Do I Have To Claim Inheritance On My Tax Return For the 2021 tax year you don t have to worry about paying federal tax on an inheritance unless its value is worth over 11 7 million or double that for married couples

Generally inherited property including cash stocks and real estate is not taxable or reportable on a personal 1040 federal return However any income earned from an If you receive a Schedule A to Form 8971 from an executor of an estate or other person required to file an estate tax return you may be required to report a basis consistent

Do I Have To Claim Inheritance On My Tax Return

Do I Have To Claim Inheritance On My Tax Return

https://wealthmanagementcanada.com/wp-content/uploads/2023/01/Receiving-an-Inheritance-in-Canada-Blog-in-post.jpg

Uml Inheritance And Composition Problem In Class Diagram Stack Overflow

https://i.stack.imgur.com/JCO3q.png

Reinvest Your Tax Refund Into Your Business YouTube

https://i.ytimg.com/vi/7O_QhQ_cNvo/maxresdefault.jpg

Do I need to report inheritance on my tax return If you received a gift or inheritance do not include it in your income However if the gift or inheritance later produces You DO need to declare any INCOME received from the estate on your tax return The executors should have provided you with an IR form detailing it and the tax they paid on your behalf

Generally when you inherit money it is tax free to you as a beneficiary This is because any income received by a deceased person prior to their death is taxed on their own final individual return so it is not taxed again If you inherited assets you may owe inheritance tax Learn the basics of tax on inheritance including who pays it and how to report it to the IRS

Download Do I Have To Claim Inheritance On My Tax Return

More picture related to Do I Have To Claim Inheritance On My Tax Return

Do I Have To Claim My Inheritance On My Taxes On Probate Law

https://onprobatelaw.com/wp-content/uploads/2023/03/indianapolis-probate-lawyer-1024x512.jpeg

Disclaimer Of Inheritance Form Fill Online Printable Fillable

https://www.pdffiller.com/preview/481/367/481367606/large.png

Korean Inheritance Law based On 2022 Korean Civil Code

https://pureumlawoffice.com/wp-content/uploads/2020/04/1_Hpo-Ul458utGdaE2m1xrXw-1.jpeg

There is no federal inheritance tax that is a tax on the sum of assets an individual receives from a deceased person However the Internal Revenue Service IRS can impose a When you inherit money or property from a loved one you don t typically have to report it to the IRS or pay federal taxes However your inheritance may be taxed at the state level depending on where you live You

Beneficiaries generally don t have to pay income tax on money or other property they inherit with the common exception of money withdrawn from an inherited retirement After the grief of losing a loved one has worn off you may be wondering whether you have to share any of your inheritance with Uncle Sam Money that you inherit isn t counted

Do I Claim Inheritance On My Taxes Prudent Investors

https://media.prudentinvestors.com/hubfs/Imported_Blog_Media/paytax_hero.png

Inheritance Letter Sample How To Write An Inheritance Letter

http://culturopedia.net/wp-content/uploads/2023/04/inheritance-letter-sample.jpg

https://pocketsense.com

For the 2021 tax year you don t have to worry about paying federal tax on an inheritance unless its value is worth over 11 7 million or double that for married couples

https://ttlc.intuit.com › community › taxes › discussion › ...

Generally inherited property including cash stocks and real estate is not taxable or reportable on a personal 1040 federal return However any income earned from an

Sample Letter Sale Agreement Doc Template PdfFiller

Do I Claim Inheritance On My Taxes Prudent Investors

The Inheritance Game Characters Inheritance Truly Devious Fanart

Women Have To Claim Inheritance Right In Life Supreme Court Says

Tax free Way To Pass On An Inheritance While Still Alive MoneySense

How To Claim Inheritance Money From Overseas YouTube

How To Claim Inheritance Money From Overseas YouTube

Sample Inheritance Letter

Do I Need To Amend My Tax Return For Unemployment TaxesTalk

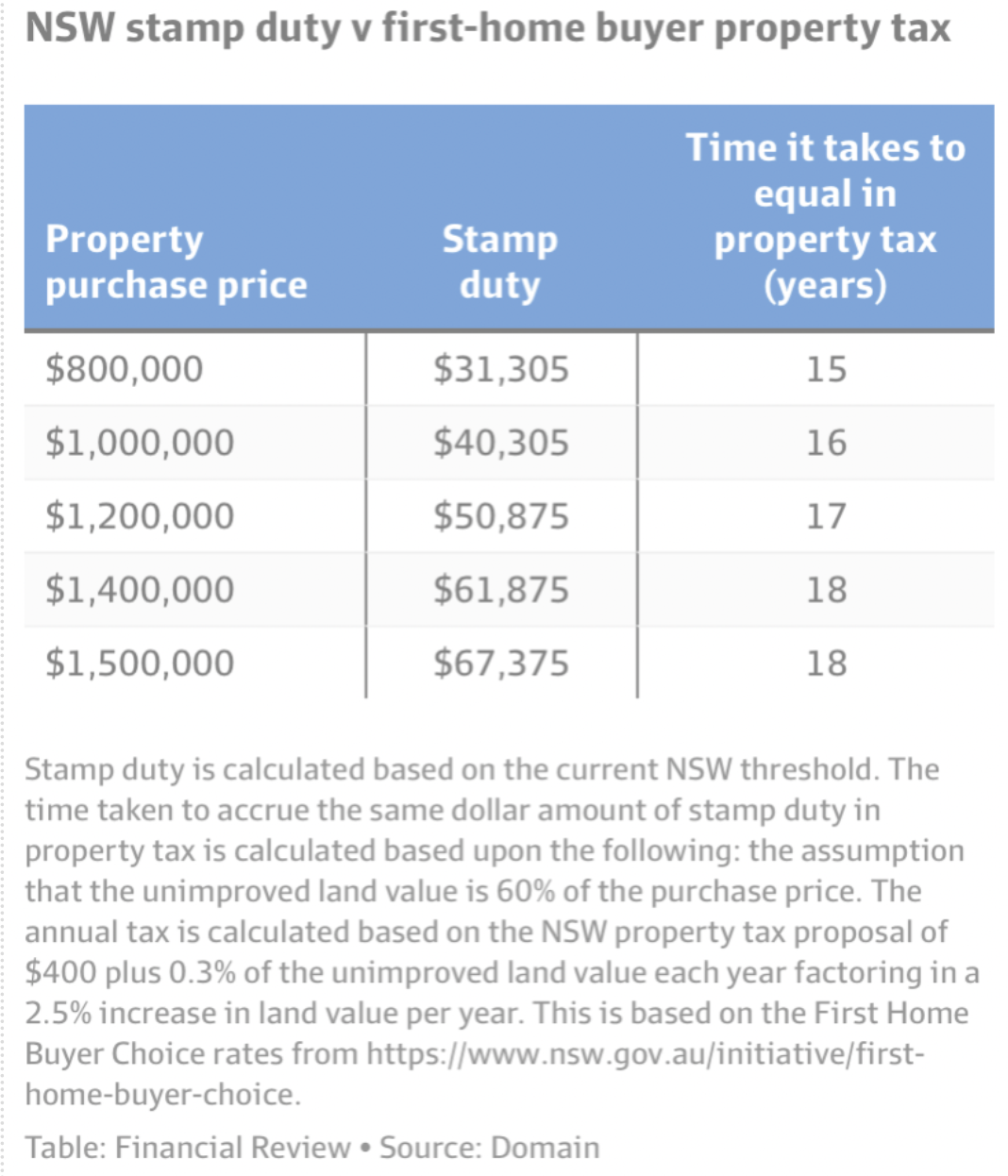

Stamp Duty Vs Land Tax Which Will Cost You More YIP

Do I Have To Claim Inheritance On My Tax Return - Generally when you inherit money it is tax free to you as a beneficiary This is because any income received by a deceased person prior to their death is taxed on their own final individual return so it is not taxed again