Tax Treatment Of Sales Rebates Web 10 nov 2015 nbsp 0183 32 This issue considers how a purchaser accounts for discounts and rebates when buying inventory What s the issue Discounts and

Web What s the issue Discounts and rebates can be offered to purchasers in a number of ways for example trade discounts settlement discounts volume based rebates and other Web 6 avr 2022 nbsp 0183 32 A rebate is a retroactive payment back to a buyer of a good or service After the sale has been made the rebate lowers the full purchase price by returning either a lump sum or percentage of the sales price

Tax Treatment Of Sales Rebates

Tax Treatment Of Sales Rebates

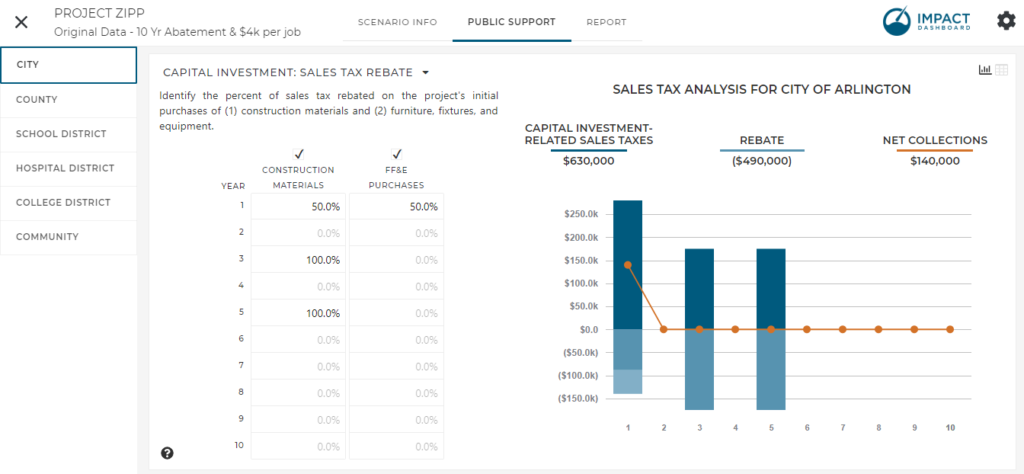

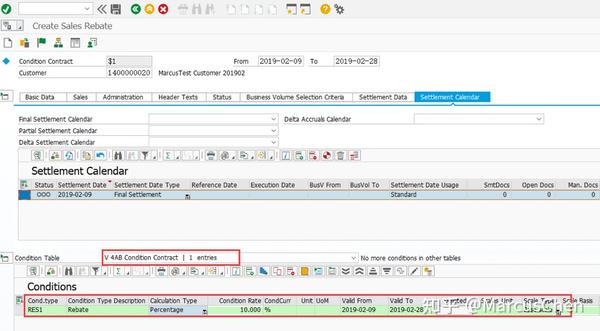

https://impactdatasource.com/wp-content/uploads/2019/06/IDB-Sales-Tax-Rebate-Screenshot-1024x474.png

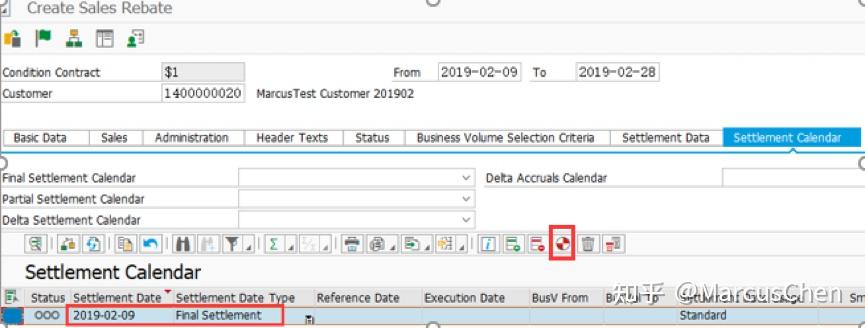

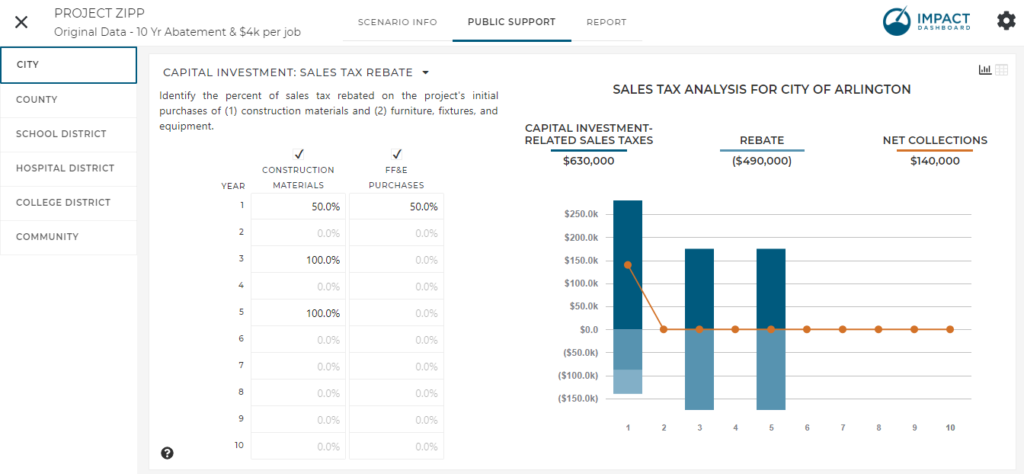

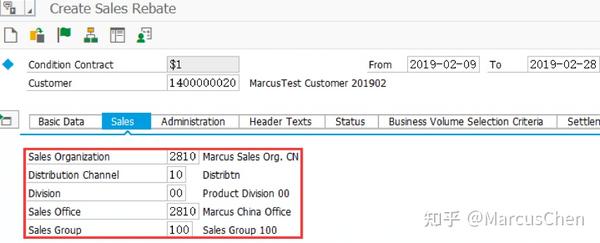

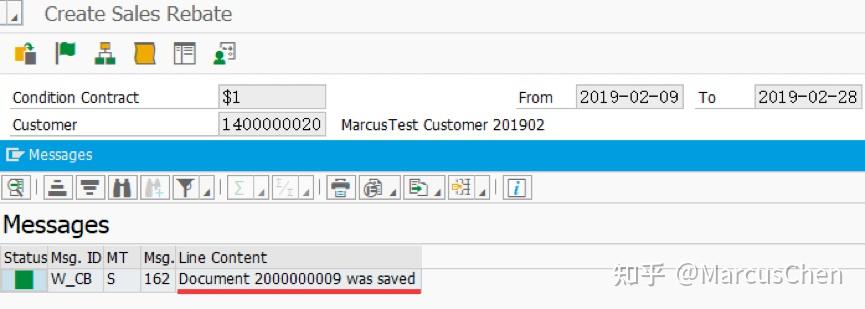

S4 Rebate

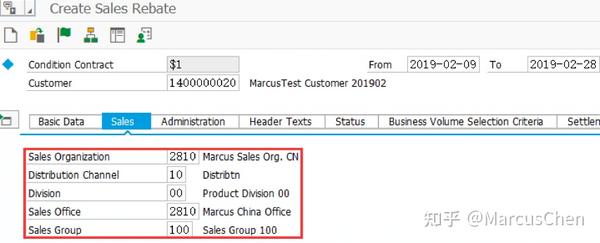

https://pic3.zhimg.com/v2-2342e495529d121587e1f63e6174017a_b.jpg

S4 Rebate

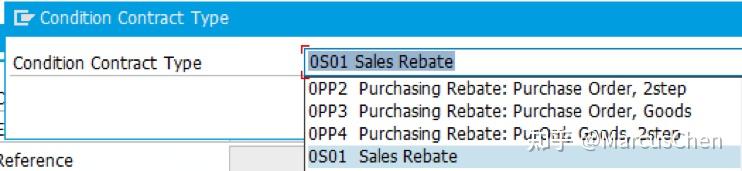

https://pic1.zhimg.com/v2-b03aab3752875a821e6d9a67ee17d664_b.jpg

Web 13 juin 2012 nbsp 0183 32 In the Ruling Taxpayer was an accrual basis manufacturer who offered certain trade promotion rebates to customers Taxpayer sold products to multiple Web Practical challenges associated with rebates volume discounts and the Value Added Tax Act 2014 Rebates also known as volume discounts bonus discounts are financial

Web 22 d 233 c 2021 nbsp 0183 32 The specific regulations vary by state but the sale price or gross sales will exclude any discounts including cash term or coupons that are not reimbursed by a Web 2 juin 2020 nbsp 0183 32 On 28 May the Court of Justice of the European Union in the World Comm Trading case Case C 684 18 addressed the VAT consequences of rebates for

Download Tax Treatment Of Sales Rebates

More picture related to Tax Treatment Of Sales Rebates

S4 Rebate

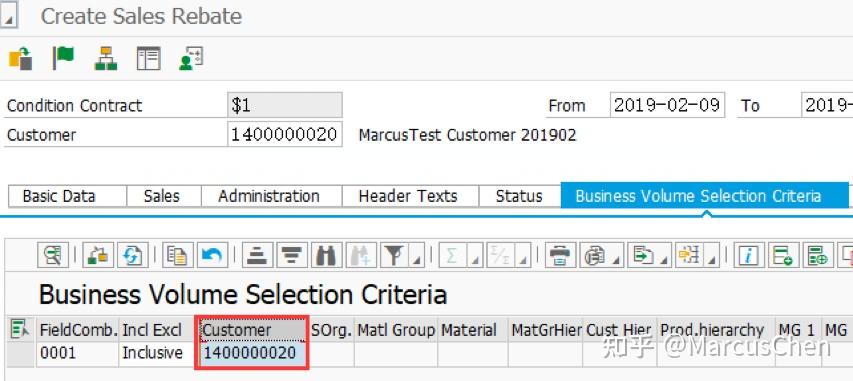

https://pic2.zhimg.com/v2-a5f0101f97c58eac5cd9ebec3e09e0bd_r.jpg

Tulsa Sales Tax Rebate Form Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/27/773/27773189/large.png

S4 Rebate

https://pic1.zhimg.com/v2-3e4f7edf067656a22b1947316bf76978_b.jpg

Web IFRS 15 also specifies the accounting treatment for certain items not typically thought of as revenue such as certain costs associated with obtaining and fulfilling a contract and Web 22 janv 2022 nbsp 0183 32 A rebate is a credit paid to a buyer of a portion of the amount paid for a product or service In a short sale a rebate is a fee that the borrower of stock pays to the investor who loaned

Web Updated August 1 2023 We have come across many problems with rebate management spanning commercial financial and operational processes Today we re focusing in on the financial side of rebate Web 1 d 233 c 2022 nbsp 0183 32 Federal state and local legislatures frequently issue tax rebates to encourage taxpayers to make certain types of purchases or to stimulate a flagging economy quickly

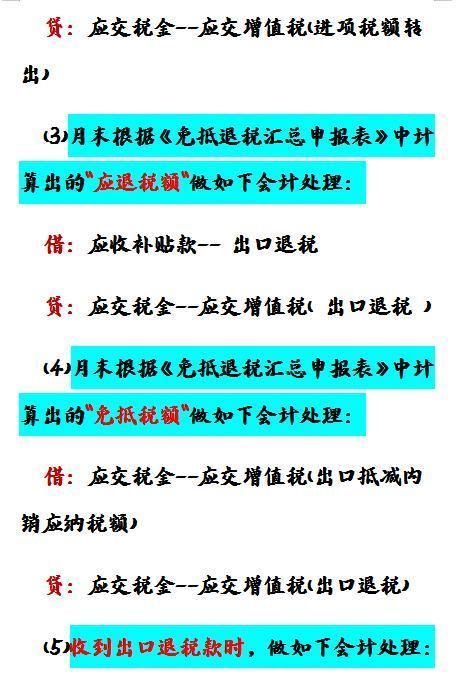

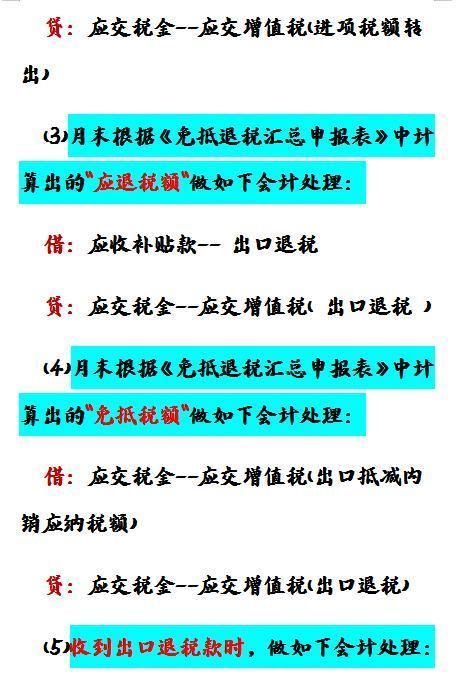

Foreign Trade Accountant Come Here This Export Tax Rebate Accounting

https://biz-crm-waimao.su.bcebos.com/biz-crm-waimao/maichongxing/history/online/article/img/2022/03/04/84f196bb4051c5afd2fd82c3320b035cde41d285.jpeg

S4 Rebate

https://pic4.zhimg.com/v2-8274f327960e0687711c881e3b702437_r.jpg

https://www.grantthornton.global/.../inventory …

Web 10 nov 2015 nbsp 0183 32 This issue considers how a purchaser accounts for discounts and rebates when buying inventory What s the issue Discounts and

https://www.grantthornton.global/globalassets/1.-member-fir…

Web What s the issue Discounts and rebates can be offered to purchasers in a number of ways for example trade discounts settlement discounts volume based rebates and other

Explaining Journal Entries And Rebates

Foreign Trade Accountant Come Here This Export Tax Rebate Accounting

How To Account For The Sales Rebate Received From The Supplier In The

Tax Treatment On Assets Held For Sales Sep 08 2021 Johor Bahru JB

Set Up Your Rebate Program Unit Salesforce Trailhead

What Is Rebate GETBATS Blog

What Is Rebate GETBATS Blog

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

S4 Rebate

Pin On Tigri

Tax Treatment Of Sales Rebates - Web Rebates are a widely used type of sales incentive Customers typically pay full price for goods or services at contract inception and then receive a cash rebate in the future This