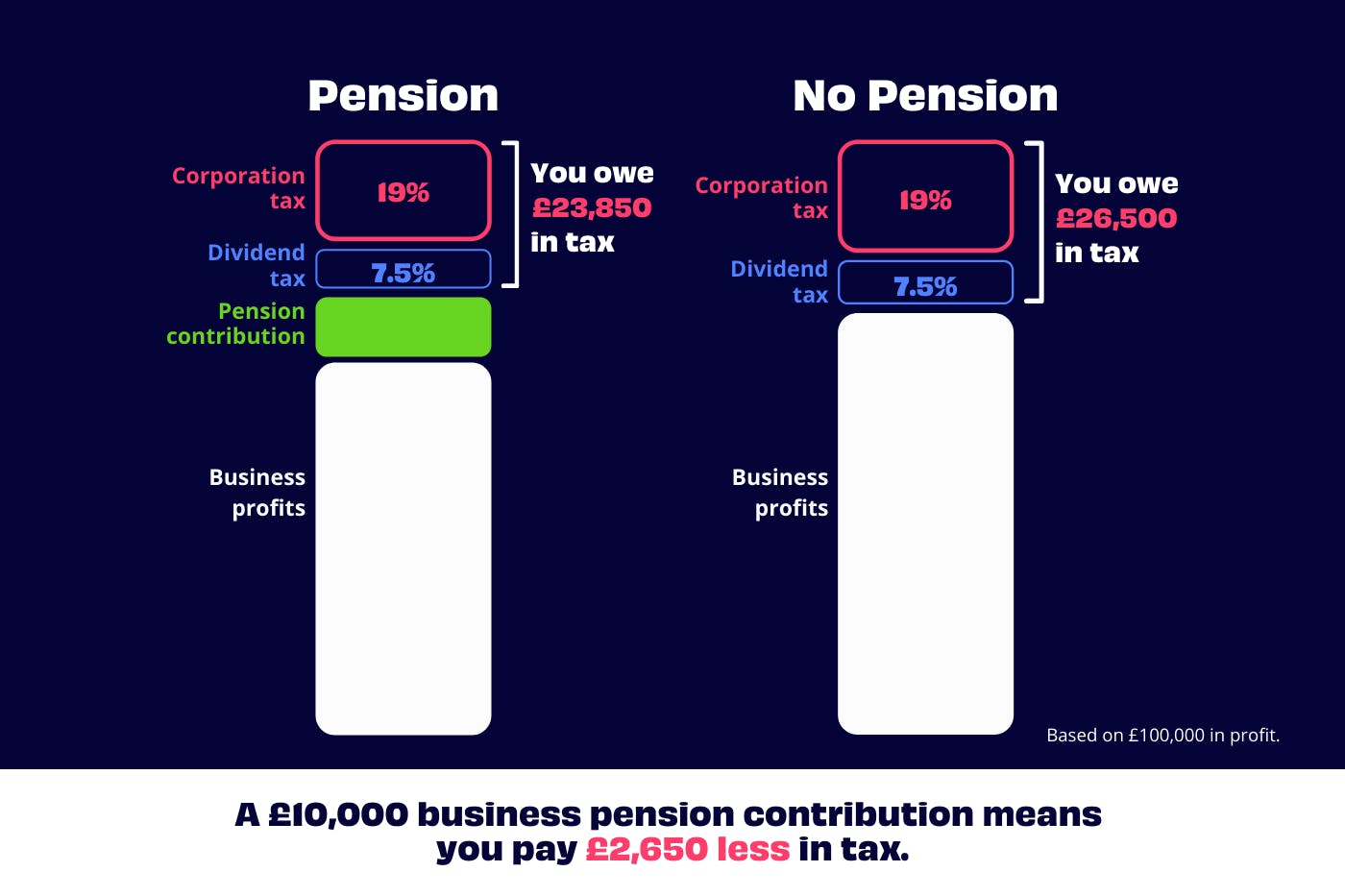

Do I Get Tax Relief On My Company Pension Contributions Web 9 Jan 2023 nbsp 0183 32 Because an employer contribution counts as an allowable company pension scheme business expense your company receives tax relief against corporation tax

Web 3 Apr 2023 nbsp 0183 32 Tax relief is paid on your pension contributions at the highest rate of income tax you pay So Basic rate taxpayers get 20 pension tax relief Higher rate taxpayers Web There are two ways you can get tax relief on your pension contributions These are known as relief at source and net pay If you re in a workplace pension your employer

Do I Get Tax Relief On My Company Pension Contributions

Do I Get Tax Relief On My Company Pension Contributions

https://www.provisio.co.uk/wp-content/uploads/2015/07/pensionsimage.jpg

Claiming Tax Relief On Personal Contributions

https://s3.studylib.net/store/data/008863819_1-2f6094913014d745c3da18091a1e8c10-768x994.png

Low Take Up Of Tax Relief On Donations Means Charities Could Be Missing

https://fundraising.co.uk/wp-content/uploads/2022/04/Screenshot-2022-04-06-at-07.18.04.png

Web 13 Apr 2023 nbsp 0183 32 Company employer contributions and tax relief 13 April 2023 6 min read How much can a company or employer pay into a pension plan Key facts Web Tax relief The government will usually add money to your workplace pension in the form of tax relief if both of the following apply you pay Income Tax you pay into a personal

Web You do not need to do anything to get tax relief at the basic tax rate on your pension contributions There are 2 types of arrangements net pay relief at source Check with Web 6 Apr 2023 nbsp 0183 32 Key points Tax relief on employer contributions is given by allowing pension contributions to be deducted as a legitimate business expense

Download Do I Get Tax Relief On My Company Pension Contributions

More picture related to Do I Get Tax Relief On My Company Pension Contributions

Changes In NHS Pension Contributions Are You A Winner Or Loser

https://www.legalandmedical.co.uk/wp-content/uploads/2022/07/Pensionable-pay1-768x742.jpg

Mac Financial Making Pension Contributions Before The End Of The Tax

http://macfinancial.uk.com/wp-content/uploads/2016/02/pension1.jpg

Can I Get Tax Relief On Pension Contributions Financial Advisers

https://www.insightifa.com/wp-content/uploads/2022/12/Tax-Relief-On-Pensions.jpg

Web 13 Mai 2022 nbsp 0183 32 Will my company qualify for tax relief on pension contributions For a trade or profession employer contributions are tax deductible if they re incurred wholly and Web 12 Mai 2016 nbsp 0183 32 You can get tax relief on most contributions you make to registered pension schemes some overseas pension schemes You can t claim relief for

Web Vor 6 Tagen nbsp 0183 32 If you re paying into a workplace pension scheme organised by your employer and are earning under 163 50 270 for the 2023 24 tax year you won t need to declare your Web 11 Dez 2023 nbsp 0183 32 Depending on your earnings you ll receive tax relief at your highest marginal rate either 20 40 or 45 For the 2023 23 tax year the corporation tax

Are You Missing Out On Pension Tax Breaks St Edmundsbury Wealth

https://stedswm.co.uk/wp-content/uploads/2022/05/image001.png

Self Employed Pension Tax Relief Explained Penfold Pension

https://images.prismic.io/penfold/d68abe56-2255-43f5-8412-5d0e13153a09_yearly-self-employed-pension-tax-relief.png?auto=compress

https://www.pensionbee.com/pensions-explained/self-employed/...

Web 9 Jan 2023 nbsp 0183 32 Because an employer contribution counts as an allowable company pension scheme business expense your company receives tax relief against corporation tax

https://www.which.co.uk/money/pensions-and-retirement/personal-pensions...

Web 3 Apr 2023 nbsp 0183 32 Tax relief is paid on your pension contributions at the highest rate of income tax you pay So Basic rate taxpayers get 20 pension tax relief Higher rate taxpayers

Pension Tax Relief In The United Kingdom UK Pension Help

Are You Missing Out On Pension Tax Breaks St Edmundsbury Wealth

How To Get Tax Relief On Bad Debt CHW Accounting

Clive Owen LLP Claiming Higher Rate Tax Relief For Pension Contributions

Tax Relief On Personal Pension Contributions Shaw Austin Accountants

How To Get Tax Relief On Pension Contributions

How To Get Tax Relief On Pension Contributions

Self Employed Pension Tax Relief Explained Penfold Pension

Pensions Contributions Personal Vs Company ICS Accounting

Learn How To Generate Tax Debt Relief Leads At Broker Calls

Do I Get Tax Relief On My Company Pension Contributions - Web You do not need to do anything to get tax relief at the basic tax rate on your pension contributions There are 2 types of arrangements net pay relief at source Check with