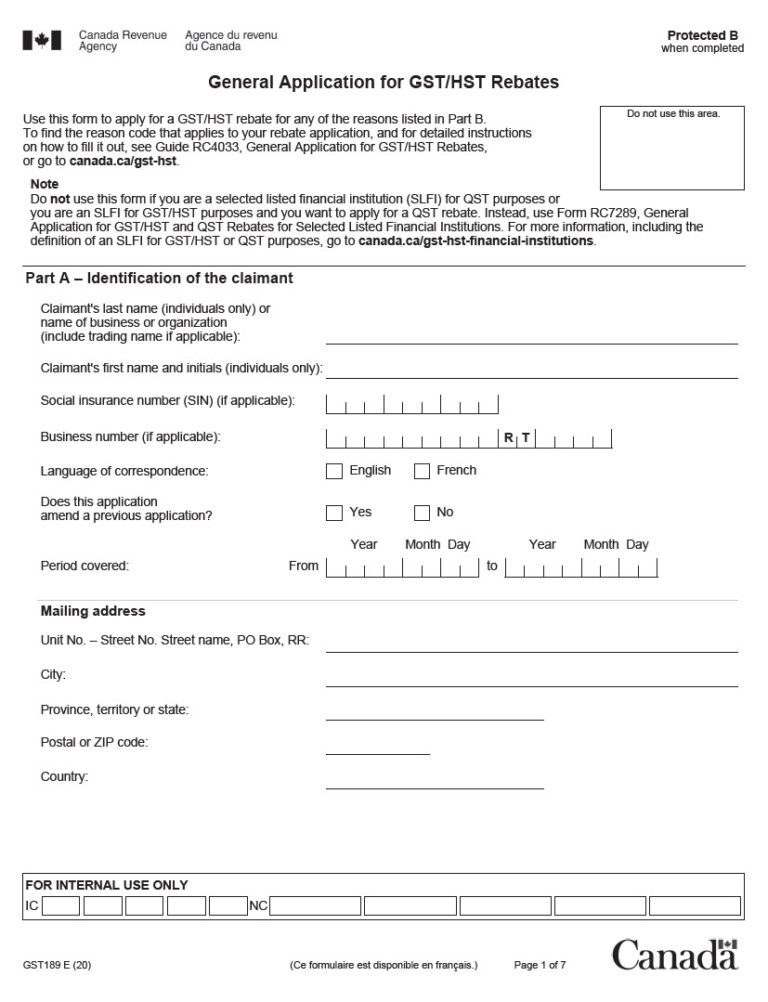

Do I Qualify For Gst Hst Rebate Verkko 1 lokak 2017 nbsp 0183 32 How to claim the GST HST rebate To claim your rebate use Form GST189 General Application for GST HST Rebate You can only use one reason code per rebate application If you are eligible to claim a rebate under more than one code use a separate rebate application for each reason code

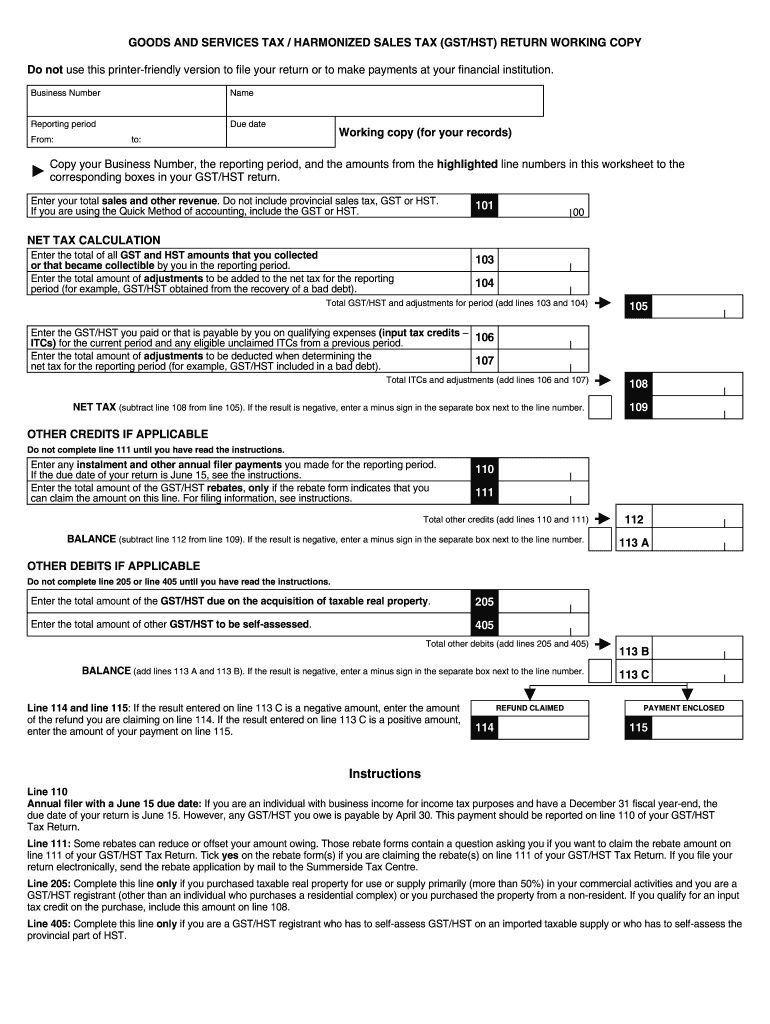

Verkko As an employee you may qualify for a GST HST rebate if all of the following conditions apply you paid GST or HST on certain employment related expenses and deducted those expenses on your income tax and benefit return your employer is a GST HST registrant You do not qualify for a GST HST rebate in either of the following situations Verkko 20 jouluk 2020 nbsp 0183 32 If you deduct the GST HST you paid on these expenses you might be eligible to claim a GST HST rebate Eligible Expenses You must have paid the GST or HST on your expenses and included them on your tax return before you can claim the rebate For example GST HST paid on vehicle maintenance gas etc

Do I Qualify For Gst Hst Rebate

Do I Qualify For Gst Hst Rebate

https://i0.wp.com/settlementcalgary.com/wp-content/uploads/2019/07/GST.png?resize=768%2C448&ssl=1

GST HST Rebate Claims Jeremy Scott Tax Law

https://jeremyscott.ca/wp-content/uploads/2023/01/GST-HST-Rebate.jpg

HOW TO QUALIFY FOR GST HST NEW HOUSING REBATE On RENTAL PROPERTIES

https://i.ytimg.com/vi/7FYyWe6c8oM/maxresdefault.jpg

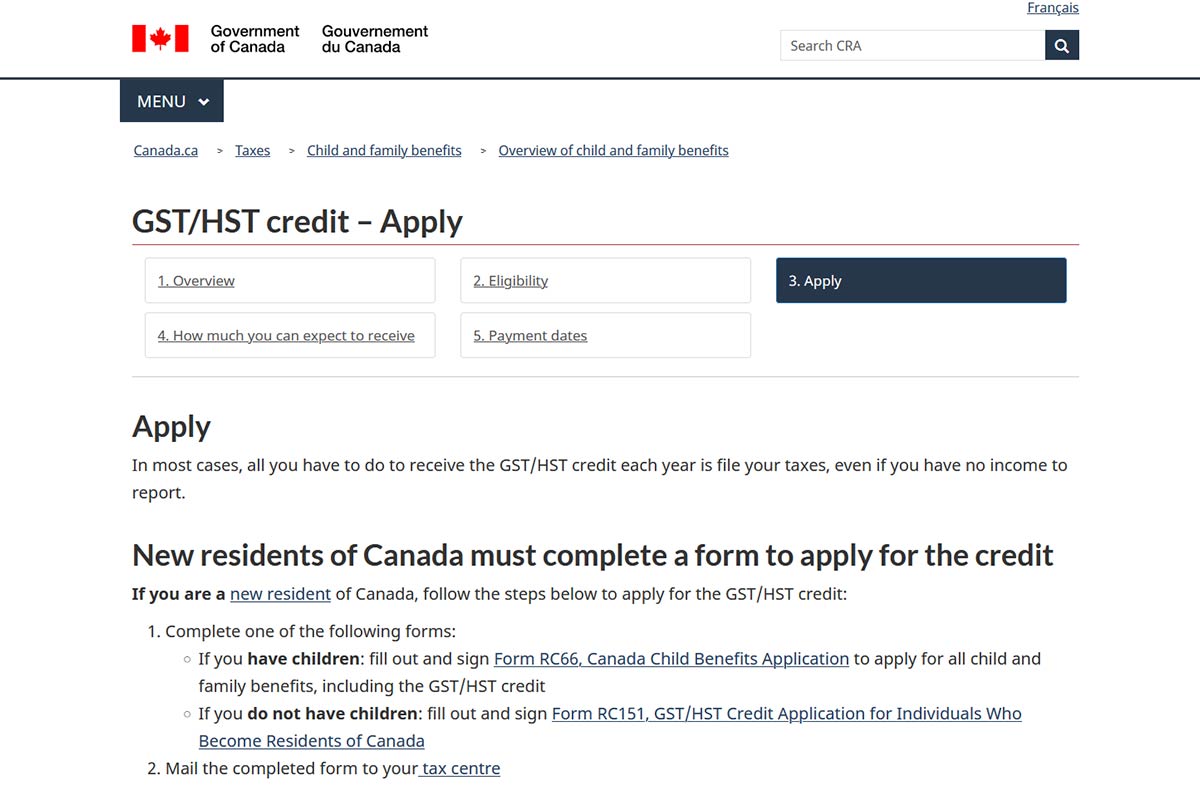

Verkko As an employee you may be eligible for the GST HST rebate if both of the following apply You paid the GST HST on certain employment related expenses and deducted those expenses on your income tax and benefit return Your employer is a GST HST registrant You are not eligible for the GST HST rebate if one of the following applies Verkko You have to be 19 years old or older to receive the GST HST credit Should you turn 19 before April 2023 file your tax return for 2021 Then the CRA will automatically decide if you re qualified to receive the credit If you re eligible you can expect your first payment in the quarterly payment after turning 19

Verkko 14 jouluk 2023 nbsp 0183 32 GST HST credit eligibility requirements To qualify for the GST HST credit your adjusted net family income must be below a certain threshold which for the 2021 tax year ranges from Verkko List of available GST HST rebates for businesses and what you need to know after filing a GST HST rebate claim

Download Do I Qualify For Gst Hst Rebate

More picture related to Do I Qualify For Gst Hst Rebate

GST HST New Housing Rebate And New Residential Rental Property Rebate

https://sqicpa.com/wp-content/uploads/2018/09/GST-HST-Rebate-1-e1537821386125.png

GST Payment Dates 2021 2022 All You Need To Know Insurdinary 2022

https://www.insurdinary.ca/wp-content/uploads/2021/11/gst-hst-credit-application.jpg

New Condo HST Rebate Sproule Associates

https://my-rebate.ca/wp-content/uploads/2021/11/image3-1.jpeg

Verkko If the CRA determines that you are eligible for the GST HST credit based on your 2022 tax return and that you will receive payments you will receive a GST HST credit notice in July 2023 It will show how much you will get and what information was used to Verkko 4 hein 228 k 2023 nbsp 0183 32 The rebate essentially a doubling of the GST HST tax credit was approved in the latest federal budget It s intended to offset the cost of rising grocery prices but can be applied to more than

Verkko the number of children under 19 years old that you have registered for the Canada child benefit and the GST HST credit For the 2022 base year payment period from July 2023 to June 2024 you could get up to 496 if you are single 650 if you are married or have a common law partner 171 for each child under the age of 19 Verkko 14 marrask 2022 nbsp 0183 32 You are eligible for the GST HST credit if you are considered a Canadian resident for income tax purposes the month before and at the beginning of the month in which the CRA makes a payment You also need to meet one of the following criteria You are at least 19 years old

How To Qualify For GST HST NEW HOUSING REBATE On RENOVATED And OWNER

https://i.ytimg.com/vi/4YjatL1BTQE/maxresdefault.jpg

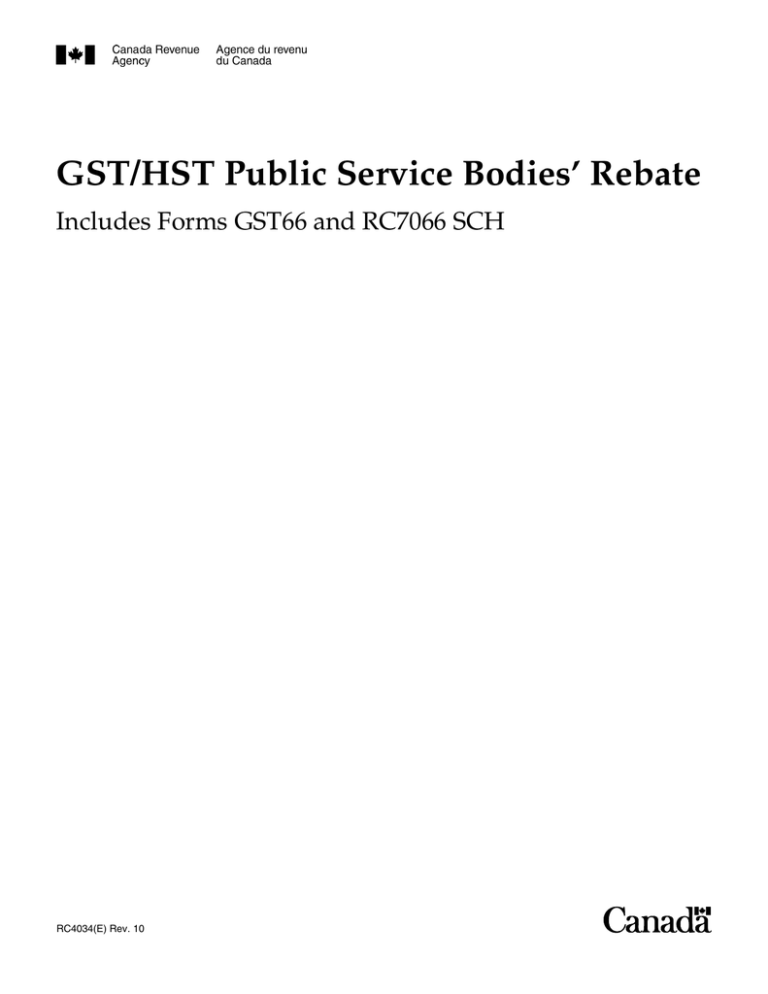

GST HST Public Service Bodies Rebate

https://s2.studylib.net/store/data/018410627_1-8aff8c6931547a8e324034d17eb5a294-768x994.png

https://www.canada.ca/.../gst-hst-rebates/application.html

Verkko 1 lokak 2017 nbsp 0183 32 How to claim the GST HST rebate To claim your rebate use Form GST189 General Application for GST HST Rebate You can only use one reason code per rebate application If you are eligible to claim a rebate under more than one code use a separate rebate application for each reason code

https://www.canada.ca/.../employee-gst-hst-rebate.html

Verkko As an employee you may qualify for a GST HST rebate if all of the following conditions apply you paid GST or HST on certain employment related expenses and deducted those expenses on your income tax and benefit return your employer is a GST HST registrant You do not qualify for a GST HST rebate in either of the following situations

GST Refund Form Rfd 01 Printable Rebate Form

How To Qualify For GST HST NEW HOUSING REBATE On RENOVATED And OWNER

Gst Return Working Form Fill Out And Sign Printable PDF Template

Blank Hst Remittance Form Printable

Fillable Online Gst 34 Fillable Form Gst 34 Fillable Form Gst34

GST HST New Housing Rebate Denied BBTS Accountax Inc

GST HST New Housing Rebate Denied BBTS Accountax Inc

How To Get Your GST HST NEW Residential REBATE SAMPLE Forms Completed

Did You Qualify For An HST Rebate New Housing GST HST Rebate

GST In Malaysia Explained

Do I Qualify For Gst Hst Rebate - Verkko Eligibility for the GST HST new housing rebate You may be eligible for a new housing rebate for some of the GST HST paid if you are an individual who purchased new or substantially renovated housing from a builder including housing on leased land if the lease is for at least 20 years or gives you the option to buy the land for use as your