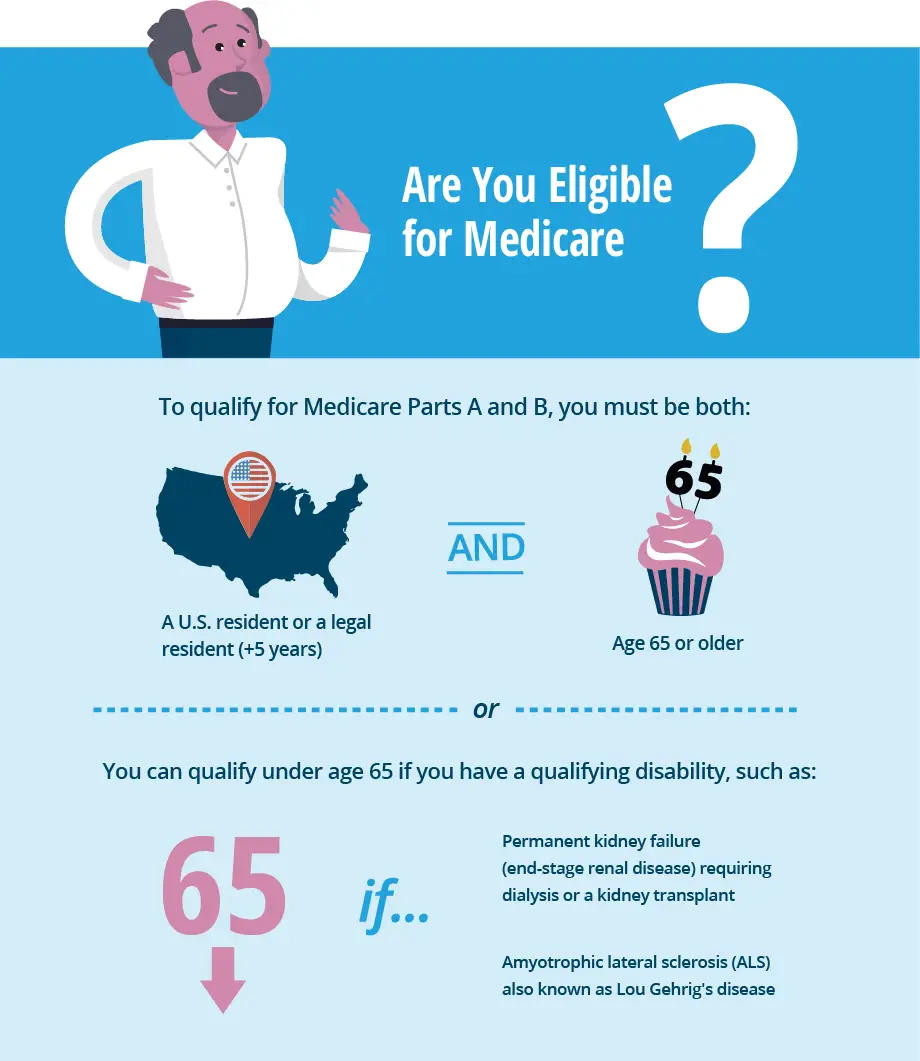

Do I Get Medicare Tax Back Web How to Request a Refund If your employer has withheld Social Security or Medicare taxes in error follow these steps Request a refund from your employer You must first request a refund of these taxes from your employer If your employer is able to refund these taxes no further action is necessary For Yale earned income contact the Yale

Web 5 Dez 2023 nbsp 0183 32 The Medicare tax rate for 2023 and 2024 is 2 9 and is split between employees and their employer with each paying 1 45 It s a mandatory payroll tax applied to earned income and wages and Web Updated September 21 2023 Reviewed by Erika Rasure Fact checked by Pete Rathburn What Is Medicare Tax Medicare tax or hospital insurance tax is a federal employment tax that funds a

Do I Get Medicare Tax Back

Do I Get Medicare Tax Back

https://www.retireguide.com/wp-content/uploads/qualifiers-for-additional-medicare-tax-768x0-c-default.jpg

What Is Medicare Tax Definitions Rates And Calculations ValuePenguin

https://res.cloudinary.com/value-penguin/image/upload/c_limit,dpr_1.0,f_auto,h_1600,q_auto,w_1600/v1/health_insurance/medicare-tax-rate-full.jpg

Why Is Medicare

https://www.iselect.com.au/content/uploads/2018/05/ISEL0021-Medicare_Health_Tiles-900pix-v3.png

Web 29 Juni 2020 nbsp 0183 32 While everyone pays some taxes toward Medicare you ll only pay the additional tax if you re at or above the income limits If you earn less than those limits you won t be required to pay Web 11 Sept 2023 nbsp 0183 32 Medicare taxes are subject to change However rates did not change from 2022 to 2023 Government agencies set tax rates and decide who is responsible for what amounts If the government decides to increase taxes in the future it is feasible you could see that reflected in your paycheck

Web Vor einem Tag nbsp 0183 32 In 2024 the standard premium is 174 70 This premium cost scales with your income going up to as much as 594 monthly Medicare Part B typically covers 80 of the total cost of eligible Web 21 Sept 2023 nbsp 0183 32 It is also known as the Medicare Part A tax Both employees and employers contribute to this tax with each paying a specific percentage of the employee s wages For employees The current tax rate for employees is 1 45 of their wages This means that 1 45 of the employee s earnings is withheld from their paycheck to fund

Download Do I Get Medicare Tax Back

More picture related to Do I Get Medicare Tax Back

Where Do I Enter My Medicare Tax On Form 1040

https://www.irs.gov/pub/xml_bc/33440030.gif

Download Instructions For IRS Form 8959 Additional Medicare Tax PDF

https://data.templateroller.com/pdf_docs_html/2017/20172/2017286/instructions-for-irs-form-8959-additional-medicare-tax_print_big.png

How and When Do I Get Medicare Coverage Healthfirst

https://learn.healthfirst.org/uploads/images/_1200x630_crop_center-center_82_none/[email protected]?mtime=1600182651

Web 26 M 228 rz 2016 nbsp 0183 32 Yes indeed The law requires you to pay Medicare taxes on all your earnings for as long as you continue to work regardless of whether you re already receiving Medicare benefits Sometimes the exact reverse of the preceding question is asked I m 60 and my employer recently quit taking Medicare and Social Security out of Web 21 Dez 2023 nbsp 0183 32 If you make 250 000 a year you ll pay a 1 45 Medicare tax on the first 200 000 and 2 35 on the remaining 50 000 Another result of ACA reforms is the Net Investment Income Tax NIIT

Web 27 Dez 2023 nbsp 0183 32 1 Medicare premiums are rising Let s start with the biggest basic Medicare change in 2024 premiums are going up changing what you ll pay for Medicare in 2024 In brief looking at the Web 13 Okt 2023 nbsp 0183 32 If you are unable to get a full refund of the amount from your employer file a claim for refund with the Internal Revenue Service on Form 843 Claim for Refund and Request for Abatement Attach the following items to Form 843 A copy of your Form W 2 to prove the amount of social security and Medicare taxes withheld If applicable INS Form

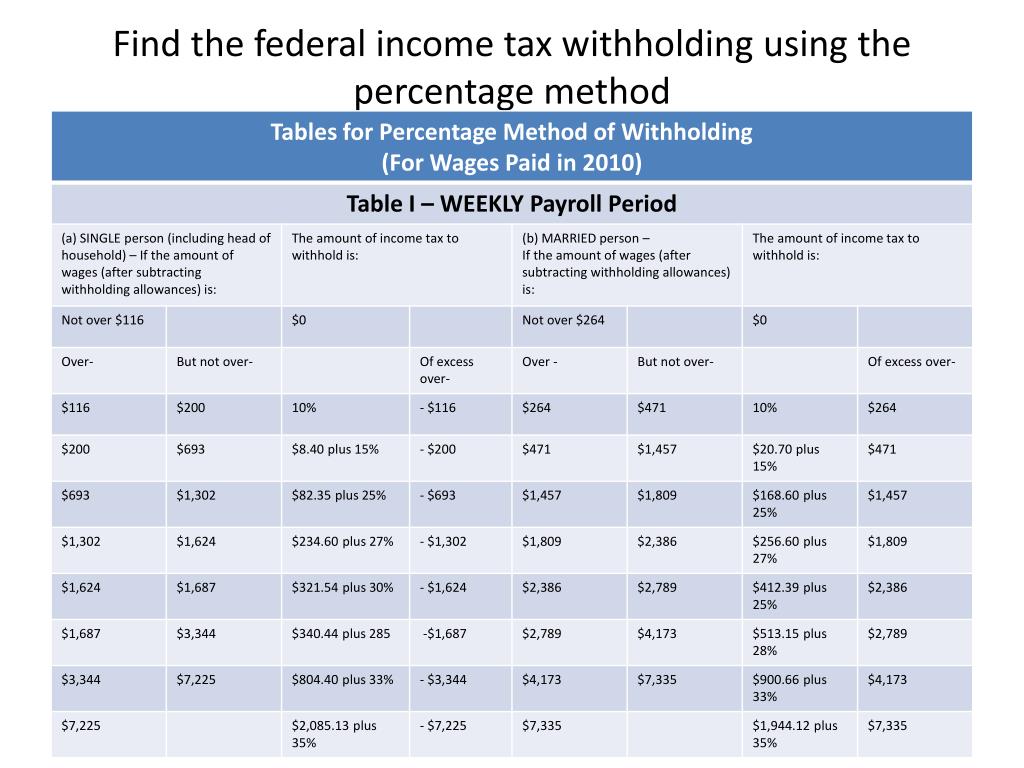

How To Find Medicare Tax Withheld

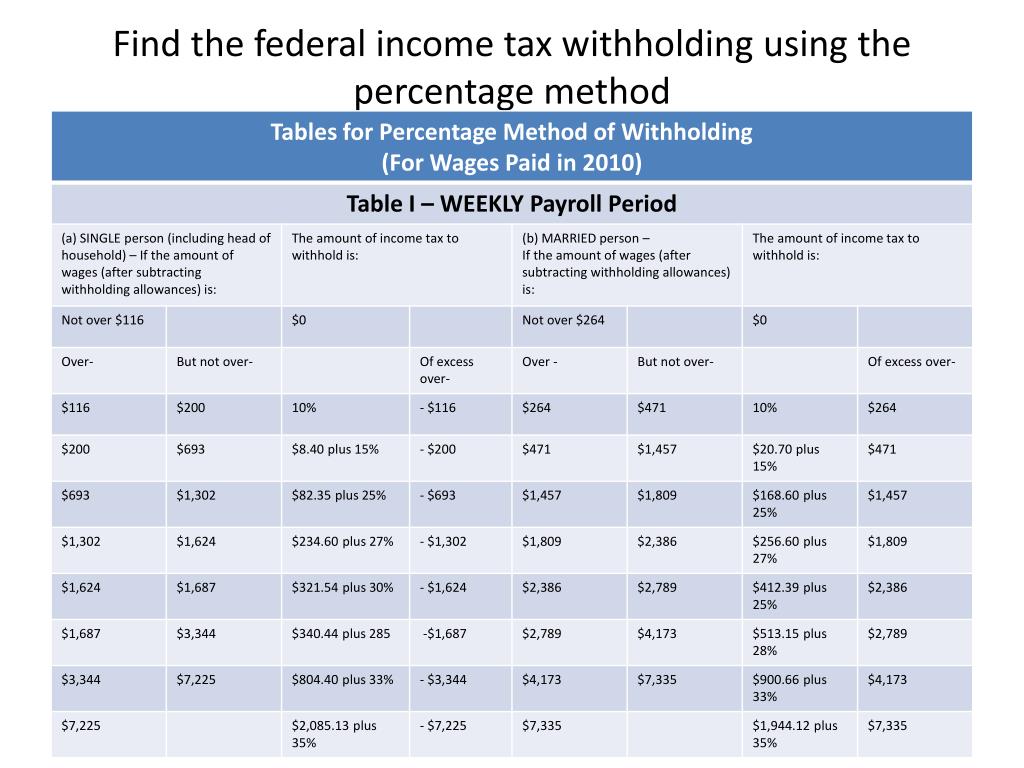

https://image1.slideserve.com/2765931/find-the-federal-income-tax-withholding-using-the-percentage-method1-l.jpg

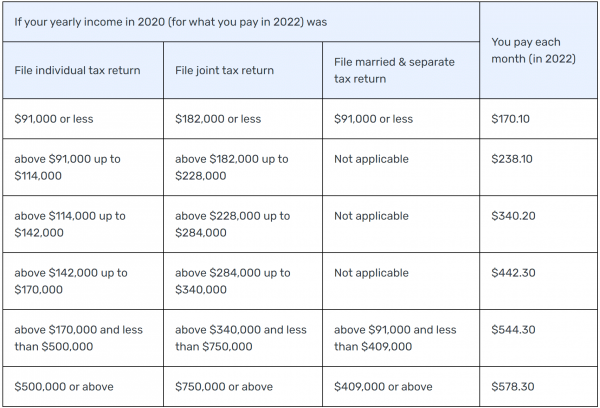

2022 IRMAA Medicare Brackets Tax Arnold Mote Wealth Management

https://arnoldmotewealthmanagement.com/wp-content/uploads/2020/12/2022-IRMAA-Medicare-brackets-tax-e1643923215509.png

https://oiss.yale.edu/.../us-taxes/social-security-and-medicare-tax-refund

Web How to Request a Refund If your employer has withheld Social Security or Medicare taxes in error follow these steps Request a refund from your employer You must first request a refund of these taxes from your employer If your employer is able to refund these taxes no further action is necessary For Yale earned income contact the Yale

https://www.nerdwallet.com/article/taxes/medicare-tax

Web 5 Dez 2023 nbsp 0183 32 The Medicare tax rate for 2023 and 2024 is 2 9 and is split between employees and their employer with each paying 1 45 It s a mandatory payroll tax applied to earned income and wages and

What Is Medicare Tax Withheld On Paystub

How To Find Medicare Tax Withheld

Why Is There A Medicare Tax On My Paycheck

What Is The Employee Medicare Tax

When Are You Eligible For Medicare Part B

Where To Get Medicare Information MedicareTalk

Where To Get Medicare Information MedicareTalk

When Do You Get Medicare After Disability MedicareTalk

RACGP Any Plan To strengthen Medicare Must Include These Three Things

Medicare Advantage Give Back Benefit Part B Reduction Plans YouTube

Do I Get Medicare Tax Back - Web 21 Sept 2023 nbsp 0183 32 It is also known as the Medicare Part A tax Both employees and employers contribute to this tax with each paying a specific percentage of the employee s wages For employees The current tax rate for employees is 1 45 of their wages This means that 1 45 of the employee s earnings is withheld from their paycheck to fund