Do Disabled Veterans Get A Property Tax Break In Texas Tax Code Section 11 131 requires an exemption of the total appraised value of homesteads of Texas veterans who received 100 percent compensation from the U S

Disabled veterans including surviving spouses and children applying for exemption under Tax Code Section 11 22 have up to five years after the delinquency date for taxes on A disabled veteran who owns property other than a residence homestead may apply for a different disabled veteran s exemption under Tax Code Section 11 22 that applied

Do Disabled Veterans Get A Property Tax Break In Texas

Do Disabled Veterans Get A Property Tax Break In Texas

https://collegeaftermath.com/wp-content/uploads/2022/07/pexels-karolina-grabowska-8147356-1-1024x683.jpg

Do Disabled Veterans Pay Property Taxes

https://media.marketrealist.com/brand-img/W3NUXY6Fx/0x0/veteran-flag-1633362582449.jpg

Top 15 States For 100 Disabled Veteran Benefits CCK Law

https://cck-law.com/wp-content/uploads/2023/05/Top-15-States-for-100-Disabled-Veteran-Benefits-1.jpg

Some veterans may even qualify for a 100 percent tax exemption Texas law provides partial exemptions for any property owned by disabled veterans or surviving spouses You qualify for the homestead tax exemption if the following apply to you You own a home and occupy it as your residence homestead You have a disability

In Texas veterans with a disability rating of 100 are exempt from all property taxes 70 to 100 receive a 12 000 property tax exemption 50 to 69 receive a 10 000 Veterans with a 10 or more disa bility rating qualify f or a Disabled Vetera n Exemption You can apply the exemption to any property and it is transferrable to the surviving

Download Do Disabled Veterans Get A Property Tax Break In Texas

More picture related to Do Disabled Veterans Get A Property Tax Break In Texas

Disabled Veteran Property Tax Exemptions In Texas YouTube

https://i.ytimg.com/vi/4d9PnKtDb-A/maxresdefault.jpg

Do Seniors Get A Property Tax Break In California VVP Law Firm

https://www.vvplawfirm.com/wp-content/uploads/2022/02/ww-1.png

Do 100 Disabled Veterans Qualify For Property Tax Exemptions YouTube

https://i.ytimg.com/vi/jG-waEDZwro/maxresdefault.jpg

Veterans who are 100 disabled or unemployable are exempt from paying property taxes The exemption is transferrable to the surviving spouse Requirements You must The tax reduction can be applied to one property in Texas that the veteran owns even for properties given to veterans through charitable organizations Senior disabled veterans

Veterans in Texas may qualify for a property tax exemption depending on their disability rating Texas Property Tax Exemption for Partially Disabled Veterans and Veterans over age 65 Property tax in Texas is a locally assessed and locally administered tax Texas offers

Property Tax Exemption For Disabled Veterans YouTube

https://i.ytimg.com/vi/61TdtqxQIkU/maxresdefault.jpg

Do Disabled Veterans Pay Tolls In Illinois

https://americanwomenveterans.org/wp-content/uploads/2023/08/Do-Disabled-Veterans-Pay-Tolls-In-Illinois-1024x574.jpg

https://comptroller.texas.gov/taxes/property-tax/...

Tax Code Section 11 131 requires an exemption of the total appraised value of homesteads of Texas veterans who received 100 percent compensation from the U S

https://comptroller.texas.gov/taxes/property-tax/...

Disabled veterans including surviving spouses and children applying for exemption under Tax Code Section 11 22 have up to five years after the delinquency date for taxes on

Disabled Veterans Property Tax Exemptions By State Tax Exemption

Property Tax Exemption For Disabled Veterans YouTube

EGR Veteran Pushes For Changes To State s Disabled Veterans Exemption

Property Tax Exemption For Disabled Veterans Esper Aiello Law Group

Additional Benefits For 100 Disabled Veterans CCK Law

New Texas Law Gives Elderly And Disabled Property Tax Break

New Texas Law Gives Elderly And Disabled Property Tax Break

Can Disabled Veterans Get A Discount On Car Insurance Dripiv Plus

Hecht Group Oklahoma Property Tax Exemption For Disabled Veterans

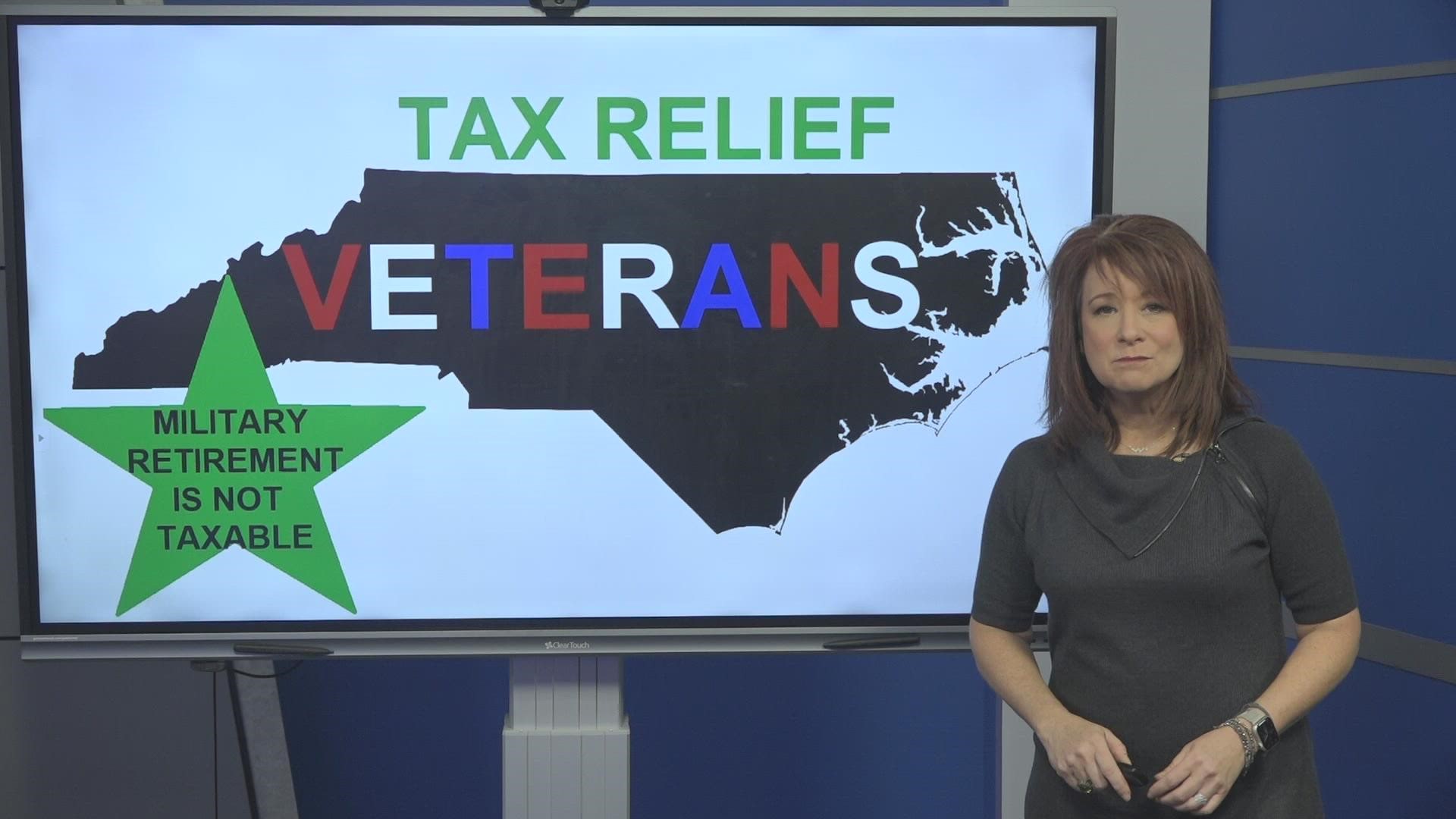

NC Gives Veterans Tax Credits On Income And Property Taxes Wfmynews2

Do Disabled Veterans Get A Property Tax Break In Texas - A concise guide detailing property tax exemptions for Texas disabled veterans including eligibility exemption amounts based on disability rating benefits for donated properties