Do Capital Gains Get Added To Taxable Income The difference between the income tax and the capital gains tax is that the income tax is applied to earned income and the capital gains tax is applied to profit made on the sale of a

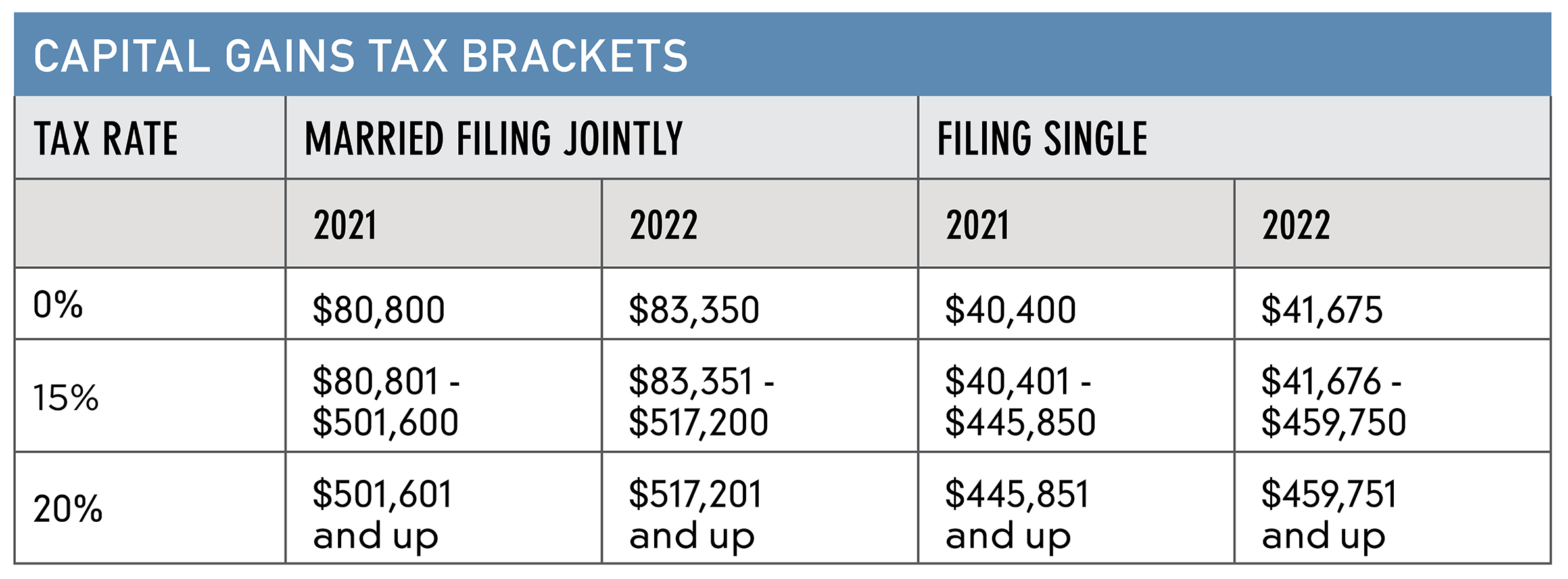

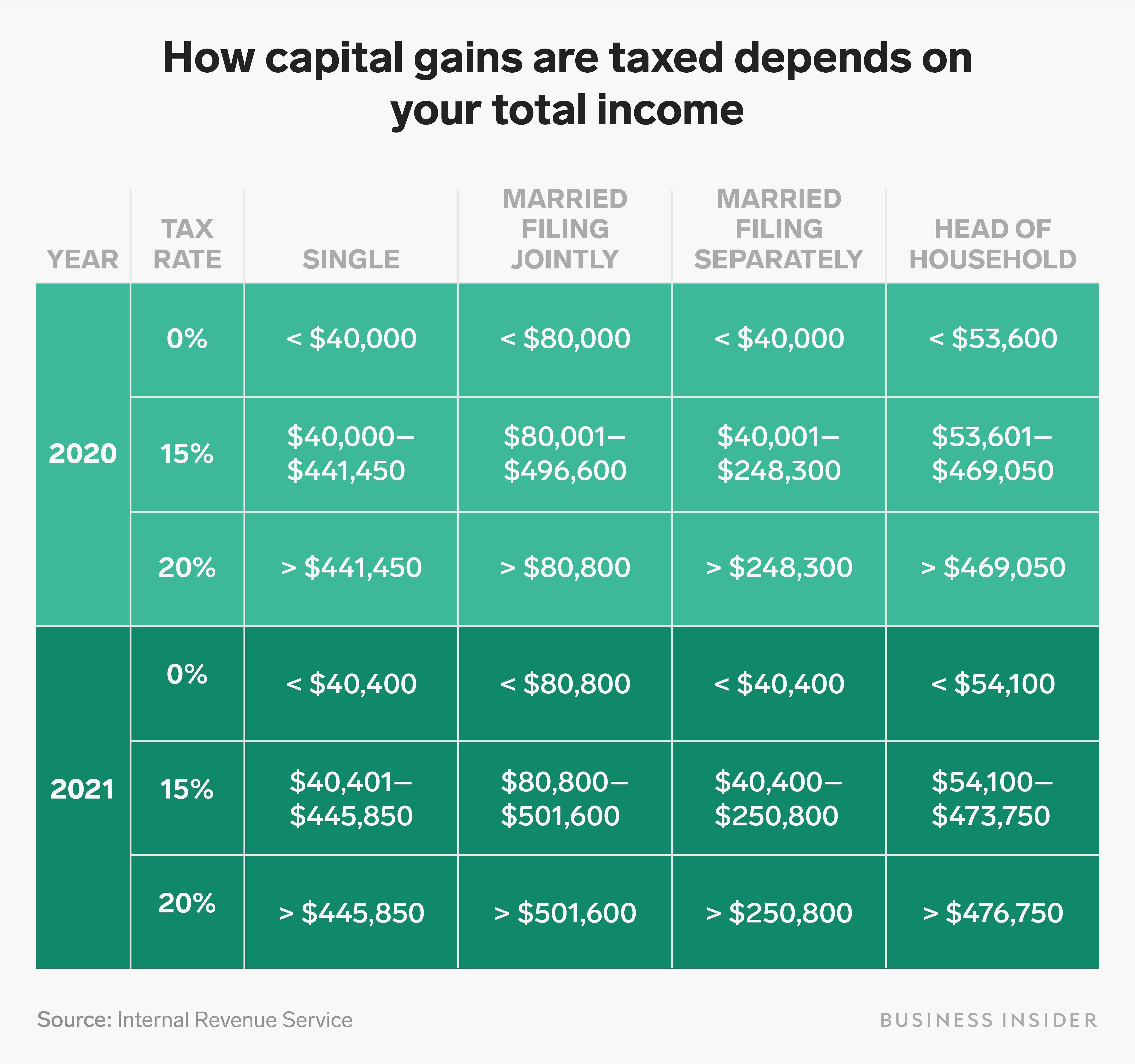

Short term capital gains are generally taxed at the individual s ordinary income tax rate which can be as high as 37 On the other hand long term capital gains have preferential tax rates As of my last training data they If your taxable income is above the 15 bracket you will pay tax on your capital gains at 20

Do Capital Gains Get Added To Taxable Income

Do Capital Gains Get Added To Taxable Income

https://www.taxslayer.com/blog/wp-content/uploads/2023/02/Taxable-vs-Nontaxable-Income-min-2.jpg

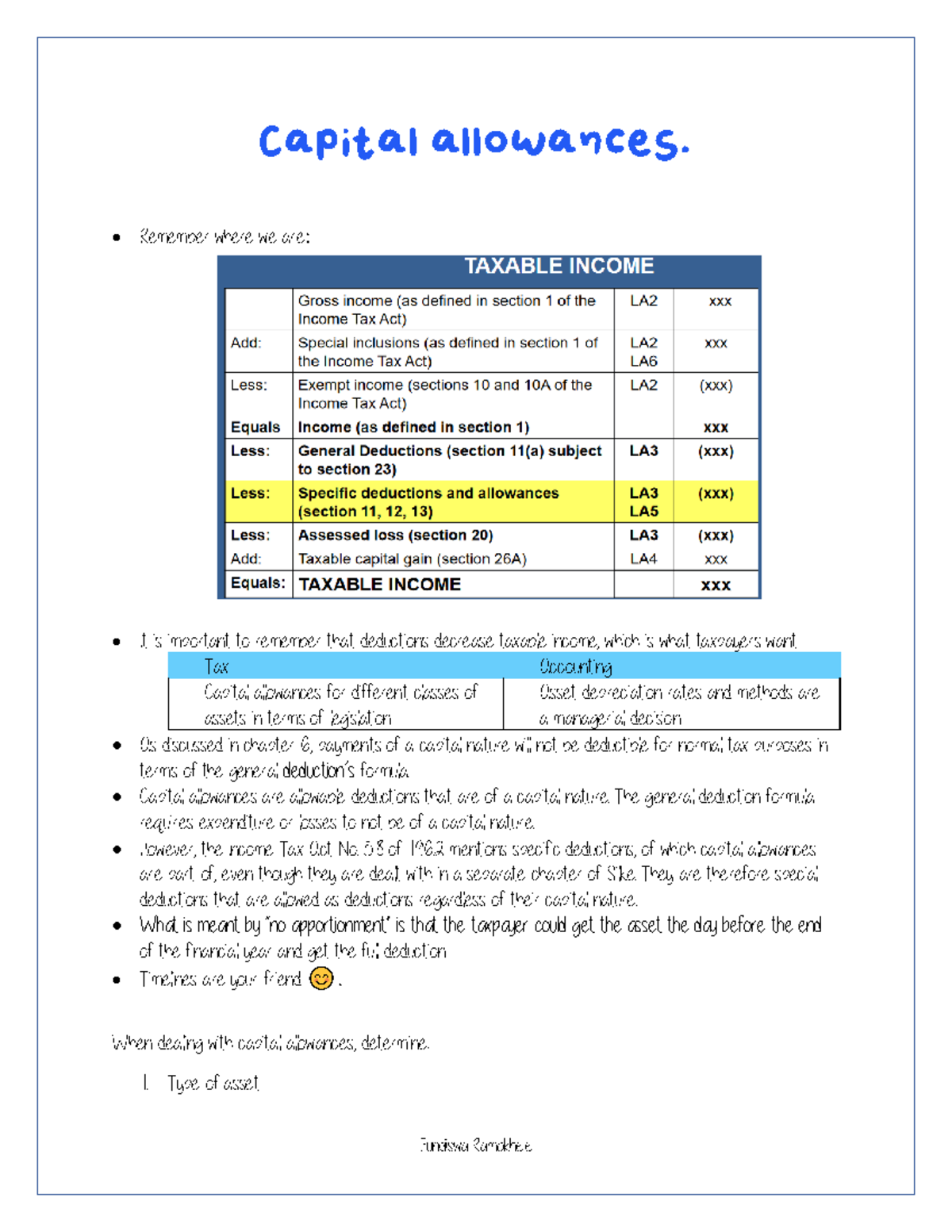

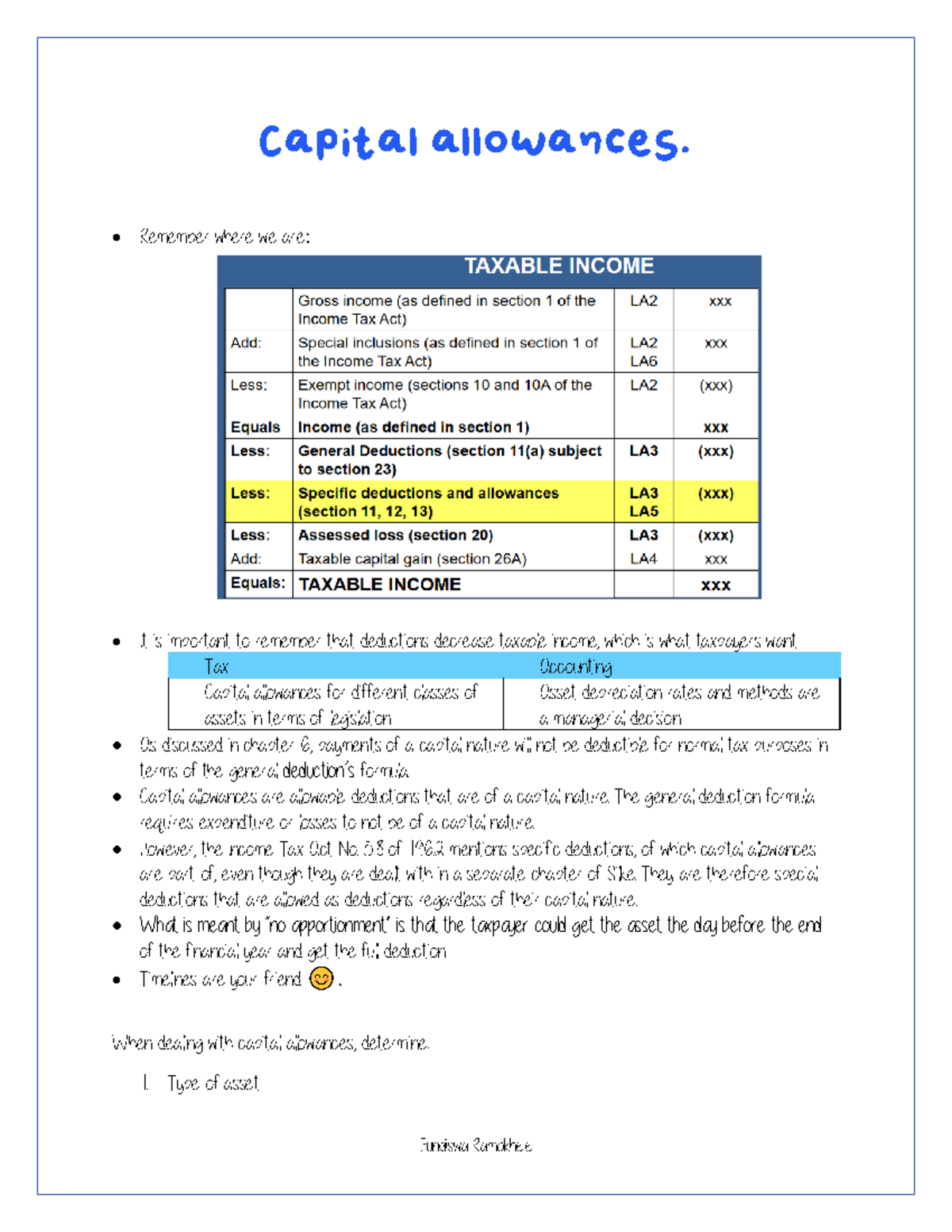

Capital Allowances 4576 Remember Where We Are It Is Important To

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/89fbf526a02ac4b1ec804957b20a90c3/thumb_1200_1553.png

Cuddy Financial Services s Tax Planning Guide 2022 Tax Planning Guide

https://cdn.ltmclientmarketing.com/WEBTPG/articles/2022TPG/Chart-Capital_Gains_Tax_Brackets.jpg

For the tax year 2024 those whose income is 47 025 or less do not have to pay capital gains tax There is no age based criteria that exempts one from paying a capital gains tax By contrast long term capital gains are taxed at different generally lower rates The capital gains rates are 0 15 and 20 depending on your taxable income

Capital gains are generally included in taxable income but in most cases are taxed at a lower rate A capital gain is realized when a capital asset is sold or exchanged at a price higher than its basis Basis is an asset s purchase price Net capital gains are taxed at different rates depending on overall taxable income although some or all net capital gain may be taxed at 0 For taxable years

Download Do Capital Gains Get Added To Taxable Income

More picture related to Do Capital Gains Get Added To Taxable Income

Capital Gains Are The Profits You Make From Selling Your Investments

https://www.businessinsider.in/photo/79520838/Master.jpg

The Different Tax Rates For Unearned Income Lietaer

https://imgtaer.lietaer.com/what_is_the_tax_rate_for_capital_gains_and_dividends.jpg

Call Girls In Erotic Massages Independent Escort Service In Erotic

https://thegirlscurls.com/wp-content/uploads/2022/10/escort-service-delhi.png

Capital gains can have tax benefits over regular income specifically long term capital gains That s because long term capital gains have a lower tax rate than regular income and short term capital gains which are also Capital gains taxes are taxes levied on the profit from selling an asset for an amount greater than its purchase price These taxes are categorized into

At the federal level capital gains are taxed based on the several factors including the type of asset how long you held the asset and your overall income level If you only held When you realize a capital gain the proceeds are considered taxable income The amount you owe in capital gains taxes depends in part on how long you owned the asset

Can Capital Gains Impact Your Eligibility For BadgerCare

https://www.investorsalley.com/wp-content/uploads/capital-gains.jpg

How To Write A Capital Improvement Plan

https://i2.wp.com/www.transformproperty.co.in/blog/wp-content/uploads/2014/08/Capital-gains-tax-infographic.jpg

https://www.investopedia.com/ask/ans…

The difference between the income tax and the capital gains tax is that the income tax is applied to earned income and the capital gains tax is applied to profit made on the sale of a

https://www.financestrategists.com/tax/t…

Short term capital gains are generally taxed at the individual s ordinary income tax rate which can be as high as 37 On the other hand long term capital gains have preferential tax rates As of my last training data they

How To Calculate Taxable Income H R Block

Can Capital Gains Impact Your Eligibility For BadgerCare

Tori Brixx toribrixx Take Her Away Page 7 Of 20 DynastySeries

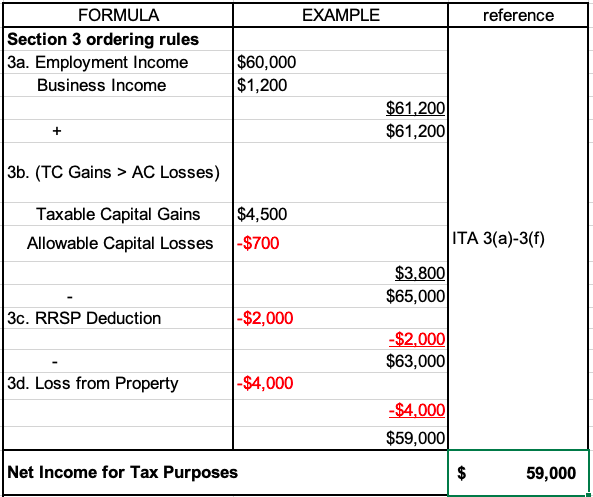

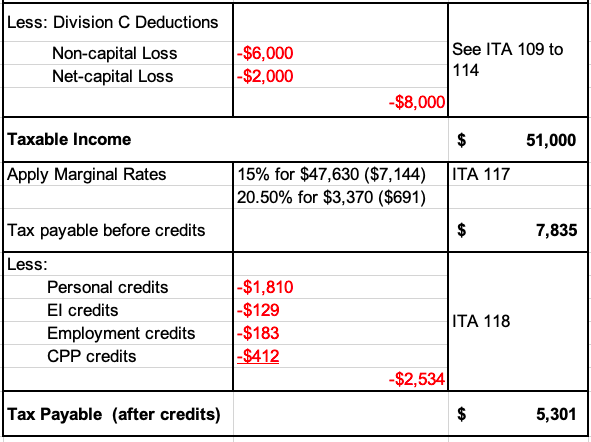

How Do You Get From Net Income For Tax Purposes To Taxable Income To

:max_bytes(150000):strip_icc()/TaxableIncome_Final_4188122-0fb0b743d67242d4a20931ef525b1bb1.jpg)

Amount Of Gross Salary Declared Is Less Than The Amount Of Gross Salary

Understanding Capital Gains Tax A Comprehensive Guide

Understanding Capital Gains Tax A Comprehensive Guide

Capital Gains Vs Ordinary Income The Differences 3 Tax Planning

Capital Gains Vs Ordinary Income The Differences 3 Tax Planning

How Do You Get From Net Income For Tax Purposes To Taxable Income To

Do Capital Gains Get Added To Taxable Income - Gains from the sale of assets you ve held for longer than a year are known as long term capital gains and they are typically taxed at lower rates than short term gains and