Do I Owe Franchise Tax California S Corporations will have to pay the franchise tax at 1 5 of the taxable income or 800 whichever is higher for the fiscal year Limited Liability Companies LLCs pay a minimum of 800 franchise tax in California Their franchise tax varies by income level Income from 250 000 to 499 999 pay 900 tax

You may owe penalties and interest even if your tax return shows that a refund is due Penalty 25 of the total tax amount due regardless of any payments or credits made on time Every corporation that is incorporated registered or doing business in California must pay the 800 minimum franchise tax Exceptions to the first year minimum tax Newly incorporated or qualified corporations are not required to pay the minimum franchise tax in their first taxable year

Do I Owe Franchise Tax California

Do I Owe Franchise Tax California

https://i.pinimg.com/originals/be/ea/f7/beeaf7fbee754333e1d98b73aaff4ade.png

Do I Owe The Exit Tax When I Sell My Home At A Loss NJMoneyHelp

https://njmoneyhelp.com/wp-content/uploads/2020/04/house-2368389_1920-1024x683.jpg

Selling A Home Outside The U S Do I Owe Taxes To The IRS ThinkGlink

https://www.thinkglink.com/wp-content/uploads/2023/04/Selling-a-house-scaled.jpeg

At the time of publication the yearly California franchise tax is 800 for all noncorporate entities subject to the tax For corporations the 800 figure is the minimum franchise tax due The state requires corporations to pay either 800 or the corporation s net income multiplied by its applicable corporate tax rate whichever is larger State of California Franchise Tax Board Corporate Logo e Services

How Do You Calculate California Franchise Tax The minimum 800 annual franchise tax is straightforward when it applies Other taxes such as the S Corporation tax or Corporation tax are more complicated because they are based on net income Net income refers to income minus tax deductions Yes You ll have to make your franchise tax payment for that year plus pay a 250 penalty to the California Franchise Tax Board On top of that you ll continue to owe the California Franchise Tax until you reinstate your suspended business

Download Do I Owe Franchise Tax California

More picture related to Do I Owe Franchise Tax California

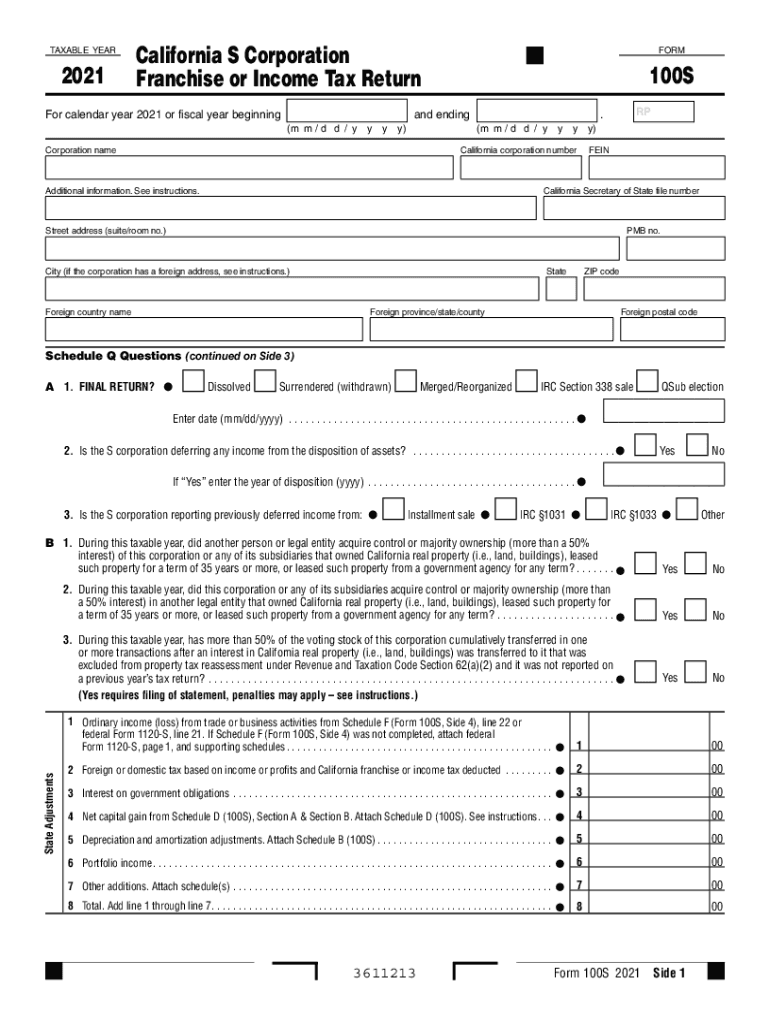

California 100s Instructions 2021 2024 Form Fill Out And Sign

https://www.signnow.com/preview/585/642/585642824/large.png

Why Do I Owe Taxes This Year On My 1040NR Tax Return NRA Tax Explained

https://blog.sprintax.com/wp-content/uploads/2023/04/Why-owe-money-on-tax-return-nonresident-min.jpg

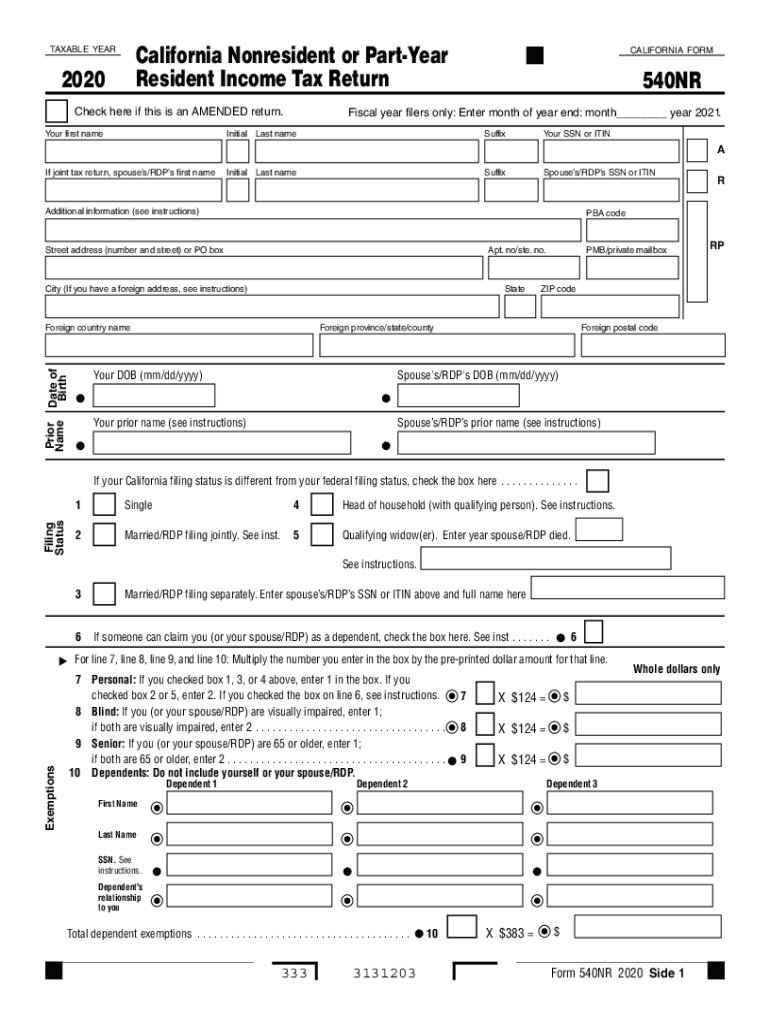

540nr 2020 2024 Form Fill Out And Sign Printable PDF Template

https://www.signnow.com/preview/560/831/560831996/large.png

California law generally imposes a minimum franchise tax of 800 on every corporation incorporated qualified to transact business or doing business in California A corporation that incorporates or qualifies to do business in California is exempt from paying the minimum franchise tax in its first taxable year For tax years beginning on or after January 1 2021 and before January 1 2024 LLCs that organize register or file with the Secretary of State to do business in California are not subject to the annual tax of 800 for their first tax year

What you may owe You filed tax return You received a letter Estimated tax payments Popular Court ordered debt Vehicle registration collections Wage withholding Last updated 01 22 2024 Pay including payment options collections withholding and if I owe California CA state taxes and can t pay What do I do February 07 2020 by Jean Lee Scherkey EA Getting a bill from the California Franchise Tax Board CA FTB is an awful lot like receiving a confirmation from the Bates Motel about your upcoming stay especially when you can t pay the balance due

Why Do I Owe The California Franchise Tax Board For Special Situations

https://www.besttaxserviceca.com/wp-content/uploads/2022/03/why-do-i-owe-the-california-franchise-tax-board-for-special-situations.webp

When To Pay Franchise Tax In California

https://www.taxuni.com/wp-content/uploads/2021/04/Franchise-Tax-Board-Forms.jpg

https://www.accountinghub-online.com/california-franchise-tax

S Corporations will have to pay the franchise tax at 1 5 of the taxable income or 800 whichever is higher for the fiscal year Limited Liability Companies LLCs pay a minimum of 800 franchise tax in California Their franchise tax varies by income level Income from 250 000 to 499 999 pay 900 tax

https://www.ftb.ca.gov/pay/penalties-and-interest

You may owe penalties and interest even if your tax return shows that a refund is due Penalty 25 of the total tax amount due regardless of any payments or credits made on time

Printable Federal Withholding Tables 2022 California Onenow

Why Do I Owe The California Franchise Tax Board For Special Situations

Simplifying Quarterly Tax Estimates

The Pros And Cons Of The California Franchise Tax Increase Icsid

Tony X On Twitter blockbuster I Never Returned This How Much Do I

Does My Texas Business Owe Franchise Tax STOP WORRYING YouTube

Does My Texas Business Owe Franchise Tax STOP WORRYING YouTube

Do I Owe My Friends An Explanation For Why I m Having Gastric Sleeve

How Much Do I Owe In Taxes Landsberg Bennett

Free IOU I Owe You Template Contract For Money Owed

Do I Owe Franchise Tax California - At the time of publication the yearly California franchise tax is 800 for all noncorporate entities subject to the tax For corporations the 800 figure is the minimum franchise tax due The state requires corporations to pay either 800 or the corporation s net income multiplied by its applicable corporate tax rate whichever is larger