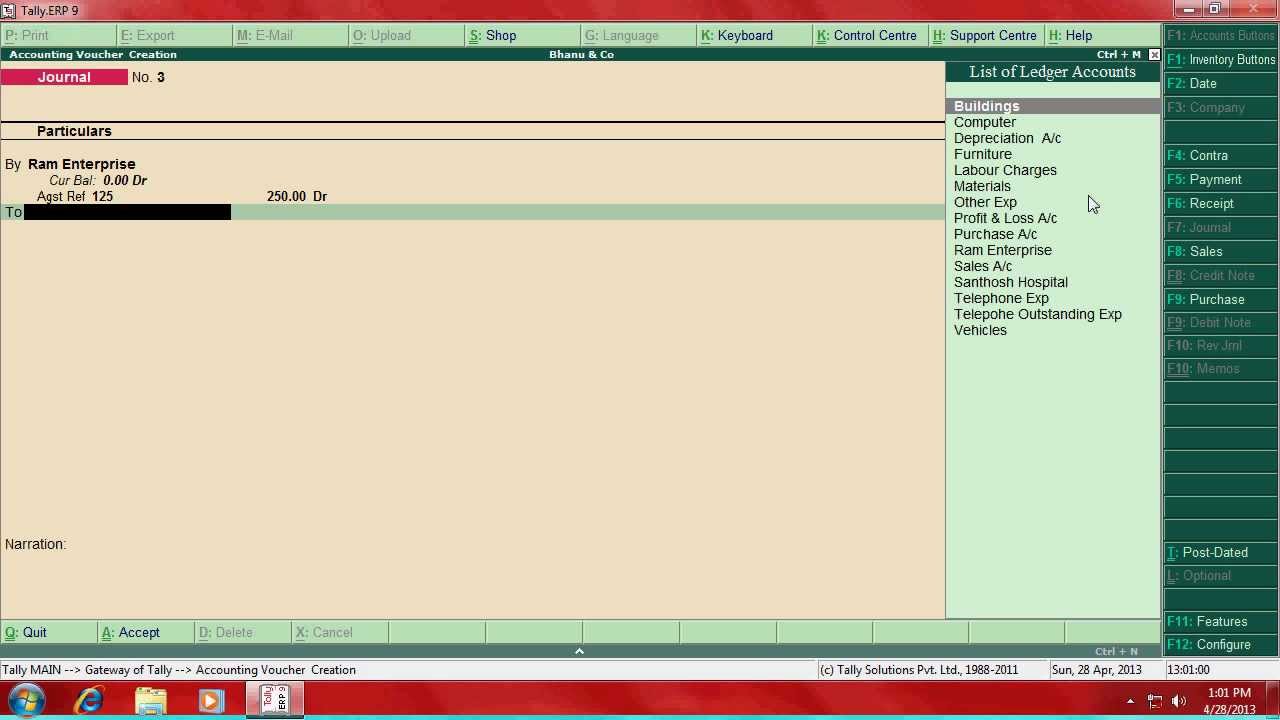

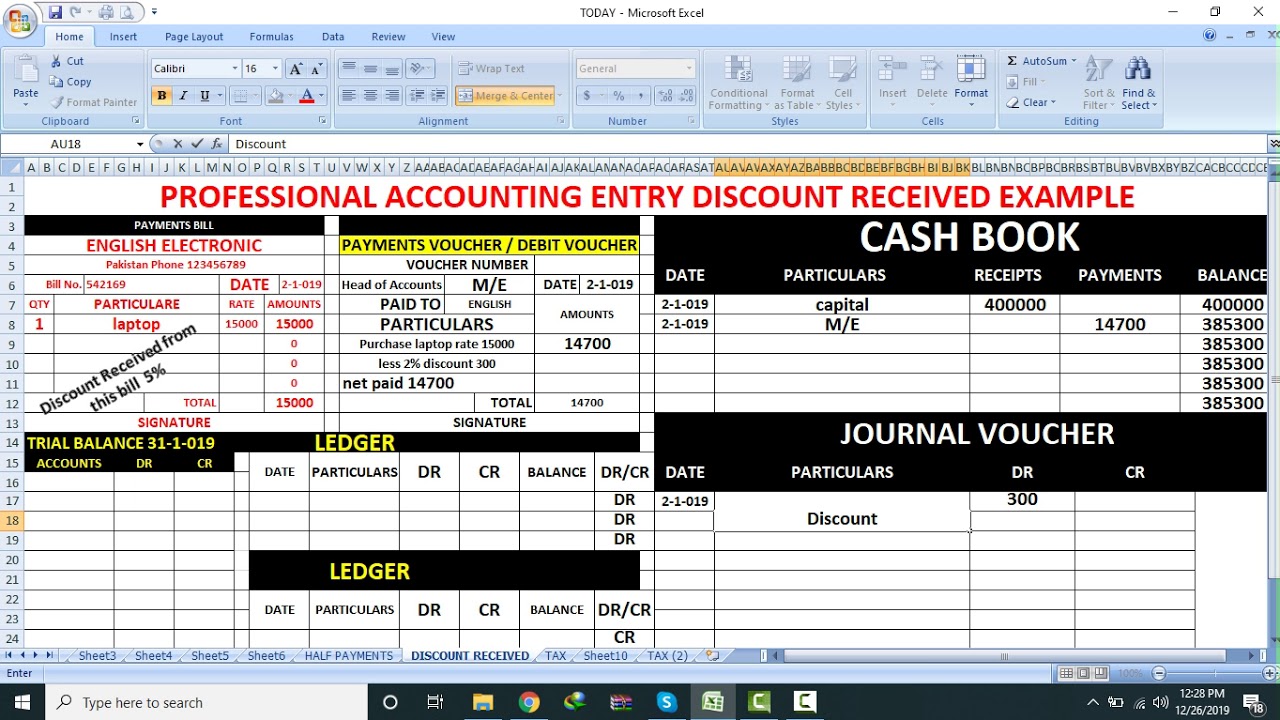

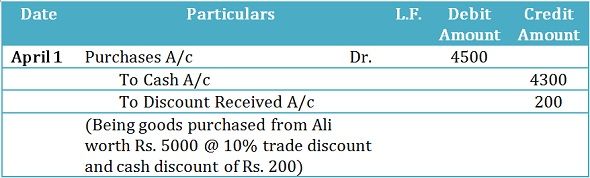

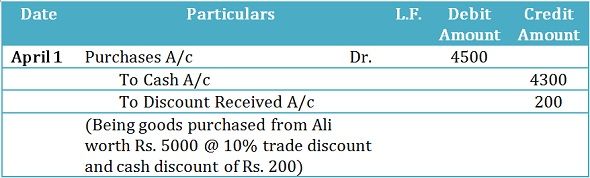

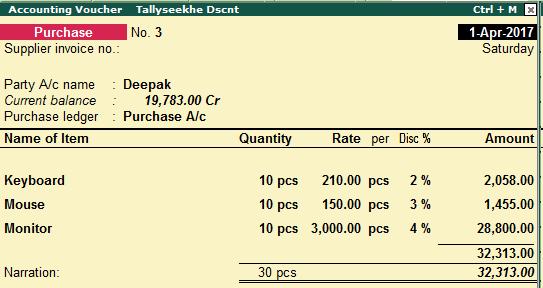

Solution B Discount Received When at the time of purchase or paying cash any concession is received from the seller it is called discount received Journal Entry Example Goods purchased for cash 20 000 discount received 20 Cash paid to Vishal 14 750 and discount received from him 250 Solution This Video indicates about how to post discount allowed and received entries along with GST Tax invoice in TALLY ERP9 more

Discount Received Journal Entry In Tally

Discount Received Journal Entry In Tally

https://i.ytimg.com/vi/C4JRtgEWaeY/maxresdefault.jpg

Downstairs Whirlpool Gate Goods Returned To Supplier Journal Entry

https://media.geeksforgeeks.org/wp-content/uploads/20220414185713/Discreceivq-660x313.PNG

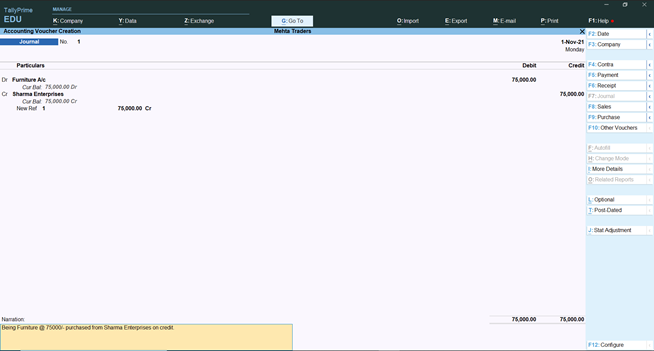

Journal Voucher Entry In Tally With Examples Startupopinions

https://www.startupopinions.com/wp-content/uploads/2019/04/journal-voucher-of-Tally-ERP-9.jpg

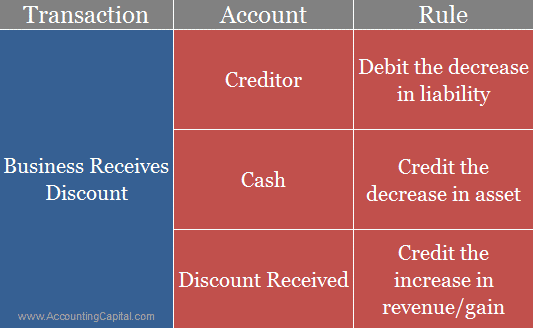

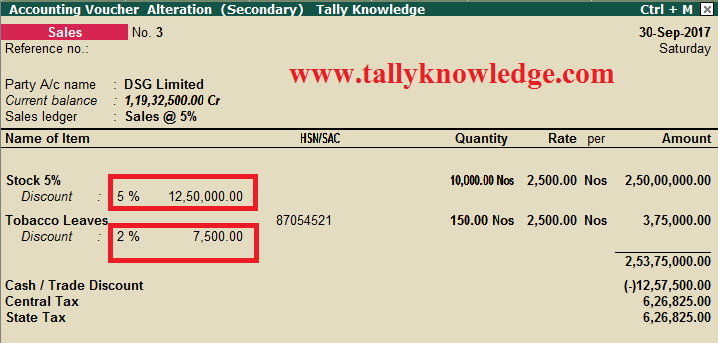

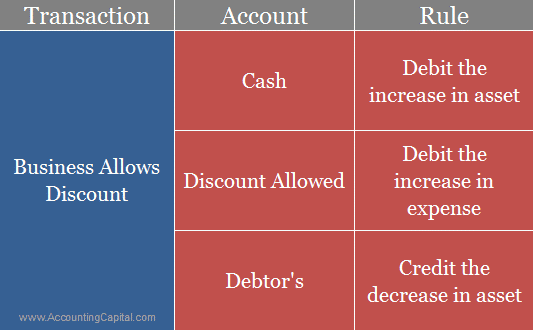

Unlock the power of Tally Prime with our comprehensive guide on discount received entries In this tutorial we delve into the intricacies of recording disco A discount allowed is when the seller grants a payment discount to a buyer A discount received is when the buyer is granted a discount by the seller

A discount allowed is a reduction in the selling price of an item while a discount received is a reduction in the purchase price of an item The two terms are often used interchangeably but there are some important differences between them You can record GST sales with discount at item level in TallyPrime While recording a sales transaction you can easily enter the discount rate or amount for each stock item To consider discounts for GST sales you have to create a discount ledger and then select it in the invoice

Download Discount Received Journal Entry In Tally

More picture related to Discount Received Journal Entry In Tally

Entry Of Discount Given To Customers In Tally ERP9 YouTube

https://i.ytimg.com/vi/5OBp85Dw18s/maxresdefault.jpg

How To Enter Journal Entry In Tally YouTube

https://i.ytimg.com/vi/Baer4HwiMII/maxresdefault.jpg

Journal Voucher Entry In Tally With Examples Startupopinions

https://i1.wp.com/www.startupopinions.com/wp-content/uploads/2019/04/accounting-entries-in-tally.jpg?resize=696%2C360&ssl=1

In this journal entry the purchase discounts is a temporary account which will be cleared to zero at the end of the period Its normal balance is on the credit side and will be offset with the purchases account when the company calculates cost of goods sold during the accounting period Journal Entries of Accounting for Sales Discounts The two journal entries as shown below At the time of origination of the sales the seller has no idea whether the buyer will avail of the sales discounts by paying off the outstanding amount early or making the full payment on the due date

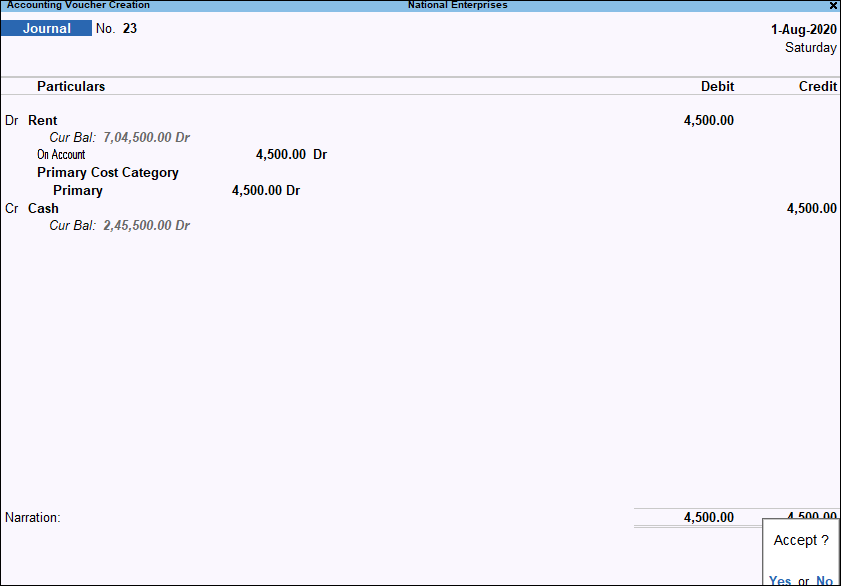

Use TallyPrime s reports to analyze discounts granted and their impact on revenue By following these steps you can effectively record receipts with discounts in TallyPrime ensuring accurate accounting and tracking of your sales transactions If you are accounts savvy you can use Journal voucher for accounting entry in TallyPrime to record any type of transaction In a Journal voucher you will see the By To Dr Cr entries that you are familiar with when doing entries in the account books

Tally ERP 9 Discount Value In Invoice YouTube

https://i.ytimg.com/vi/k3Eoly4hLeU/maxresdefault.jpg

How To Pass Journal Entry In Tally Prime 2023 Screenshots

https://caknowledge.com/wp-content/uploads/2021/09/journal-entry-accounting-expenss-tally.png

https://www.wallstreetmojo.com › discount-allowed...

Guide to what is Discount Allowed and what Discount is Received Here we discuss its journal entries including examples advantages differences

https://www.geeksforgeeks.org › journal-entry-for...

Solution B Discount Received When at the time of purchase or paying cash any concession is received from the seller it is called discount received Journal Entry Example Goods purchased for cash 20 000 discount received 20 Cash paid to Vishal 14 750 and discount received from him 250 Solution

Journal Entries DISCOUNT RECEIVED JOURNAL ENTRY YouTube

Tally ERP 9 Discount Value In Invoice YouTube

Discount Received Journal Entry CArunway

Journal Entry In TallyPrime Tally Solutions

Discount Received Journal Entry KaydenceminJoyce

Difference Between Trade Discount And Cash Discount with Example

Difference Between Trade Discount And Cash Discount with Example

How To Enter GST Sales With Cash Trade Discount At The Item Level

Discount Received Journal Entry KaydenceminJoyce

Tally Me Discount Ki Entry Tally Seekhe Tally Learn In Hindi

Discount Received Journal Entry In Tally - A discount allowed is a reduction in the selling price of an item while a discount received is a reduction in the purchase price of an item The two terms are often used interchangeably but there are some important differences between them