Do I Have To Pay Social Security Tax When I Retire Once retired and living on unearned income you will no longer be paying Social Security and Medicare payroll taxes You will still be subject to income taxes at

If you decide to strike out on your own in retirement you ll probably need to pay income taxes on your earnings plus Social Security and Medicare taxes 12 4 on the first 160 200 of You will pay tax on your Social Security benefits based on Internal Revenue Service IRS rules if you File a federal tax return as an individual and your combined income is

Do I Have To Pay Social Security Tax When I Retire

Do I Have To Pay Social Security Tax When I Retire

https://www.picnictax.com/wp-content/uploads/2020/10/x8266555568_76a0221632_k.jpg.pagespeed.ic_.7UZk5tRppC.jpg

Social Security Benefit Taxes By State 13 States Might Tax Benefits

https://www.gannett-cdn.com/-mm-/9e1f6e2ee20f44aa1f3be4f71e9f3e52b6ae2c7e/c=0-110-2121-1303/local/-/media/2020/03/08/USATODAY/usatsports/MotleyFool-TMOT-3a93e1ff-6cd31771.jpg?width=2121&height=1193&fit=crop&format=pjpg&auto=webp

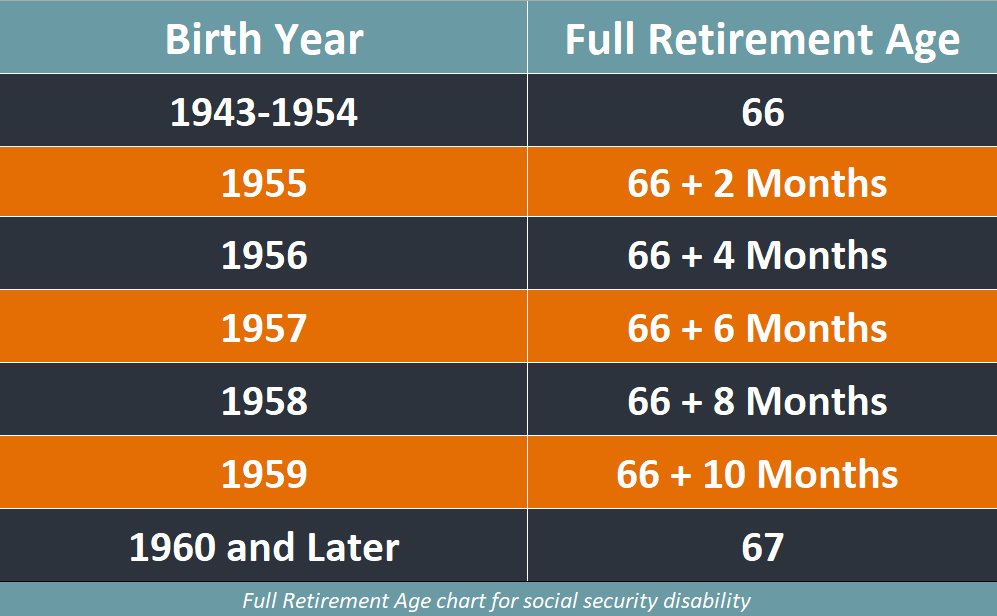

Can You Collect Social Security At 66 And Still Work Full Time

https://www.clausonlaw.com/blog/wp-content/uploads/2022/08/data-1.png

However there are narrow exceptions to paying Social Security taxes that apply at any age such as an individual who qualifies for a religious exemption When you re ready to Aug 25 2023 at 10 06 a m When You Pay Taxes on Social Security Getty Images If your combined income is between 25 000 and 34 000 32 000 and 44 000 for couples you could owe income tax

You must pay taxes on up to 85 of your Social Security benefits if you file a Federal tax return as an individual and your combined income exceeds 25 000 Joint return and Social Security income is generally taxable at the federal level though whether or not you have to pay taxes on your depends on your income level If you have other sources of retirement income such

Download Do I Have To Pay Social Security Tax When I Retire

More picture related to Do I Have To Pay Social Security Tax When I Retire

Social Security GuangGurpage

https://www.pgpf.org/sites/default/files/03-Should-We-Eliminate-the-Social-Security-Tax-Cap-graphic-2023.jpg

What Happens If You Don t Pay Your Taxes A Complete Guide All

https://www.allthingsfinance.net/wp-content/uploads/2020/04/image1-56-1536x1086.jpg

Got A Job At Age 70 Do I Pay Into Social Security Again

https://i2.cdn.turner.com/money/dam/assets/131219135502-social-security-pay-1024x576.png

However there are narrow exceptions to paying Social Security taxes that apply at any age such as an individual who qualifies for a religious exemption When you re ready to Retirement Money Home 10 Social Security Rules Everyone Should Know These rules dictate how much you will pay into Social Security and the amount you will

If you are at least 65 unmarried and receive 15 700 or more in nonexempt income in addition to your Social Security benefits you typically need to file Say you file individually have 50 000 in income and get 1 500 a month from Social Security You would pay taxes on 85 percent of your 18 000 in annual

Social Security Tax Increase In 2023 City Of Loogootee

https://cityofloogootee.com/wp-content/uploads/2022/10/cropped-Social-Security-Tax-Increase-in-2023.jpg

Thousands Of Seniors May No Longer Have To Pay Social Security Tax

https://www.the-sun.com/wp-content/uploads/sites/6/2022/03/NINTCHDBPICT000716297258.jpg?w=620

https://www.forbes.com/sites/davidrae/2020/02/23/...

Once retired and living on unearned income you will no longer be paying Social Security and Medicare payroll taxes You will still be subject to income taxes at

https://www.nerdwallet.com/article/investing/...

If you decide to strike out on your own in retirement you ll probably need to pay income taxes on your earnings plus Social Security and Medicare taxes 12 4 on the first 160 200 of

How Tax Rates In Canada Changed In 2022 Loans Canada 2022

Social Security Tax Increase In 2023 City Of Loogootee

10 Ways To Increase Your Social Security Payments

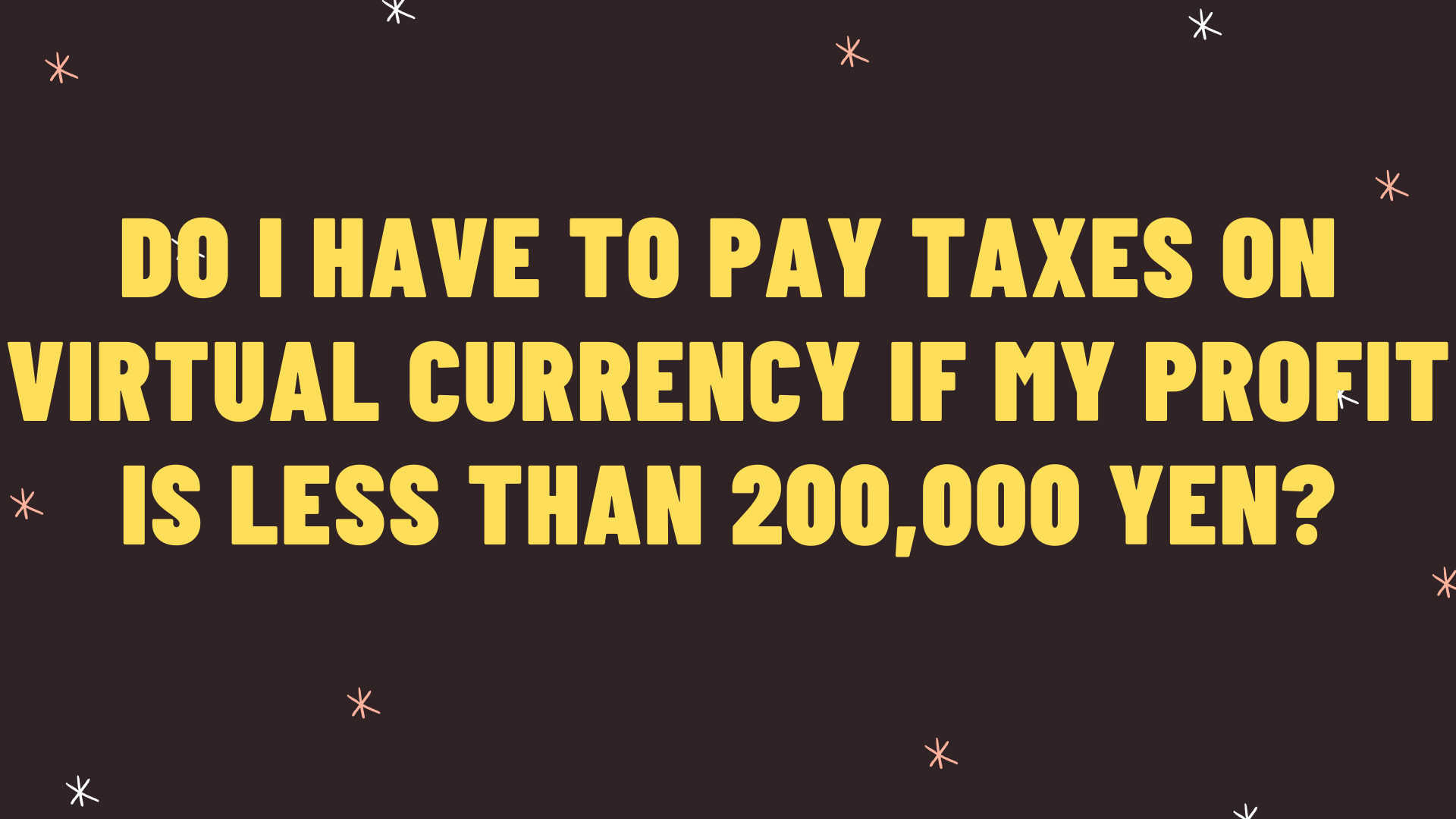

Do I Have To Pay Taxes On Virtual Currency If My Profit Is Less Than

Will I Still Have To Pay Social Security If I Work Past Retirement Age

Do I Have To Pay LMI As A Lump Payment

Do I Have To Pay LMI As A Lump Payment

You May Have To Pay Tax On Social Security Benefits Boris Benic And

When It Pays To Pay Social Security Tax

Do I Have To Pay Taxes On Venmo Transactions Taxation Rules

Do I Have To Pay Social Security Tax When I Retire - However there are narrow exceptions to paying Social Security taxes that apply at any age such as an individual who qualifies for a religious exemption When you re ready to