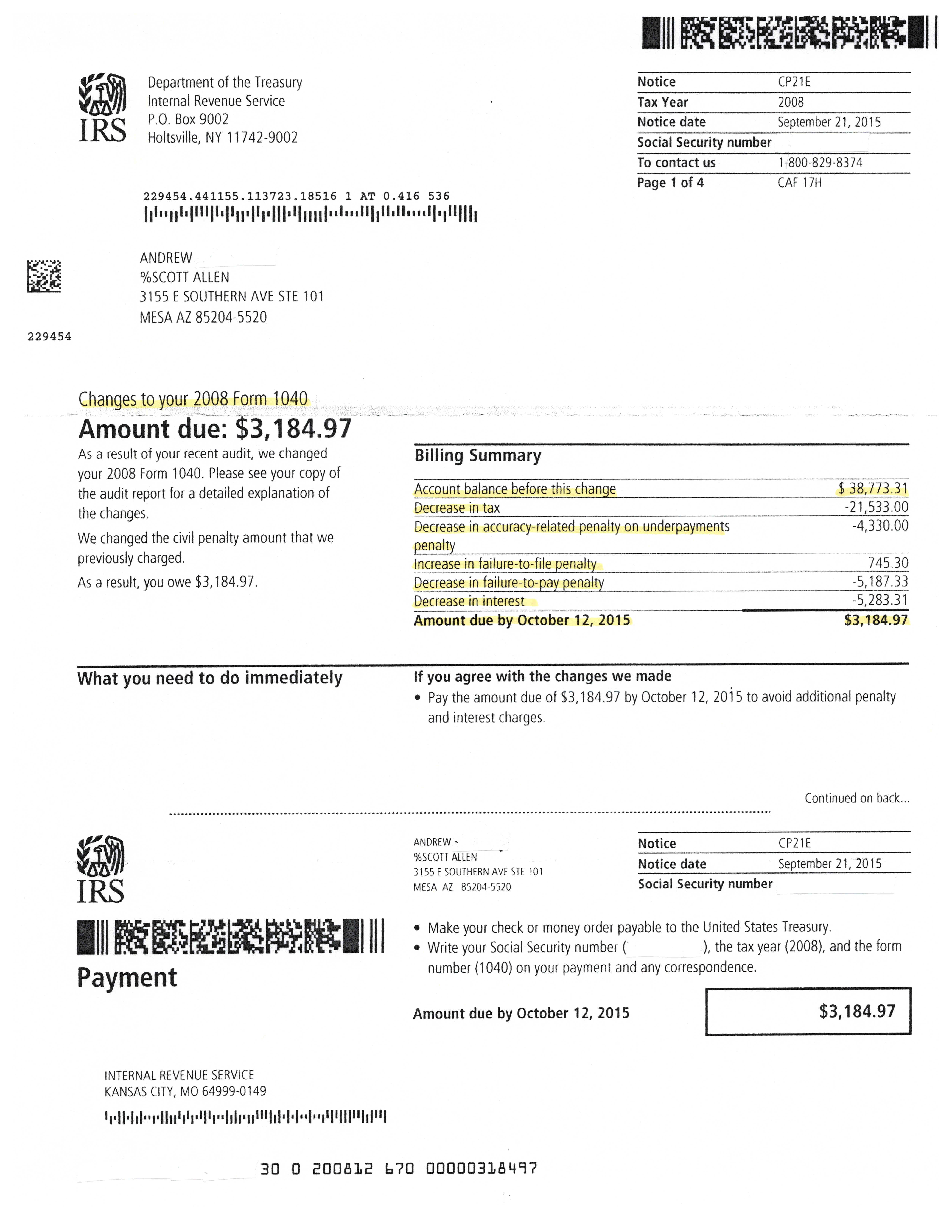

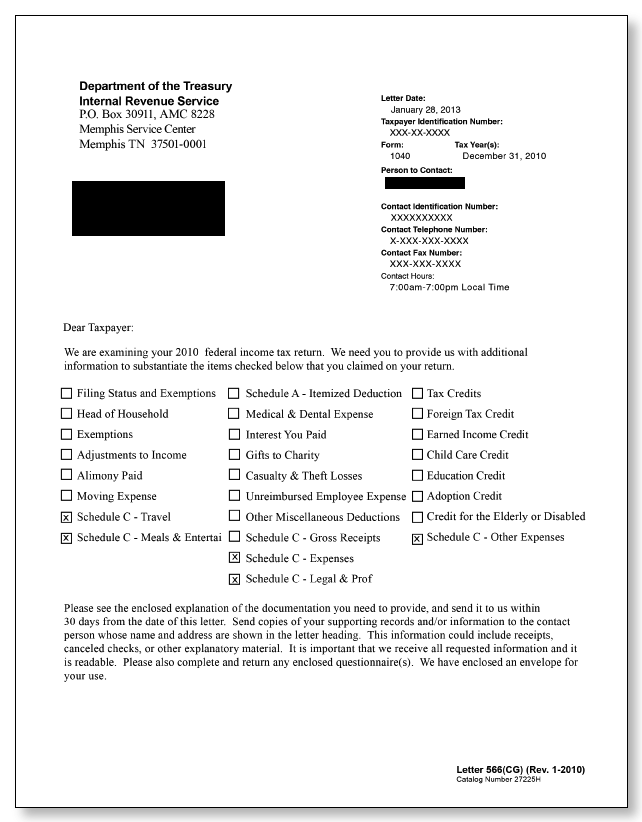

Do All Irs Audit Letters Come Certified Mail An IRS audit letter is certified mail that will clearly identify your name taxpayer ID form number employee ID number and contact information For example

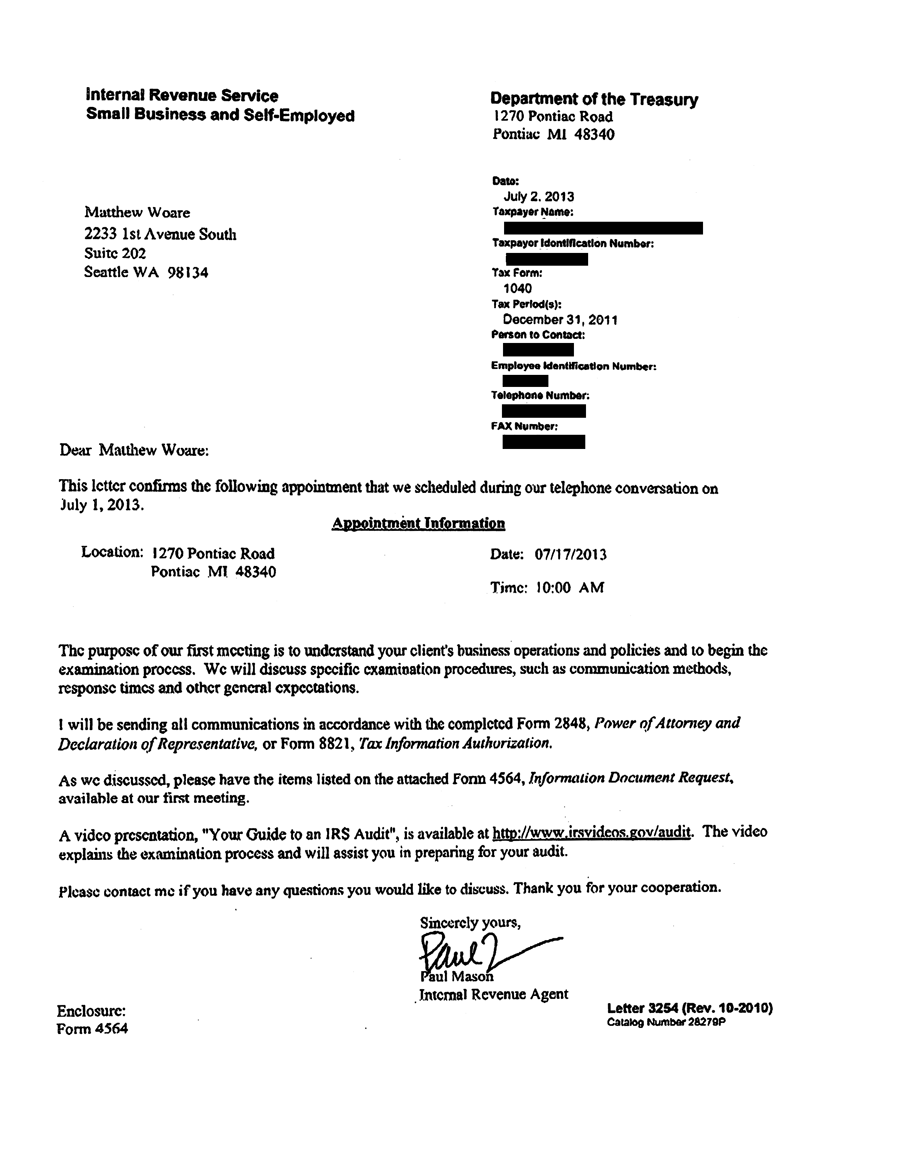

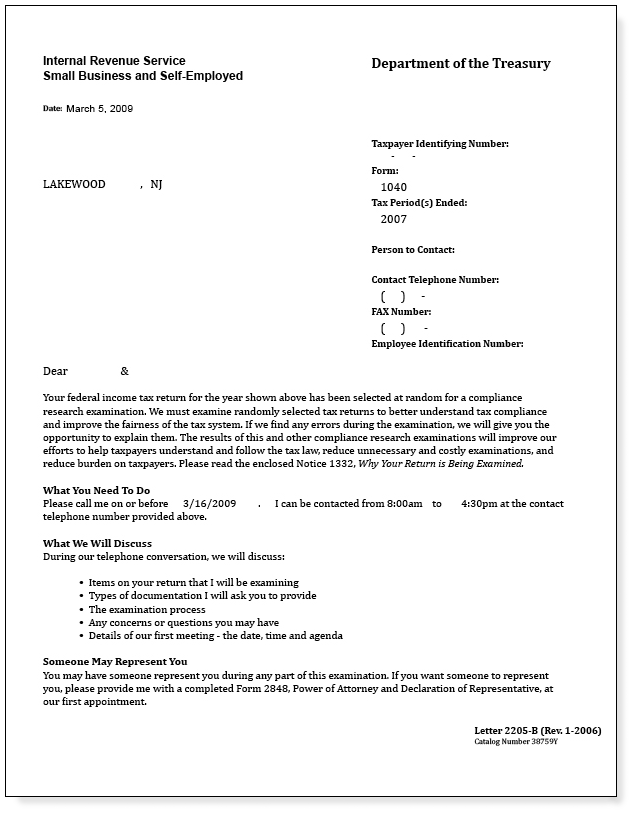

Received an IRS audit letter via certified mail Learn how to respond to IRS mail audits understand your tax return notification and what steps to take next The audit process starts with an IRS certified mail letter and involves examining your financial records income deductions and credits This official notice

Do All Irs Audit Letters Come Certified Mail

Do All Irs Audit Letters Come Certified Mail

http://www.taxaudit.com/getattachment/895d2c7c-4e49-45e7-a753-ee2e148bf23d/IRS-Audit-Letter-4870-Sample-1;

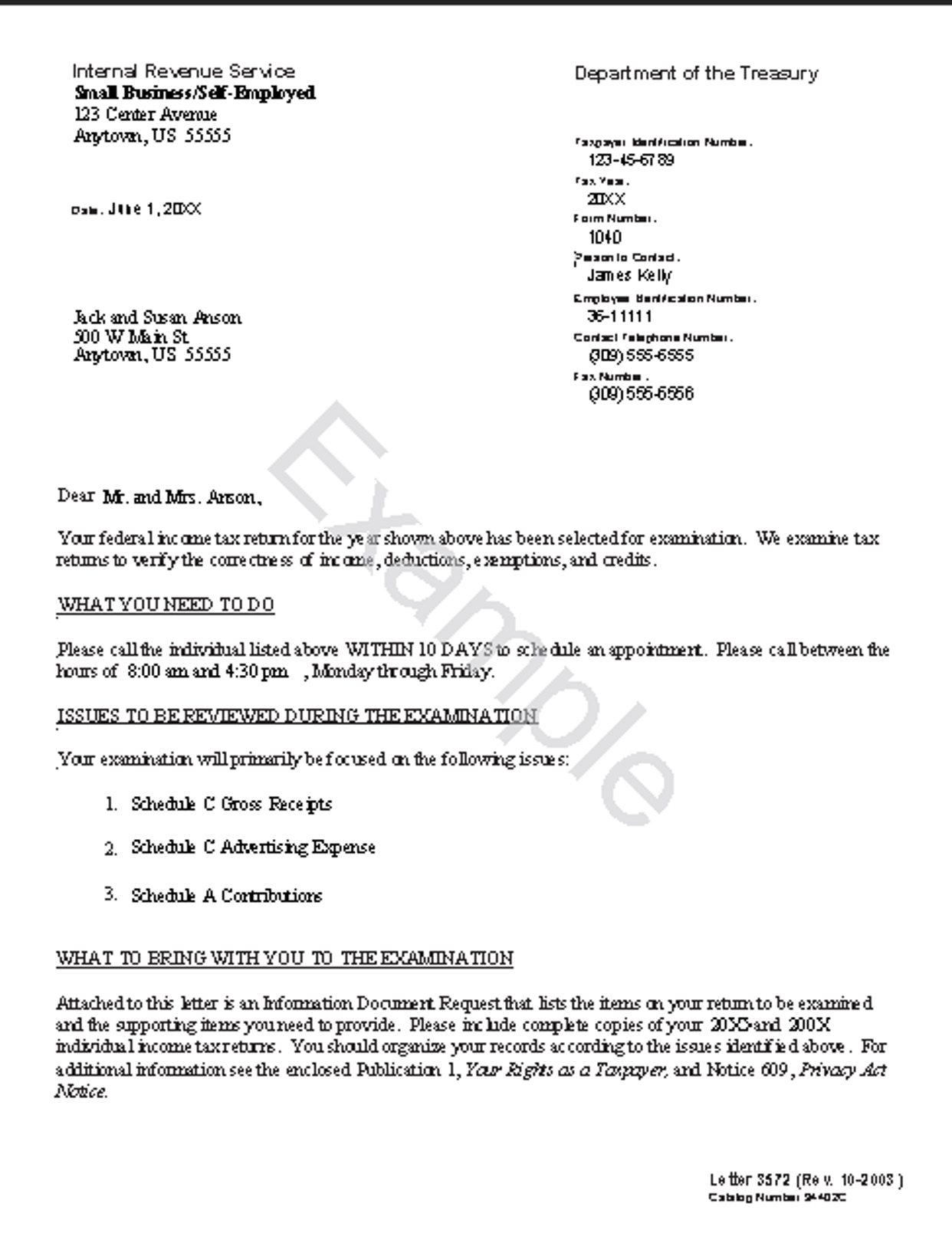

IRS Audit Letter 692 Sample 1

http://www.taxaudit.com/getattachment/ae5bff03-c84c-43cf-be59-dda5d2e54fe6/IRS-Audit-Letter-692-Sample-1;

Successful IRS Audit Reconsideration In Phoenix Arizona Tax Debt Advisors

https://taxdebtadvisors.com/blog/wp-content/uploads/2015/09/phoenix-irs-audit-reconsideration.jpg

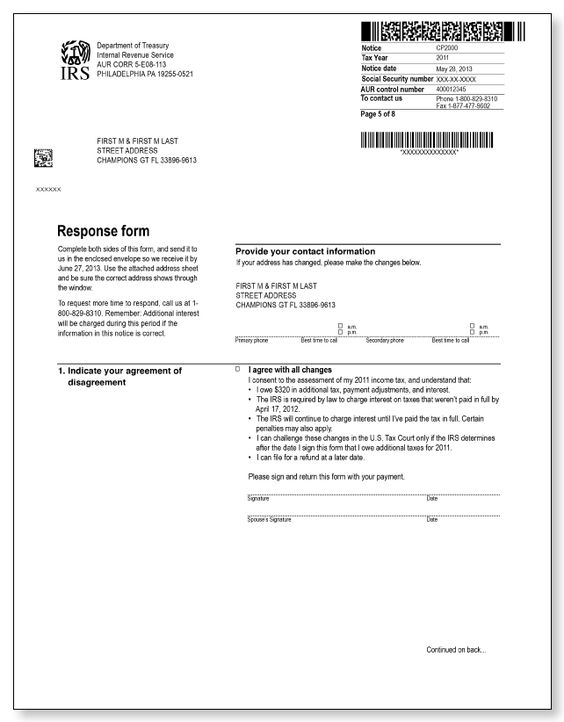

This topic deals with an audit by mail where the IRS sends you a letter explaining your tax return has been selected for examination and identifying the items under review The letter will An IRS audit letter will come to you by certified mail and you might notice that indicated on the IRS audit envelope When you open it up your audit letter from the IRS will identify your name taxpayer ID form

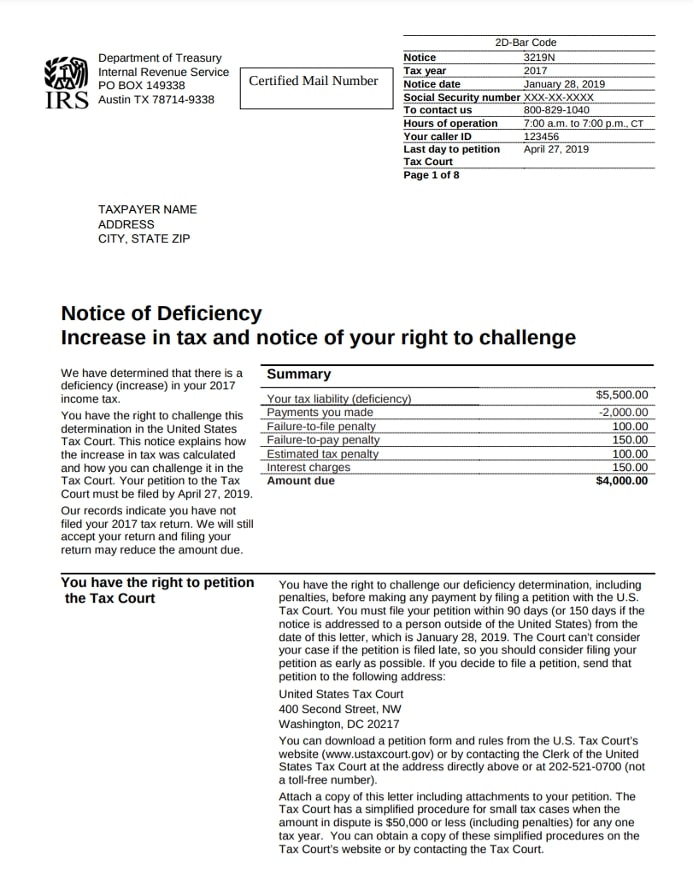

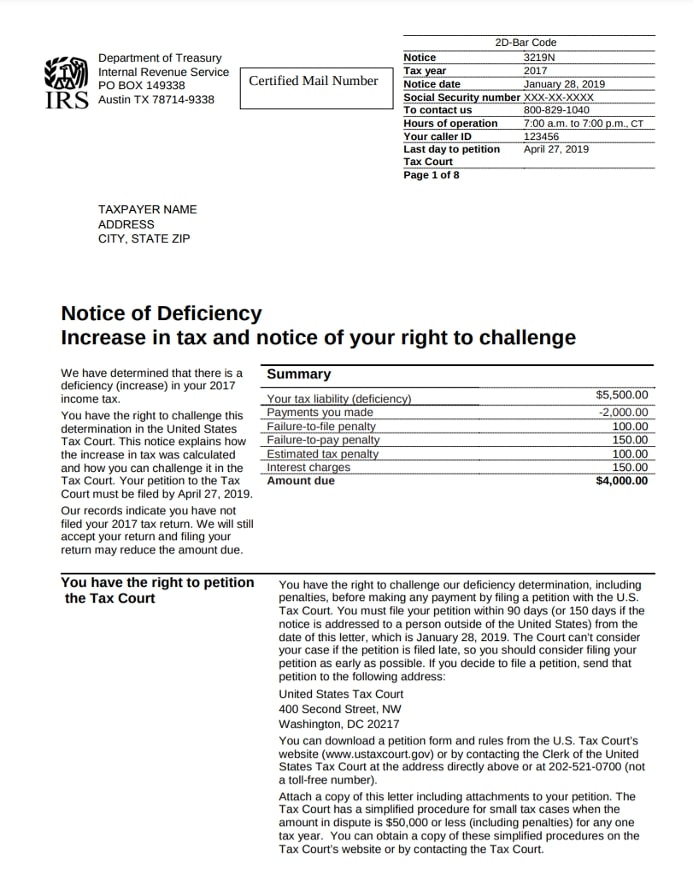

Under certain conditions the IRS will send letters through the post office via certified mail A specific set of circumstances will require the IRS to notify you of an action or event through certified mail If an agreement is not reached or you do not respond the IRS will send you a Statutory Notice of Deficiency by certified mail You have 90 days from the date on the notice to

Download Do All Irs Audit Letters Come Certified Mail

More picture related to Do All Irs Audit Letters Come Certified Mail

Audit Letter 3572 Steps To Answer Respond To The IRS

https://taxhelpaudit.com/wp-content/uploads/2017/12/AuditLTR3572.png

IRS Audit Letter CP05 Sample 1

http://intuit.taxaudit.com/getattachment/b24da8aa-2d1e-473e-95bf-153f9c8ae409/IRS-Audit-Letter-CP05–Sample-1;

Sample Letter Audit Doc Template PdfFiller

https://www.pdffiller.com/preview/497/333/497333966/large.png

Most IRS letters and notices are about federal tax returns or tax accounts The notice or letter will explain the reason for the contact and gives instructions on what An IRS Audit Letter typically arrives by certified mail It includes a statement revealing that your income tax return has been identified for examination why

IRS certified letters require the recipient to sign for the mail This provides the IRS with proof you receive their notice and confirms the identity of the How long should you keep your tax records in case of an audit Generally the IRS recommends hanging on to your tax documents for three years and

IRS Certified Mail Understanding Your Letter And Responding

https://trp.tax/wp-content/uploads/2021/09/notifeofdeficiencyifrstpage.jpg

IRS Audit Notice How To Survive One With Free Response Template

https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/62561105ec60bd7822cf5f68_irs-audit-notice-cp-2000.png

https://www.communitytax.com/tax-blog/irs-audit-letter

An IRS audit letter is certified mail that will clearly identify your name taxpayer ID form number employee ID number and contact information For example

https://www.taxfyle.com/blog/irs-letter

Received an IRS audit letter via certified mail Learn how to respond to IRS mail audits understand your tax return notification and what steps to take next

Sample IRS Audit Letters You Might Receive How To Respond

IRS Certified Mail Understanding Your Letter And Responding

Irs Audit Letter Sample Free Printable Documents

Irs Response Letter Template

IRS Audit Letter CP09 Sample 1

IRS Audit Letter CP2501 Sample 1

IRS Audit Letter CP2501 Sample 1

Fillable Online IRS Audit Letter 2604C Sample PDF Taxaudit Fax

What Does An IRS Audit Letter Look Like And How Should I Respond

Irs audit letter ProActive Tax Solutions

Do All Irs Audit Letters Come Certified Mail - If the IRS is going to audit you it will most likely do it in the form of a mail audit Here s how to handle delays responses and calling the IRS The IRS conducts more than three out