Gst Rebate For New Home Web 9 sept 2022 nbsp 0183 32 Application form to claim the GST HST new housing rebate if you built a new house or substantially renovated or added a major addition to your house

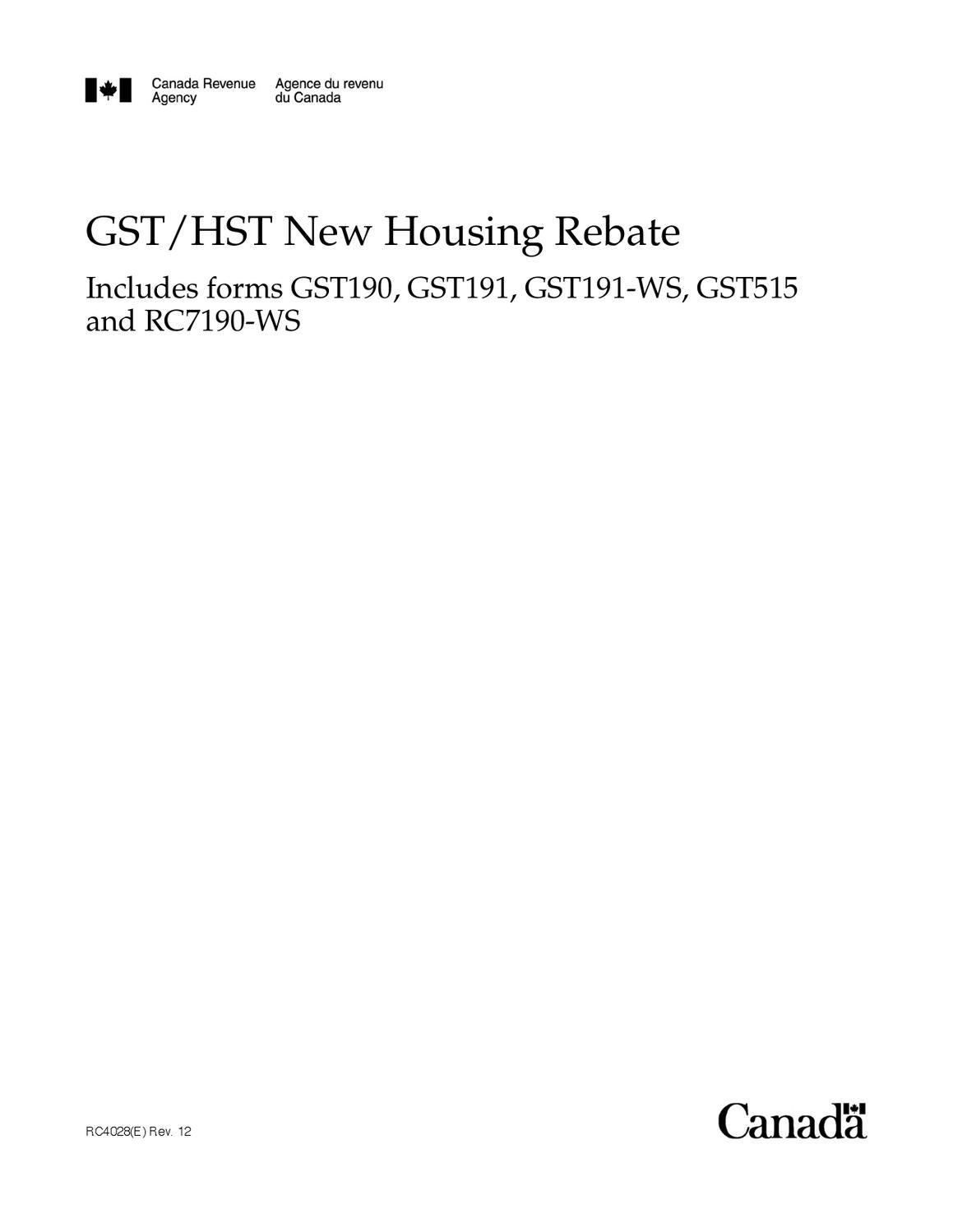

Web The GST HST new housing rebate is a Canadian federal government program that offers a rebate on the Goods and Services Tax GST or the Harmonized Sales Tax HST for new homes The rebate is available to Web 17 juin 2022 nbsp 0183 32 RC4028 GST HST New Housing Rebate You can view this publication in HTML rc4028 e html PDF rc4028 22e pdf Last update 2022 06 17

Gst Rebate For New Home

Gst Rebate For New Home

https://data.templateroller.com/pdf_docs_html/1869/18693/1869358/form-gst524-gst-hst-new-residential-rental-property-rebate-application-canada_print_big.png

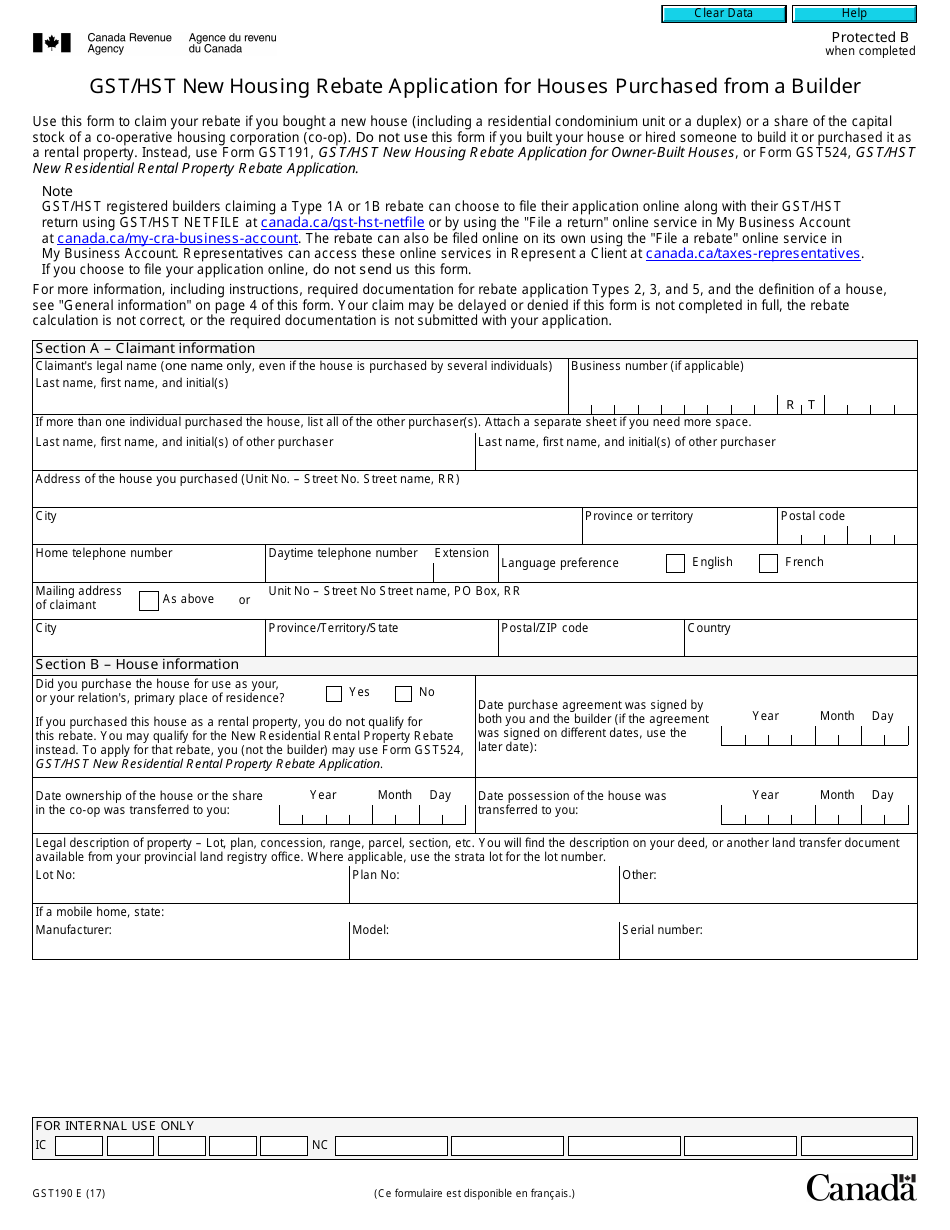

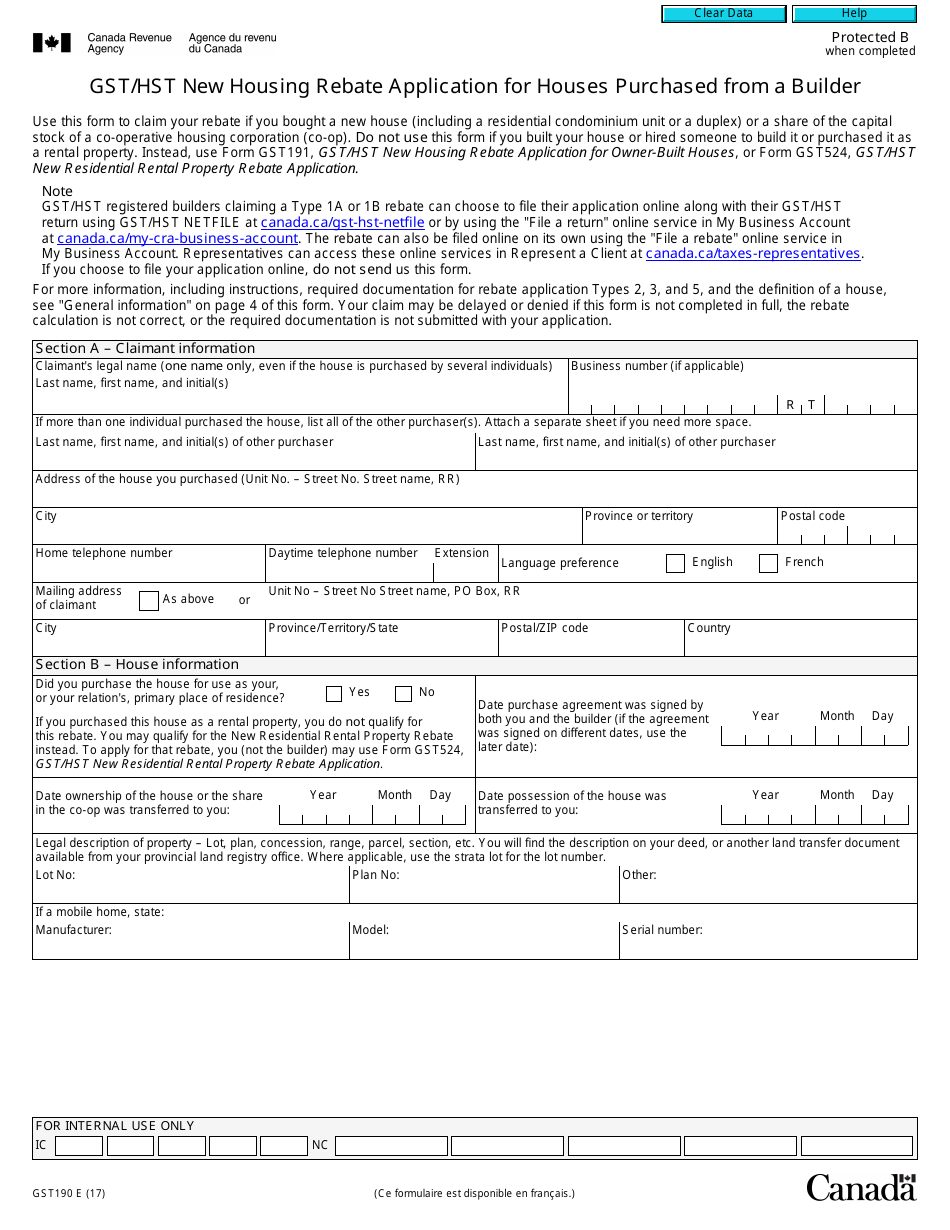

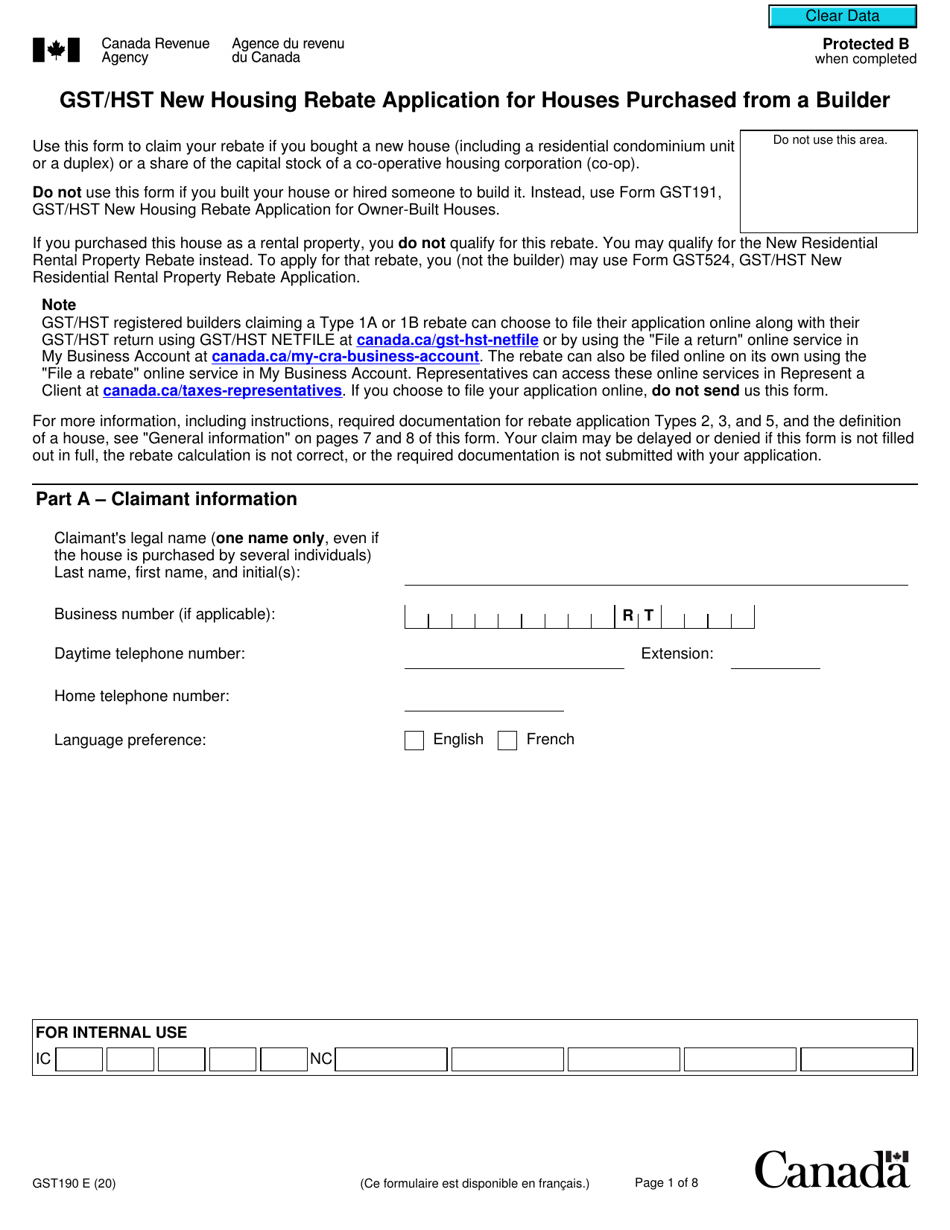

Form GST190 Download Fillable PDF Or Fill Online Gst Hst New Housing

https://data.templateroller.com/pdf_docs_html/1867/18672/1867279/form-gst190-gst-hst-new-housing-rebate-application-for-houses-purchased-from-a-builder-canada_print_big.png

Gst Hst New Housing Rebate Application For Owner Built Houses

https://vislab-us.net/images/b7b544631f56d8e6f6974363f8729b7f.jpg

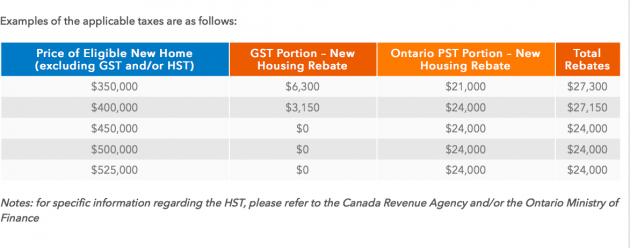

Web 26 oct 2022 nbsp 0183 32 The amount of rebate you can receive for the GST Portion is 36 of the GST tax amount up to a maximum of 6 300 The amount of rebate you can receive for the Web 3 juin 2022 nbsp 0183 32 The GST HST new housing rebate is a rebate provided to homebuyers to apply for a refund on GST HST paid on their homes When you purchase newly built or

Web A GST HST new housing rebate is provided for part of the tax paid by an individual who builds or substantially renovates his or her own primary place of residence or that of a Web 4 avr 2022 nbsp 0183 32 In most cases the maximum rebate will be 36 of the GST portion paid up to a maximum of 6 300 buyers will receive approximately 36 of the total tax paid There

Download Gst Rebate For New Home

More picture related to Gst Rebate For New Home

New Home HST GST Rebate By Nadene Milnes Issuu

https://image.isu.pub/130131143253-b171a3397fa948ceb10c5a961451c8bc/jpg/page_2.jpg

GST HST New Housing Rebate Rebates House With Land Home Construction

https://i.pinimg.com/originals/47/85/a0/4785a08c0575ae3c0c047a6f2e5849a8.png

New Home HST GST Rebate By Nadene Milnes Issuu

https://image.isu.pub/130131143253-b171a3397fa948ceb10c5a961451c8bc/jpg/page_26.jpg

Web 11 mai 2020 nbsp 0183 32 First the new housing rebate equals 36 of the GST that all buyers need to pay when buying a new home in Canada This rebate is up to 6 300 and valid on homes with a fair market value of 350 000 or Web 29 ao 251 t 2022 nbsp 0183 32 If the newly built home value is under 350 000 you can receive a rebate of up to 42 of the PST The rebate rate is reduced as the purchase price increases up to 450 000 after which there is no rebate

Web 500 000 purchase price x 5 GST in BC GST on new home purchase 25 000 If you bought a brand new condo of the same price in Toronto your HST would be calculated Web 20 mars 2015 nbsp 0183 32 To calculate his GST HST Federal rebate 6 300 x 457 000 428 625 100 000 1 787 63 To calculate his Ontario new housing rebate 428 500 x 8 x

Tax Rebate Blog Series GST HST New Housing Rebate

https://static.wixstatic.com/media/5555c4_26b45f63e44142248b8cb2e1d65d279c~mv2.jpg/v1/fill/w_1000,h_563,al_c,q_90,usm_0.66_1.00_0.01/5555c4_26b45f63e44142248b8cb2e1d65d279c~mv2.jpg

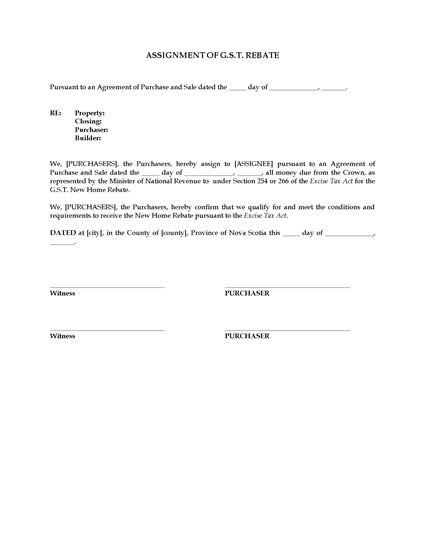

Canada Assignment Of GST New Home Rebate Legal Forms And Business

https://www.megadox.com/content/images/thumbs/0011597_assignment-of-gst-new-home-rebate-canada_550.jpeg

https://www.canada.ca/.../services/forms-publications/forms/gst191.html

Web 9 sept 2022 nbsp 0183 32 Application form to claim the GST HST new housing rebate if you built a new house or substantially renovated or added a major addition to your house

https://www.canadalife.com/.../what-is-the-gs…

Web The GST HST new housing rebate is a Canadian federal government program that offers a rebate on the Goods and Services Tax GST or the Harmonized Sales Tax HST for new homes The rebate is available to

Form GST190 Download Fillable PDF Or Fill Online Gst Hst New Housing

Tax Rebate Blog Series GST HST New Housing Rebate

New Home HST GST Rebate By Nadene Milnes Issuu

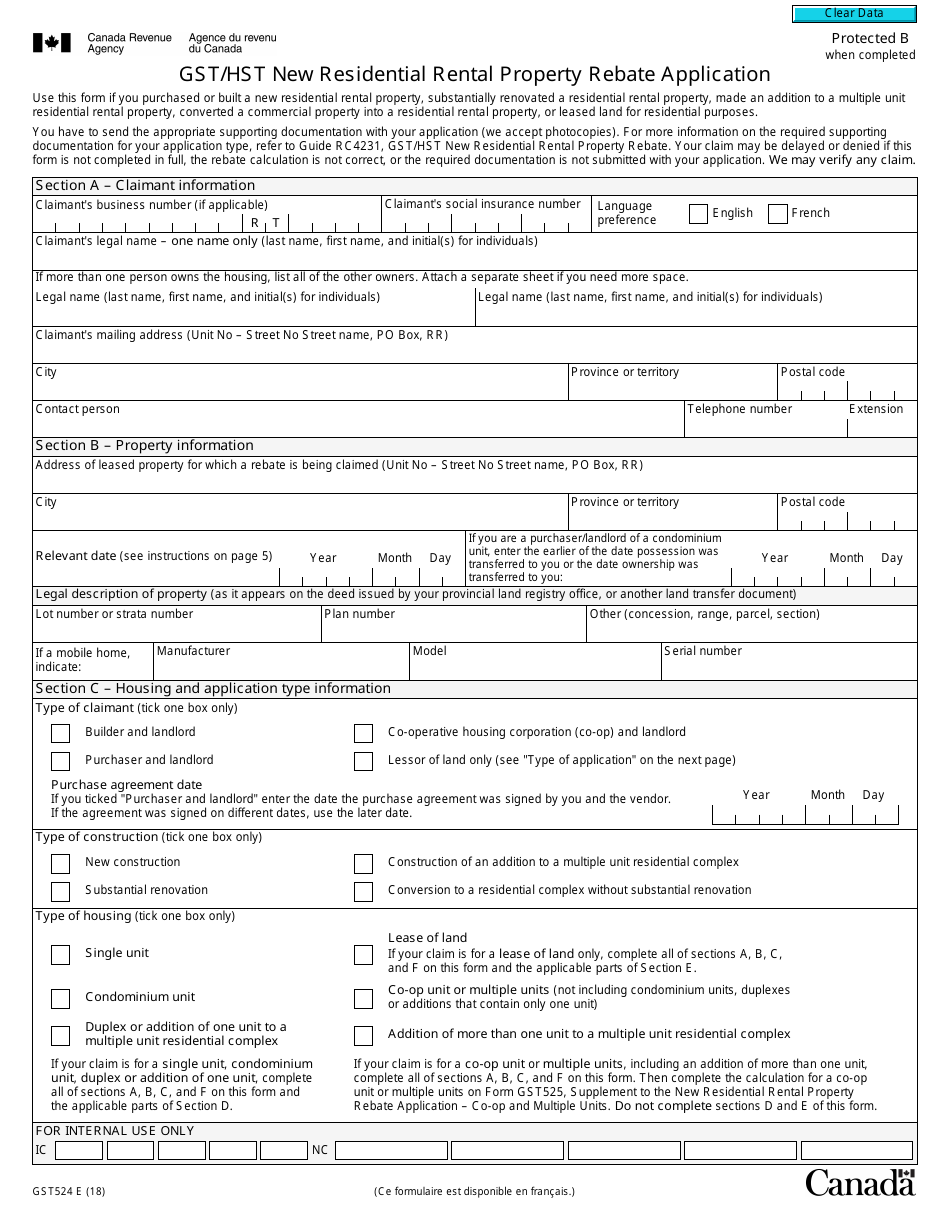

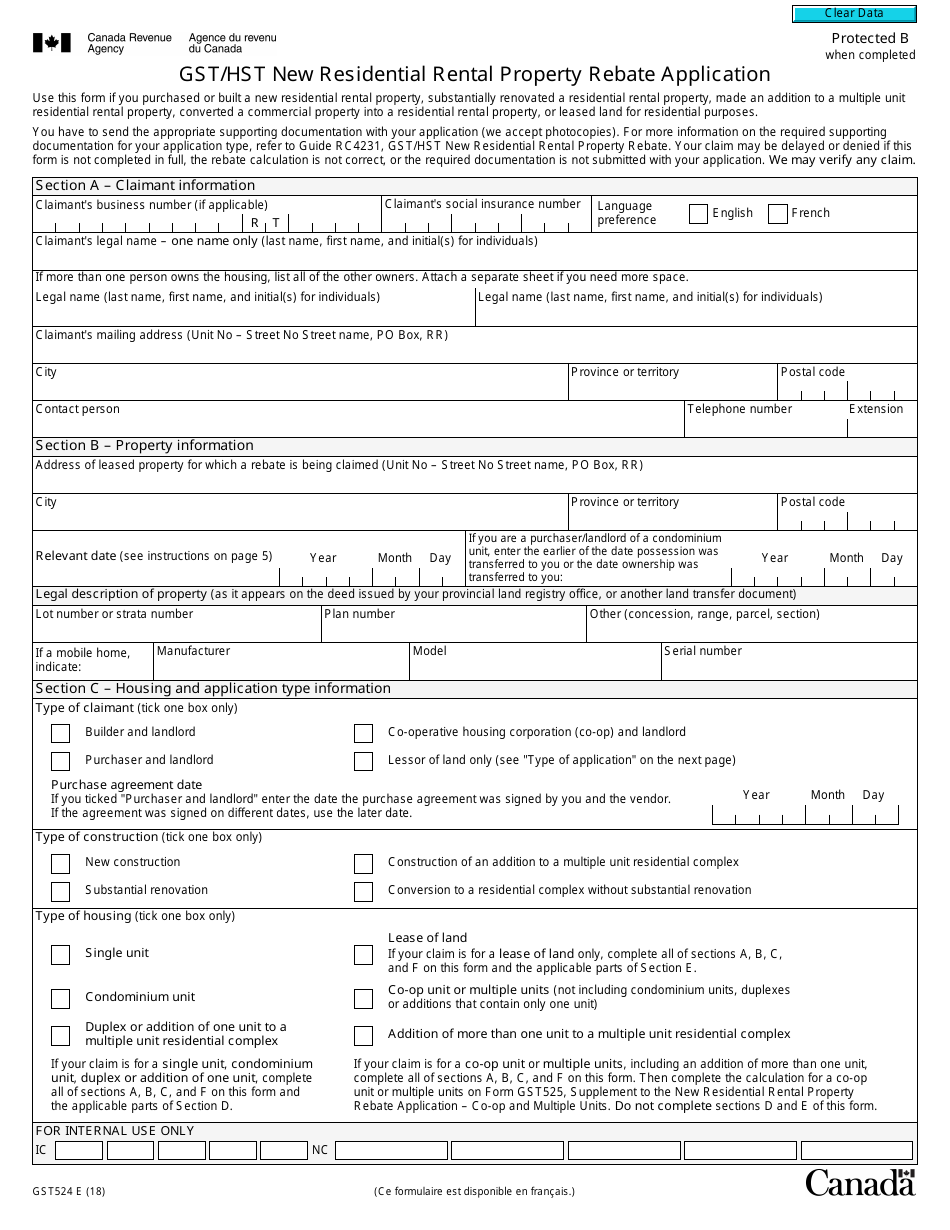

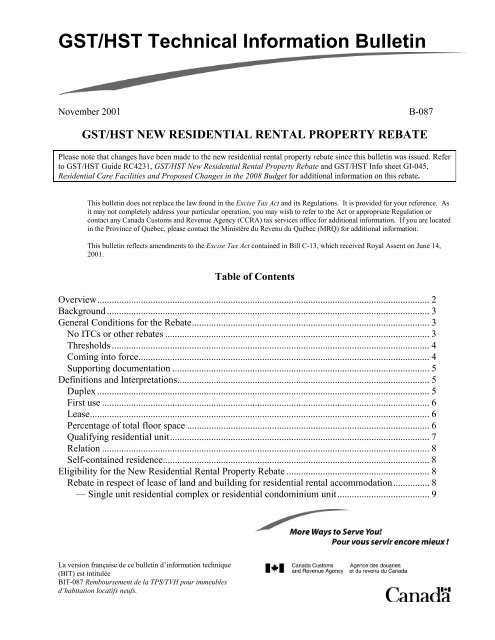

GST HST New Residential Rental Property Rebate Agence Du

Gst Hst New Housing Rebate Application For Owner Built Houses

Gst Hst New Housing Rebate Application For Owner Built Houses

Gst Hst New Housing Rebate Application For Owner Built Houses

New Home HST Rebate Calculator Ontario

GST HST New Home Rebate 2020 Denied Kalfa Law

GST HST New Housing Rebate Denied BBTS Accountax Inc

Gst Rebate For New Home - Web 4 avr 2022 nbsp 0183 32 In most cases the maximum rebate will be 36 of the GST portion paid up to a maximum of 6 300 buyers will receive approximately 36 of the total tax paid There