Do I Pay Taxes On My Pension Income Pensions are taxable earnings Earnings related pensions the national pension and the guarantee pension are taxable income in Finland However pensioners housing allowance care allowance front veteran s supplements and the child increase of the national pension are exempt from tax

Tax card and tax return Income Earned income Tax rates on pay pensions and benefits in 2024 Your tax rate means how much tax you have to pay on the income you receive The tax rate is determined by the amount of earned income you receive during the year Earned income includes pay from employment as well as Payments from private and government pensions are usually taxable at your ordinary income rate Rubio says Pensions are normally taxed on the federal side In some cases the pension

Do I Pay Taxes On My Pension Income

Do I Pay Taxes On My Pension Income

https://i.ytimg.com/vi/GxsA3gpKoag/maxresdefault.jpg

8 Reasons To Hire Someone To Help With Your Income Tax Planning Black

https://blackdiamondfs.com/wp-content/uploads/2021/08/taxfilingstatus.jpeg

Do You Pay Taxes On Your Pension Income HowStuffWorks

https://media.hswstatic.com/eyJidWNrZXQiOiJjb250ZW50Lmhzd3N0YXRpYy5jb20iLCJrZXkiOiJnaWZcL3RheC1wZW5zaW9uLW9yaWcuanBnIiwiZWRpdHMiOnsicmVzaXplIjp7IndpZHRoIjoiMTIwMCJ9fX0=

You may have to pay Income Tax at a higher rate if you take a large amount from a private pension You may also owe extra tax at the end of the tax year If you take some or all of your Once you start receiving your pension the IRS regards it as income and you ll pay taxes on it accordingly on the federal level Check the tax laws in your state to see how it handles pension income because it can vary widely Pretax and post tax contributions to your pension make a difference

Our tax law provides for a pay as you go system which requires taxes to be paid on income as it is received There are two ways which taxes are typically paid ax T Withholding You can request federal tax be withheld from For example if you file as an individual and your combined income is between 25 000 and 34 000 you may have to pay income tax on up to 50 of your benefits If your income is more than 34 000 you may have to pay taxes on up to 85 of your benefits Taxes are limited to 85 of your Social Security benefits

Download Do I Pay Taxes On My Pension Income

More picture related to Do I Pay Taxes On My Pension Income

How Do I Pay Taxes On My I Bond Interest Nj

https://www.nj.com/resizer/6CBB5QUDqC-wm6WF_m76NuOhO9g=/1280x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/QZW7EKFWJZCBJCSEUA5K4ALSDY.jpg

CI Post 2 Do Immigrants Pay Taxes

https://sites.psu.edu/jasminracquel/wp-content/uploads/sites/4979/2014/01/Undoc_Taxes_Infographic.jpg

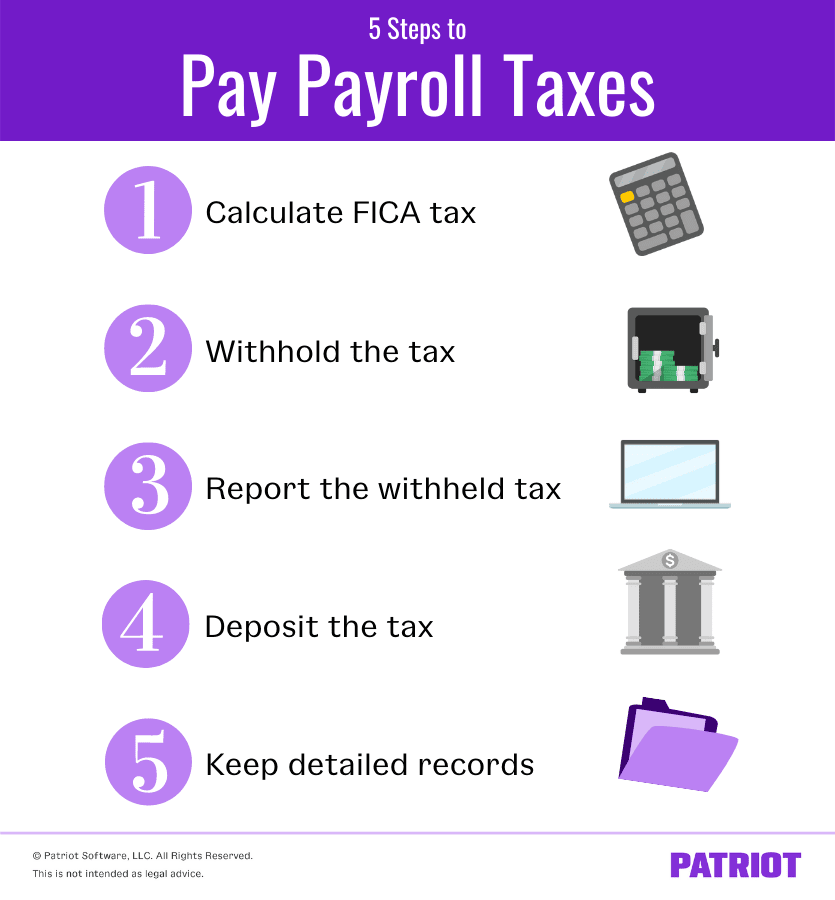

How To Pay Payroll Taxes Finansdirekt24 se

https://www.patriotsoftware.com/wp-content/uploads/2022/07/5-Steps-to-Pay-Payroll-Taxes-2-1.png

Here s the answer You don t pay tax on the portion of the pension payments that represent a return of the after tax amount you contributed Is my pension or annuity payment taxable ITA home This interview will help you determine if your pension or annuity payment from an employer sponsored retirement plan or nonqualified annuity is taxable It doesn t address Individual Retirement Arrangements IRAs Information you ll need

Updated April 29 2024 Reviewed by Khadija Khartit Fact checked by Suzanne Kvilhaug If you ve been proactive you ve saved for retirement through an individual retirement account IRA and 401 Social Security Benefits Depending on provisional income up to 85 of Social Security benefits can be taxed by the IRS at ordinary income tax rates Pensions Pension payments are generally

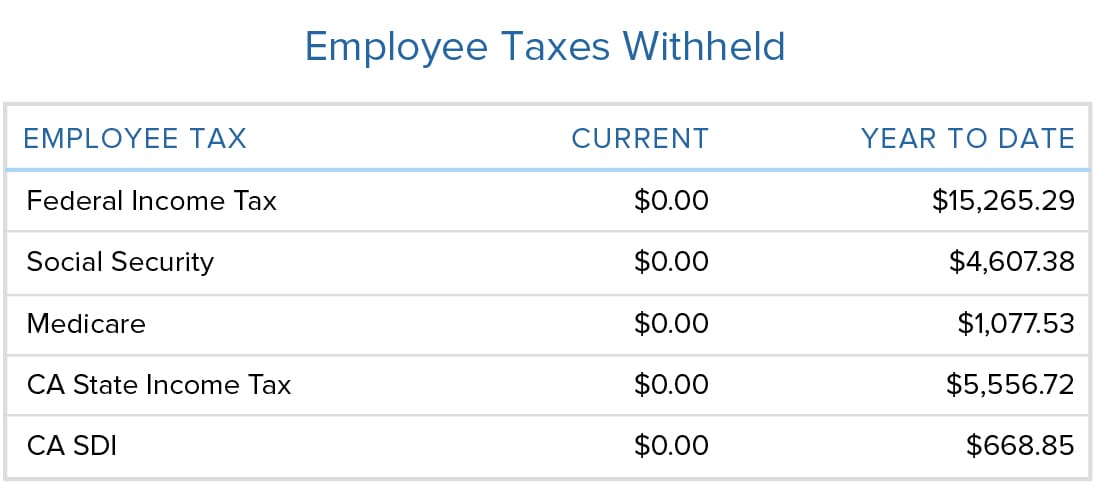

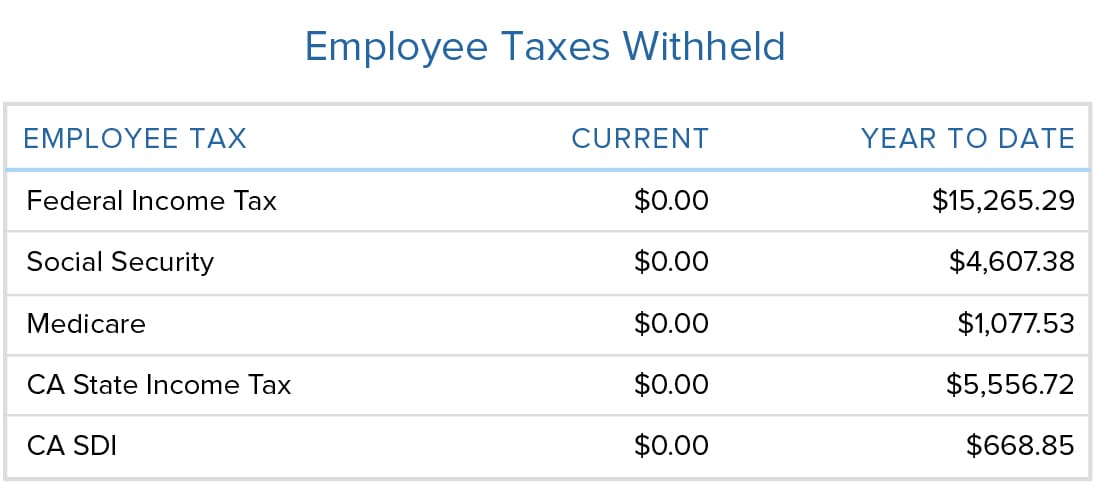

Where Can I Find My Year to date Federal And State Withholding Amount

https://support.joinheard.com/hc/article_attachments/4788931701143/Paystub-employee-taxes-withheld.jpeg

SO LET ME GET THIS STRAIGHT I m Paying TAXES On My Wages Then

https://imageproxy.ifunny.co/crop:x-20,resize:640x,quality:90x75/images/2a66c0b12e3516a5e3112fa5c7ca2ca1d1cdfaebac8fb4a10fb8ee18ffd4320b_1.jpg

https://www.etk.fi/.../pensions/taxation-of-pensions

Pensions are taxable earnings Earnings related pensions the national pension and the guarantee pension are taxable income in Finland However pensioners housing allowance care allowance front veteran s supplements and the child increase of the national pension are exempt from tax

https://www.vero.fi/en/individuals/tax-cards-and...

Tax card and tax return Income Earned income Tax rates on pay pensions and benefits in 2024 Your tax rate means how much tax you have to pay on the income you receive The tax rate is determined by the amount of earned income you receive during the year Earned income includes pay from employment as well as

Do I Have To Pay Taxes On My Weekly Workers Compensation Benefits Or

Where Can I Find My Year to date Federal And State Withholding Amount

How Much Does An Employer Pay In Payroll Taxes Tax Rate

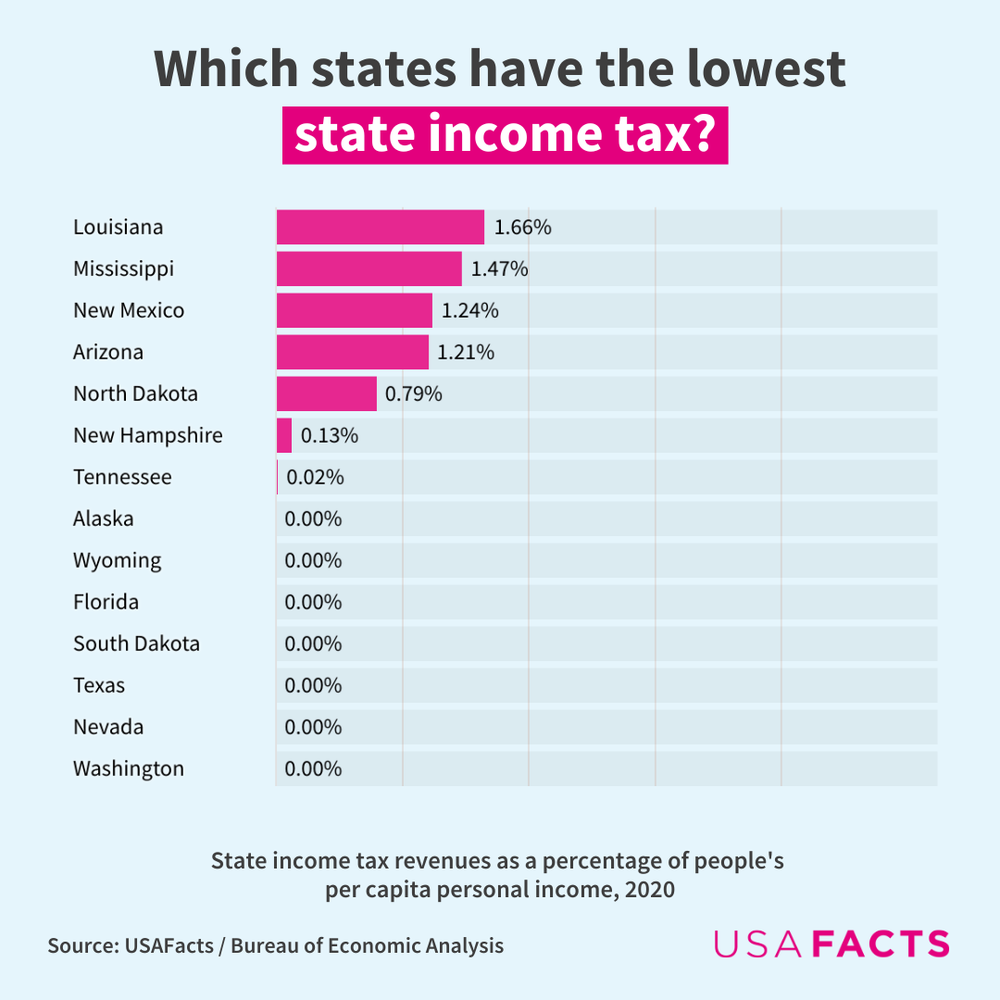

Which States Have The Highest And Lowest Income Tax USAFacts

Paying Taxes Poster Template Layout Revenue Vector Image

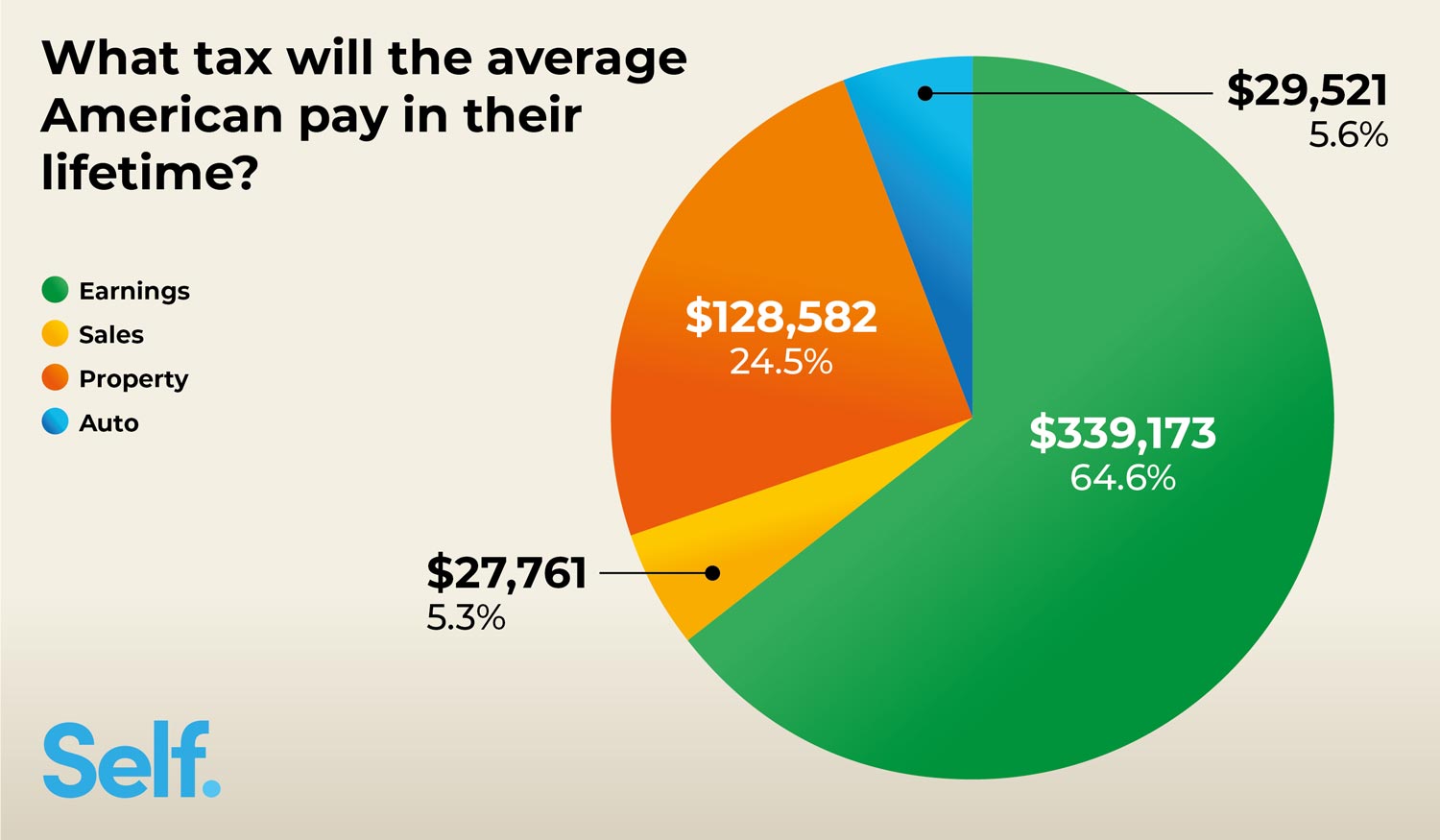

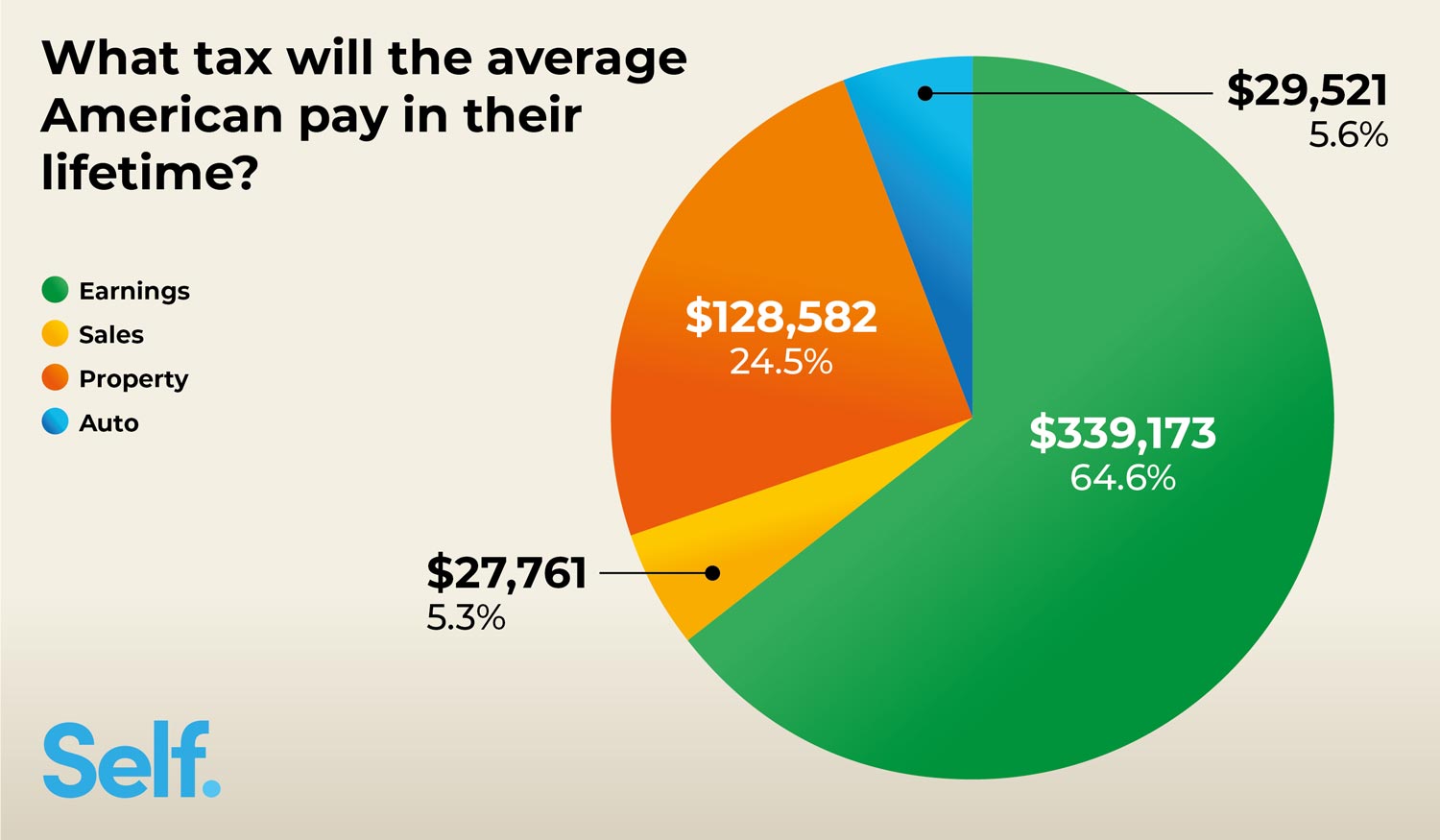

Life Of Tax How Much Tax Is Paid Over A Lifetime Self

Life Of Tax How Much Tax Is Paid Over A Lifetime Self

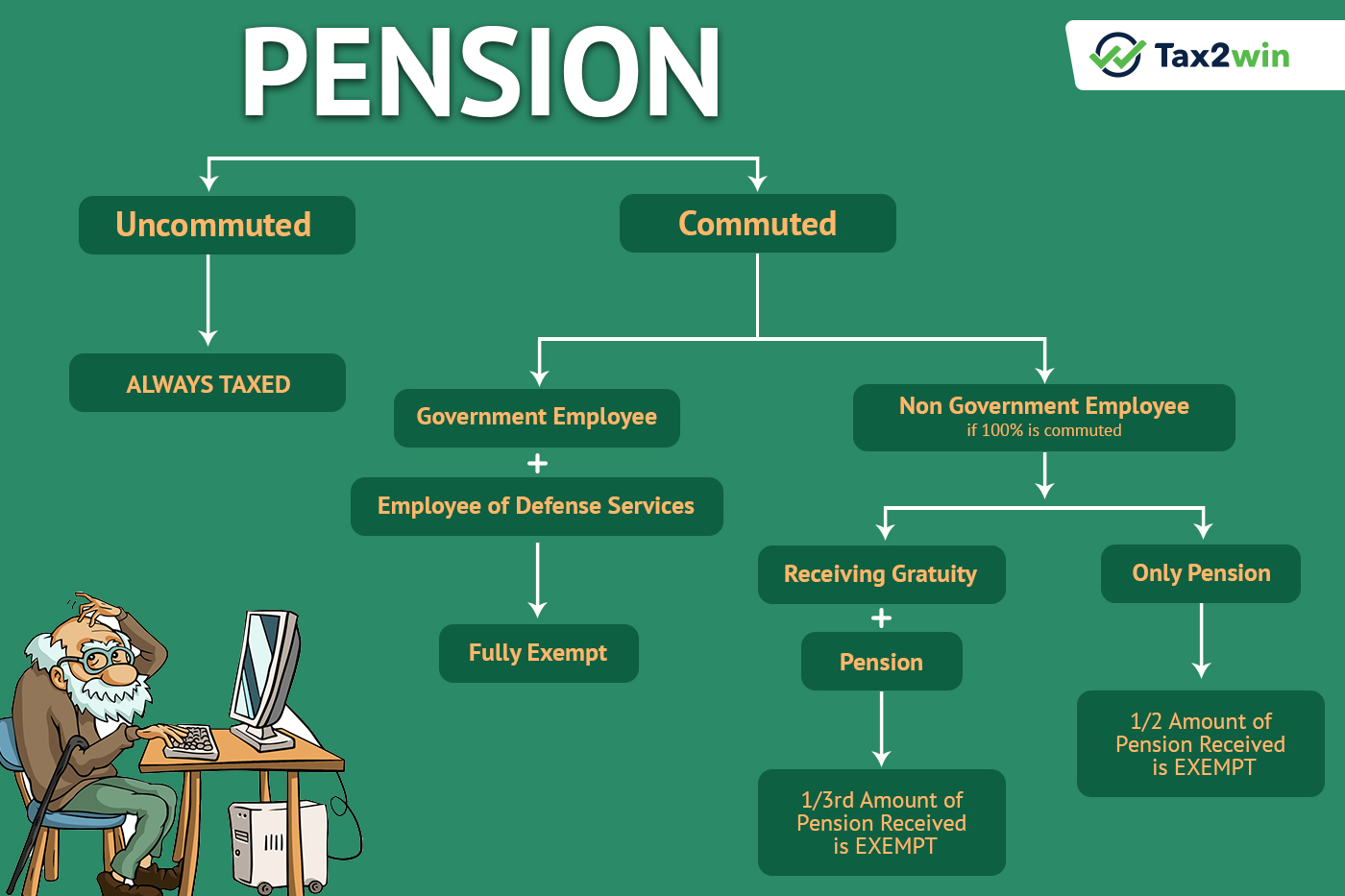

Income Tax Return For Pension Earners No More A Tedious Task Tax2win Blog

What Are The Three Types Of Tax Credits Leia Aqui What Are The

Ask Bob Why Do I Pay Taxes On My Social Security And Pension Benefits

Do I Pay Taxes On My Pension Income - Once you start receiving your pension the IRS regards it as income and you ll pay taxes on it accordingly on the federal level Check the tax laws in your state to see how it handles pension income because it can vary widely Pretax and post tax contributions to your pension make a difference