Input Tax Rebate Meaning Web 16 ao 251 t 2023 nbsp 0183 32 Input tax credit refers to the mechanism of claiming a reduction of tax paid on the inputs of a business or profession In India under the Goods and Service

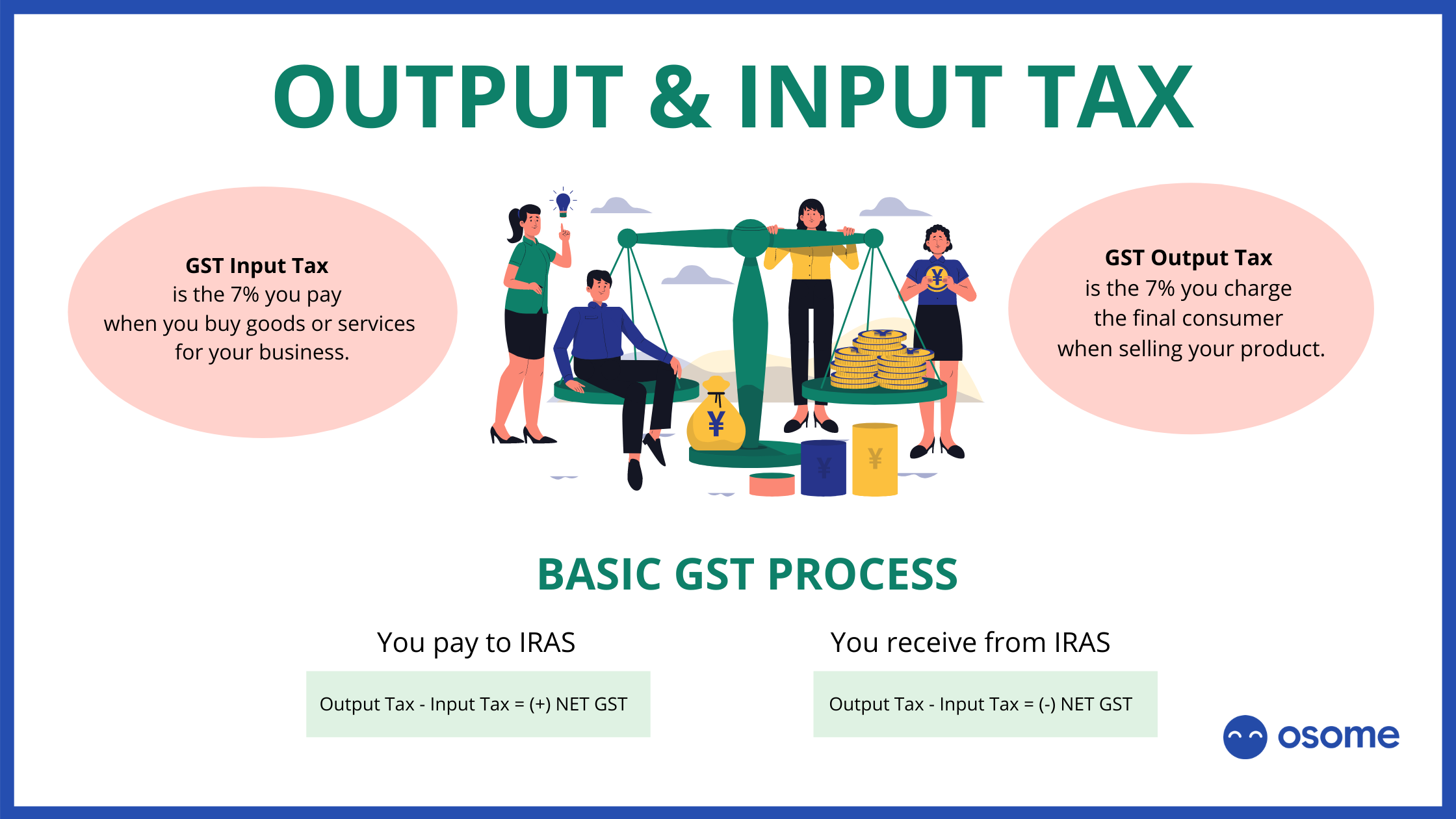

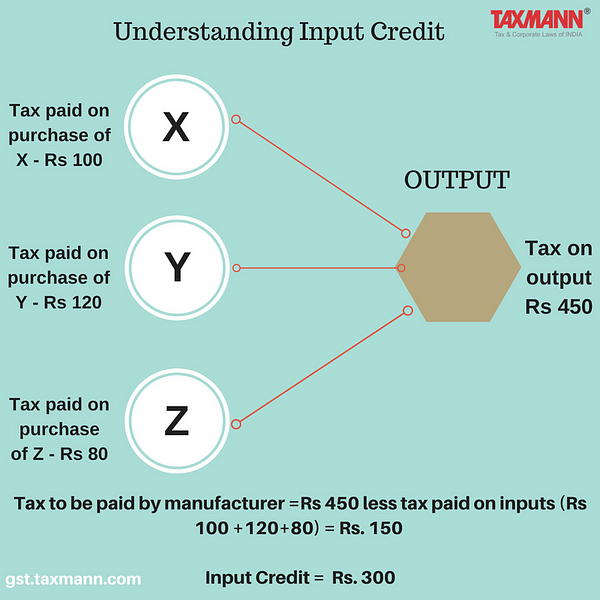

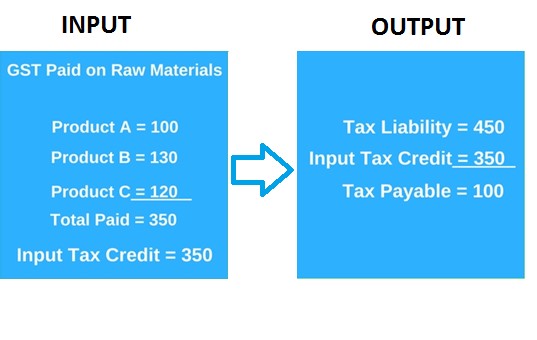

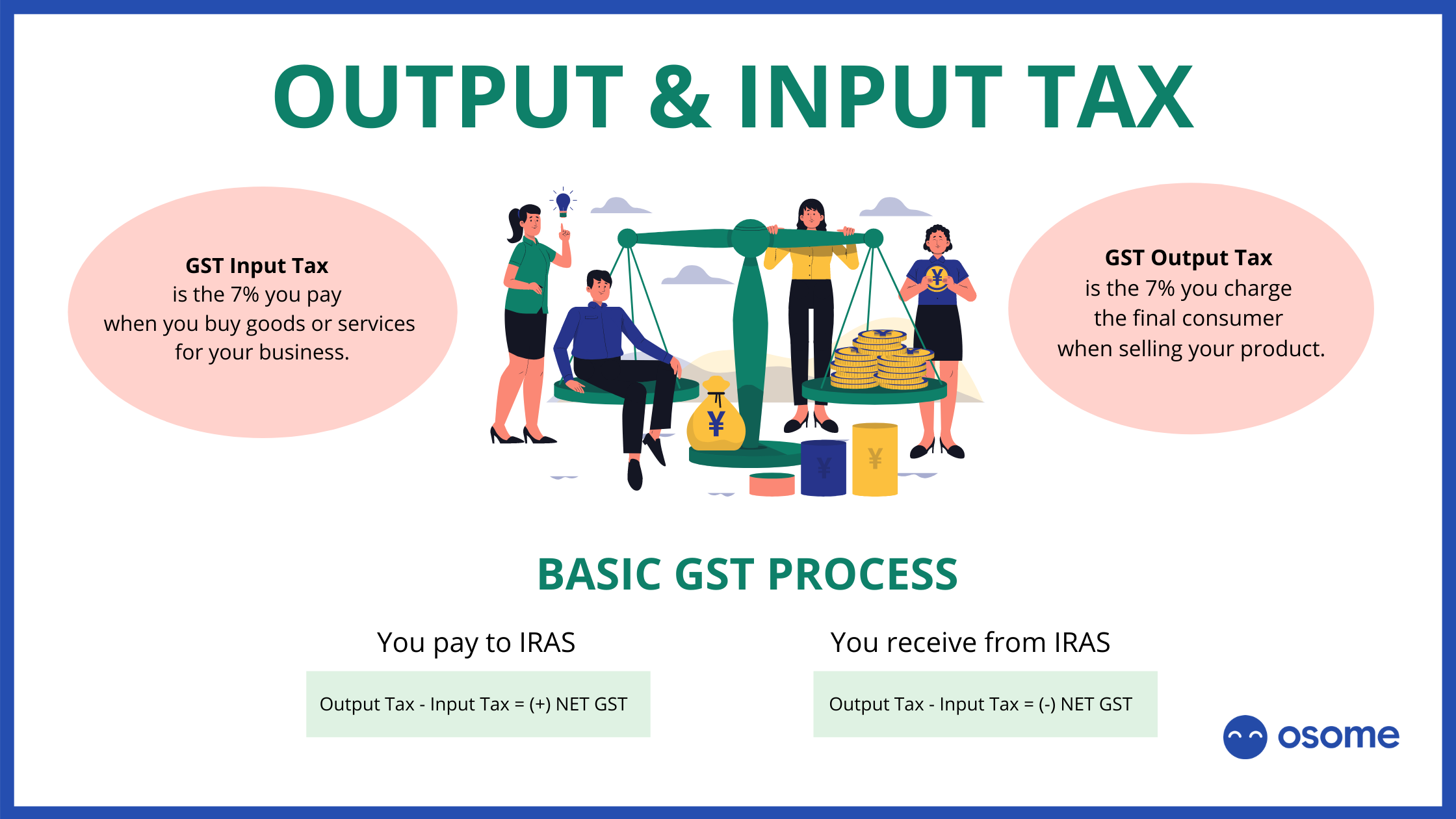

Web 4 sept 2023 nbsp 0183 32 Input Tax Credit or ITC is a tax a business pays on its purchases and is later used to offset its tax liability when it makes a sale Businesses can reduce their tax Web 31 janv 2023 nbsp 0183 32 How to calculate ITCs How to claim ITCs Time limit for claiming ITCs Records you need to support your claim Overview As a GST HST registrant you

Input Tax Rebate Meaning

Input Tax Rebate Meaning

https://osome.com/content/images/2021/03/Differences-between-input-and-output-tax.png

What Is Input Tax Credit Under GST How Does Input Tax Credit Mechanism

https://cdn-images-1.medium.com/max/600/1*Ubb7ZbeJkigEw5T68_JPDw.png

Input Tax Credit Meaning Conditions To Avail Documents Required

https://www.edukating.com/files/blog/256790342611647853071.jpg

Web 6 avr 2023 nbsp 0183 32 April 06 2023 What is an Input Tax An input tax is a levy paid by a business on acquired goods and services An example of an input tax is the value Web 8 nov 2021 nbsp 0183 32 Input VAT or Input tax is the amount of tax added to goods or services you purchase These are on your business expenses These could be Goods you purchase

Web ITCs and ITRs Input Tax Credits ITCs and Input Tax Refunds ITRs As a registrant you can generally recover the GST and QST you paid or have to pay on taxable property Web 26 nov 2021 nbsp 0183 32 Key Takeaways What Are Input Tax Credits Input tax credits or ITCs are credits that some businesses can claim for sales taxes in Canada These can be claimed on items purchased to produce goods

Download Input Tax Rebate Meaning

More picture related to Input Tax Rebate Meaning

VAT Partial Exemption Everything You Need To Know Tide Business

https://web.uploads.tide.co/2020/10/16191117/what-input-tax-cant-i-recover-infographic-1024x899.jpg

Rebate Meaning In Gujarati Rebate Rebate In Gujarati

https://i.ytimg.com/vi/BmgMBmWxMXw/maxresdefault.jpg

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

https://i.ytimg.com/vi/DwFvkMZgBmc/maxresdefault.jpg

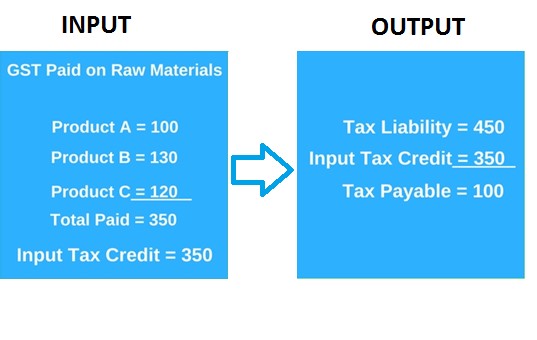

Web 14 janv 2020 nbsp 0183 32 Input tax credit means credit of Input tax i e tax levied on input goods input services or both Any goods including capital goods and any input services used Web Conditions for claiming input tax When purchasing from GST registered suppliers or importing goods into Singapore you may have incurred GST input tax You can claim the input tax incurred when you satisfy all of

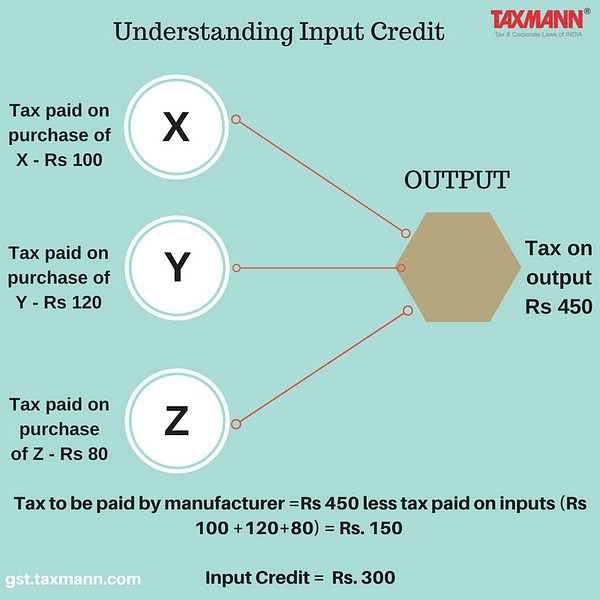

Web In South Africa a supplier granting volume discounts can claim an input tax deduction in the tax period in which the credit note is issued to the recipient in respect of the rebate Web What is Input Tax Credit ITC Input Tax Credit ITC is the heart and soul of GST It is because it protects the interest of the manufacturers by providing them tax deductions

GST And How To Avail Input Tax Credit In India

http://www.industrybuying.com/wp-content/uploads/2017/10/GSt-Input.jpg

Rebate Meaning YouTube

https://i.ytimg.com/vi/SdxgtWS3OmY/maxresdefault.jpg

https://cleartax.in/g/terms/input-tax-credit

Web 16 ao 251 t 2023 nbsp 0183 32 Input tax credit refers to the mechanism of claiming a reduction of tax paid on the inputs of a business or profession In India under the Goods and Service

https://www.5paisa.com/stock-market-guide/tax/input-tax-credit-gst

Web 4 sept 2023 nbsp 0183 32 Input Tax Credit or ITC is a tax a business pays on its purchases and is later used to offset its tax liability when it makes a sale Businesses can reduce their tax

Input Tax Credit ITC In GST Meaning How To Claim It And Examples

GST And How To Avail Input Tax Credit In India

What Is Input Credit Under GST And How To Claim It

What Is Export Tax Rebate In China Yansourcing

Tax Rebate On Income Upto 5 Lakh Under Section 87A

Rebate Meaning In Hindi Rebate Ka Matlab Kya Hota Hai Word Meaning

Rebate Meaning In Hindi Rebate Ka Matlab Kya Hota Hai Word Meaning

Input Tax Credit Or ITC Guide On Meaning Eligibility And How To

Input Tax Credit Under GST Taxmann Blog

Income Tax Rebate Under Section 87A

Input Tax Rebate Meaning - Web 8 nov 2021 nbsp 0183 32 Input VAT or Input tax is the amount of tax added to goods or services you purchase These are on your business expenses These could be Goods you purchase