Do First Time Home Buyers Pay Land Transfer Tax In Bc Starting April 1 2024 property transfer tax exemptions will be changing Exemptions may apply to first time home buyers purchasing

First time home buyers program If you re purchasing your first home you may qualify to reduce or eliminate the amount of property transfer tax you pay Newly built home exemption If you re purchasing a newly built home you may qualify for a property transfer tax exemption Family exemptions Transfer of a principal residence PDF In British Columbia the Property Transfer Tax rate is 1 on the first 200 000 of the purchase price 2 on the portion of the purchase price between 200 000 and 2 million and 3 on the portion of the purchase price above 2 million

Do First Time Home Buyers Pay Land Transfer Tax In Bc

Do First Time Home Buyers Pay Land Transfer Tax In Bc

https://i.pinimg.com/originals/06/10/3c/06103c199974a3a500874bd198b5e400.png

A Breakdown Of Transfer Tax In Real Estate UpNest

https://www.upnest.com/1/post/files/2021/08/shutterstock_1060115645-1.jpg

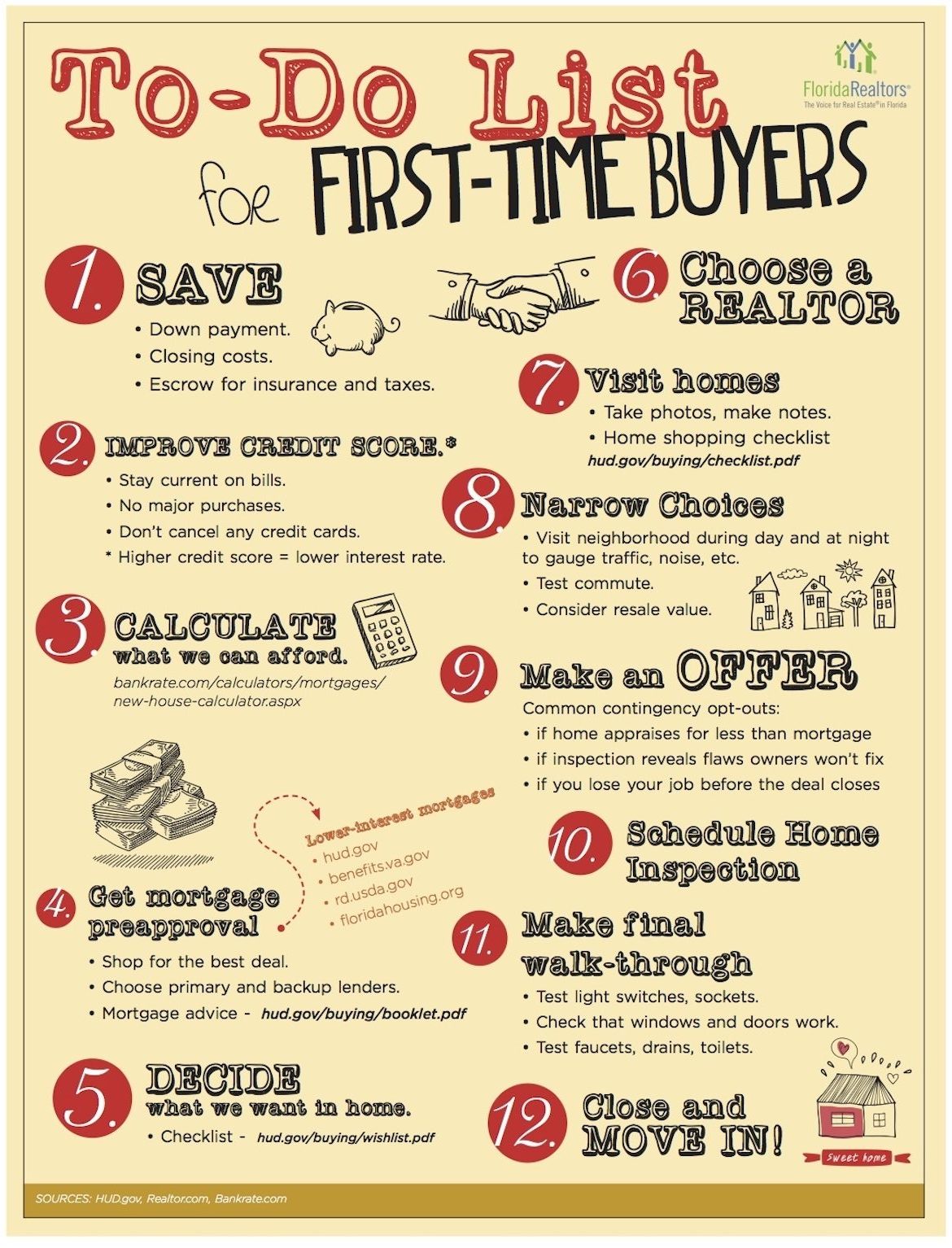

First Time Home Buyers Guide In 12 Steps Brickellmania

https://brickellmania.com/wp-content/uploads/2020/01/First-Time-home-buyers-rotated-e1605118908267.jpg

It is estimated these changes for first time homebuyers will benefit about 14 500 people twice as many as before with total savings up to 8 000 from buying their home Secondly the newly built home exemption for purchasers who buy a new home for their principal residence will grow from 750 000 to 1 1 million on the fair market value EXEMPTIONS TO THE PTT First Time Home Buyers Program The First Time Home Buyers FTHB Program gives a PTT exemption to eligible first time home buyers To qualify for a full exemption first time buyers must be a Canadian citizen or permanent resident have lived in BC for 12 consecutive months before the date the property is

This blog address the most commonly asked questions about Property Transfer tax and looks at how you as a purchaser can avoid paying property transfer tax as a First time home buyer or someone who purchased a Calculate property transfer tax for BC including British Columbia s Newly Built Homes Exemption calculation Find out about rebates for first time home buyers and speculation tax for foreigners

Download Do First Time Home Buyers Pay Land Transfer Tax In Bc

More picture related to Do First Time Home Buyers Pay Land Transfer Tax In Bc

Do You Pay Land Transfer Tax On Inherited Property

https://www.burnaby.com/wp-content/uploads/2023/11/do-you-pay-land-transfer-tax-on-inherited-property-e1699378274369.jpg

Land Transfer Tax Rebates For First Time Home Buyers Cris Kambouris

https://criskambouris.com/wp-content/uploads/sites/87/2018/06/Land-Transfer-Tax-Rebates-for-First-Time-Home-buyers.jpg

:max_bytes(150000):strip_icc()/how-do-buyer-s-agents-get-paid-1798872_FINAL-74f688f80ea24f05932d17f21d83a550.png)

How Do Home Buyer Agents Get Paid

https://www.thebalancemoney.com/thmb/spm_fdTbQx3gjM81FRCORlv0ff4=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/how-do-buyer-s-agents-get-paid-1798872_FINAL-74f688f80ea24f05932d17f21d83a550.png

First time home buyers program If you re purchasing your first home you may qualify to reduce or eliminate the amount of property transfer tax you pay Purpose built rental exemption The government has announced effective February 19 2014 under the Property Transfer Tax PTT First Time Home Buyers Exemption program qualifying first time buyers can buy a home worth up to 475 000 The previous threshold was 425 000 The partial exemption continues and will apply to homes valued between 475 000 and

British Columbia Many first time homebuyers say they can t access B C s tax exemption benefit Few properties in the province qualify for the program due to the 500 000 price When you a buy a house or condo in BC you are subject to land transfer tax on closing Use Ratehub ca s calculator to determine your land transfer tax or view BC s current rates below Ratehub ca s land transfer tax calculator Price Location I m a first time home buyer I m buying a newly built home Determining your land transfer tax

/AA014351-56a0e4f93df78cafdaa622f5.jpg)

First Time Home Buyers Tax Credit In Canada

https://www.thoughtco.com/thmb/PSFMjh_DoVtm1_iqHPiHskjIALg=/1280x853/filters:fill(auto,1)/AA014351-56a0e4f93df78cafdaa622f5.jpg

Home Buying Guide For Home Buyers First Time Home Buyers Etsy

https://i.etsystatic.com/20671095/r/il/c01d59/3193528016/il_fullxfull.3193528016_n7ax.jpg

https://bridgewellgroup.ca/property-transfer-t…

Starting April 1 2024 property transfer tax exemptions will be changing Exemptions may apply to first time home buyers purchasing

https://perryrfriedman.com/gov/content/taxes/...

First time home buyers program If you re purchasing your first home you may qualify to reduce or eliminate the amount of property transfer tax you pay Newly built home exemption If you re purchasing a newly built home you may qualify for a property transfer tax exemption Family exemptions Transfer of a principal residence PDF

Transfer Tax In The Philippines Lumina Homes

/AA014351-56a0e4f93df78cafdaa622f5.jpg)

First Time Home Buyers Tax Credit In Canada

Build A Real Estate Business Not A Job Sales And Marketing Real

What To Look For When Buying A Home Which Buying Your First Home

First time Buyer Land Transfer Tax Rebate Increasing To 4 000

Home Buying Guide For Home Buyers First Time Home Buyers Etsy

Home Buying Guide For Home Buyers First Time Home Buyers Etsy

The Real Estate Listing Packet Contains 7 Forms To Help You When You

100 Questions Every First Time Home Buyer Should Ask With Answers

Navigating Land Transfer Tax For First time Home Buyers

Do First Time Home Buyers Pay Land Transfer Tax In Bc - This blog address the most commonly asked questions about Property Transfer tax and looks at how you as a purchaser can avoid paying property transfer tax as a First time home buyer or someone who purchased a