Do Banks Deduct Tax On Interest Web Since 6 April 2016 your interest has been paid gross Up to and including 5 April 2016 banks and building societies automatically deducted income tax from the interest you received on non ISA savings and current accounts unless you

Web 6 Dez 2023 nbsp 0183 32 Tax deductible interest is a borrowing expense that a taxpayer can claim on a federal or state tax return to reduce their taxable income Several types of interest are tax deductible Web 21 Dez 2023 nbsp 0183 32 If your savings account has 10 000 and earns 0 2 interest you are only taxed on the 20 interest the bank pays you You are not taxed on the 10 000 or principal amount You are not taxed on

Do Banks Deduct Tax On Interest

Do Banks Deduct Tax On Interest

https://www.tlgva.com/wp-content/uploads/2018/05/imrs.php_.jpg

Income Tax News Do I Have To Request The Bank To Deduct TDS From My

https://www.livemint.com/lm-img/img/2023/07/26/1600x900/ITR_banks_1690348242153_1690348242317.jpg

Mortgage Interest Tax Relief Calculator DermotHilary

https://www.annuity.org/wp-content/uploads/mortgage-interest-deduction-formula-640x0-c-default.jpg

Web 12 Okt 2023 nbsp 0183 32 Savings amp Investment By law banks and building societies are required to deduct income tax at 20 from interest on savings Most of the time this is done automatically without us even knowing However similar to dividends there are different rates of tax on savings dependant on income Web Banks building societies and other institutions that deduct tax on the interest they pay under the Tax Deduction Scheme for Interest TDSI

Web the Tax Deduction Scheme for Interest TDSI and deduction of income tax from yearly interest and a number of other types of income The Tax Deduction Scheme for Interest TDSI 2 10 Under TDSI tax is currently deducted at 20 from interest paid by deposit takers most commonly banks and building societies This is the most common type of Web 2016 banks and building societies will no longer be required to deduct income tax at source from interest paid to account holders The arrangements under which banks and building societies currently deduct tax from such interest are called the Tax Deduction Scheme for Interest TDSI

Download Do Banks Deduct Tax On Interest

More picture related to Do Banks Deduct Tax On Interest

Tax Deduction Letter PDF Templates Jotform

https://files.jotform.com/jotformapps/tax-deduction-letter-c1c1da39f77a424f295c2df1cb0f2b87.png

Student Loan Interest Can You Deduct It On Your Tax Return E S

https://www.esevans.com/wp-content/uploads/2020/05/05_26_20_153549086_ITB_560x292.jpg

Banks Will Deduct Tax From Your Cash Withdrawal By Checking Income Tax

https://trak.in/wp-content/uploads/2020/09/Untitled-design-19-2.jpg

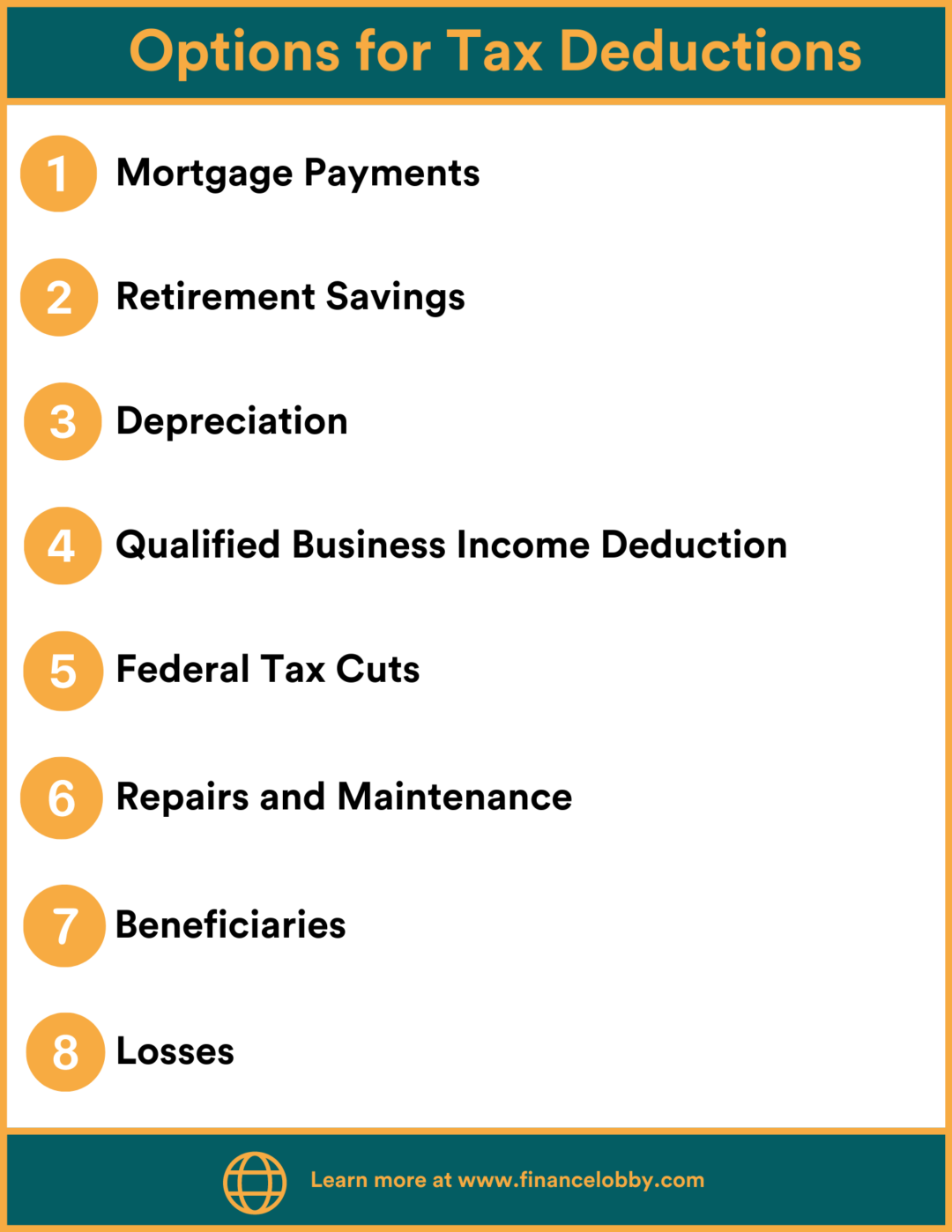

Web 17 Jan 2023 nbsp 0183 32 In general tax deductible interest is interest you pay on your mortgage student loans and some investments Tax deductible interest might be an adjustment to income or it can be an itemized deduction depending on the type of loan How Tax Deductible Interest Works You must pay interest in most cases when you borrow money Web Vor 4 Tagen nbsp 0183 32 In any event the amount of interest you received during the tax year shouldn t come as a big surprise on tax day You should receive a Form 1099 INT from your bank or credit union early in the

Web In practice the main circumstances where tax will be deducted are where a company makes a payment of interest to an individual or other non corporate person or where interest is paid by a Web Vor 4 Tagen nbsp 0183 32 The interest earned from FDs is a taxable income and is subject to tax deductions In the case of fixed deposits whether it is with a bank post office or NBFC TDS is deducted in accordance

How S corp Owners Can Deduct Health Insurance

https://www.peoplekeep.com/hubfs/All Images/Featured Images/How S Corp owners can deduct health insurance_featured.jpg#keepProtocol

Investment Expenses What s Tax Deductible Charles Schwab

https://www.schwab.com/learn/sites/g/files/eyrktu1246/files/Example-2.png

https://www.santander.co.uk/.../current-accounts/how-interest-is-paid

Web Since 6 April 2016 your interest has been paid gross Up to and including 5 April 2016 banks and building societies automatically deducted income tax from the interest you received on non ISA savings and current accounts unless you

https://www.investopedia.com/terms/t/tax-deductible-interest.asp

Web 6 Dez 2023 nbsp 0183 32 Tax deductible interest is a borrowing expense that a taxpayer can claim on a federal or state tax return to reduce their taxable income Several types of interest are tax deductible

How To Avoid TDS On Interest On Fixed Deposits Bank FD Wealth18

How S corp Owners Can Deduct Health Insurance

Can You Deduct Property Taxes And Mortgage Interest In 2019 YouTube

List Of Tax Deductions Here s What You Can Deduct

Deductible Business Expenses For Independent Contractors Financial

Tax Deductions You Can Deduct What Napkin Finance

Tax Deductions You Can Deduct What Napkin Finance

3 Ways To Calculate Bank Interest On Savings WikiHow

Deduct Interest On A Commercial Property Loan Finance Lobby

Solved Linda Who Files As A Single Taxpayer Had AGI Of Chegg

Do Banks Deduct Tax On Interest - Web 5 Dez 2016 nbsp 0183 32 Because of this the obligation on banks and building societies to deduct tax at source from payments of interest on accounts was removed from the same date